Summary:

- I maintain a buy rating for Box, Inc., citing its potential to achieve 15% growth targets and an attractive entry point at the current share price.

- Despite a stable quarter with notable profitability improvements, the market reacted negatively due to concerns over growth acceleration, presenting a buying opportunity.

- Key growth drivers include the adoption of Suites and the upcoming Enterprise Advanced SKU, expected to significantly uplift annual contract value.

PM Images

Summary

Following my coverage on Box, Inc. (NYSE:BOX) in March, which I recommended a buy rating due to my expectation that it can achieve its growth targets in the coming years, this post is to provide an update on my thoughts on the business and stock. As a brief recap, I had a price target of ~$42 for BOX previously, and the share price has rallied strongly to as high as $35 before the earnings two days ago. I believe the current share price represents an attractive entry point for investors, as I don’t see any fundamental change to BOX’s ability to accelerate growth to 15%.

Investment thesis

For those that have missed the earnings release, 3Q25 saw total revenue of $275.9 million, representing 5% y/y growth. Of which, subscription revenue came in at $269.7 million, and professional services revenue came in at $6.2 million. This was against a total billings growth of 4.3% y/y to $265.1 million. Although revenue growth was not spectacular, improvements in profitability are notable. Gross margin expanded by more than 500 bps to 81.9% from 76.3% last year, and this drives ~440 bps adj EBIT margin expansion, resulting in adj net profit y/y growth of 27%.

This was overall a very stable and great quarter, in my opinion. But clearly, the market didn’t think so as BOX’s share price fell sharply to ~$32. Looking from the bearish investors’ point of view, the reason for the fall seems to be the lack of data to convince investors that BOX can accelerate growth to 10-15% (as guided in the analyst day). There is merit to this view, as billings only grew by 3% y/y on a constant currency basis, and the net retention rate was stable at 102%. The lack of growth acceleration momentum overwhelms the positive impact of margin expansion.

However, my view is that the bears may be too myopic, in that they are overly focused on the quarterly performance and not looking far enough. I think for starters, BOX showed that they can execute as per guided. 3Q24 revenue growth came in line with guidance at ~6% y/y growth on a constant currency basis, and the same was true for billings growth. This lends credence to their 10-15% growth guide.

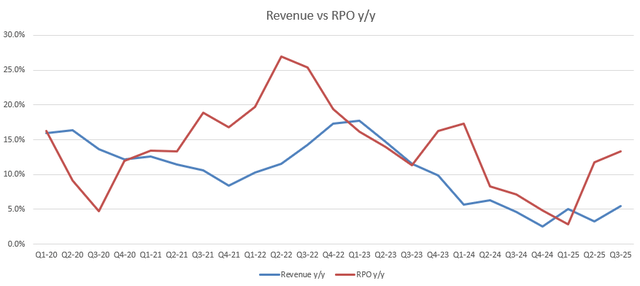

Next, if you look at the remaining performance obligations [RPO] growth, 3Q24 marked the second quarter of acceleration (3% in 1Q25, 12% in 2Q25, and 13% in 3Q25). I take this as an early sign of growth acceleration in the coming quarters (historically revenue y/y growth has lagged RPO y/y growth).

I think the more important aspect is that bears seem to be overlooking the positive mix shift impact that BOX is benefiting. Specifically, BOX is gaining traction in winning larger deals, and the contribution from these customers should get larger over time as the mix gets bigger. For instance, customers that are paying >$100K annually grew 8% y/y (higher than revenue growth). Customers also continue to upgrade to Enterprise Plus, wherein 59% of revenue now comes from Suites, an 800 bps increase vs. last year and 100 bps vs. 2Q25. Given that Suites had an 83% attach rate (up 400 bps y/y) to new deals worth >$100,000, Suites as a percentage of total revenue should continue to shift up, and it should drive an acceleration in revenue growth.

The adoption of Suites is very important to note because it shows that customers are willing to adopt BOX new solutions. I note this because management noted there is growing interest among its customers for the new Enterprise Advanced SKU, which will be available in January, with management noting the potential to close some of those deals in 4Q24. This could be a huge growth catalyst, as the new SKU is expected to drive a 20-40% annual contract value uplift relative to Enterprise Plus when priced on a like-for-like basis.

From initial conversations with customers at BoxWorks, we’re already seeing growing interest in this new plan to tap into Box’s breakthrough new features.

Yes, so we do expect to achieve somewhere between a 20% to 40% uplift for eAdvanced relative to where Enterprise Plus is priced on kind of a like-for-like volume basis. 3Q25 earnings results call

Finally, I think the bears are also forgetting the fact that the macro environment is still not completely out of the woods yet. Rates are still at elevated levels, and management noted there was not much of a change to the macro environment. But my view is that as we get into 2025, when Trump gets into office (which removes all the uncertainties about what policies he is going to implement) and the Fed continues to cut rates, the macro environment should get better, which means a better demand environment for BOX.

Valuation

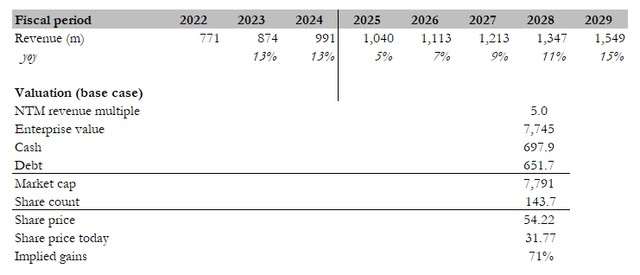

As such, I believe the recent share price represents an attractive entry point for investors. My view remains that BOX can accelerate its growth to 15% over the next few years, and my assumption is it achieves this growth by FY29. The key update I have made to my model is the NTM revenue multiple. Previously, I assumed BOX would trade at 4.2x (in the base case), but I now think it should trade at 5x. The reason for this change is because the market has shown its willingness to upgrade BOX multiple times over the past few months. And if BOX is trading at 4.5x forward revenue today with a high-single-digit growth outlook, the multiple should easily go up from here when growth accelerates to 15x. Assuming the recent peak of 5x, I got to a share price target of $54 in FY28.

Risk

The bears may be right that growth is unlikely to accelerate. It is true that billings growth and net retention rate have not shown signs of inflection despite the positive adoption of Suites and a growing base of large customers. If this is the case, BOX multiple is unlikely to sustain at this level. Moreover, RPO y/y growth may not be indicative of future revenue y/y growth, despite historical trends.

Conclusion

In conclusion, my rating for BOX is buy. While the recent earnings report may have disappointed some investors due to a lack of immediate growth acceleration, I believe the long-term growth story remains intact. Growth drivers such as the adoption of Suites and the launch of Enterprise Advanced should drive growth acceleration in the coming years. Hence, I maintain my bullish stance on BOX.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.