Summary:

- Low-beta (0.49), $152 billion-market cap NextEra has attracted investor interest for its renewables portfolio & for position as the largest US regulated retail utility, located in high-growth Florida.

- However, despite good Florida growth, the company’s results have stumbled due to higher natural gas costs and supply chain difficulties, particular solar panel origin sanctions.

- The company’s 2.2% dividend, EPS disappointment, campaign finance probe distraction, and non-bargain financial metrics make it less attractive at this time.

Sunshower Shots/iStock via Getty Images

NextEra Energy (NYSE:NEE) is a holding company for a regulated retail utility (the combined Florida Power & Light (FPL) and Gulf Power that together have about six million customer accounts) and an unregulated generation subsidiary, NextEra Energy Resources (NEER). NEER generates clean energy from solar, wind, and nuclear power.

FPL’s and Gulf Power’s financials and operations were combined effective January 1, 2022. Prior years’ results for the two have also been combined so as to be comparable.

The company led its 4Q/2022 webcast with a discussion of media charges that the company had violated state and federal campaign finance probes. Although information has yet to come out, this adds unpleasant uncertainty to the company’s operations.

A far bigger challenge was that the company’s earnings were nearly 40% lower than expected.

While the recently-passed IRA contains many long-term incentives for NextEra’s renewables and (new) hydrogen businesses, the solar panel origination legislation and general supply chain snags, along with permitting problems for Mountain Valley Pipeline led to less rosy estimates and results than last year.

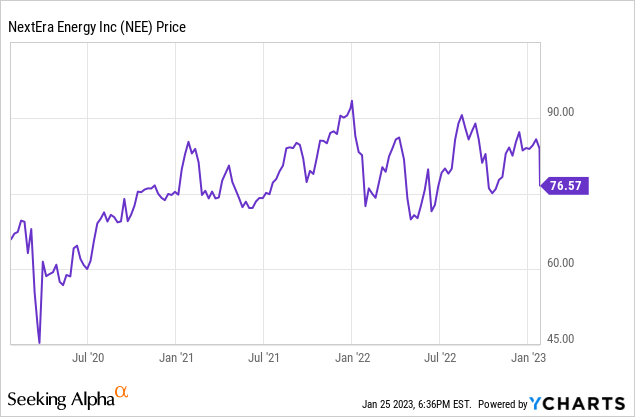

Poorer-than-expected results and news of the probe led to a stock decline of -8.2%.

At a market capitalization of $152 billion and a beta of 0.49, NextEra Energy is less volatile than the overall stock market, a plus for investors seeking stability.

However, its dividend yield is only 2.2% and like all utilities, it faces risks from inflation and rising interest rates, even if rate of increase tempers as much as expected.

I recommend investors wait for a more stabilized renewables environment before investing in NextEra. Lower natural gas prices in the next several months and Florida growth make the stock a keeper, though.

Full Year 2022 Results and Guidance

Next Era reported fourth quarter 2022 net income of $1.522 billion, or $0.76/share and full-year 2022 net income of $4.15 billion or $2.10/share. This latter was 37% less than the average of analysts’ expectations of $2.88/share. The stock price fell -8.7% to $76.59/share in the trading session after the announcement, January 25, 2023.

Dividing: FPL reported a year-over-year increase in income of $500 million, from $3.2 billion in 2021 to $3.7 billion in 2022. However, NextEra Energy Resources reported a net income drop of over $300 million, from $599 million in 2021 to $285 million in 2022.

Company management forecasts adjusted EPS for 2023 to be between $2.98-$3.13 and expects out-year adjusted EPS at an annual growth rate of 6-8% off the 2024 level, rising to an estimated $3.63-$4.00 by 2026.

On the development side, NextEra estimates projects totaling between 32,700 and 41,800 megawatts between 2023 and 2026. The current project backlog is at a record 19,000 megawatts.

Macro

The Florida state economy is strong and growing. Growth in electricity demand is directly tied to economic growth, so FPL’s demand prospects are good.

Natural gas prices were much higher in 2022 due to the Russian invasion of Ukraine and pull of US gas overseas to displace lost Russian exports. This meant higher generating costs for NextEra.

ESG project concerns ranging from a fine of $8 million for eagle kills from wind turbines for NextEra to the limits on solar paneling sourcing from China, along with increased emphasis on backup generation and batteries for renewables, added to grid stability concerns slowing the addition of new projects, led to lower returns on renewables.

The company faced substantial hurricane recovery costs during the year.

Traditional projects did not advance either: NextEra took a $867 million hit on its share of the stalled Mountain Valley Pipeline.

Natural Gas Prices

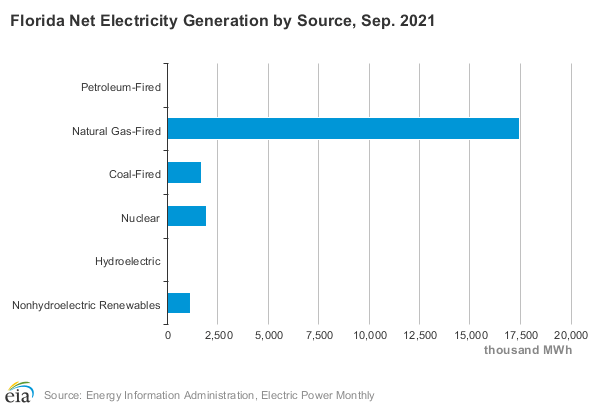

Florida is the second-largest generator of electricity in the country after Texas and the third-largest consumer after Texas and California. Natural gas has remained the primary generation fuel in Florida.

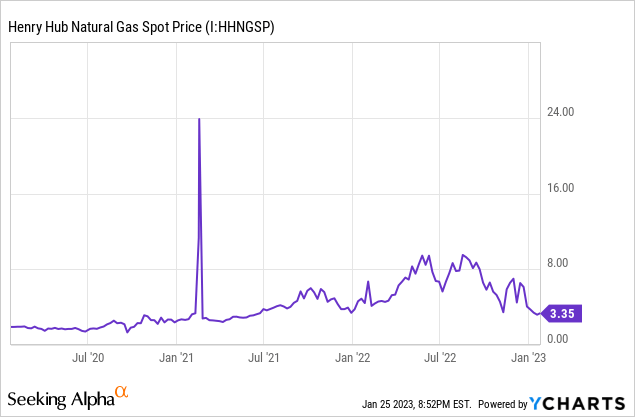

The Henry Hub (Louisiana) natural gas futures price for February 2023 is at $2.93/MMBTU on January 25, 2023.

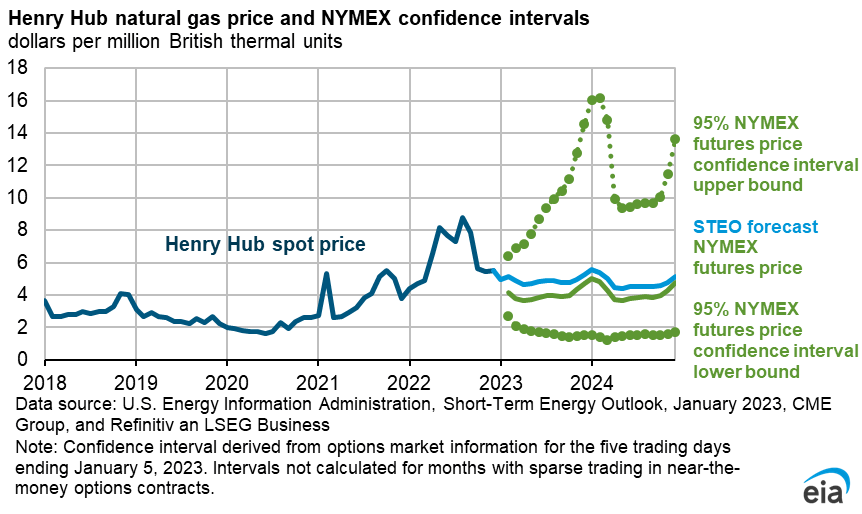

Forward natural gas prices are similar, and lower than they have been in over eighteen months. Even the projections from the EIA’s January 10, 2023 Short Term Energy Outlook, shown below, now appear too high.

EIA

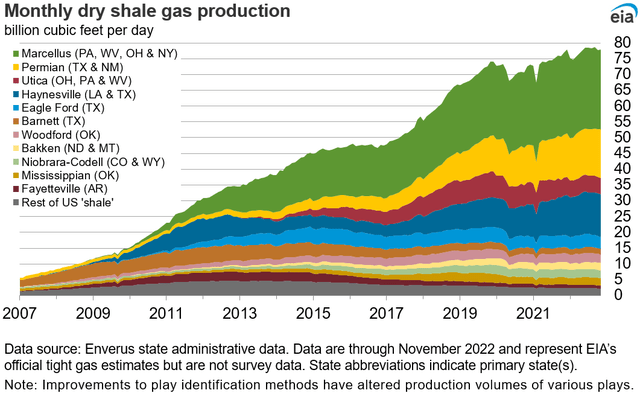

As ever and even in the face of serious European gas shortages due to the cessation of Russian imports, US gas producers are “outperforming” with production back up to 100.5 BCF/D. Moreover, with Permian oil production expected to reach 5.7 million BPD in 2023 and 6.0 million BPD in 2024, we can expect proportionately higher levels of must-be-produced associated natural gas from the basin. For example, at present the west Texas (Waha hub) gas price is 10% less than the Henry Hub price. At times, the Waha price is actually negative.

Gas prices may tick up once the 2 BCF/D Freeport LNG plant comes back online; however, additional demand from new LNG plants is not expected until late 2024.

Governance

NextEra Energy grew from a utility founded in 1925. The company is headquartered in Juno Beach, Florida and is among the largest global generators in the world of electricity from wind and solar power.

At January 1, 2023, Institutional Shareholder Services ranked NextEra’s overall governance as 6 (down from 2 a year ago), with sub-scores of audit (6), board (7), shareholder rights (3), and compensation (7). On the ISS scale, 1 represents lower governance risk and 10 represents higher governance risk.

As of August 2022, NextEra’s ESG ratings from Sustainalytics were “medium” with a total risk score of 28 (54th percentile). Component parts are environmental risk 14.1, social 7.6, and governance 5.8. The only negative factor noted (but really not so “negative” in view of the need for reliability) is the company’s use of thermal coal. Controversy level is 2, or “moderate,” on a scale of 0-5, with 5 as the worst.

At December 30, 2022, shorted shares were only 0.9% of floated shares.

Insiders own a negligible 0.2% of stock.

NextEra’s beta is an attractive 0.49: its stock moves directionally with the overall market but to a smaller extent (less volatility). This is characteristic of utility stocks.

On September 29, 2022, the four largest institutional stockholders, some of which represent index fund investments that match the overall market, were Vanguard (9.5%), BlackRock (7.2%), State Street (5.8%), and JP Morgan (3.2%).

Blackrock, State Street, and JP Morgan are signatories to the Net Zero Asset Managers, a group that as of December 31, 2022, manages $59 trillion in assets in assets worldwide and which (despite less energy supply due to reduced Russian exports to Europe) limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

Vanguard was also originally a signatory but recently withdrew.

This could be a problematic governance issue for NextEra because NextEra is so proactively involved in renewables, and yet they are experiencing operational, logistical, and community-related issues in getting new solar and wind projects rolling.

As first discussed over a year ago and after twenty years with FPL, FPL’s chairman, president, and CEO, Eric Silagy, is retiring May 15, 2023. Former NextEra senior executive, Armando Pimentel, will transition into the roles of president and CEO of FPL starting February 15, 2023. John Ketchum, chairman, president, and CEO of NextEra, who has been in the top job one year, will also be the chairman of FPL. In the investor Q&A, Ketchum mentioned FPL’s newly-promoted chief operating officer, Chris Chapel-formerly the vice president of customer service at NextEra–as a possible eventual FPL chief.

Regulators

The company’s most significant regulator, for FPL, is the Florida Public Service Commission. In rate cases NextEra responds to input from a wide variety of customer-stakeholders.

Stock and Financial Highlights

NextEra’s January 25, 2023, closing price was $76.59/share, 84% of its 52-week high of $91.35/share. Its market capitalization is $152.2 billion.

Trailing price to earnings ratio is 36 at the trailing twelve months’ earnings per share (EPS) of $2.10.

Adjusted EPS is a non-GAAP measure that adds back:

*non-qualifying hedge losses,

*Mountain Valley Pipeline impairment charge,

*unrealized losses on equity securities held in NEER decommissioning funds,

*and subtracts income tax benefit and NEP investment gains,

was $2.90/share for 2022.

The average of the company’s range for 2023 adjusted EPS is higher at $3.05/share.

At December 31, 2022, NextEra had liabilities of $109.5 billion, including $55.2 billion of long-term debt, and assets of $158.9 billion, giving a liability-to-asset ratio of 69%, standard for a utility and lower than many.

A dividend of $1.70/share yields 2.2%.

NextEra has an average rating from fifteen analysts of 1.8, or “buy” leaning toward “strong buy.”

Positive and Negative Risks

As interest rate increases will impact NextEra and all utilities due to rising debt costs. Moreover, higher interest rates could attract investors away from dividend-paying equities.

Inflation in labor, capital, and materials costs are projected to continue this year. There is no certainty that NextEra could raise rates to offset increased costs.

Weather, including hurricanes like Ian, always remain a risk for Florida utilities.

The campaign finance probes will remain, at minimum, a distraction from operations.

Despite the IRA, the market for utility-scale renewables may cool.

Positive risks are the continued growth of Florida’s population and economy and the falling natural gas prices.

Recommendations

I do not recommend NextEra Energy to dividend-seekers.

I am downranking NextEra from “buy” to “hold” for investors seeking capital appreciation. Primarily, the company is facing a slowing in its renewables project business, not of ambition–plenty of projects are in the queue–but of timing and costs. While the IRA incentives will help, the simple fact of the European example (insufficient energy from wind when cheap Russian gas went away) coupled with the increasingly apparent need for 1:1 backup–often load-following natural gas–to renewables for grid stability and grid delays in connecting renewable projects making them higher cost, has cooled the ardor of many utilities and their regulators.

Momentum is strong in places like California and New York, so a healthy market still exists for NEER projects. Still the fact of a category of projects called “wind repowering” speaks to the need for not-cheap battery backup.

Interest costs are going up and NextEra has a considerable amount of debt ($55 billion) in its capital structure. Yet the company is still not bargain-priced with a current price/earnings ratio of 36.

Hydrogen projects may be interesting but they are longer-term and could be a fairly marginal market.

The campaign finance probe news was likely an unpleasant shock to many investors–along with the shortfall in results. Although the probes appear to be minor, at a minimum they will be a tedious distraction.

On the FPL side of the business, Florida growth remains impressive. Even here, however, the flood of New Yorkers may slow.

The basic investing premise is the same: NextEra fills a key niche as the country’s largest renewable power generator together with healthy, growing, and consumer-friendly (less expensive) utility retail operations in the attractive Florida market. Once past current hurdles, as natural gas prices come down and the renewables market finds new footing, NextEra continues to be one of the most interesting companies in the sector.

nexteraenergy.com

Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I hope you enjoyed this piece. I run a Marketplace service, Econ-Based Energy Investing, featuring my best ideas from the energy space, a group of over 400 public companies. Each month I offer:

*3 different portfolios for your consideration, summarized in 3 articles, with portfolio tables available 24/7 to subscribers

*3 additional in-depth articles = 6 EBEI-only articles;

*3 public SA articles, for a total of 9 energy-related articles monthly;

*EBEI-only chat room;

*my experience from decades in the industry.

Econ-Based Energy Investing is designed to help investors deal with energy sector volatility. Interested? Start here with an initial discount.