Summary:

- UnitedHealth Group Incorporated continues to focus on value-based care, leveraging AI to improve efficiencies and patient outcomes, which is crucial for long-term success.

- UnitedHealth’s third-quarter revenues reached $101 billion, a 9% increase, driven by Optum Health and Optum Rx, showcasing robust financial health.

- Despite headwinds like Medicare rate cuts and cyberattacks, UnitedHealth maintains its 2024 earnings outlook, reinforcing confidence in UNH’s future performance.

J Studios

Introduction

When I started investing (more like reckless trading) after the Great Financial Crisis, I remember watching a documentary about Joseph “Joe” Ackermann, who was the CEO of Deutsche Bank (DB) during the housing crisis.

He made a huge name for himself, as Deutsche Bank was one of the few major banks in the world that did not need government assistance. For what it’s worth, he was the last CEO of the bank before its success went downhill.

One of the things that stood out in the documentary was that he got a “casual” call from his security detail, mentioning he had gotten yet another death threat.

Unfortunately, this is quite common in the business world and often overlooked, as the number of actual incidents is rather low. Plenty of major companies do not spend money on protection, as many executives do not believe they need it — or feel uncomfortable having bodyguards.

Unfortunately, sometimes, this goes wrong, as The Wall Street Journal headline “Murder at Dawn: A Top Executive’s Final Moments in Manhattan” indicates.

On December 4, UnitedHealth Group Incorporated (UNH) CEO Brian Thompson was fatally shot in midtown Manhattan. The 50-year-old lost his life in what is now almost certainly a targeted attack.

According to the New York Post, the shell castings were engraved with “deny,” “depose,” and “defend,” which could refer (I’m not implying anything) to a book from 2010 condemning the insurance business, in which Mr. Thompson obviously was a major player.

According to Bloomberg, he worked for more than 20 years for the company and took over as CEO of UnitedHealthcare’s insurance division in 2021.

The Daily Mail reported that the insurance giant has been in the spotlight for a while, as it has been accused of denying many claims, including through the use of potentially faulty artificial intelligence. This is also the sentiment I get when browsing social media, as some very disturbed commenters use these accusations to explain why “some had it coming.”

As one can imagine, this makes the situation for many quite difficult, as social sentiment is a factor that some are always “suffering” from. Especially, banks and insurance companies are regularly targeted by dissatisfied customers or simply opponents of the entire industry.

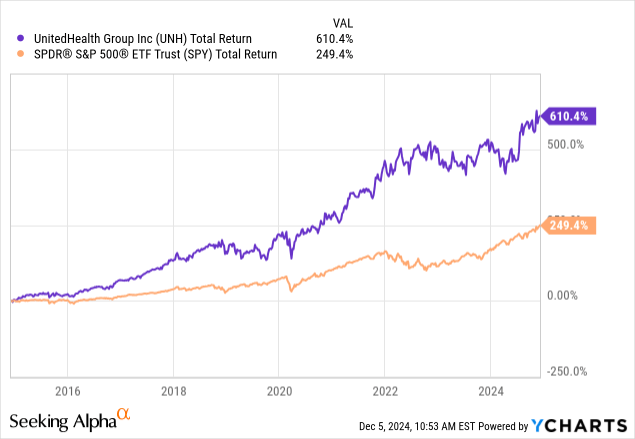

In general, UnitedHealth has done extremely well, returning more than 600% over the past ten years alone. It recently made a new stock price high when the market started to bet on looser regulations.

However, there are still major issues on the horizon, including increasing healthcare costs, which are projected to reach $6.8 trillion by 2030.

I wrote this in my most recent article on the company, titled “I’m Sticking To My Call: UnitedHealth Is Among The Best Dividend Growers.”

Since then, shares have returned 21%, which begs the question: What’s next?

In this article, I’ll update my thesis, even though it’s not very easy in light of the tragic assassination.

UNH Remains As Upbeat As Ever

During its third-quarter earnings call, the company highlighted its success in expanding its offerings, including serving over 2 million new commercial customers, fulfilling 1.6 billion prescriptions via Optum Rx, and addressing 4.7 million patients through what UnitedHealth calls “value-based arrangements.”

Moreover, despite a wide range of headwinds like CMS Medicare rate cuts, Medicaid redeterminations, and the aftermath of a cyberattack on Change Healthcare, UnitedHealth stuck to its 2024 earnings outlook, which is what analysts care a lot about — for obvious reasons.

Value-based care is the company’s focus on addressing issues like cost pressure, as it aims to achieve better patient outcomes with higher efficiencies. Technically speaking, this is a win-win, as it reduces costs and improves the lives of its patients.

UnitedHealth Group Incorporated

This also includes artificial intelligence, as advanced practice clinicians use it to streamline patient history reviews, which frees up a lot of valuable time. Nurses use it to improve documentation reviews, and consumer advocates use it to improve customer satisfaction reviews.

Essentially, it frees up time (more efficiencies) and specializes care in a more effective way:

The effectiveness of value-based care for patients is proven and powerful, and it’s good for the system. At UnitedHealth Group, we’re purposefully organized to support the transition to value-based care. It requires deep engagement with patients, setting the foundation to move to more coordinated care, connecting patients to primary care earlier, driving clinically accurate diagnoses, more effectively recognizing and managing chronic conditions and slowing disease progression. – UNH 3Q24 Earnings Call.

During this month’s Investor Day (the one that was held when the assassination took place), the company reiterated its focus on these measures and plans to build a national ambulatory quality patient management system, which is aimed at improving care quality across ambulatory networks.

Moreover, the deployment of automated prior authorizations in its pharmacy operations has reduced turnaround times from an average of 7.5 days to just 29 seconds.

As companies like UnitedHealth are dealing with plenty of operational complexities, AI has the potential to make a huge and lasting impact for all parties involved. In general, while AI is still young, it is excellent for simple tasks like data management, which is why so many companies are using it.

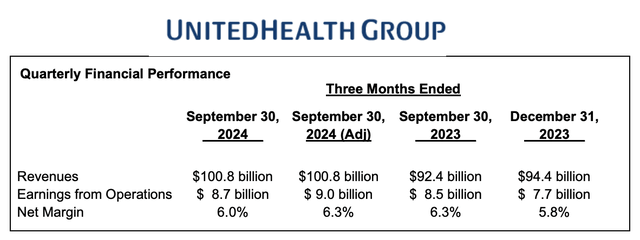

So far, these plans are working, as its financials remain fantastic. On top of confirming its guidance (more on that later), the company reported third-quarter revenues of $101 billion, 9% more compared to the prior-year period.

UnitedHealth Group Incorporated

Major growth drives were Optum Health and Optum Rx, which added a combined $7 billion to the company’s revenues, boosted by more types of care services and growth in pharmacy benefits from new customers and more specialty services.

This is great news for shareholders.

UnitedHealth’s Impressive Shareholder Value

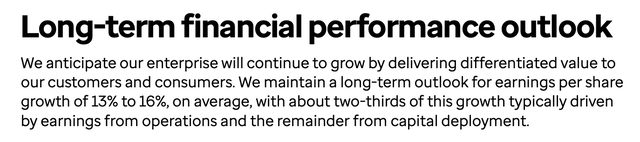

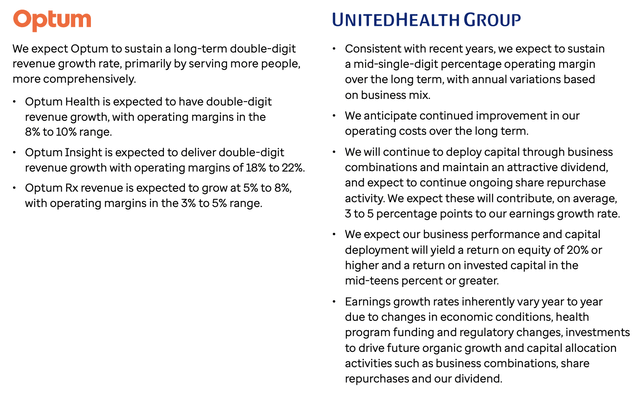

During its December Investor Day, the company noted that despite cautious optimism regarding funding pressures, it remains committed to its long-term annual EPS growth target of 13% to 16%.

Achieving this would be a huge deal, as it would imply between 13% and 16% annual capital gains if we assume no valuation changes(!).

As we can see below, the company expects that two-thirds of this target will be driven by earnings. The remaining third will be driven by capital deployment. This includes M&A and buybacks.

Whereas M&A improves total revenues (and earnings), buybacks enhance the per-share value of a company.

UnitedHealth Group Incorporated

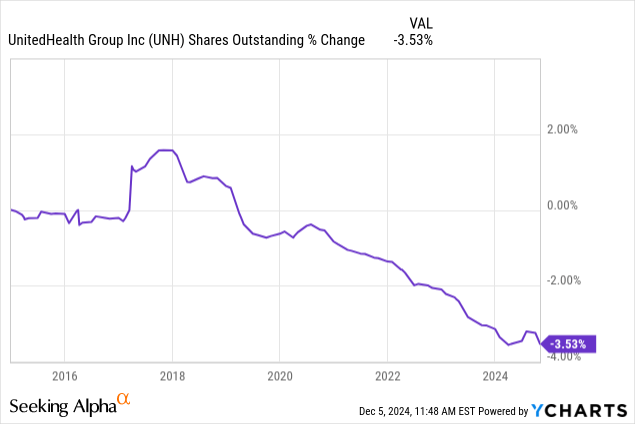

With that said, over the past ten years, buybacks have been a small factor, as the company has reduced its share count by less than 4.0%, which is a small number over this long period.

The fact that buybacks did not play a major factor shows how aggressive the company’s organic and acquired growth was. Going forward, the company has five growth pillars:

- Value-based care

- Benefits

- Pharmacy

- Financial services

- Technology-led initiatives.

These are expected to help the company breach a highly fragmented market. Note that despite its size, the giant’s market share is still below 10%.

Moreover, regarding its value-based care model, 100% of its patients in this segment will be integrated into unified care data systems. That’s up from 18% in 2023. Meanwhile, the consolidation of electronic medical records across the network has improved care team efficiency and patient experiences.

According to the company, these improvements have already generated close to $1 billion in efficiencies over two years, putting Optum in a great spot to serve more patients and achieve long-term margin targets of 8% to 10%.

UnitedHealth Group Incorporated

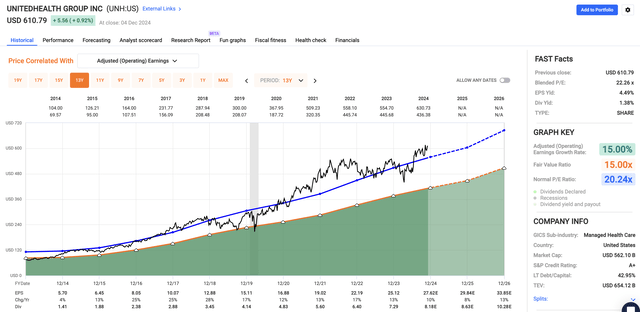

Going back to its outlook, analysts agree with the company. Using the FactSet data in the chart below, the company is expected to boost EPS growth from 8% in 2025 to 13% in 2026, which is the lower end of its long-term guidance range of 13% to 16%.

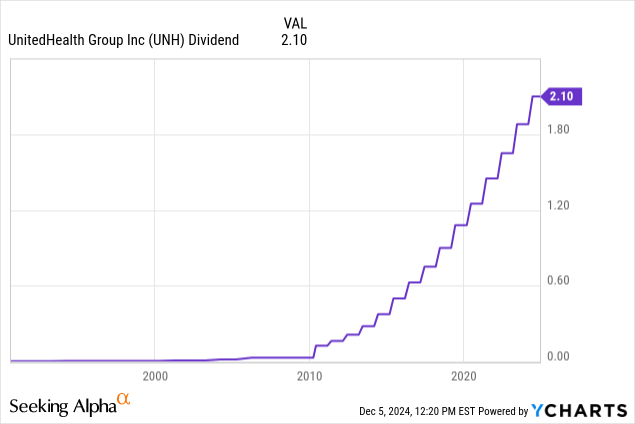

This is supported by what the company calls an “attractive dividend” with a yield of 1.4%. While this is not a yield that income-focused investors will get excited about, it comes with a sub-30% payout ratio, a five-year CAGR of 15%, and a history of 14 consecutive annual hikes.

A dividend like this really adds up over time, especially because the company expects to maintain double-digit annual EPS growth for a prolonged period.

Unfortunately, UNH equity is not cheap.

As I already briefly wrote, since my June article, the stock has returned more than 20%. That’s great for existing shareholders but not for the risk/reward.

Currently, UNH trades at a blended P/E ratio of 22.3x, as we can see in the FAST Graphs chart above, roughly two points above its ten-year average. This is further worsened by “subdued” earnings growth, at least compared to its long-term guidance.

However, this is not bad news, as everyone seems to be sure that there’s a path to 13-16% annual EPS growth. That’s a good argument to pay 22.3x current earnings for a stake in the company.

The tricky part is that UNH needs to prove that its outlook is valid by successfully navigating current inflation and potential regulatory headwinds.

That is not easy.

However, the company remains in a good spot, which is why I stick to a Buy rating. However, if I were in the market for UNH stock, I would be a gradual buyer to use potential corrections to add more aggressively to my position.

That’s how I usually deal with companies that are in the process of accelerating earnings growth without trading at a valuation that is “obviously” attractive.

Takeaway

UnitedHealth continues to deliver exceptional growth and shareholder value, driven by its focus on value-based care, innovation, and operational efficiency.

Despite regulatory risks and inflationary challenges, the company is poised to achieve its impressive 13-16% annual EPS growth target.

While its dividend yield may not excite income-focused investors, consistent double-digit dividend growth and a sub-30% payout ratio make it a strong long-term play.

However, with the stock trading above its ten-year average, I recommend a gradual buying approach for investors interested in the stock, allowing room to capitalize on potential market corrections.

That said, UnitedHealth remains a standout in the healthcare sector, as it balances strong fundamentals with a clear path to sustained growth.

In the dividend growth realm, it clearly stands out.

Pros & Cons

Pros:

- Strong Growth Potential: UnitedHealth’s focus on value-based care and its technology-driven initiatives position it for long-term success with a 13-16% annual EPS growth target.

- Solid Dividend Growth: With a 15% five-year CAGR and a healthy payout ratio, the dividend is set to grow steadily for many years to come.

- Operational Efficiency: AI-driven solutions are improving care quality and reducing costs.

- Impressive Financials: The company consistently reports strong earnings and revenue growth, making it a reliable performer for shareholders. One could even say it’s a “sleep well at night stock,” when adding its anti-cyclical profile.

Cons:

- Expensive Valuation: Trading at a P/E of 22.3x, the stock is more expensive than its historical average, which may limit upside potential in the short term.

- Regulatory Risk: Navigating increasing healthcare costs and potential regulatory challenges will require precision. The room for error is small.

- Low Dividend Yield: At 1.4%, the dividend is not attractive for yield-focused investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.