Summary:

- Amazon is on track to outperform the market on an absolute basis in 2024, but there are some caveats.

- Even if short-term momentum in AWS profitability is sustained, Amazon would have a hard time outperforming the market in 2025.

- Further multiple repricing appears highly unlikely, unless AMZN continues to deliver better-than-expected margins through the next fiscal year.

Julie Clopper

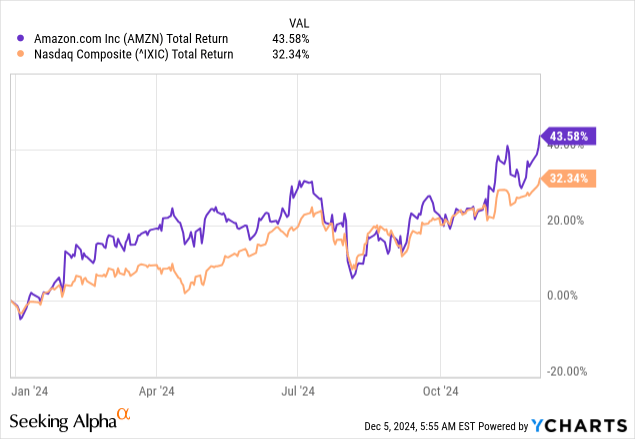

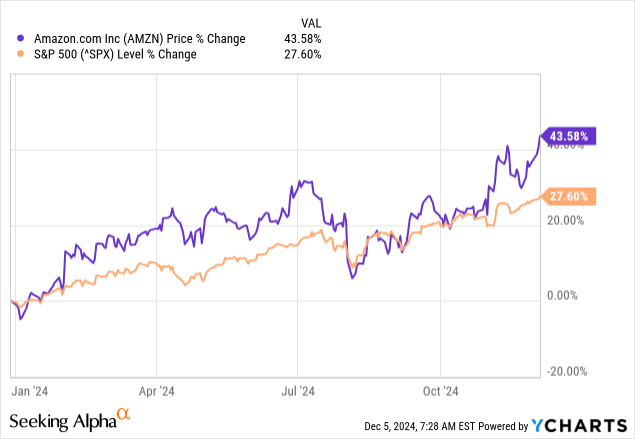

Year-to-date performance of Amazon.com, Inc.’s (NASDAQ:AMZN) stock appears to be something to brag about as a total return of nearly 44% over the course of less than 12 months is a rare sight for a company that is being classified as a “megacap”.

While it is hard to discredit such high shareholder returns in less than a year, investors should also keep in mind the fact that the vast majority of this performance is due to market-wide forces. During the same timeframe, the Nasdaq Composite Index delivered a total return of 32% – a performance that up until recently was at par with that of AMZN and with significantly lower volatility.

Without a doubt, during good times for the equity market and momentum stocks in particular, Amazon is in a very good position to outperform the market albeit not by a significant amount.

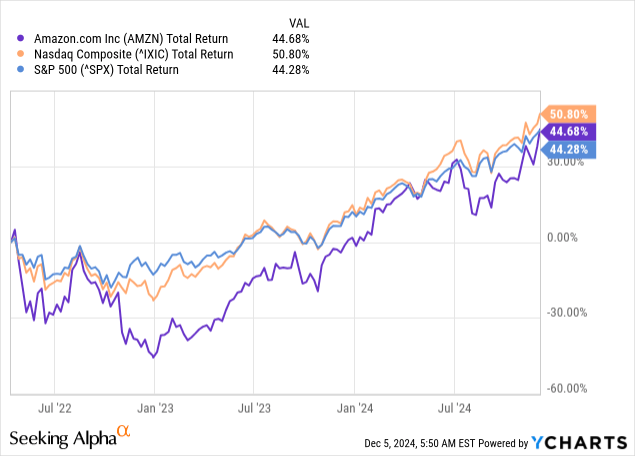

During more challenging years for the equity market, however, the AMZN stock tends to significantly underperform the market. That is why AMZN share price performance is still roughly in line with the broader equity market since I first covered the stock in early 2022.

With that in mind, anyone buying AMZN at its current levels should have a strong conviction in the broader equity market performance over the coming year. Should 2025 turn out to be worse-than-expected for equities, it could take years before AMZN shareholders breakeven on their current purchases.

Nonetheless, the stock is by no means in the same situation it was back in 2021 with the business now being significantly more profitable and the stock also trading at more conservative multiples.

A Strong Year

The year 2024 would go down in history as a rather unusual period of Amazon. Profitability reached a new record high as both e-commerce and AWS businesses are on track to close the fiscal year with margins that are well-above the historical average.

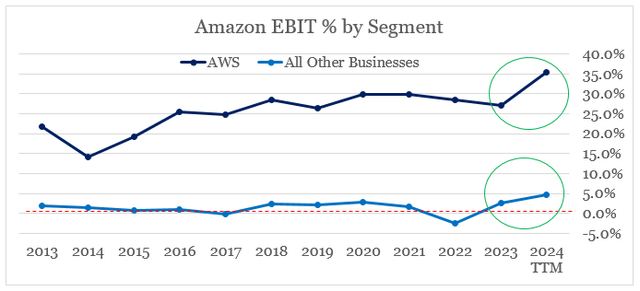

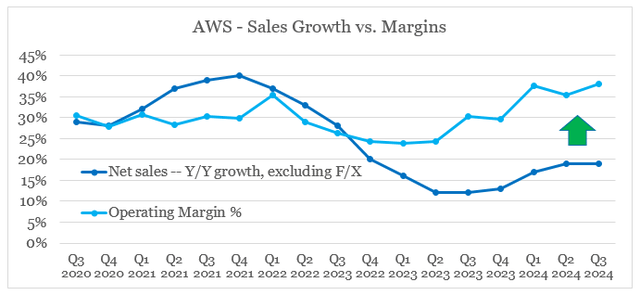

Although operating margins expanded both in North America and International business segments, it was the margin increase in AWS that took the market by surprise. On a year-to-date basis, AWS EBIT margin stands at 37%, compared to 26% in the same period a year ago.

prepared by the author, using data from SEC Filings

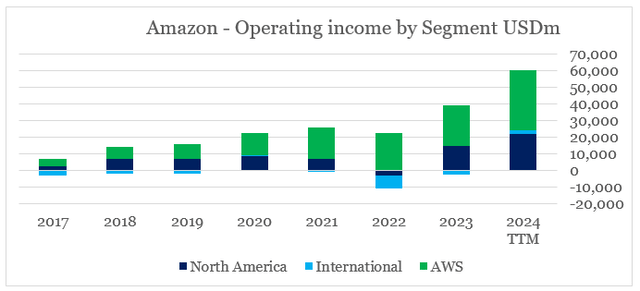

Profitability improvements across the board were definitely good news for investors, but in reality it was AWS that stole the show and once again became the key driver for the share price. In spite of the e-commerce business’ enormous size, the absolute increase in profitability of AWS was at par with that of North America and International business segments combined.

prepared by the author, using data from SEC Filings

AWS now accounts for roughly 60% of Amazon’s operating profit and remains the key driving force for the share price. No matter how exciting the long-term prospects of the advertising or other businesses are, any small change in AWS expected profitability is likely to have significant implications for shareholder returns.

For the time being, AMZN shareholders have no reason to worry as the whole cloud sector seems to be capacity constrained which drives what’s — in my view — a temporary increase in margins.

We’ve seen significant reacceleration of AWS growth for the last four quarters.

Source : Amazon Q3 2024 Earnings Transcript

Second, we are rapidly expanding our OCI capacity to meet the demand that you see in our 52% RPO cloud growth.

Source: Oracle Q1 2025 Earnings Transcript

For anyone with a long-term investment horizon, the risk of reversal in AWS margins in a serious concern, however, short-term investors seem to have little to worry about given the strong momentum in demand.

Looking Through The Lens Of Multiples

In spite of the strong business momentum for Amazon, the stock failed to outperform the market in 2024. At least, not until AMZN reported its Q3 results in late October and the stock skyrocketed.

Even though Amazon’s quarterly results did not disappoint in Q1 and Q2, the market needed a perfect storm kind of event in order to push the share price return above that of the broader equity market.

On one hand, that was the sharp reversal of AWS margins in the third quarter which exceeded 38% – the highest in history.

prepared by the author, using data from SEC Filings and quarterly presentations

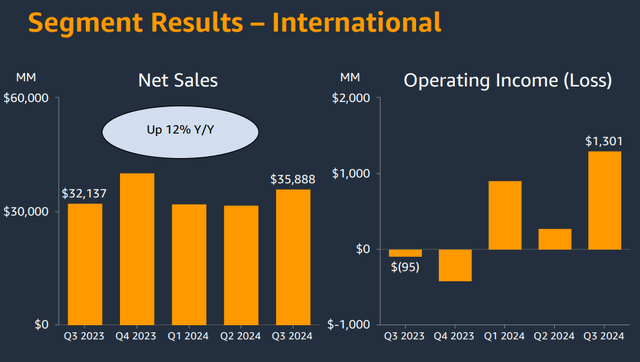

Results in the North America segment were also quite strong during the third quarter with operating income increasing more than 30% from a year ago. Lastly, profitability in the International segment reversed its course from the prior quarter and reported a record-high operating income of $1.3bn.

Amazon Investor Presentation

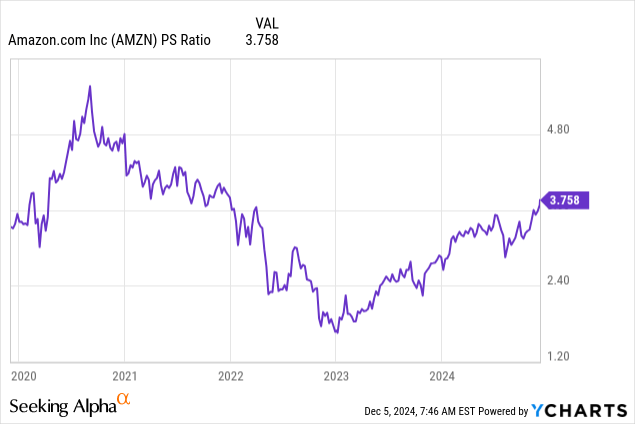

Contrary to all that, AMZN share price still trades at a price/sales multiple that well-below the record highs from late 2020 and 2021.

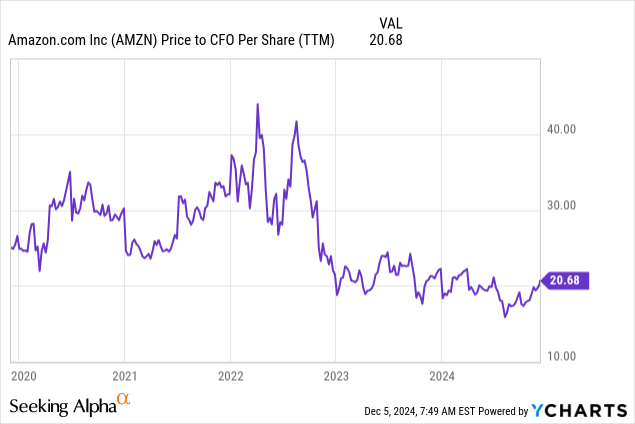

Even on a cash flow basis, AMZN remains very conservatively priced relative to its 2021 highs.

To some, this disparity between Amazon’s profitability and the share price multiple could be a signal that the stock is now a bargain. In reality, however, it is a direct result of the following:

- exuberant valuations of growth stocks in 2021 that are unlikely to be repeated;

- concerns regarding the sustainability of AWS record-high margins beyond the very near-term.

Conclusion

As a successful 2024 draws to a close, Amazon shareholders should keep in mind that the market now expects more. Provided that 2025 is another good year for equities, AMZN investors would need to see the company exceeding expectations not only in its e-commerce business, but also in terms of AWS profitability. Given the strong momentum in demand for cloud services, this is likely to be the case over the coming quarters, but the question regarding the long-term sustainability of these margins remains.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the cloud space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.