Summary:

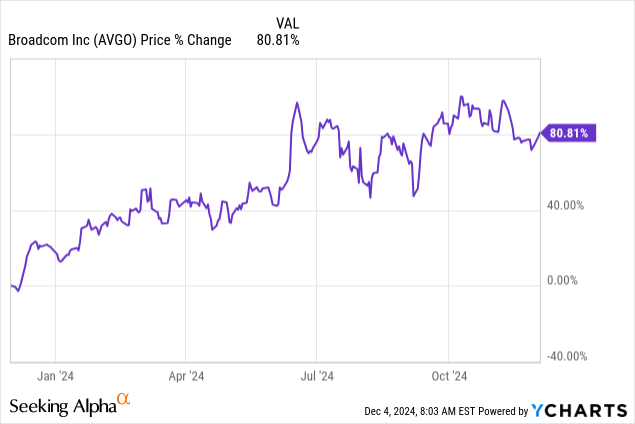

- Broadcom’s stock has surged 80% in the past year, driven by its leadership in semiconductor and infrastructure software solutions, including the VMware acquisition.

- Despite the company’s strong market position and growth prospects in AI, 5G, and cloud computing, current valuation suggests it is currently overvalued.

- Given the overvaluation and associated risks, I recommend holding Broadcom stock while exploring other semiconductor market opportunities.

JHVEPhoto

Broadcom (NASDAQ:AVGO) has performed phenomenally over the last year, returning over 80%. Fellow investors therefore might wonder if the company is still at an attractive entry point valuation-wise. In this article, we will first take a look at Broadcom’s business as a whole and then analyze what growth rates the market is currently implying with Broadcom’s valuation. At the end of this analysis, we will evaluate if these implied and required growth rates are achievable for the company.

The Business

Broadcom is currently operating in two major segments:

Semiconductor Solutions

This segment includes the following products and services:

- Networking: AVGO is providing ethernet switches and routers for data centers, cloud providers and telecom companies.

- Broadband and Wireless: Broadcom is supplying wireless connection devices, which can be used for smartphones, cable, and satellite. They are currently also supplying Apple (AAPL) for example.

- Storage and Industrial: The companies semiconductors are used in storage controllers and several automation applications.

Infrastructure Software

In the infrastructure software segment, there are two main under-segments:

- Mainframe & Enterprise Software

- Automation and Cybersecurity

The VMware Acquisition

Broadcom purchased VMware in 2023 for ~$60 billion. There are several benefits in this acquisition, but these two are the main ones in my opinion:

- Cross-Selling: Due to VMware’s dominant market position, Broadcom is able to sell its existing products and services to the already existing ecosystem of VMware and vice versa.

- Reducing Cyclicality: Through the purchase, Broadcom’s revenue becomes less lumpy as they aren’t that reliant on the historical cyclical semiconductor market.

Opportunities

Diversified Revenue Streams: With the increasing software part of the company, revenue streams are more diversified and provide steady recurring income.

Dominant in High-Growth Markets: The company is very well positioned to capitalize from the rapid growth in the data center, AI and 5G market.

Enterprise Digital Transformation: Companies are increasingly moving to scalable and adaptable IT infrastructures. This development should drive growth to VMware.

Risks To Consider

Customer Concentration: The company is currently heavily reliant on Apple as a big customer. Should Apple go for cost-cutting or for alternative sourcing, Broadcom’s revenue will certainly take a big hit.

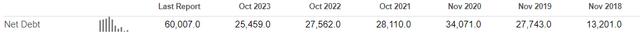

Debt: The recent acquisition led to an increase to $60 billion in net debt, potentially restraining the company from future M&As and more R&D expenses, if interest rates continue to stay “high”.

Broadcom’s Debt Development (seekingalpha.com)

Economic Slowdown: Like mentioned, the semiconductor market has historically been cyclical. A potential economic downturn could therefore lead to a decreasing top and bottom line for Broadcom. Also, a potential recession may cause companies to postpone investments into their Infrastructure Software.

Integration Risks: The acquisition can only unlock its true potential if the two companies successfully integrate. This can be very challenging as two different company cultures have to be combined into one. According to experts up to 90% of M&A integrations fail.

Valuation

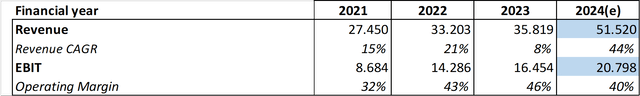

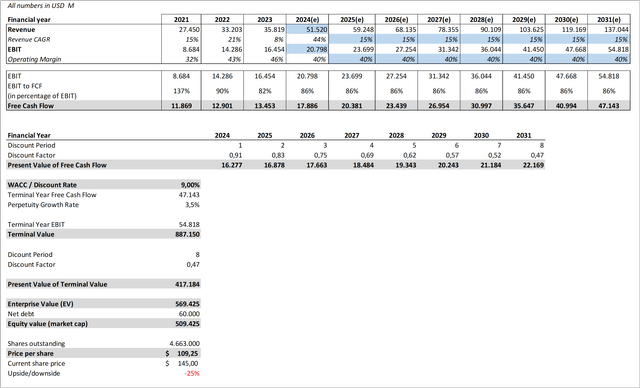

To evaluate the company, we need a few assumptions apart from the revenue. For 2024, I assumed that it will manage to achieve its Q4 guidance for revenue and profitability. For the EBIT margin I averaged out the last four years and used 40% for the next 8 years.

Broadcom EBIT Development (investors.broadcom.com)

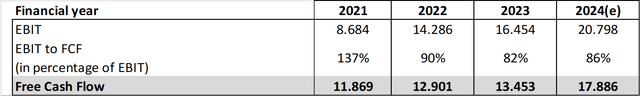

For the free cash flow conversion, I did the same thing, but only for 2022 & 2023 as 2021 seems to be a positive outlier.

Broadcom Free Cash Flow Development (investors.broadcom.com)

For the WACC I used 9.0%, which is right around the company’s current rate and for the perpetuity growth rate, 3.5% seems reasonable.

Broadcom’s Required Growth (I) (own assumptions)

Broadcom’s Required Growth (II) (own assumptions)

With these assumptions, we get a required growth rate of 20% p.a. for the next eight years to justify the current valuation. Given that their profitability and free cash flow conversion stay at today’s levels.

Is This Achievable For Broadcom?

Like mentioned above, the company is currently operating with two business segments: semiconductor solutions and infrastructure software. The revenue distribution as of Q3/2024 is 56% semiconductors and 44% software.

Broadcom’s Revenue Per Segment (investors.broadcom.com)

For the semiconductor market, experts expect the following growth rates for the next years:

Grand View Research: 7.9% p.a.

Fortune Business Insight: 14.9% p.a.

Statista: 10% p.a.

Giving us an average market growth rate of 10.9%. For the infrastructure software market, on the other hand, experts anticipate these market rates:

Grand View Research: 8.4% p.a.

Research Nester: 8.9% p.a.

If we average out all these growth rates and assume an almost 50/50 split between the segments, then a growth rate of 10% for Broadcom’s market segments is very realistic. I think due to the above-mentioned opportunities, Broadcom might be able to grow above the market rate in some areas. Especially the increasing AI adoption as well as potential leverage through the recent acquisition could increase their growth rate. Other Analyst expect the following revenue growth rates for the company in the next few years:

Analyst’s Broadcom Revenue Expectation (seekingalpha.com)

Even when assuming growth rates of 15% p.a. – 50% above the underlying market rates and above analysts’ expectations — the company is currently overvalued by 25%.

Broadcom Discounted Cash Flow Analysis 15% p.a. (own assumptions)

When assuming an EBIT margin improvement of 5% in 2025 to 45% and 2026 to 50%, the company seems still overvalued by 5%.

Conclusion

The business is in a strong position to capitalize on revolutionary developments like artificial intelligence, 5G, and cloud computing while utilizing its dominance in vital semiconductor components. But given the expected growth, Broadcom seems to currently be overvalued by a range of 25% to 5% (45% when assuming 10% p.a. revenue growth). For investors that want to gain exposure to the semiconductor market, I rather recommend checking my NVIDIA analysis (NVDA) and ASML article (ASML), which I just rated a Buy and Strong Buy. Because of the valuation, the mentioned risks and the other potential buys, I currently rate the company a Hold.

What’s Your Perspective? Let’s Discuss!

Thank you for reading my analysis! I’d love to hear your ideas and points of view — whether you agree, disagree, or have your unique take on the stock. Let’s start a discussion in the comments! I welcome any helpful arguments and ideas that can help us better comprehend this topic. Thanks!

~ Fabian – FF

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.