Summary:

- Intel CEO Pat Gelsinger has resigned.

- With the board likely forcing his hand, questions remain on next steps.

- I think Intel should maintain course on its foundry turnaround with its new 18A node.

FinkAvenue

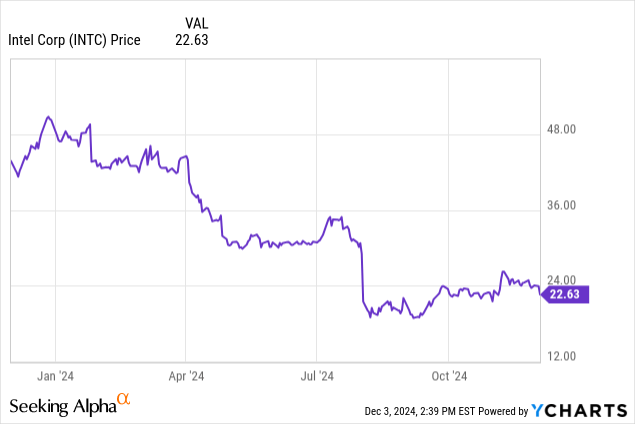

Intel (NASDAQ:INTC) (NEOE:INTC:CA) stock’s wild ride continued this week as the company said on Monday that CEO Pat Gelsinger was retiring. Shares ended more than 5% higher on the day, but gave up those gains and then some in Tuesday trading as the market digested the implications of the news. While I don’t think this was the right move on the part of Intel’s board of directors, I think INTC remains a Buy on a favorable risk-reward profile.

An eventful 2024 becomes yet more eventful for Intel shareholders, and unfortunately, yet again, not in a good way. The company announced that CEO Pat Gelsinger, who had come back to lead Intel’s turnaround in 2021, was retiring. However, later reporting from Bloomberg claimed that the board of directors, which had lost confidence in Gelsinger’s ability to turn the company around, had given him a choice between retiring and being fired. INTC has dropped 65% since his hiring and the board had apparently had enough.

Before getting into my analysis of this move, just to give some background, I’ve been fairly bullish on INTC since the initial sell-off back in August. After being bearish on Intel for the better part of a decade, I claimed the stock was a buy on foundry turnaround prospects and restructuring moves. That article can be read here.

There was a period of uncertainty where Intel was mulling spinning off the foundry business before making an attempt at a turnaround, a move that I didn’t think was in the best interest of shareholders. But then the company laid out a vision of Intel Foundry as an independent subsidiary, paving the way for an eventual spin-off down the road, and reported upbeat Q3 2024 results, which restored my confidence in the stock.

Turnaround Failure?

This was always going to be a painful, costly, and lengthy turnaround. Successful foundries aren’t built in a day, or a month, or even a year, just as they aren’t destroyed in that timeframe — it took Intel about 5 years from its initial 10nm failures to losing the lead to TSMC (TSM). After all, you don’t attempt to develop five new process nodes in four years by saving money and being risk-averse. A major restructuring was always in the cards, with the overall goal being to innovate hard and fast in order to create a bridge to a competitive and externally successful manufacturing node. For Intel, that node is 18A.

This strategy was coming together with some positive momentum after Intel scored a major 18A design win with Amazon for custom AI chips, which counteracted some early rumors that Broadcom (AVGO) was unimpressed by initial yields. More good news came last week as the Biden administration finalized CHIPS funding to the tune of nearly $8 billion to assist Intel’s fab investments stateside.

Barron’s

Things were looking up, and the turnaround appeared to be on track. But alas, it seems Intel can’t get out of its own way.

Gelsinger’s entire tenure and his strategic vision has been to complete a turnaround of the foundry division with a competitive node, so forcing him out before the ramp of that node certainly doesn’t send an optimistic message to the market, in my opinion. If the node is performant and is the culmination of the 5N4Y plan, why not let Gelsinger at least lead the launch of his turnaround plan’s first major accomplishment? Personally, I still expect the node to capture some market share and score some large customers, but this move from the board shows doubt at a time when the company desperately needs the node to be a success. This firing does not instill confidence in shareholders.

I think the most likely reason behind the resignation/firing is a difference of opinion over how to proceed with the foundry business. Gelsinger has long been a proponent of a foundry turnaround, even as many shareholders and analysts have called for a spin-off to unlock the highly profitable chip design business. This move could be an acknowledgement of an increased sense of urgency and a shorter timeframe to complete a spin-off. The initial jump in stock price after the news of Gelsinger’s departure was likely a bet on the increased odds of a break-up.

However, further complicating the matter of a spin-off, CHIPS funding is contingent on Intel maintaining the foundry; specifically, Intel must maintain 50.1% ownership of the fab business. The company is not currently in the position to turn down $8 billion in funding, so a more likely outcome might be to take a hybrid approach and sell off some of the foundry while moving forward with the original turnaround plan. This seems like a compromise the board might be interested in pursuing, and could be a significant factor in who is chosen as the next CEO.

To me, going for a spin-off now or within the next 2–3 years would be the prioritization of short-term profits over the long-term value of Intel. As part of Intel, the foundry has a chance at a successful turnaround, but as an independent entity, those odds go way down, in my opinion. The fab business should get spun off eventually, but doing so now would be a prime example of selling low. Intel should let 18A play out and commit whatever resources are necessary to make it a success, and then re-assess after the dust has settled. There’s more value in that strategy than cutting bait and selling a stake at a steep discount.

Investor Takeaway

Regardless of the exact strategy the company elects to take, I think Intel still holds value as we close in on the 18A ramp and the stock’s valuation continues to trade at extremely depressed levels. However, investors shouldn’t jump in expecting a quick buck; this story will likely take years to play out and the foundry could remain unprofitable for a while.

That said, I do think INTC represents a favorable risk-reward profile and that the current price is a solid entry point for prospective long-term investors. The firing of Gelsinger is an unfortunate and frustrating move before one of the most important launches in the company’s history, but the stock still has upside as it navigates this turnaround. I am re-iterating INTC as a Buy.

Thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.