Summary:

- Mastercard Incorporated shares are currently down 2% after Q4 results, and are just about 8% higher than the level at the start of 2021.

- Excluding currency, revenues, EBIT and EPS all grew by high-teens; including currency effects, growth was still in the solid double-digits.

- Even with currency headwinds and the exit from Russia, Mastercard has achieved an EPS CAGR of more than 11% in 2019-22.

- Consumer spending continues to be strong, and management outlook implies a “low teens” EBIT growth in 2023.

- With shares at $375.17, we expect an exit price of $571 and a total return of 55% (16.2% annualized) by 2025year-end. Buy.

lcva2

Introduction

Mastercard Incorporated (NYSE:MA) reported Q4 2022 results this morning (January 26); shares are down 1.9% as of 3 pm EST.

We initiated our Buy rating on Mastercard in April 2019. MA shares have gained 62% (including dividends) since then, but the current share price is only 8% higher than at the start of 2021, even after an 8% rebound year-to-date:

|

Mastercard Share Price (Last 5 Years)  Source: Google Finance (26-Jan-23). |

Excluding currency, Q4 2022 saw high-teens year-on-year growth in revenues, EBIT and EPS, as the final part of the post-COVID rebound more than offset the exit from Russia; including currency, growth was still double-digits. Volumes continued to be strong, though with a small deceleration in December attributed to lower U.S. gasoline prices and COVID-related disruption in China. 2023 will see the resumption of Mastercard’s regular growth algorithm, with management outlook implying a low-teens EBIT growth. MA shares are at a reasonable 34.9×2022 EPS for a resilient, multi-year compounder. Our forecasts indicate a total return of 55% (16.2% annualized) by 2025 year-end. Buy.

Mastercard Buy Case Recap

Our investment case on Mastercard has been based on a belief that its 15%+ EPS CAGR and premium valuation would continue, driven by:

- Electronic payment volumes are growing structurally, from both GDP growth and the continuing shift away from cash and cheques; even in the U.S. and Europe, a significant amount of consumer spending remains in cash; the potential is even greater in newer geographies

- Mastercard and Visa (V) are increasingly penetrating new payment verticals including Business-to-Business, Business-to-Consumer and Peer-to-Peer; they are also increasingly providing value-added services that utilize their platform status and wealth of data, adding further revenue growth

- Incumbent payment networks enjoy natural advantages in scale and network effects; regulations ensure a high barrier to entry

- Payment networks have natural operational leverage, being highly scalable and having largely fixed costs, so earnings grow faster than revenues

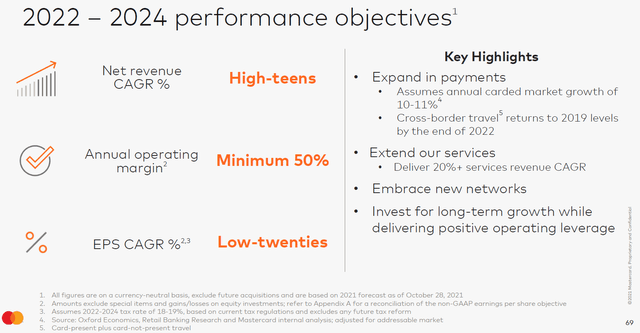

Mid-term targets set out at the investor day in November 2021 include a revenue CAGR in the high-teens, an EBIT margin of at least 50% (compared to 54.3% in 2021), and an EPS CAGR in the low 20s, though our own investment case is more conservative:

|

Mastercard 2022-24 Targets  Source: MA investor day presentation (Nov-21). |

COVID-19 was a significant short-term negative for Mastercard, with travel restrictions disrupting high-margin cross-border volumes, but a long-term positive, accelerating the shift to electronic payments.

Q4 2022 saw another quarter of double-digit growth, as Mastercard completed its rebound from pandemic disruption.

Mastercard Q3 2022 Results

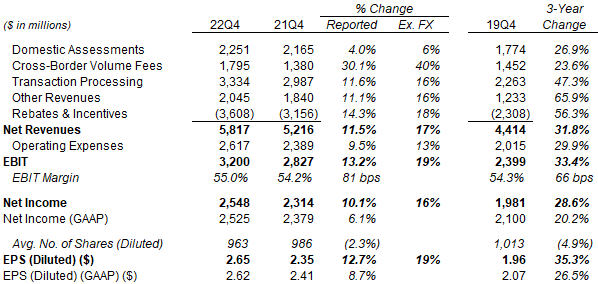

Q4 2022 was another quarter of double-digit year-on-year growth in revenues, EBIT and EPS, despite currency headwinds and the exit from Russia in Q2 2022. Excluding currency, revenues grew by 17% year-on-year, EBIT grew 19% (with margin expanding 81 bps), Net Income grew 16%, and EPS grew 19%:

|

Mastercard Adjusted P&L (Q4 2022 vs. Prior Periods)  Source: MA results releases. |

Revenue growth was driven by a 40% growth in Cross-Border Volume Fees, which benefited from a 31% increase in Cross-Border Volume as well as favorable mix. Transaction Processing revenue grew 16%, helped by favorable mix, FX-related revenues and pricing. Other Revenues grew 16%, driven “primarily” by Cyber & Intelligence and Data & Services, showing Mastercard’s continuing momentum in value-add services.

Acquisitions was a small 1 ppt headwind on EBIT growth (and a 2 ppt headwind on Net Income growth), having added 1 ppt to revenue growth but 3 ppt to Operating Expenses growth.

Compared to pre-COVID Q4 2019, Mastercard’s revenues, EBIT and EPS were all more than 30% higher in U.S. dollars, though, with EPS CAGR of 10.5% being a few points below our long-term assumption of mid-teens (after the exit from Russia and the strong dollar both reduced Mastercard earnings).

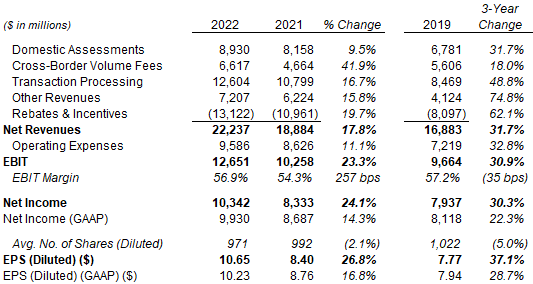

The full-year picture is similar, showing strong double-digit year-on-year growth across both revenues and earnings, and with 2022 EPS being 37.1% higher than in 2019:

|

Mastercard Adjusted P&L (2022 vs. Prior Years)  Source: MA results releases. |

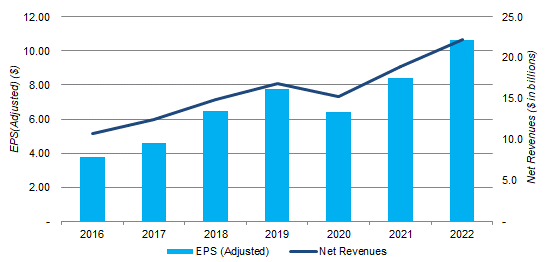

Mastercard revenues and EPS appears to be back on their long-term growth trajectory, which looks remarkably consistent except for the interruption by COVID-19 in 2020-21:

|

Mastercard Revenues & Adjusted EPS (2016-22)  Source: MA results releases. |

Across 2019-21, despite the headwinds from currency and Russia, Mastercard’s EPS CAGR was 11.1%.

Mastercard’s Strong Volume Trends

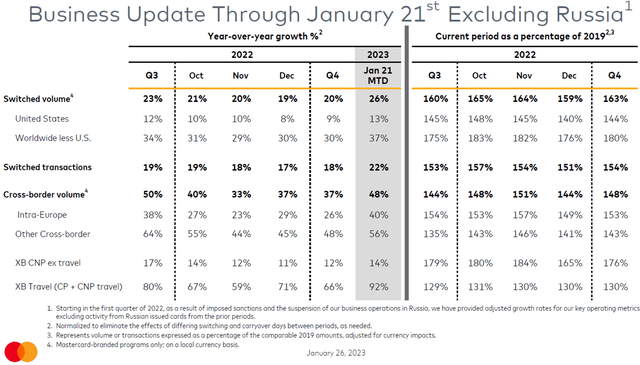

Mastercard’s volume trends continue to be strong. Relative to 2019 levels, Q4 2022 Switched Volume was at 163% and Cross-Border Volume was at 148%, in both cases a few ppt higher than in Q3 2022:

|

Mastercard Volume Local Growth vs. Prior Years (Since Q3 2022)  Source: MA results presentation (Q4 2022). Key: XB = Cross-Broder, CNP = Card Not Present, CP = Card Present. |

Within Q4 2022, December growth rates versus 2019 were a few points lower than those in November. Management did not explain this fully but referred to lower gasoline prices in the U.S. as well as COVID-related disruption in China.

January 2023 showed significantly higher year-on-year growth rates than in Q4, but this was helped by lapping the heightened disruption from the Omicron variant of COVID-19 back in January 2022.

Looking ahead, Mastercard is generally upbeat on consumer spending, though noting some uncertainty in the macro environment. As CEO Michael Miebach explained on the earnings call:

“While the macroeconomic and geopolitical environment remains uncertain … the broadly resilient labor market with low unemployment and rising wages, coupled with elevated consumer savings levels, are key drivers of consumer spending … From an overall consumer spending standpoint, we expect the consumer to be relatively resilient. Spending patterns have largely normalized relative to the effects of the pandemic with the notable exception of China.”

The normalization of spending patterns means that Q4 is likely to be the last quarter that benefits materially from a post-COVID rebound. The only area of spending that has not fully recovered is Cross-Border Volume in Asia, as China has only reopened in December. Back in Q4 2019, China represented 1% of inbound travel cross-border volume and 2% of outbound cross-border volume, and this volume remained 50% lower in Q4 2022. Cross-Border Volume Fees, in turn, were about 20% of Mastercard gross revenues in Q4 2019. So the upcoming recovery in China-related travel volumes will be helpful to Mastercard but likely not make a material difference.

Mastercard’s 2023 Outlook

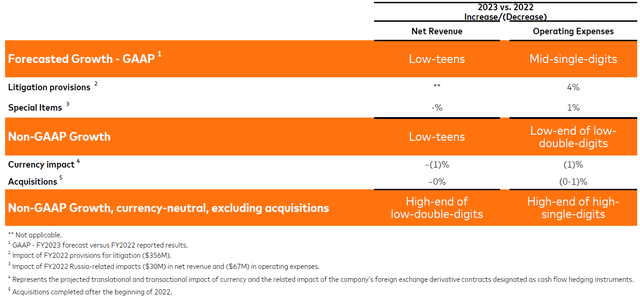

For 2023, on a non-GAAP basis, management is expecting organic growth of “high-end of low-double-digits” in revenues and “high-end of high-single-digits” in Operating Expenses; including acquisitions and currency, this becomes a “low-teens” growth in revenues and a “low-end of low-double-digits” growth in Operating Expenses:

|

Mastercard 2023 Outlook  Source: MA results presentation (Q4 2022). |

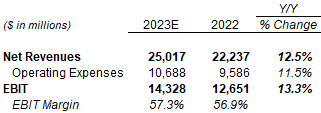

Applying our interpretation of the words used, we believe the new outlook implies a 13% growth in Adjusted EBIT:

|

Illustrative Mastercard FY23 P&L Estimates (Non-GAAP)  Source: Librarian Capital estimates. |

However, a higher tax-rate is expected to be a headwind in 2023. Management expects the tax rate to be 18-18.5%, compared to 15.7% in 2022 (both on non-GAAP basis), so Net Income growth is likely to be a few points lower than EBIT growth. Even with buybacks, 2023 EPS growth will likely be slightly below our long-term mid-teens assumption.

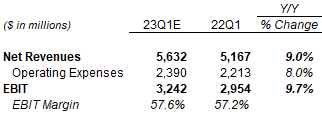

For Q1 2023, again applying our interpretation, management outlook seems to imply an EBIT growth of just below 10%:

|

Illustrative Mastercard Q1 2023 P&L Estimates (Non-GAAP)  Source: Librarian Capital estimates. |

After the very strong rebound in 2022 and with a potential recession in the U.S. in 2023, one year of below-trend growth would not be surprising, and would not change our long-term investment case.

Valuation – Is Mastercard Stock Overvalued?

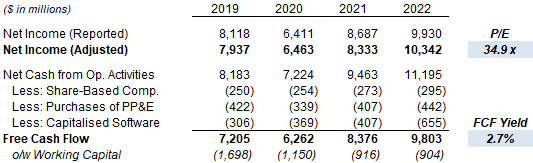

At $375.17 as of 3 pm EST, Mastercard shares are trading at a 34.9x P/E and a 2.7% Free Cash Flow (“FCF”) Yield:

|

Mastercard Net Income, Cashflows & Valuation (2019-22)  Source: MA company filings. |

The Dividend Yield is 0.6%, with an annual dividend of $2.28 ($0.57 per quarter, raised 16% in December).

Mastercard repurchased $8.8bn of its stock during 2022 (including $2.4bn in Q4), equivalent to 2.4% of its current market capitalization. Another $9bn was added to the buyback program in December.

Mastercard’s P/E multiple modestly below our assumption of 36.5x., which we believe to be reasonable for a resilient, multi-year compounder like Mastercard. In addition, whether a stock is “overvalued” depends on its prospective returns from the current price, not on valuation multiples based on snapshot financials.

We believe Mastercard is attractively valued.

Mastercard Stock Forecasts

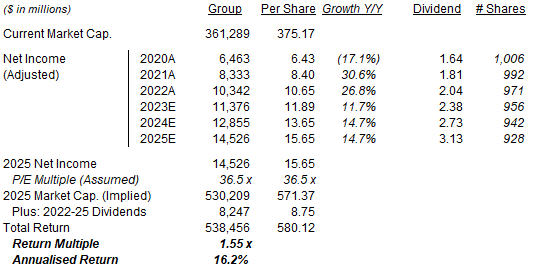

We updated our 2022 figures and reduced our 2023 forecasts slightly. We now assume:

- 2023 Net Income growth of 10% (was 13%)

- From 2024, Net Income to grow by 13% each year (unchanged)

- Share count to fall by 1.5% each year (unchanged)

- Dividends to be based on a 20% Payout Ratio (was 22%)

- Exit P/E of 36.5x (unchanged).

Our 2025 EPS estimate of $15.65 is 2% higher than before ($15.95):

|

Illustrative Mastercard Return Forecasts  Source: Librarian Capital estimates. |

With shares at $375.17, we expect an exit price of $571 and a total return of 55% (16.2% annualized) by 2025 year-end.

Is Mastercard Stock A Buy? Conclusion

We reiterate our Buy rating on Mastercard.

Disclosure: I/we have a beneficial long position in the shares of MA,V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.