Summary:

- Salesforce’s Q3 2025 earnings showcased strong revenue growth, driven by the rapid adoption of AI-powered Agentforce and robust profit margins, prompting a Buy rating.

- Agentforce’s unprecedented adoption by major enterprises like FedEx and IBM highlights its efficiency and cost-saving potential, driving significant future revenue growth.

- Salesforce’s $53.1 billion backlog and expanding margins, including a 20% GAAP operating margin, underscore its financial strength and operational excellence.

- Despite trading at all-time highs, Salesforce’s valuation remains attractive relative to historical averages, supported by strong cash flow and predictable recurring revenue.

J Studios

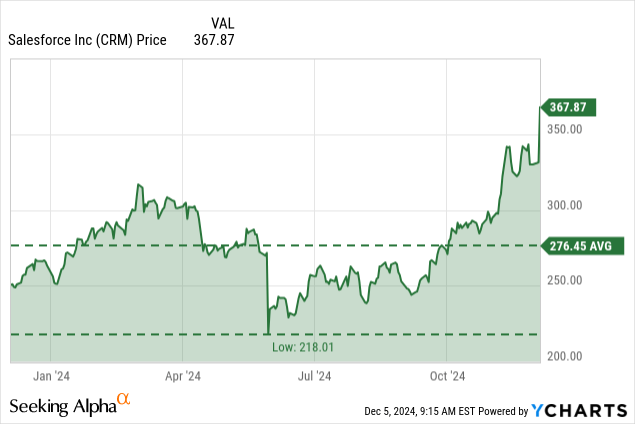

On December 3rd, Salesforce (NYSE:CRM) reported its Q3 2025 earnings, delivering a solid revenue beat but slightly missing on EPS. The market’s reaction was swift and enthusiastic, with the stock rallying over 10% post-results. I’m initiating coverage on Salesforce with a Buy rating.

What draws me to Salesforce is its exceptional operational excellence, robust profit margins, and the rapid adoption of its AI-powered agent, Agentforce, across multiple segments. The Q3 results offered a clear and compelling vision of Salesforce’s future as it fully embraces the AI era. With Agentforce driving efficiency and higher-margin subscription revenues, I see a significant opportunity for sustained revenue growth and margin expansion in the coming years.

Despite the recent rally that pushed CRM stock to all-time highs, I believe it remains attractively valued. In comparison to an overvalued SaaS sector plagued by thin EBITDA and high customer acquisition costs, Salesforce stands out as a profitable, efficient, and discounted play relative to its historical averages.

With its AI-driven strategy and strong financial foundation, Salesforce is well-positioned to deliver long-term value, making it a compelling buy at current levels.

The rapid adoption of Agentforce is a huge milestone for Salesforce securing over 200 deals within just one week of launch is unprecedented in enterprise software deployments, where sales cycles typically span multiple quarters. These weren’t just pilot programs – they included major enterprises like FedEx, Accenture, ACE Hardware, and IBM. More significantly, management indicated a pipeline of thousands of potential transactions, suggesting the initial 200 deals are just the tip of the iceberg. The strategic significance of Agentforce lies in its integration with Salesforce’s vast data ecosystem, processing over 2 quadrillion records quarterly through Data Cloud, which saw a 130% YoY growth in paid customers.

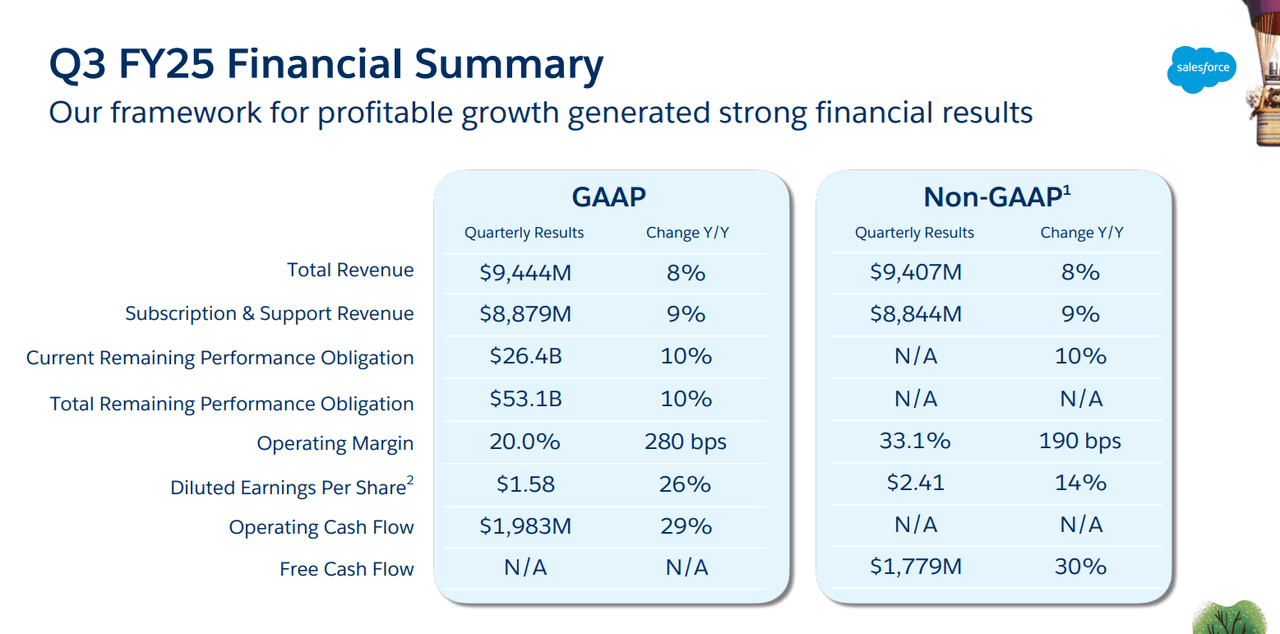

Salesforce Q3 FY25 Presentation Deck

The company’s backlog metrics provide exceptional visibility into future revenue streams. The total remaining performance obligation (RPO) of $53.1 billion, with $26.4 billion due within 12 months, represents a 10% YoY growth in both metrics. This growth is particularly impressive considering the challenging macro environment and speaks to the critical nature of Salesforce’s solutions. The current RPO growth was driven by both early renewal favorability and strong new bookings performance indicating healthy customer retention and expansion.

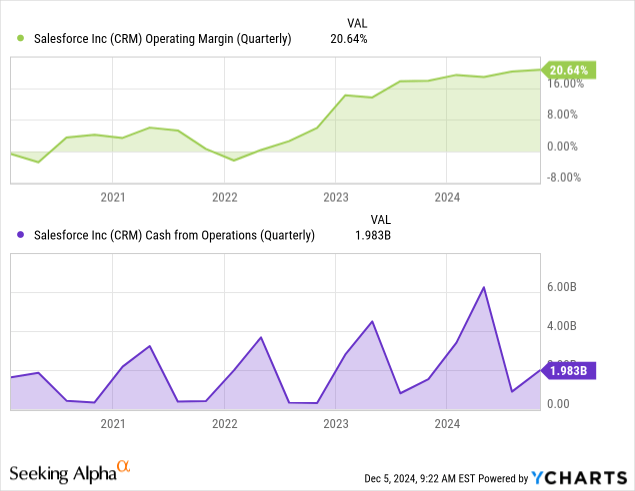

For the first time in its history, the company achieved a 20% GAAP operating margin, while the non-GAAP operating margin expanded 190 basis points YoY to 33.1%. Operating cash flow grew 29% YoY to $1.98 billion, demonstrating that profitability isn’t coming at the expense of cash generation.

What makes this particularly compelling is that Salesforce is achieving these margin improvements while simultaneously investing in next-generation AI capabilities. The company is executing on two fronts that typically trade off against each other innovation and operational efficiency. This combination of expanding margins, strong backlog visibility, and leadership in enterprise AI creates a unique investment opportunity, even with the stock trading near all-time highs.

Even in the broader competitive landscape, no other enterprise AI software has demonstrated this combination of scale and profitability improvement. Microsoft’s Copilot hasn’t shown the same level of enterprise integration and adoption. Salesforce’s advantage lies in its vast repository of customer data 200-300 petabytes which provides the foundation for more accurate and less hallucinogenic AI agents, a critical factor for enterprise adoption.

The company delivered revenue of $9.44 billion representing an 8% YoY growth in both nominal and constant currency terms. What I find most compelling is the composition of this revenue growth. Subscription and support revenue, which I consider the lifeblood of any SaaS business, grew 9% to $8.88 billion. This wasn’t driven by price hikes or one-off deals. Sales Cloud and Service Cloud both achieved double-digit growth demonstrating the robust demand for Salesforce’s core offerings. The company’s geographic diversification is also paying off with EMEA growing 9% in constant currency and APAC showing impressive 14% growth.

Agentforce: A New Growth Driver

I’ve never seen adoption rates quite like what I’m witnessing with Agentforce. The initial traction is frankly staggering. Landing 200 enterprise deals in the first week of launch is unprecedented in enterprise software where sales cycles typically stretch across multiple quarters. But what really caught my attention was the caliber of these early adopters. Companies like FedEx, Accenture, and IBM are implementing Agentforce across their core operations. Take Adecco Group, for instance, they’re using Agentforce to process 300 million job applications annually, a scale that would be impossible with traditional human-only workflows.

What I find particularly compelling is how Salesforce has leveraged its existing infrastructure to give Agentforce a significant competitive advantage. Through SaleForce Data Cloud they’re processing an astounding 2.3 quadrillion records quarterly, up 147% YoY. This massive data foundation, built from over 200 petabytes of customer information provides Agentforce with accuracy and contextual understanding that standalone AI solutions simply can’t match.

Salesforce has spent years building what they call “More Core” a unified platform that seamlessly connects their various clouds. For instance, Air India is using Agentforce to handle more than 550,000 monthly service cases by accessing unified data across loyalty, reservations, and flight systems. This level of integration is possible because Agentforce isn’t a bolt-on solution, it’s built directly into the platform that 150,000 companies already use daily.

The economics of Agentforce are particularly intriguing to me. At $2 per conversation, Salesforce has positioned it at a price point that makes compelling ROI sense for enterprises. When you consider that a typical customer service interaction can cost companies $15-50, the potential for cost savings becomes obvious. I’m seeing early adopters like Wiley reporting 40% faster case resolution times, while Vivint is using Agentforce to tackle high volume support calls and reduce service rep churn.

Management indicated they’re seeing thousands of potential transactions in the pipeline, and I believe this is conservative. With the upcoming release of Agentforce 2.0 in December, I expect adoption to accelerate further. The platform’s ability to reduce costs while improving service quality creates a powerful value proposition that I believe will be adopted across Salesforce’s entire customer base.

$53.1 Billion Backlog

I’m particularly impressed by the strength and composition of their backlog metrics. The 10% YoY growth in both total and current RPO, especially in today’s cautious enterprise spending environment, speaks volumes about Salesforce’s market position.

Looking at the quarterly progression of RPO metrics I’m noticing an important trend. The stability in these numbers – $53.1 billion total RPO in Q3 compared to $53.5 billion in Q2 which shows consistent performance rather than lumpy deal timing. What’s particularly interesting is that these numbers don’t yet reflect meaningful contributions from Agentforce, which only launched in late October. Given the early traction of Agentforce with over 200 deals in its first week, I expect these RPO numbers to see an additional uplift in coming quarters.

The quality of the backlog is just as important as its size. In the case of Salesforce’s early renewal favorability and strong new bookings both contributed to the current RPO growth. Furthermore, half of their top 10 deals in Q3 came from international markets suggesting a healthy geographic diversification in their backlog.

Valuation Analysis

Despite trading at all-time highs, the stock offers compelling value relative to its historical multiples. Let me explain why I believe the current valuation is justified and potentially conservative.

Looking at the forward P/E multiple of 36.6x, it represents a significant discount to the company’s 5-year average of 43.48x. This compression in valuation multiple is because Salesforce has actually improved its operational efficiency and market position. The company is now generating superior margins compared to its historical performance with GAAP operating margins reaching 20% for the first time.

The EV/EBITDA multiple of 34.5x, while higher than the sector median of 20.2x requires context. When I compare Salesforce to its peers like Adobe (28.8x) and Intuit (41.6x), the premium doesn’t seem excessive, especially considering Salesforce’s leadership position in enterprise AI.

Price/Sales ratio of 9.5x versus its historical average of 8.0x, I notice something interesting. While slightly above historical levels, this premium is modest considering the company’s dramatically improved margin profile. The current P/S ratio looks even more reasonable when I factor in that Salesforce now generates an EBIT margin of 19.75% compared to historical single-digit margins.

The recurring revenue model adds another layer of valuation support. With subscription and support revenue making up 94% of total revenue and growing at 9% YoY, Salesforce offers predictability that many software companies lack. The $53.1 billion total RPO provides exceptional visibility into future revenue streams, which I believe should command a premium multiple.

I believe current valuation metrics actually understate Salesforce’s potential. The company’s guidance for 24-26% operating cash flow growth suggests accelerating financial performance. When factoring in the potential uplift from Agentforce adoption and continued margin expansion, the current valuation appears to offer an attractive entry point despite the stock’s recent strength.

Hurdles Ahead

While overall growth remains robust the United States and parts of EMEA showed some constraints in spending patterns. This aligns with what I’m seeing across the enterprise software sector companies are scrutinizing their IT budgets more carefully than ever. The retail and consumer goods sectors in particular demonstrated more measured spending in Q3 which could be a leading indicator of broader enterprise caution.

While Salesforce has taken an early lead with Agentforce, the competitive landscape is intensifying rapidly. Microsoft’s (MSFT) massive investment in OpenAI and the rollout of Copilot presents a serious challenge given Microsoft’s deep enterprise relationships and vast resources.

The currency headwind impact is more significant than many investors realize. Looking at the Q3 numbers, I noticed a $25 million YoY FX impact on revenue guidance for Q4 and a more substantial $100 million impact on full-year projections. With 37% of revenue coming from international markets, currency fluctuations can materially impact reported results. EMEA’s growth of 12% in nominal terms translated to just 9% in constant currency, highlighting this exposure.

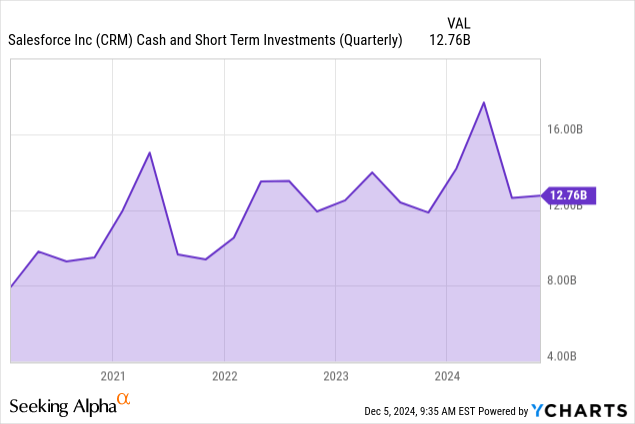

However, I believe Salesforce’s management team has demonstrated strong risk management capabilities. The company’s strong cash position of $12.76 billion and robust free cash flow generation provide significant buffers against these risks.

Investment Thesis Conclusion

The combination of:

-

Strong backlog

-

Rapid Agentforce adoption

-

Expanding margins

-

Reasonable valuation relative to growth potential

Creates a compelling investment opportunity. I believe Salesforce is well-positioned to capitalize on the enterprise AI transformation while maintaining operational excellence. Looking ahead, I expect Agentforce adoption to accelerate through FY2025 and FY2026, driving both revenue growth and margin expansion.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.