Summary:

- Salesforce rallied over 10% despite missing EPS consensus and providing lower YoY revenue growth guidance in 4Q, driven by strong 3Q bookings growth and optimism around Agentforce.

- Its subscription and support revenue growth is projected to decelerate further to 8.2% YoY in 4Q, and its non-GAAP EBIT margin is expected to see a slight sequential decline.

- Management indicated that Agentforce is currently in its early adoption phase and will not materially contribute to cRPO growth in 4Q.

- Unless Agentforce can drive a YoY revenue growth rebound, I expect earnings growth in FY2026 to be significantly lower due to the continued downtrend in revenue growth and stabilized margins.

- EV/Sales TTM has increased by 63% over the past 6 months, surpassing 54% of its price appreciation during this period. However, its non-GAAP P/E FY2025 appears to be fairly valued, having jumped by 33% since my last rating.

JHVEPhoto

What Happened

Salesforce (NYSE:CRM) rallied more than 10% despite missing its non-GAAP EPS consensus and guiding a lower YoY revenue growth in 4Q FY2025. While management’s discussion on its featured Agentforce platform was promising, it did not seem to justify this price reaction.

On the positive side, CRM demonstrated a strong backlog momentum in 3Q FY2025, and management slightly raised the lower end of its FY2025 revenue guidance. However, on the negative side, the upward revisions do not indicate a sequential rebound in total revenue growth, which I primarily focused on. Additionally, the FY2025 operating margin outlook suggests a sequential decline for the next quarter, likely due to the normalization process.

In my 1Q FY2025 earnings analysis, I downgraded the stock from a “Buy” to a “Hold,” citing slowing revenue growth into the single digits. Since then, YoY growth has continued to decline, while the stock has experienced a significant rally. The non-GAAP P/E for FY2025 has expanded substantially from 27.5x at the time of my previous rating to 36.6x currently, reflecting a 33% on multiple expansion.

CRM is now at a mature stage, with a slowdown in revenue growth but margin expansion driving earnings and FCF growth. However, the previous margin expansion also appears to be stabilizing. It’s important to understand that the current U.S. equity market is largely momentum-driven, with price action dominated by multiple expansion. From a fundamental perspective, I believe CRM is fairly valued, and I maintain my “Hold” rating on the stock.

Agentforce Will Not Have Material Contribution in 4Q FY2025

The company model

The company’s CEO, Marc Benioff, appraised a new featured platform, Agentforce, as the “next revolution of Salesforce”. This platform, powered by AI agents, can assist humans in managing workloads more effectively. Since its release on October 24th, the company has seen increasing demand for Agentforce. They plan to announce Agentforce 2.0 on December 17th. Under the current GenAI frenzy, I believe CRM has made the right move to enhance its platforms with advanced AI capabilities. However, since Agentforce is still in its early adoption phase, it’s too early to tell if it will drive significant growth for the company right now. But the recent expansion in valuation has told us the answer.

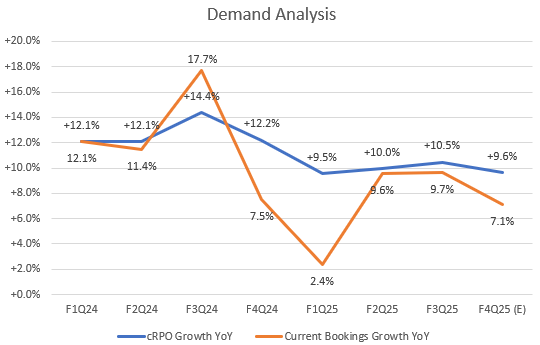

The company’s current backlogs experienced a sequential improvement in 3Q, growing 10.5% YoY, driven by 9.7% YoY growth in current bookings. However, the resilient demand did not translate into a growth rebound in total revenue. During the 3Q FY2025 earnings call, the management noted that Agentforce related bookings will not meaningfully contribute to cRPO in 4Q, which is expected to grow “approximately 9%” YoY to $30.26 billion. Considering $100.05 billion of revenue consensus in 4Q, we can calculate 4Q current bookings at $13.91 billion ($100.05 billion + $30.26 billion – $26.4 billion), implying 7.1% YoY growth. This reflects a deceleration compared to 7.5% YoY growth in 4Q FY2024.

Revenue Growth Continues Trending Lower

The company model

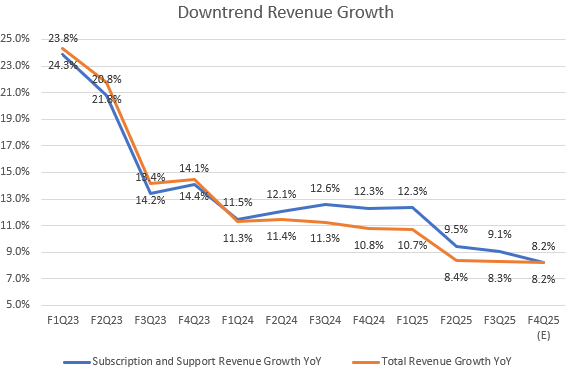

As shown on the chart, CRM’s growth continues to normalize as it reaches a mature stage, indicating that the company is making a transition from high growth to high quality. CRM topped its revenue estimate by $90 million in 3Q FY2025, growing 8.3% YoY. Although the company raised $100 million of its low end of FY2025 revenue outlook from $37.7 billion to $37.8 billion in 3Q, this only implies a $10 million bump for 4Q FY2025. Moreover, the midpoint of 4Q revenue guidance is $10 billion, slightly below the $10.05 billion consensus. Considering this market consensus, CRM is revenue growth in 4Q is expected to be 8.2% YoY, showing continued slowdown from its previous quarter.

Although new acquisitions, including Own Company and Zoomin, will be incorporated into CRM’s forward guidance, management expects subscription and support revenue growth to be approximately 10% YoY in constant currency. However, they anticipate a 30-bps currency headwind for FY2025, leading to my consensus of at least 9.7% YoY. This implies an 8.2% YoY growth rate for 4Q FY2025, indicating a further slowdown. Additionally, management continues to expect growth headwinds in the professional services business segment.

Margin Expansion Stabilized

The company model

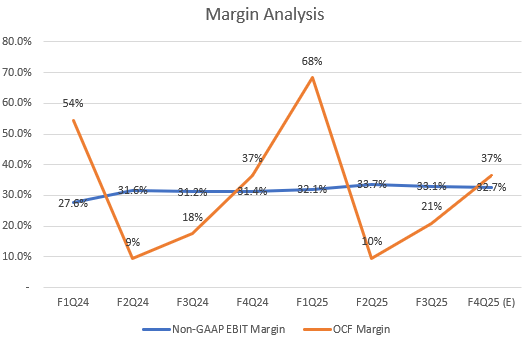

Now, let’s dig into the company’s margins. CRM’s non-GAAP EBIT margin was 33.1% in 3Q FY2025, reflecting a sequential decline from the previous quarter. I believe this decline is primarily due to healthy normalization after a period of strong margin expansion in FY2024. Based on the FY2025 non-GAAP EBIT margin guidance of 32.9%, I estimate that its 4Q margin will further decline to 32.7%, despite showing YoY improvement.

I expect the blue line on the chart will remain flat over the next several quarters as this normalization persists. This trend will likely result in a lower YoY earnings growth in FY2026. We saw that non-GAAP diluted EPS growth has normalized to 14.1% YoY in 3Q FY2025, down from 51% YoY in 3Q FY2024. Without a meaningful rebound in total revenue growth, I believe YoY earnings growth will trend lower. Lastly, based on guidance, I estimate that its OCF margin for 4Q FY2025 will be 37%, consistent with 3Q FY2024.

Valuation

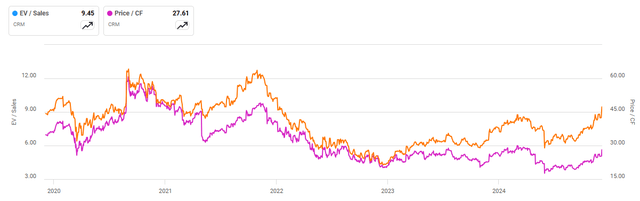

Recently, CRM’s valuation multiples are moving too fast, even though they are not overly stretched on its 5-year horizon. Its EV/Sales TTM has increased by 63% in 6 months, rising from 5.8x on May 30th to 9.45x, surpassing its 54% of its price appreciation during this period. As previously mentioned, we saw a 33% jump in its non-GAAP P/E FY2025 since my last rating. This suggests that CRM’s recent price movement has been largely driven by multiple expansion, reflecting a more optimistic growth outlook.

I acknowledge that strong growth in earnings and cash flow over the past 12 months has helped bring its non-GAAP P/E TTM and P/OCF TTM below their 5-year averages. This highlights CRM’s success in improving its quality despite slowing top-line growth. Therefore, a company transitioning from high growth to high quality may face a lower forward valuation multiple. This is because during periods of strong revenue growth, investors often push multiples higher, anticipating strong future earnings growth to justify a lower forward multiple

As CRM’s margin expansion stabilizes and revenue growth continues to decelerate, its P/E FY2026 is unlikely to lower significantly. I believe CRM’s current price level has already factored in the growth optimism associated with Agentforce, even though the management said that it will not drive significant backlogs growth in the next quarter. With all that in mind, I believe that CRM is currently faired valued.

Conclusion

In summary, CRM is currently at a critical juncture, transitioning from a high-growth phase to more stable, high-quality earnings since 2H FY2023. While the company has demonstrated strong momentum in its backlog, the continued deceleration in revenue growth and stabilizing margin expansion suggest that YoY earnings growth may slow significantly in FY2026. Despite the promise of the Agentforce platform, which is still in its early stages, its immediate impact on revenue remains uncertain. Investors should wait to see if future earnings calls indicate any revenue growth rebound driven by Agentforce. The recent valuation expansion reflects investor optimism about a higher growth outlook, but I believe CRM is fairly valued at current levels. Therefore, I maintain my “Hold” rating on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.