Summary:

- Prudential Financial is one of my portfolio’s smaller core holdings.

- An improving operating environment and growth catalysts are helping the company to return to growth.

- Prudential’s liquidity was well within its targeted range as of March 31.

- Shares of the financial services giant could be trading 5% below fair value.

- Prudential offers an appealing combination of safe yield and decent growth prospects.

A distant view of the Rock of Gibraltar.

chica_fuerte

I probably own more stocks than most other investors. Much of this admittedly stems from earlier in my investing journey, in which I was a huge proponent of diversification.

I own 100 stocks within my dividend stock portfolio, with Amazon (AMZN) now being my lone non-dividend payer after Alphabet (GOOGL) recently declared its first dividend.

However, I’m more concentrated than many would probably expect. My top 50 holdings account for 71.9% of my portfolio. In the next 12 months, there are approximately 10 positions that I plan to exit. Collectively, they account for less than 5% of the portfolio.

Most of them have had little to no dividend growth for the last two to three years. From that point, I’ll redeploy the capital proceeds into higher conviction picks.

One of the higher conviction picks in my relatively diversified portfolio includes the asset manager and insurer, Prudential Financial (NYSE:PRU). The financial services company accounts for 0.9% of my portfolio weighting and is my 44th-biggest holding.

When I last covered Prudential with a buy rating in February, there were a few traits that I found to be attractive.

At that time, the company announced a 4% raise in its quarterly dividend per share to $1.30. This marked its 16th consecutive year of dividend growth since the Great Recession dividend cut in 2008. The company was in excellent financial condition, with an A credit rating from S&P and $4.1 billion in parent company liquidity. Finally, shares appeared to be slightly undervalued.

Today, I’m reiterating my buy rating. Briefly, Prudential’s first-quarter financial results for March 31, which were shared on April 30, demonstrated that the company is making a comeback. The steadily growing dividend is also comfortably covered by profits and free cash flow. Parent company liquidity is within the targeted range and improving. Lastly, shares still look to be discounted relative to my updated fair value estimate.

Prudential Is Displaying All-Around Strength

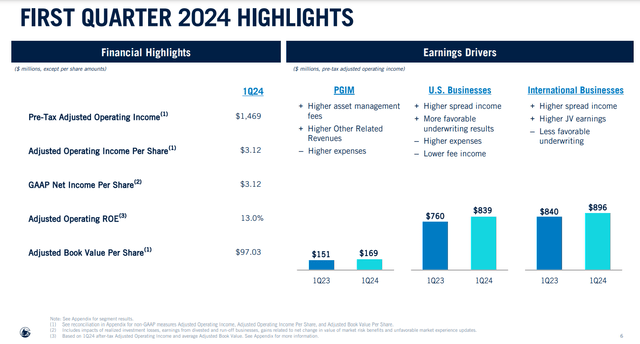

Prudential Q1 2024 Earnings Presentation

Prudential narrowly missed the analyst consensus for after-tax adjusted operating income per share to start 2024. Yet, I believe it was still a productive first quarter to begin the year.

The company’s after-tax adjusted operating income per share climbed by 15.6% year-over-year to $3.12 in the first quarter. This was $0.03 below the analyst consensus according to Seeking Alpha.

What was behind this double-digit growth in the bottom line?

The quick answer is that Prudential showed solid growth in each of its three core operating segments: PGIM, U.S. Businesses, and International Businesses.

The company’s global investment management business, PGIM, did well during the first quarter. Thanks to market appreciation and $26.6 billion in net inflows, the segment’s assets under management grew by 6% year-over-year to top $1.3 trillion. This boosted asset management fees and other related revenue, which was only partially countered by higher expenses. That’s how PGIM’s pre-tax adjusted operating income rose by 11.9% over the year-ago period to $169 million for the first quarter.

Prudential’s U.S. Businesses segment also had a strong first quarter. The segment’s higher net investment spreads and improved underwriting results more than offset higher expenses and lower fee income in the quarter. This is what propelled U.S. Businesses’ pre-tax adjusted operating income 10.4% higher year-over-year to $839 million during the quarter.

Lastly, Prudential’s International Businesses segment logged growth in pre-tax adjusted operating income as well. Like the U.S. Businesses segment, this segment benefited from higher spread income. Along with higher joint venture earnings, this more than neutralized the less favorable underwriting. That explains how pre-tax adjusted operating income jumped by 6.7% over the year-ago period to $896 million for the first quarter.

Prudential’s 2% lower share count due to share repurchases was also another catalyst that powered after-tax operating income per share growth in the first quarter.

Moving forward, some tailwinds are working in the company’s favor. For one, 80% of Prudential’s AUM have outperformed their respective benchmarks in the last five years. Over the last 10 years, that figure is even higher at 92%.

As Prudential keeps outperforming benchmarks, this should keep net inflows steady in the years ahead. Additionally, the company has shown that it can thoughtfully expand its offerings to alternative assets like private credit. This was most recently exemplified by the majority interest purchase of Deerpath Capital last May.

Internationally, Chairman and CEO Charlie Lowrey noted in his opening remarks during the Q1 2024 Earnings Call that the company is broadening its product portfolio in Japan. Prudential’s recently announced sale of its Argentina business also means that it is narrowing its focus to fewer high-growth emerging markets. The thought is that a laser-like focus on fewer markets can help Prudential to better scale businesses in these markets than a scattershot approach.

This is why I think the FAST Graphs analyst consensus for the next few years is sensible. The consensus is that after-tax operating income per share will rise by 17% in 2024 to $13.60. In 2025, earnings are expected to grow by another 7% to $14.56. In 2026, growth is projected at 6.4% to $15.49.

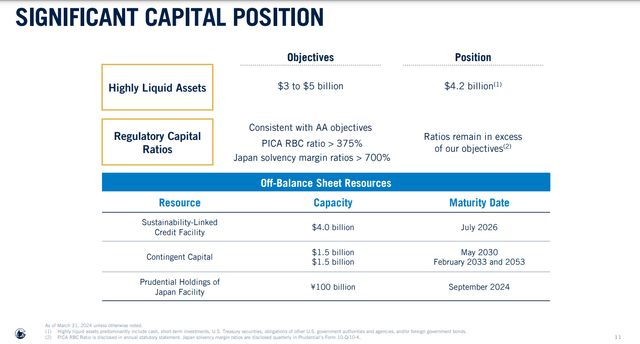

Prudential Q1 2024 Earnings Presentation

Aside from Prudential’s near-term growth potential, the company’s balance sheet is another positive. As of March 31, it had $4.2 billion in liquidity. For context, this was firmly within the targeted range of between $3 billion and $5 billion. Coupled with access to billions more in credit facilities, that provides the company with adequate capital for share repurchases, opportunistic acquisitions, and a cushion for any future economic downturns (unless otherwise sourced, all details in this subhead were according to Prudential’s Q1 2024 Earnings Press Release and Prudential’s Q1 2024 Earnings Presentation).

Fair Value Could Be Close To $120 A Share

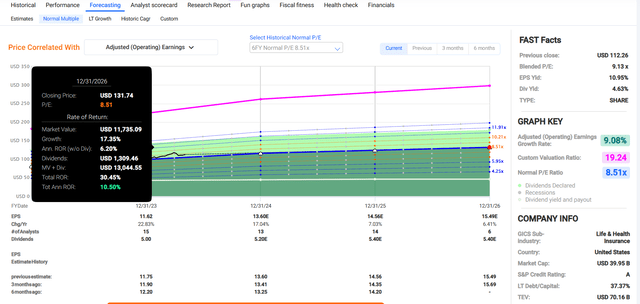

FAST Graphs, FactSet

Even after rallying 7% since my previous buy rating, shares of Prudential could still be a buy. This is because time and an improving earnings outlook have made shares slightly more valuable than my previous fair value of $114 a share.

In the last six years, shares of Prudential have traded at a normal P/E ratio of 8.5 per FAST Graphs. The current-year P/E ratio of 8.3 is just below this valuation multiple. This period has included various interest rate policies from the Federal Reserve, which is why I think the normal P/E ratio blends out to a reasonable valuation multiple.

This calendar year is approximately 35% in the books. Thus, most (~65%) of my fair value estimate will be using the $13.60 after-tax adjusted operating income per share analyst consensus for 2024. The remaining 35% of my fair value for the next 12 months will be using the $14.56 after-tax adjusted operating income per share analyst consensus for 2025 as the earnings input. This works out to a 12-month forward after-tax adjusted operating income per share consensus of $13.93.

Plugging in a valuation multiple of 8.5, I get a fair value of $118 per share. Compared to the $113 share price (as of May 4, 2024), this is a nearly 5% discount to fair value.

Mid-Single-Digit Annual Dividend Growth Should Persist

Dividend Kings Zen Research Terminal

Prudential’s 4.6% forward dividend yield is about 100 basis points greater than the financial sector median of 3.6%. This earns it a B grade from Seeking Alpha’s Quant System for forward dividend yield.

This attractive starting income also could have the potential to keep growing at a decent rate in the years to come. That’s because Prudential’s high-30% EPS payout ratio is moderately below the 50% payout ratio that rating agencies prefer from their industry.

Not to mention that the company’s free cash flow also handily covers its dividend obligation. In 2023, Prudential produced $6.5 billion in free cash flow. Against the $1.8 billion in dividends paid for the year, this equates to a 28.4% free cash flow payout ratio. That left the company with enough free cash flow to also repurchase $1 billion of shares during the year. Yet, Prudential still had excess free cash flow (info according to page 156 of 389 of Prudential’s 10-K filing).

This is why I think the company should have no problem handing out 4% to 5% annual dividend growth for the foreseeable future.

Risks To Consider

Prudential is a business with encouraging fundamentals. Like any business, however, there are risks to the investment thesis.

In asset management and insurance, reputation is everything. This is why Prudential’s continued success depends on its ability to maintain a positive brand image.

The company’s reputation could be damaged by a variety of events. That includes misconduct or a major cyber breach. If something of this nature happened, Prudential could face massive litigation on one front. On the other front, a loss of client trust could be the nail in the coffin in a worst-case scenario.

The company is also exposed to insurance risk. If claims were materially higher than premiums received due to natural disasters or a pandemic, that could financially strain even the most resilient of financial services companies.

Summary: Safe And Market-Beating Income With 10% Annual Total Return Potential

Prudential is delivering consistently growing dividends to shareholders. The company’s growth prospects are recovering. The balance sheet is A-rated by S&P on a stable outlook. Best of all, shares could be marginally discounted. Put this all together and I believe 10% annual total returns through 2026 are realistic. That’s why I am keeping my buy rating for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PRU, AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.