Summary:

- Asana, Inc.’s Q2 2025 earnings and guidance were disappointing, leading to a 10% drop in share price and highlighting its transition away from high growth.

- Despite a strong cash position, Asana remains overvalued, with its stock not attractively priced even at 4x forward sales.

- Asana’s recent initiatives show promise, but macroeconomic headwinds and competition, particularly from monday.com, hinder its growth prospects.

- With minimal revenue growth and substantial unprofitability, investors should avoid buying the dip in Asana’s stock.

DNY59

Investment Thesis

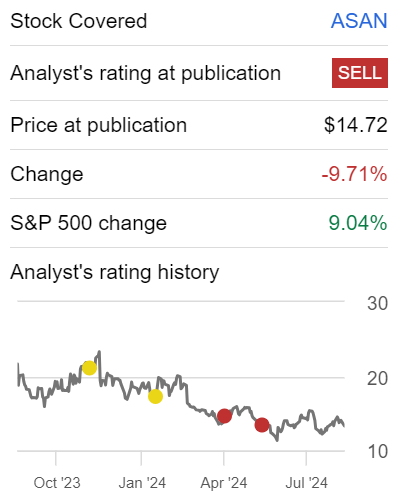

Asana, Inc. (NYSE:ASAN) delivered fiscal Q2 2025 earnings results and guidance that were unpleasant and led to its share price falling by slightly more than 10% after hours. More specifically, it was a reminder that Asana is no longer a high-growth business.

Even though Asana carries nearly 20% of its market cap as cash once its debt profile is factored in, Asana is still not attractively priced to entice investors to buy the dip on this stock.

In summary, I continue to make the case that Asana is overvalued and that investors will look back to $13 per share as a price to aspire towards, and not the floor on its share price.

Rapid Recap

In my June analysis, I said,

[…] the stock may look cheap at 4x forward sales, but I believe that investors will look back in time to $13 per share as a high point to aspire towards.

Author’s work on ASAN

Many investors may feel that since its share price is already 40% from the highs set earlier this year, that the stock is cheaply priced. A bargain. A value stock, if you will.

Yet, I make quite another argument. I state plainly that investors should not buy this dip.

Asana’s Near-Term Prospects

Asana is a work management platform designed to help teams coordinate and streamline their tasks and projects. It offers tools that allow organizations to plan, manage, and track work across various teams and departments, ensuring everyone is aligned on objectives and deadlines. Recently, Asana has been focusing on integrating AI to enhance its platform, making workflows more efficient by automating tasks such as prioritizing work, drafting content, and managing complex processes.

As Asana frequently states, they sold for coordination.

The company’s recent introduction of Asana AI Studio, which allows businesses to build and customize AI-powered workflows, is generating significant interest. With promising signs of stabilization in key industry sectors like retail and media, Asana expects its business to accelerate in the coming quarters, especially as it continues to expand its enterprise offerings and secure large multi-year deals.

Here’s a quote from the earnings call that supports this argument.

Early access to our Asana AI Studio beta program is getting great response from our customers. When we talked to our top 100 customers, virtually every customer wanted to be part of our beta program.

Nonetheless, Asana faces several challenges, including ongoing macroeconomic headwinds which many companies have discussed, plus a slowdown in the IT sector, which continues to impact its overall growth. Additionally, competition is intensifying, particularly from monday.com (MNDY), which has been gaining market share with its user-friendly platform and aggressive expansion.

Given this balance context, I continue to charge that investors would do well to avoid buying this dip. And so, let’s delve into Asana’s fundamentals.

Asana Revises its Revenue Guidance Lower

In my previous analysis, I said,

Another set of quarterly results and the facts are in. Asana is no longer a growth company. It may have a Founder with deep pockets capable of buying up a lot of stock in the company, but this doesn’t change the underlying reality, that Asana is no longer a growth stock.

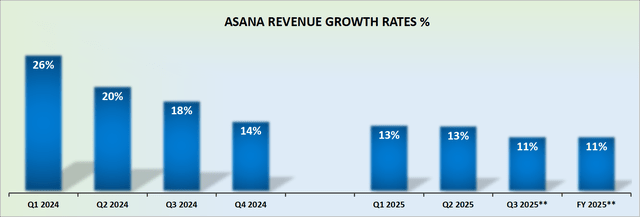

And yet, I could have just as easily said this now. Of course, this downward revision isn’t great, we are looking at 100 basis points slower than previously expected.

Still, this is a reminder that Asana lost much of its traction. Even as its comparable quarters ease up, and its growth rates should improve, the facts show that Asana is not delivering the sort of growth rates investors demand.

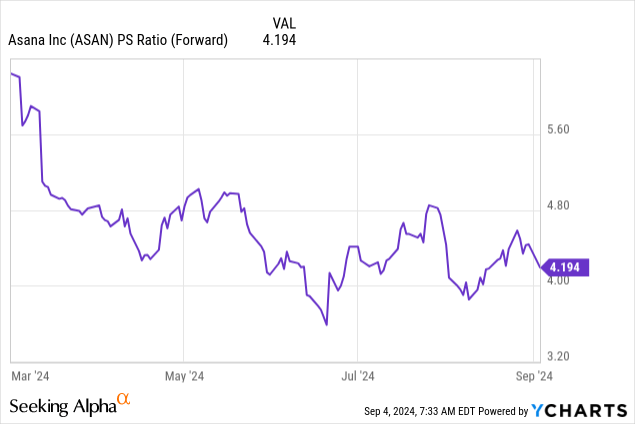

And what complicates matters further, is that Asana’s stock isn’t cheap.

ASAN Stock Valuation — 4x Forward Sales

Looking ahead to fiscal Q3 2025 and Asana may deliver around negative 8% non-GAAP operating margins. This means that even as we put aside the blasphemous discussion of what’s GAAP vs. what’s non-GAAP profits, the business is still far from being profitable.

Of course, Asana’s bulls would retort that the business is already free cash flow positive and is expected to remain free cash flow positive going forward.

To that, I would counter by remarking that this has more to do with Asana’s deferred revenues being paid upfront in cash, rather than the underlying operations being profitable.

What investors are eyeing up here is a business that is still roughly priced at 4x forward sales, and that is no bargain.

In the interest of objectivity, I will highlight that Asana’s balance sheet carries nearly $500 million of net cash, including marketable securities. This means that nearly 20% of its market cap is made up of cash.

For a business that isn’t immediately hemorrhaging cash, that is more than enough cash on its balance sheet to support its operations. But is that cash enough to reignite its operations and for the business to regain traction? No, I don’t believe it is.

In summary, the business is barely growing its revenues, it’s substantially unprofitable (by most measures), and the stock isn’t particularly cheap. All in all, investors would do well to call it a name on this stock.

The Bottom Line

After carefully analyzing Asana’s recent performance and financial outlook, it’s clear that the company is no longer the high-growth story it once was. Despite a solid cash position, the business struggles with profitability and faces mounting competition, which makes it difficult to justify its current valuation.

While Asana’s recent initiatives have sparked interest, these efforts alone aren’t enough to offset the broader challenges it faces.

It might be wise to avoid this investment before your portfolio gets tangled in a poor posture.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.