Summary:

- Asana was part of the 2021 euphoria in the stock market and experienced a meteoric rise and fall in stock prices.

- Its stratospheric growth rates were never sustainable but its growth seems have stabilized and operational costs are starting to be reined in.

- Despite the challenges, Asana’s platform remains relevant in today’s environment, focusing on enhancing productivity and collaboration for remote teams.

- Stabilizing financials, Q2 earnings preview, and improved valuations suggest that the worst may be behind Asana, making it a hold for potential investors.

AndreyPopov

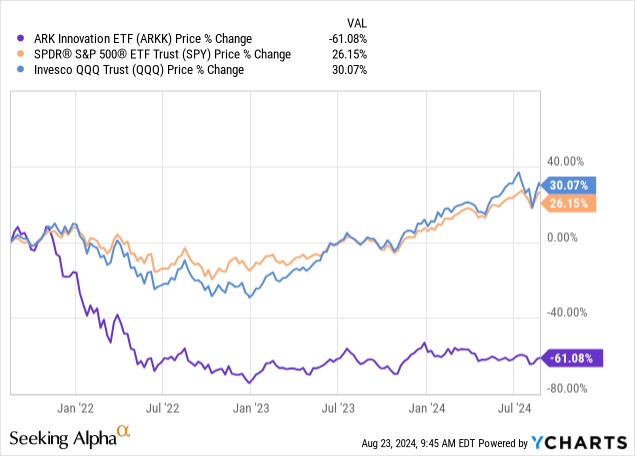

Asana (NYSE:ASAN) was a prime example of the exuberance of 2021 and the eventual bust in the stock prices that followed shortly after. In hindsight, many don’t consider the correction in general market during that time as anything significant as stock market rebounded to all time highs within a short timeframe. But there are a lot of names that are still trading around all time lows (I find ARKK to be good proxy to measure this phenomena)

While I think many such names may never recover as their business fundamentals continue to weaken going into a weaker economy, when I look at Asana I feel the worst may be behind us.

Asana’s products and its relevance in the current environment

Asana is a leading work management platform that helps teams organize, track, and manage their work and functions as a powerful tool for enhancing productivity and collaboration across organizations. It operates on a subscription-based model with multiple pricing tiers which allows the company to cater to a wide range of customers. The main selling point is its proprietary “work graph,” a multi-dimensional data model that captures tasks, projects, goals, and their relationships. This technology provides dynamic views and real-time insights, enabling teams to manage work more effectively.

Asana’s platform is highly relevant in today’s environment, where remote and distributed workforces are becoming the norm and provides for seamless collaboration ensuring that teams can work together effectively without location being an obstacle. Additionally, another big trend I have personally noticed in today’s workplaces is shorter product lifecycles and a long growing need for agile and efficient workflows. With the product’s focus on reducing “work about work” it plays a big role in increasing productivity.

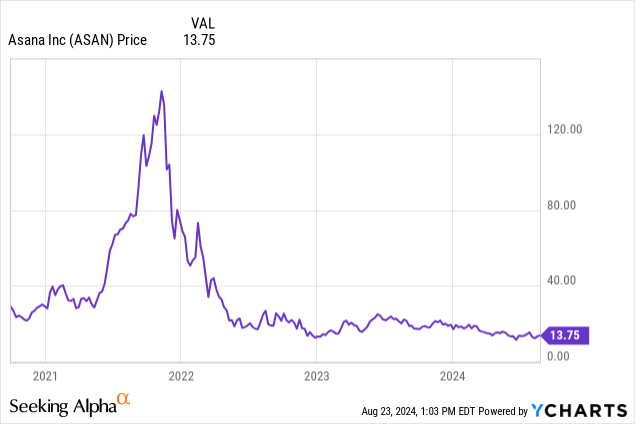

Asana’s meteoric rise and fall

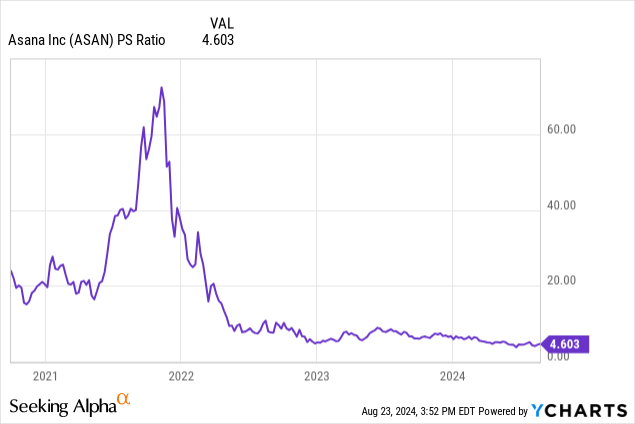

The stock’s meteoric rise was supported initially by an exponential topline growth. But as growth stories go, each big beat in growth comes with even bigger expectations for the future. When the reality stops matching expectations the stock sees a dramatic reset in its valuations and price (PS ratio was 72x at its peak price of $142)

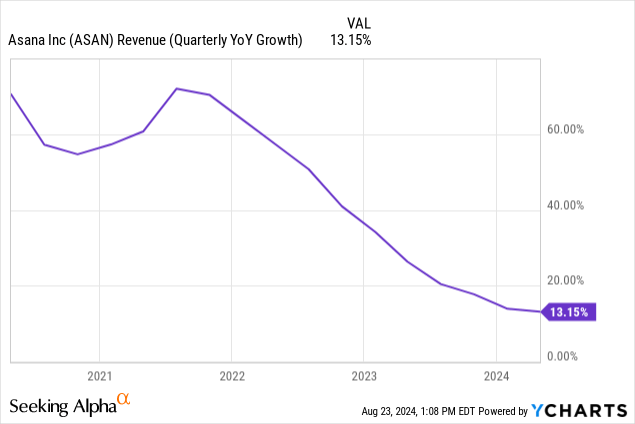

Summarizing its journey, we saw a peak topline growth of close to 70% which has now come down all the way to low double digits. At the same time the drawdown from its peak stock price has been approximately 90%!

Is the worst behind us?

Exhibit A: Stabilizing financials

I am by no means saying a stock that has fallen 90% from its highs won’t have room to fall further. But by what we have observed in the last year it seems that the worst of the move may be behind us.

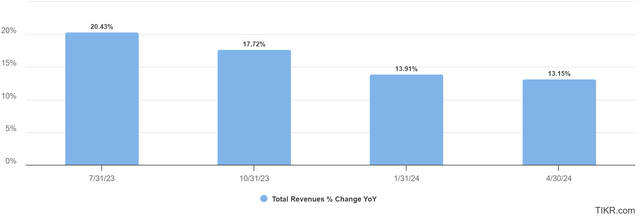

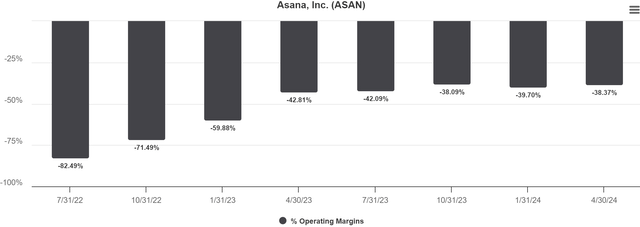

Tikr

Tikr

Change in growth rates has significantly come down and has stabilized in recent quarters. While the company has not provided any indications of when it will be GAAP profitable, it has indicated in its most recent earnings call that it will be Free Cash flow positive for Fiscal 2025. Although this can get misleading when it comes to stock based compensation, there are clear indications that the company is trying to improve its bottom-line. Its gross margins have always been high around 90% but the culprit was its sales and marketing expenses. They have started to rein this in resulting in the improvement of its operating margins.

Exhibit B: Q2 Earnings Preview

In the last 12 months we have seen net revenues of $672M and a diluted EPS of -$1.16. For Q2 Fiscal 2025, the company anticipates revenues of $177M – $178M, reflecting a year-over-year growth of 9% – 10%. For the full FY 2025, they expect revenues to range between $719M and $724M, representing a growth of 10% – 11% year-over-year. However, they project a non-GAAP loss from operations between $55M and $59M, with an operating margin of approximately negative 8% at the midpoint of their guidance and a net loss per share of $0.21 to $0.19.

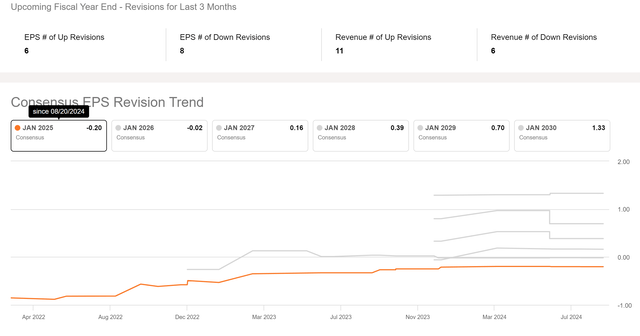

Earnings Revisions for FY (SA)

Analysts are solidly divided in their estimates for the year as the number of up revisions and down revisions are more or less equal but the consensus is along the lines of what the management has laid out.

Overall, the takeaway here is that revenue growth rates will continue to stabilize, bottom line will continue to improve and the worst may be behind us.

Exhibit C: Valuation that has come down to earth

As mentioned earlier, the company at one point was trading at a Price to Sales multiple of approximately 72x at the height of the exuberance seen in the stock market during 2021. Sure there was some justification with high growth rates but clearly most of the times its not sustainable. The good news is that it looks a lot better now and when you look at its percentile rank it is further clear that it is currently trading close to its lowest multiples in history.

The percentile rank chart below shows that 97% of the time the Price to Sales ratio was higher that it is now.

Valuation Percentile Rank (Koyfin)

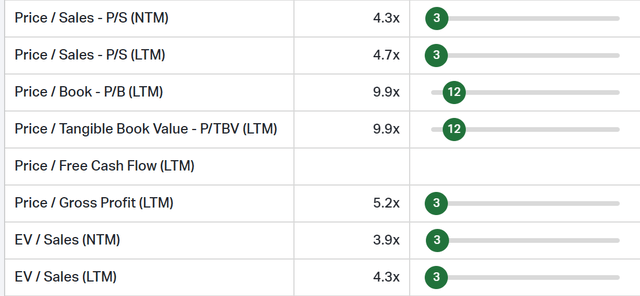

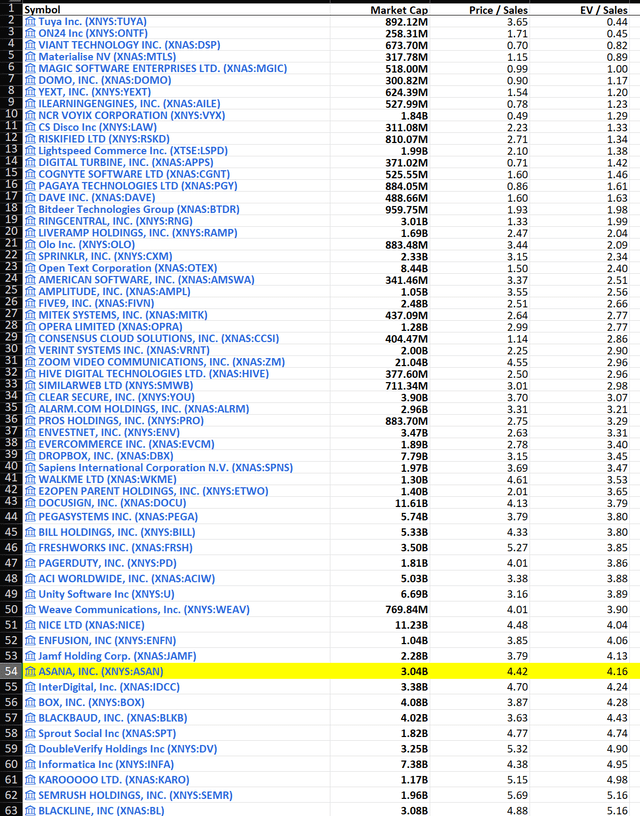

May be a more important question to answer would be to check if its valuation holds up when compared to its own industry. I took an export from Seeking Alpha for all the Application Software industry components and considered only stocks with market caps above $250M and ended with a list of 135 companies. Asana ranks 55 (lower than the median) for its Price to Sales and if we try to leverage the strength of its balance sheet (It has more cash than its total debt) and look at its EV/Sales ratio the results do not change much (Rank 53). With 10% growth rate this ratio could go lower and there is a good case to be made here again that the worst could be behind us.

Software Application Industry comps (SA)

Why this is a Hold?

I like the company, I have used its products and I think its a wonderful fit for today’s software development workflow needs. I would love to be an investor in the company but I would like take a wait and watch approach for the following reasons –

1. Growth has stabilized and is forecasted to grow at low double digits but without a timeline towards definite profitability it is too early to be an investor

2. Earnings will provide further confirmation on the direction of the company

3. Valuation is fair now but does not offer an attractive reward from a risk perspective

4. The stock has entered a consolidation phase and I don’t have to get in at the absolute bottom. I would like to see if the company is able to exceed expectations from here on which would propel the stock higher and then revisit my thesis.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.