Summary:

- Asana has underperformed along with the software sector due to slowing top-line growth.

- Customers have held back headcount growth amidst the higher interest rate environment.

- The company has a large net cash position and is targeting a second half acceleration in growth rates.

- I reiterate my buy rating for ASAN stock.

Kimberly White

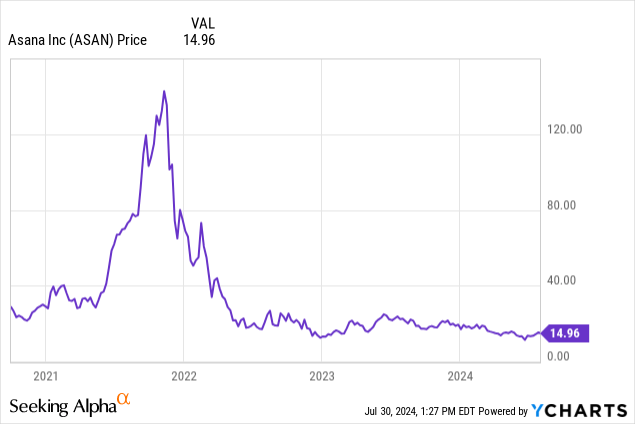

Asana (NYSE:ASAN) is one of the few tech stocks which still trades around the same levels as the 2022 tech crash. The company has seen growth disappear as customers sought to limit IT expenses amidst the higher interest rate environment and rise of generative AI. Management believes that they are seeing encouraging signs of a reversal, making ASAN a unique software business with high torque to an improving macro environment. The company has a net cash balance sheet and management expects to generate positive free cash flow by the end of the year. The valuation looks quite reasonable, especially if growth can accelerate moving forward. I reiterate my buy rating for the stock.

ASAN Stock Price

I last covered ASAN in October, where I rated the stock a buy amidst CEO Moskovitz’s incessant insider buying. Moskovitz has not made any purchases this year, and the stock has underperformed the broader market by around 40%.

That steep underperformance has only improved the buying opportunity.

ASAN Stock Key Metrics

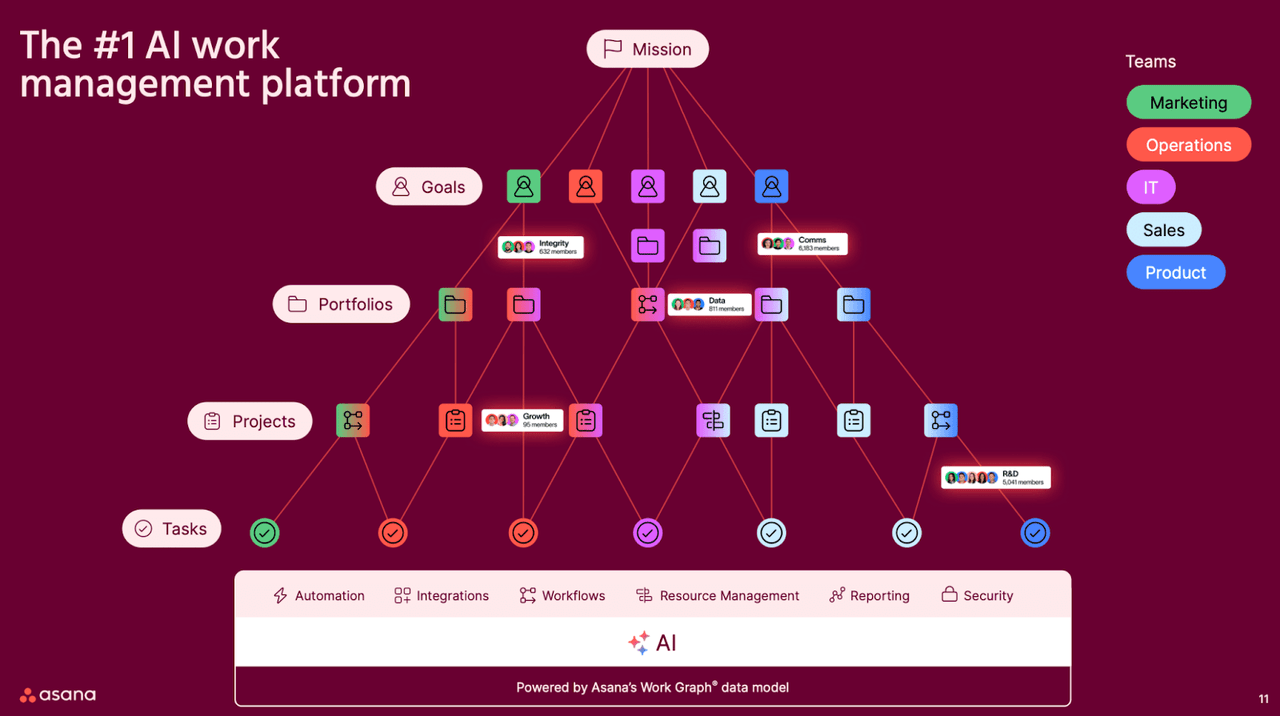

ASAN is an enterprise tech company selling work management software. The company helps various teams across an organization cooperate across projects and tasks.

This kind of headcount-based growth is a model that has typically earned generous valuations from the market due to the recurring nature and secular growth backing it, but the software sector has seen some weakness as of late. ASAN has traded weakly even prior to this bout of sector weakness, perhaps due to its lack of non-GAAP profitability and slower growth rates.

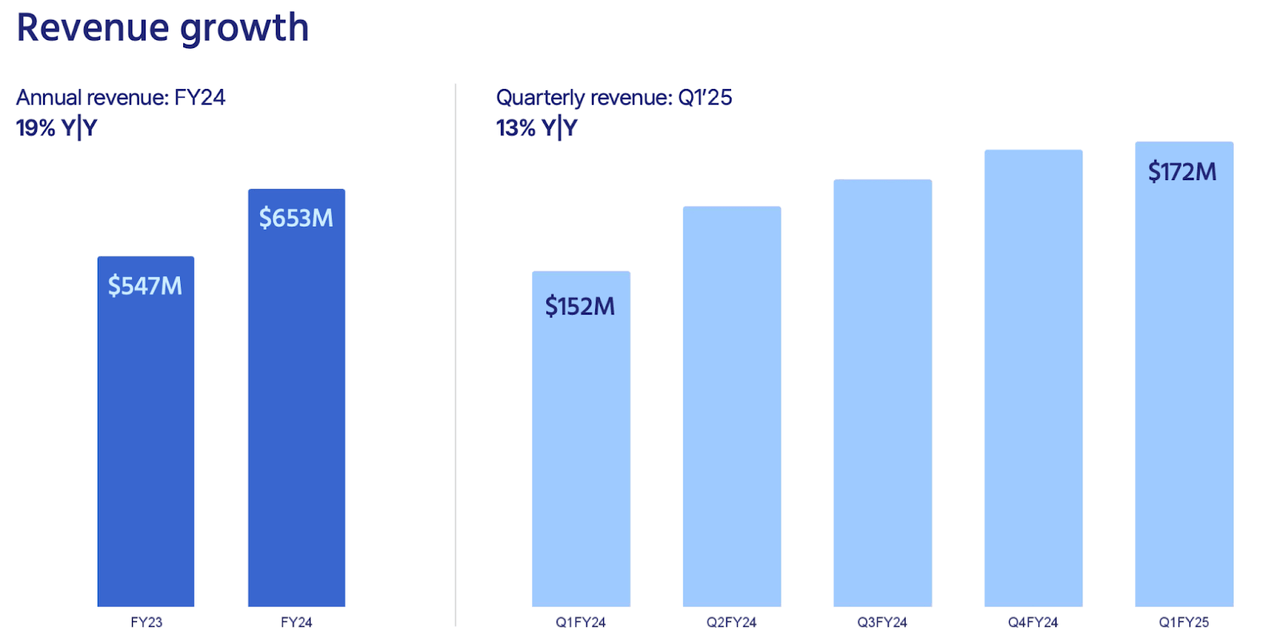

In the latest quarter, revenue grew at 13% YoY to $172 million, surpassing guidance of $169 million.

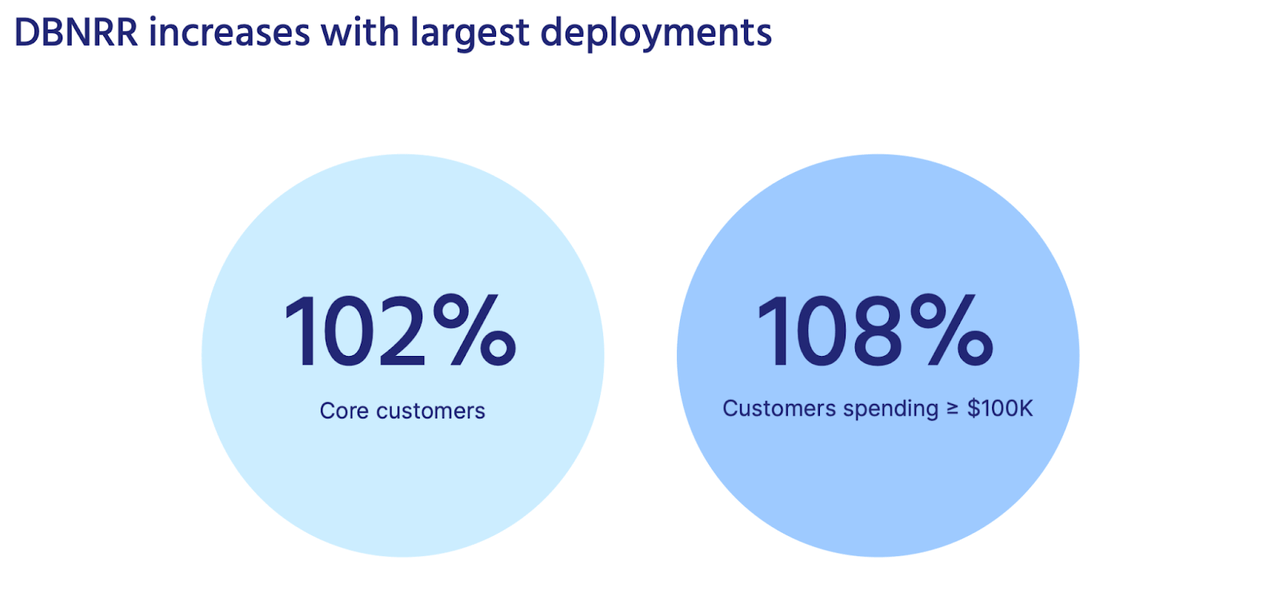

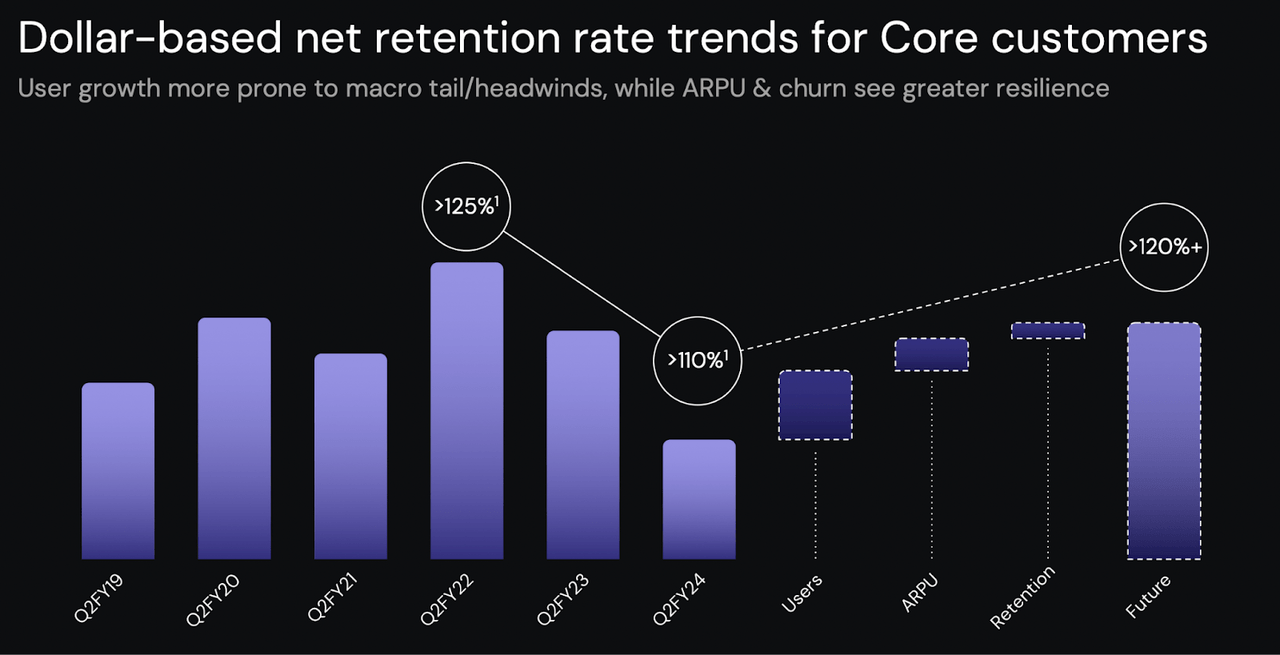

ASAN saw its dollar-based net retention rate compress further to 102% (down from 105% in the fourth quarter). Enterprise tech companies across the board have seen pressure to expansion rates as customers have continued to be cost conscious. It is not clear if this is solely due to the higher interest rate environment, or also due to customers potentially waiting to see if generative AI might have an impact on long-term headcount requirements.

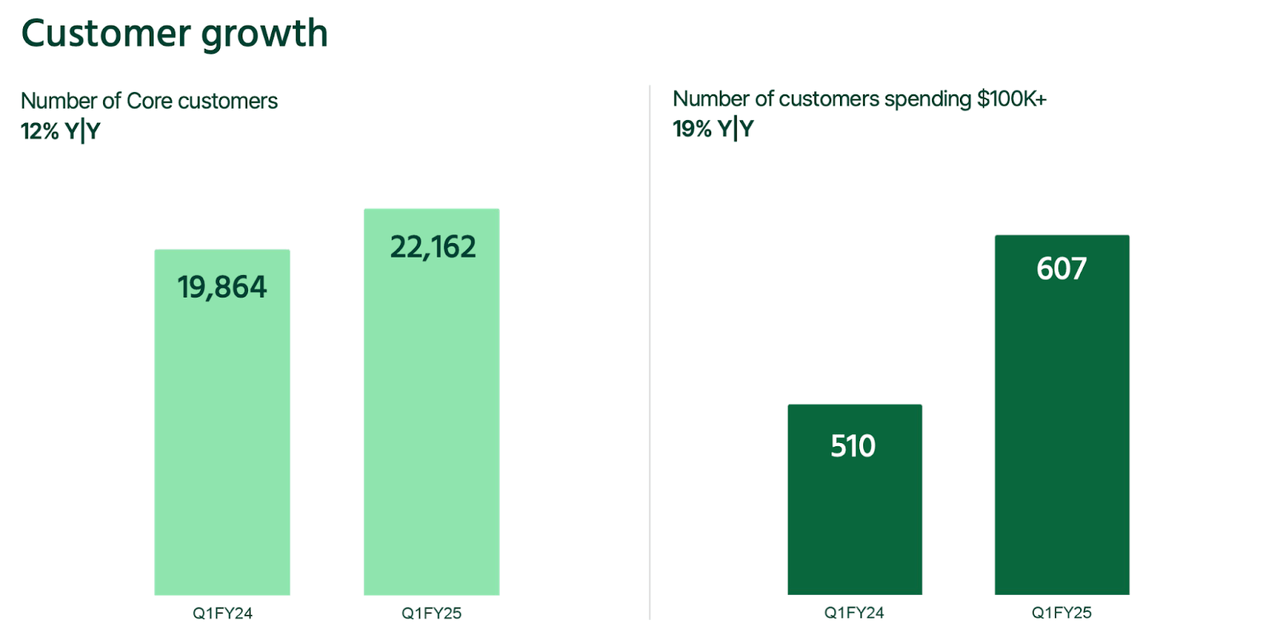

ASAN nonetheless continued to see solid growth in customers, with core customers growing 12% YoY.

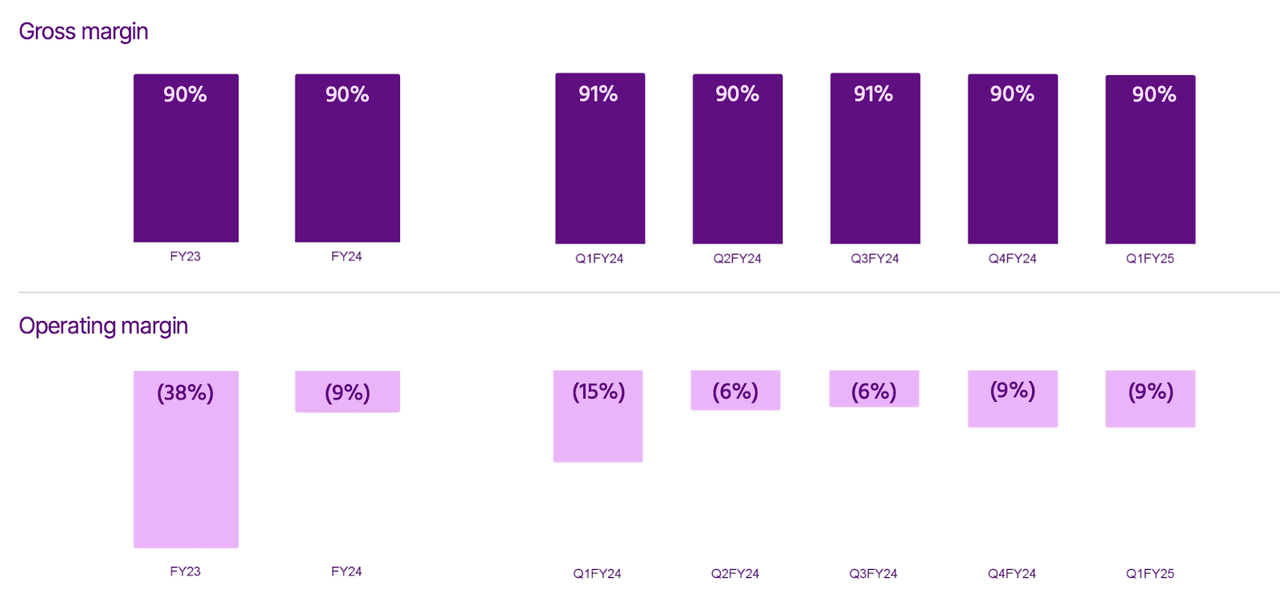

On the profitability side, ASAN delivered 600 bps of non-GAAP operating margin improvement but remained unprofitable with a 9% margin loss.

ASAN ended the quarter with $524 million of cash versus $42.4 million of debt, representing a strong net cash balance sheet. While ASAN is unprofitable, the $4.3 million quarterly cash burn appears easily manageable relative to the cash position.

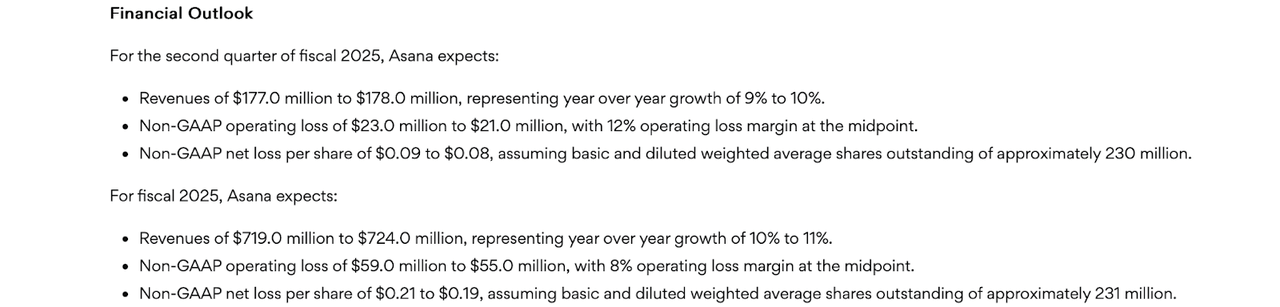

Looking ahead, management has guided for up to 10% YoY revenue growth to $178 million in the second quarter, and 11% YoY revenue growth to $724 million for the full year.

On the conference call, management reiterated expectations for the dollar-based net retention rate to bottom at “slightly below 100%” in the second quarter, and “stabilize” the following quarter. Management noted that they continue to lap tough comparables, but also noted that they are “seeing good signs with stability across new bookings and our average contract values” and believe that they are “well poised for re-acceleration in the second half of the year.” Management explained that belief as being due to tech layoffs appearing to ease, which had been an outsized driver of the weakness over the past year. Current remaining performance obligations continued to grow strongly, growing 15% YoY, with deferred revenue growing 13% YoY. While there are not yet clear signs of an acceleration in growth, the strong cRPO showing indicates that there aren’t exactly signs of an imminent breakdown either.

Management noted that they were “front-loading our investments this year to capture the AI opportunity” but still maintaining their expectation of positive free cash flow generation for the year.

In late June, management reiterated guidance while authorizing a $150 million share repurchase program. A share repurchase program might seem unusual given the lack of even non-GAAP profitability, but the stock looks very cheap at these levels and this program might indicate management’s conviction in the long-term health of the business.

Is ASAN Stock A Buy, Sell, or Hold?

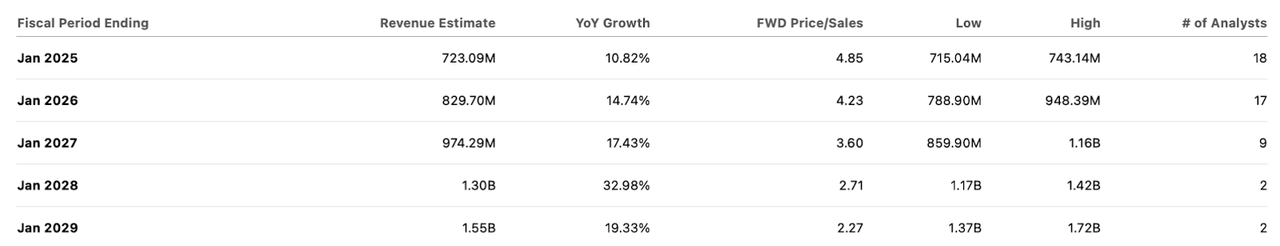

Regarding valuation, ASAN recently traded hands at just under 5x this year’s sales estimates. Consensus estimates call for an acceleration in top-line growth over the coming years.

While it can be uncomfortable to bet on an acceleration in top-line growth, the case looks reasonable here. As customers grow more comfortable with the higher interest rate environment and adjust to the new generative AI landscape, I can see headcount growth returning in earnest. It was just 10 months ago at the company’s 2023 Investor Day that management outlined expectations for the dollar-based net retention rate to return to the 120% level.

It remains to be seen if management’s forecast proves too optimistic, but the stock looks cheap even assuming far lower rates of acceleration. I can see ASAN generating 30% net margins over the long term. I note that given that ASAN is currently not even non-GAAP profitable, it may be many years until that mature margin profile is reached, and the ongoing GAAP losses may drag on annual returns. Based on 15% forward revenue growth and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see the stock trading up to 6.8x sales, representing solid upside (but perhaps not spectacular upside after factoring in the aforementioned drag from GAAP losses). I view ASAN’s software as being “mission-critical” and the kind of recession-resistant revenue stream that investors look for in these enterprise tech names – the company appears to be held back by uncertainty on forward growth rates and the long path to profitability. As such, the key catalysts to achieve that upside are the aforementioned acceleration in top-line growth as well as continued progress on profitability.

ASAN Stock Risks

ASAN might not see revenue growth accelerate. The company has a great number of competitors, including Monday.com (MNDY), Smartsheet (SMAR), Atlassian (TEAM), and others. It is possible that this market proves over-saturated and ASAN is unable to generate the operating leverage needed to boost profit margins. It is possible that the stock is not fully pricing in this risk, as there might be some valuation support due to CEO Moskovitz owning nearly 50% of shares outstanding. ASAN’s lack of even non-GAAP profitability suggests that the stock may see greater volatility in the event of a market downturn.

ASAN Stock Conclusion

For those looking for bargains in the tech sector, ASAN may be a worthy pick. The company may see growth inflect higher upon improving macro conditions – this acceleration in top-line growth may lead to a dramatic re-rating in the stock price. The company’s net cash balance sheet appears sufficient to offset the lack of profitability. I reiterate my buy rating for the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ASAN, SMAR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!