Summary:

- Asana reported its Q1 FY25 earnings where revenue grew 13% YoY, while non-GAAP operating loss narrowed as it focuses its go-to-market strategy on winning and expanding enterprise customers.

- Simultaneously, the company is rapidly building genAI capabilities along with launching AI Teammates in beta to enable teams to collaborate more efficiently, improving engagement and productivity.

- However, their FY25 revenue guidance is soft at 10-11% growth rate, while there is no certain path to profitability. At the same time, the competitive landscape is fierce.

- Assessing both the “good” and the “bad”, I believe that it is best to wait for further evidence for growth to pick up before initiating a position, making it a “hold”.

skynesher

Introduction & Investment Thesis

Asana (NYSE:ASAN) is a work-management platform that helps organizations orchestrate work from daily tasks to cross-functional strategic initiatives. The stock has severely underperformed the S&P 500 and Nasdaq 100 YTD. It reported its Q1 FY25 earnings on May 30, where revenue grew 13% YoY, while it incurred a narrower loss than the previous year at -$15M. During the earnings call, the management discussed its go-to-market initiatives to focus on enterprise customers who are spending $100,000 in Annual Recurring Revenue (“ARR”) as well as building genAI capabilities in its product roadmap that will tackle complex workflows and elevate teamwork.

While the management discussed that there is stability in its booking growth and expects to see acceleration in the second half of the year, their revenue projection for FY25 is lackluster at 10-11% growth rate. At the same time, the lack of a profitability roadmap along with a highly competitive environment can dampen Asana’s growth prospects, especially in an environment of increasing vendor consolidation. Therefore, on one hand, while the stock can substantially rise from its current levels if it is able to reignite growth, I believe that it is prudent to stay on the sidelines and wait for further management commentary in the coming quarters, making it a “hold”.

Go-to-market strategy is focused on winning enterprise customers to reignite growth

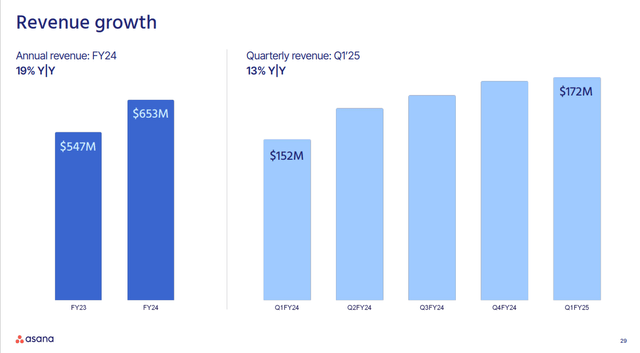

Asana reported its Q1 FY25 earnings, where revenue grew 13% YoY to $172.4M, driven by strength in the number of customers spending $100,000 in ARR, growing 19% YoY to a count of 607. At the same time, International revenue grew at a faster rate of 14.5% compared to US, contributing 39.4% of Total Revenue, as they saw international customers across verticals close multi-year deals with Asana and expand their usage as they consolidate their tech platforms.

2024 Investor Presentation: Revenue growth across quarters

During the earnings call, the management outlined that they will continue to hire quota-carrying sales reps as they remain focused on accelerating their pipeline and increasing the efficiency of outbound prospecting by customizing customer outreach using AI to better target and expand their market share in the enterprise segment. So far, they are seeing stability in new bookings and average contract value (“ACV”) as they added 30 customers with $100K+ in ACV, which is up from 20 in the previous year.

Building new genAI capabilities to help humans and AI work seamlessly together, thus elevating user experience and productivity

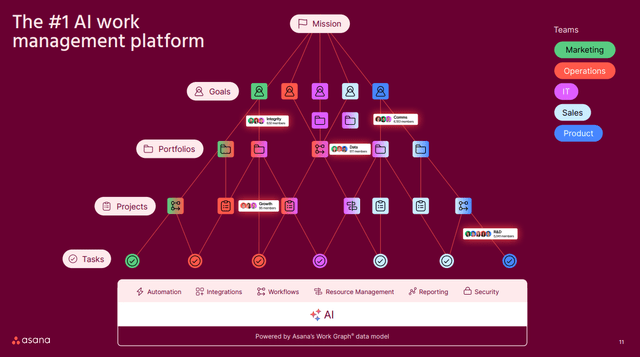

To give a quick primer on Asana, it is a work-management platform that brings teams together to help them connect the goals set at the top of an organization to the cross-functional projects and individual tasks that will support those strategies, thus enabling the entire organization to work smarter and drive superior business outcomes. Asana is able to accomplish it with Asana Work Graph, which is their proprietary data model that provides a structured map of how work gets done in organizations.

2024 Investor Presentation: How Asana is designed

With genAI playing an increasingly important role in collaborative work management, the company is rapidly building genAI capabilities within Asana Work Graph as genAI gradually takes on more complex portfolios of work, essentially playing the role of AI teammates instead of an assistant. Some of the capabilities include Smart Goals and Smart Workflows that will build automated workflows based on natural language to match specific goals that are optimized for the entire organization, along with Smart Onboarding capabilities to help individuals and teams get up to speed and deliver impact. Plus, the company is also working on releasing new genAI capabilities to surface intelligent insights by helping create comprehensive status updates through Smart status with features such as Smart Reporting, Smart Projects and more that are in the product pipeline. In its latest Investor Presentation, the company also unveiled AI Teammates in beta, which will advise teams on priorities and workflows, allowing teams to work with full transparency across use cases that include product launches, strategic planning, creative production, marketing campaigns, and more.

According to Dustin Moskovitz, CEO of Asana, Asana and Work Graph is a kind of a “digital scaffolding,” and I believe that given its superior technological capability to understand the relationship between people, work, and workflows, it can direct AI with the right context, thus driving more seamless collaboration between humans and AI across use cases, thus enabling them to expand their businesses through increasing pricing power across newer features.

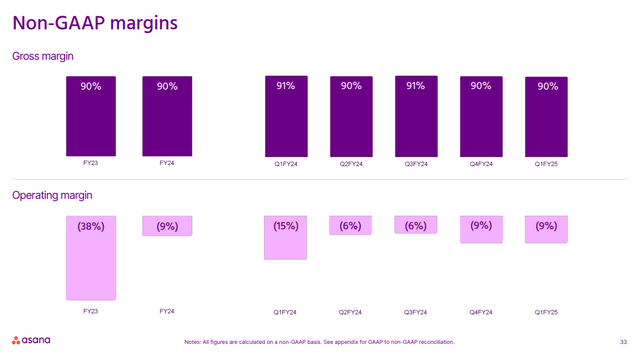

Operating at a loss in a highly competitive environment and FY25 guidance doesn’t demonstrate material improvement in growth trajectory

Shifting gears to profitability, the company incurred a loss of -$15M in non-GAAP operating profit, with a margin of -9.1%. Although it has improved by 500 basis points from the previous year as the management has streamlined its operating expenses, the management has not provided a path towards long-term profitability. While the management discussed that they are seeing signs of stability as they expect moderate reacceleration in the business in the second half, it is important to note that Asana also operates in a highly competitive environment with companies such as monday.com (NASDAQ:MNDY), Atlassian (NASDAQ:TEAM), Smartsheet (NYSE:SMAR), and others who are growing at a far superior rate with better operating metrics. Although the company is trying to differentiate with its Asana Work Graph technology along with building competitive genAI capabilities, its revenue is still expected to grow in the low teens of 10-11% YoY to $721M, while incurring a loss of -$57M in non-GAAP operating income, which is flat YoY. I firmly believe that in order for investor confidence to return, the company has to meaningfully reignite growth given its initiatives towards expanding sales capacity to attract enterprise companies and investing in R&D to drive product innovation, and unfortunately FY25 guidance doesn’t yet reflect the dawn of growth yet.

2024 Investor Presentation: Operating at a loss

Tying it together: Upside exists, but it is not worth it

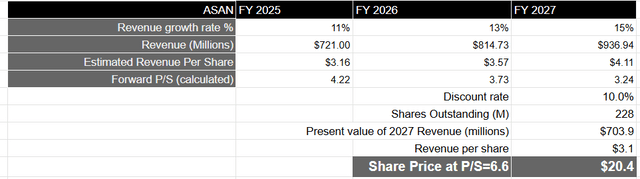

As the company has not provided a long-term financial or operating model and given that its non-GAAP operating income is still negative, I will base my valuation of Asana on my revenue growth projections over the next 3 years. Therefore, assuming that Asana achieves its FY25 revenue target and then is successfully able to reignite growth through its go-to-market and product initiatives, it should go back to growing in the mid to high teens, which is in line with the consensus estimates as well. This will result in Asana producing a total revenue of $936.9M in FY27, which will translate to a present value of $703M when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their revenues at an average rate of 4.8% with a price-to-sales ratio of 2.19, Asana should be trading at three times the multiple, given the growth rate of its revenue during this period of time. This will translate to a P/S ratio of 6.6, or a price target of $20.4, which represents an upside of 56% from its current levels.

My final verdict and conclusions

Although the valuation model suggests that there is an attractive upside, I am cautious with the company at the moment. Although I like its go-to-market strategy to focus on enterprise customers to drive higher ACV along with building genAI capabilities in its product roadmap to drive user engagement, I will not ignore the serious risks at hand, where it is operating at a loss, with an uncertain path to profitability, along with a highly competitive landscape where its competitors are growing at a faster rate than Asana. Moreover, this is taking place at a time when macroeconomic conditions are still uncertain, along with businesses consolidating their software spend on fully integrated platforms to capture pricing and operational advantage. Therefore, until the management can demonstrate an acceleration in their top-line by winning and expanding across a higher number of enterprise customers, I believe investor sentiment will remain dampened. Assessing both the “good” and the “bad,” I believe it is prudent to stay on the sidelines at the moment and wait for better indications from the management to reassess its growth prospects in the coming quarters. Till then, I will rate the stock a “hold”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.