Summary:

- Asana has fallen sharply in May and June, despite a strong Q1 earnings print that showed barely any deceleration in revenue.

- The company has maintained a very conservative outlook for FY25, positioning itself for further beat-and-raise quarters.

- The stock trades at a very cheap ~3x FY26 revenue multiple.

Morsa Images/DigitalVision via Getty Images

While AI-powered tech stocks have fueled the market rally to new all-time highs, there are a number of significant holdouts, especially among small and mid-cap software stocks. It’s these more overlooked plays, in my opinion, that deserve our attention as we look to brace our portfolios for a potential correction.

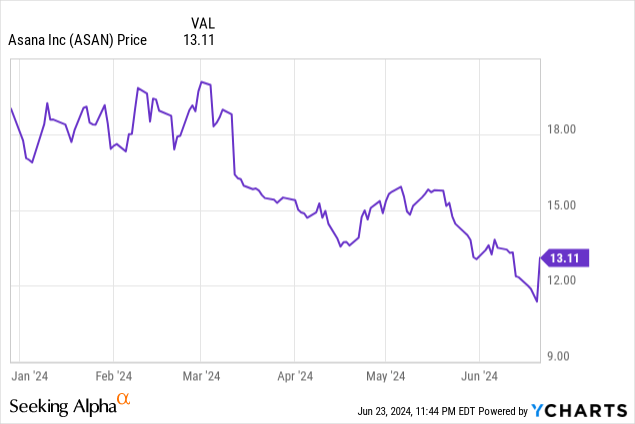

Asana (NYSE:ASAN), in particular, bears mentioning. The workflow and collaboration software platform, founded by Facebook co-founder Dustin Moskovitz, remains in a sharp slump this year, despite initially having rallied after reporting strong Q1 results. Year to date, the stock is down more than 25%:

I last wrote a neutral article on Asana in March when the stock was trading at $16 per share, downgrading the stock from a prior bullish view on slowing growth. Since then, however, a number of things have occurred: first, the company has substantially beaten its first-quarter guidance while only slightly taking up its full-year outlook, which in my view leaves plenty of room for more beat-and-raise quarters throughout the year. Second, as the stock has fallen nearly 20% over the past quarter, management has also announced a new $150 million buyback covering roughly ~5% of the company’s current market cap to take advantage of new share prices. Amid these catalysts, I’m upgrading Asana back up to a buy rating.

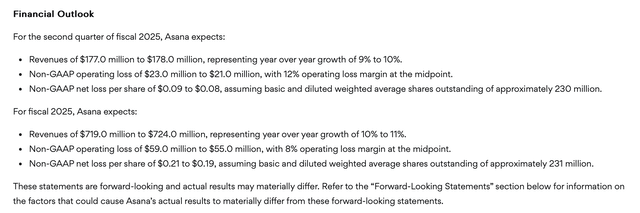

It’s important to note that Asana has a track record of guiding conservatively. The company reiterated its Q2 outlook alongside its announcement of the buyback plan in June, which calls for a deceleration to 9-10% y/y growth (versus 13% y/y growth in Q1, which didn’t decelerate from Q4 and beat the original outlook by three points). In my view, a string of beats this year will make it difficult for investors not to re-rate the stock’s valuation multiples higher.

Asana outlook (Asana Q1 earnings release)

Here, in my view, are the longer-term reasons to be bullish on Asana:

- Secular tailwinds toward remote work and distributed teams requiring organizational tools like Asana. More and more companies are embracing a distributed working model, if not a fully remote one. With fewer in-person touchpoints, software tools become critical to keeping teams together and in sync.

- Massive global TAM. Asana believes it has a $51 billion TAM by 2025 and is applicable to the global base of ~1.25 billion information workers. By that metric, Asana’s current user base represents only <5% of the global eligible workforce.

- Huge gross margin profile. Asana’s pro forma gross margins are in the ~90% range, making it one of the highest-margin software companies in the market. While the company isn’t profitable today, that gross margin profile gives Asana plenty of leeway to scale profitably when it’s larger, as nearly every dollar of incremental revenue flows through to the bottom line.

- Improving operating profit margins. The company recently crossed over to single-digit operating margin losses on a pro forma basis, setting the stage for eventual profitability build on its huge gross margins.

- Founder led. The company continues to be led by its founder Dustin Moskovitz, who is a routine purchaser of the company’s stock as well.

We note as well that the latest downturn in the stock positions Asana at incredibly cheap valuation multiples. At current share prices just north of $13, the stock trades at a $2.99 billion market cap. After we net off the $524.2 million of cash and $42.4 million of debt on the company’s most recent balance sheet, Asana’s resulting enterprise value is $2.51 billion.

Meanwhile, for next fiscal year FY26 (the year for Asana ending in January 2026), Wall Street analysts are expecting the company to generate $830.0 million in revenue, which represents 15% y/y growth against the midpoint of the company’s $719-$724 million outlook (10-11% y/y growth) for this year.

This puts the stock’s valuation multiples at:

- 3.5x EV/FY25 revenue

- 3.0x EV/FY26 revenue

To me, a valuation multiple in the ~3s is too low to ignore, whereas I was more neutral back when Asana was trading in the ~4s earlier this year. Amid a new buyback program and a quite conservative outlook for Q2 and beyond, I’d say it’s time to dive back into this stock.

Q1 download

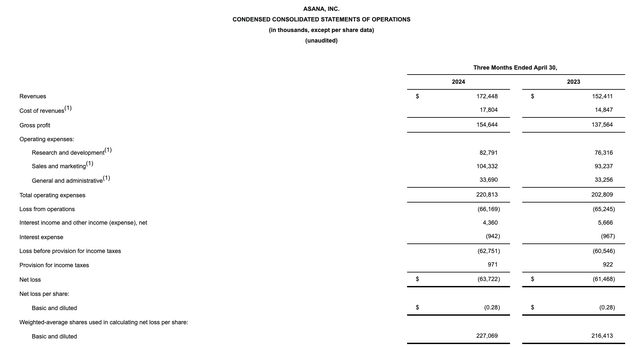

Let’s now go through Asana’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Asana Q1 results (Asana Q1 earnings release)

Revenue grew 13% y/y to $172.4 million, ahead of Wall Street’s expectations of $$168.7 million (+11% y/y) and well ahead of the company’s own guidance of 10-11% y/y growth (thus making it difficult to run to believe that Q2 will decelerate to 9-10% growth).

Despite ongoing budget scrutiny and headcount shrinkage at many customers, the company notes that its sales momentum and conversions have performed well. The company expects net revenue retention rates to bottom in Q2 and then stabilize from there. Enterprise customers, in particular, are growing and expanding faster than the company as a whole.

Dustin Moskovitz believes in addition that Asana’s AI tools will drive near-term incremental revenue. Today, Asana’s platform is capable of automated tasks such as identifying staffing risks in projects and developing project goals. Per his remarks on the Q1 earnings call:

And we expect our business will expand too. We believe AI will drive revenue growth for us in three key ways. First, it already enhances the value we deliver in our work management functionality, like with our Smart Summary and Smart Status features. We don’t package the AI parts of our core features as a separate SKU because we understand AI functionality is simply table stakes for participation in SaaS at this point. However, we believe the differentiated value provided by AI plus the Asana Work Graph makes us more competitive and increases our pricing power. It is motivating customers to migrate to our new packages. At the same time, AI is enabling us to introduce new, powerful use cases that can be sold independently, so the second way we expect it will drive revenue growth is via license-based add-ons, and we have specific ones we’re developing now.

On top of that, like we’ve suggested in the past, there might be more usage-based AI revenue in the future as well, and over the past few months we’ve gained conviction on that, specifically in the context of custom workflows. We’re working on a private beta with select customers, and intend to expand more broadly to our enterprise customers as the year continues.”

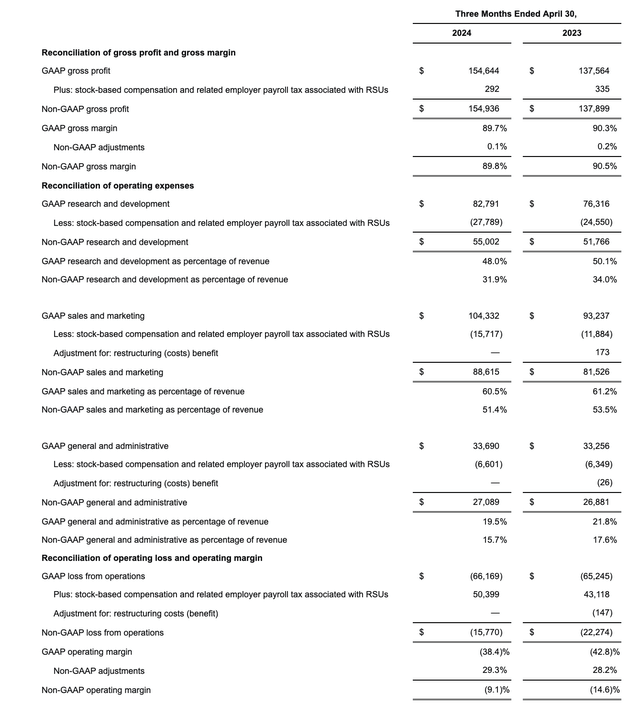

The company isn’t slouching on profitability, either. It underwent its first major round of layoffs earlier than most software companies in November 2022. Still, the company is seeing the benefits of economies of scale today, with pro forma operating margins of -9.1% in Q1 expanding 540bps y/y:

Asana margins (Asana Q1 earnings release)

Risks and key takeaways

There are, of course, a number of risks that could derail Asana. As a company that prices by seat, the fact that many enterprises are optimizing headcount (especially in the wake of AI) could put additional pressure on net revenue retention rates, extending the pain past the company’s expectations of hitting a bottom in Q2. In addition, while workflow tools are still growing rapidly, Asana plays in a very competitive space, against larger incumbents like Atlassian’s (TEAM) Jira as well as smaller companies like monday.com (MNDY) and ClickUp.

That being said, there’s plenty of cushion from a valuation standpoint when Asana is only trading at ~3x next year’s revenue. Buy the dip here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ASAN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.