Summary:

- SNOW has proven that the market’s fears surrounding the tiered storage pricing and the open-source Iceberg Table formats have been overly done.

- The new management continues to deliver excellence with growing product revenues and multi-year RPOs, exemplifying their ability to grow adoptions while cross selling to its existing consumer base.

- Even so, we are uncertain if SNOW’s renewed growth cadence deserves the eye-watering FWD P/E non-GAAP valuations of 246.39x, compared to the sector median of 25.80x.

- SNOW’s decelerating growth trend continues to imply its inability to directly compete with Databricks as well, which has reported +60% YoY growth in H1’25.

- Barring an acceleration in SNOW’s adj EPS growths in the triple digits, we believe that the eventual selling pressure is likely to be painful once buying momentum ends.

Olga Evtushkova

SNOW’s Rally Has Been Overly Fast & Furious – Expensive Valuations Offer Minimal Margin Of Safety

We previously covered Snowflake (NYSE:SNOW) in October 2024, discussing the stock’s ongoing meltdown, attributed to the decelerating topline growth trend and impacted profit margins, as the management intensified their AI growth efforts.

Combined with the elevated SBC expenses, expensive valuations, and lack of bullish support, we had believed that the stock was likely to further trend downwards before growth materialized and a bottom was found.

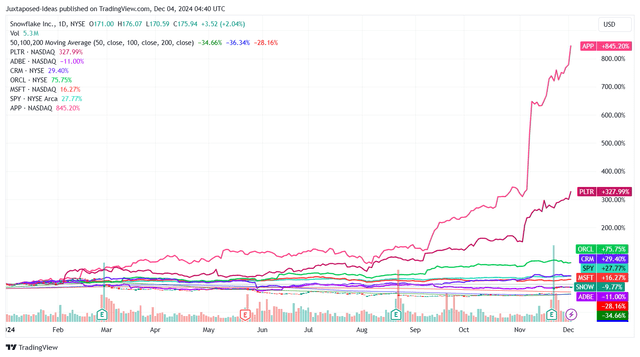

SNOW YTD Stock Price

Since then, SNOW has mostly traded sideways before charting an eye-watering rally by +36.2% after the double beat FQ3’25 earnings call in late November 2024 – an uptrend similarly observed in numerous generative AI SaaS stocks in varying degrees.

Part of the optimism may be attributed to the “strong structural AI-related demand” across the infrastructure and SaaS layer, as similarly reported by numerous players, particularly Nvidia (NVDA) and Taiwan Semiconductor Manufacturing Company (TSM), along with Palantir (PLTR) and AppLovin (APP).

These developments have also been observed in SNOW’s FQ3’25 earning results, with product revenues of $900.3M (+8.5% QoQ/ +28.8% YoY), adj operating margins of 6.5% (+1.3% QoQ/ -3.7% YoY), and adj EPS of $0.20 (+5.2% QoQ/ -20% YoY).

This is on top of the robust growth observed in its multi-year remaining performance obligation of $5.7B (+9.6% QoQ/ +54% YoY), with it exemplifying the management’s ability to increasingly cross sell to an existing consumer base while growing new adoptions.

It is apparent from these developments that SNOW’s introduction of tiered storage pricing in FQ4’24 and the increased adoption of the open-source Iceberg Table formats have not been growth headwinds indeed, with it implying that the stock’s meltdown after the FQ4’24 earnings call may have been overly done.

If anything, the management has reported “minimal headwinds from customers moving to Iceberg,” partly aided by the growing demand for its data engineering features, with it well balancing the “potential loss of storage revenue,” as observed in the robust FQ3’25 numbers above.

SNOW’s ability to generate growth through acquisitions has been impressive indeed, especially given the relatively healthy balance sheet with a net cash position of $1.88B (-41.6% QoQ/ -46.8% YoY) after the three acquisitions completed in 2024 (price undisclosed).

This is on top of its strategic partnerships with numerous hyperscalers along with AI start ups, allowing the company to increasingly grow its bookings and LLM offerings through the Snowflake Cortex AI, with over 3.2K accounts already utilizing its AI features (+28% QoQ) and over 1K deployed AI use cases.

It appears that the aggressive acquisition sprees have also been accretive to its top-lines, as observed in SNOW’s raised FY2025 revenue guidance to $3.43B (+28.9% YoY) compared to the original guidance of $3.25B (+22.1% YoY) offered in the FQ4’24 earnings call.

This is despite the dilutive impact on the SaaS company’s bottom-lines, based on the impacted FY2025 adj operating margins guidance of 5% (-3 points YoY), compared to the original guidance of 6% (-2 points YoY).

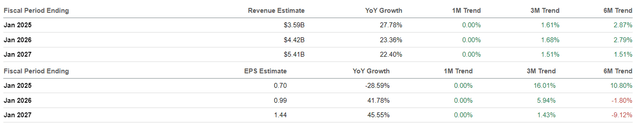

The Consensus Forward Estimates

These developments may also be why the consensus have upgraded their forward estimates, with SNOW expected to generate an accelerated top/ bottom-line growth at a CAGR of +24.5%/ +13.8% through FY2027.

This is compared to the original estimates of +23.3%/ +10.9%, while building upon the robust top-line growth of +80.4% observed between FY2020 and FY2024.

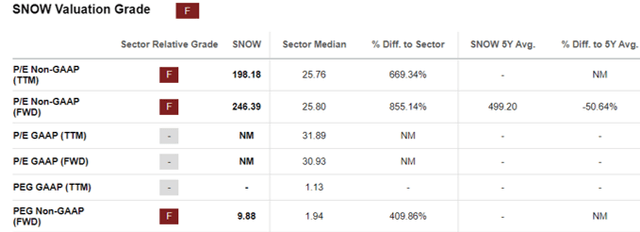

SNOW Valuations

Even so, we are uncertain if SNOW’s renewed growth cadence deserves the eye-watering FWD P/E non-GAAP valuations of 246.39x, compared to the sector median of 25.80x.

Even when comparing SNOW’s premium FWD PEG non-GAAP ratio of 9.88x to the sector median of 1.94x and its SaaS/ generative AI peers, including Oracle (ORCL) at 2.45x, Microsoft (MSFT) at 2.49x, Adobe (ADBE) at 1.61x, AppLovin (APP) at 2.61x, and Salesforce (CRM) at 2.12x – the former’s expensive valuations offer interested investors with a minimal margin of safety.

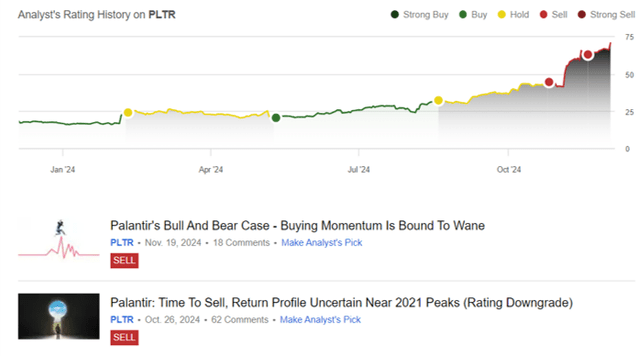

If anything, with SNOW’s frothy valuations nearing those of Palantir (PLTR) at FWD P/E non-GAAP valuations of 175.34x and FWD PEG non-GAAP ratio of 6.37x, it appears that we are potentially entering a new AI bubble stage with these stocks no longer trading based on fundamentals in our opinion.

Lastly, SNOW’s decelerating growth trend continues to imply its inability to directly compete with Databricks. For reference, Databricks has reported over +50% YoY growth in its FY2024 revenues to over $1.6B, with the management guiding for an acceleration in its growth prospects to over +60% YoY by H1’FY2025 (H1’CY2024) at $2.4B.

With SNOW expected to generate a decelerating top/ bottom-line growth at low double digits, we believe that the stock’s painful correction may only be a matter of time.

So, Is SNOW Stock A Buy, Sell, or Hold?

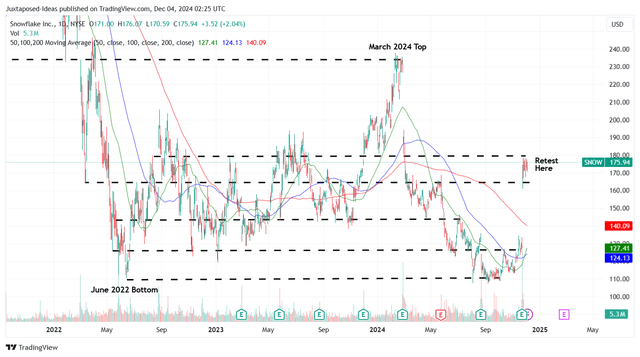

SNOW 3Y Stock Price

For now, SNOW has broken through numerous resistance levels while running away from its 50/ 100/ 200 day moving averages, with the stock appearing to be well supported at current levels in the $170s.

The combination of inflated valuations and sky-high stock prices continue to imply that the stock is currently buoyed by momentum instead of fundamentals, with it remaining to be seen when buying momentum may end.

If anything, we believe the stock market has also entered greedy territory, with it potentially contributing to the market’s over exuberant sentiments and numerous generative AI/ SaaS stocks’ premium valuations after the promising Q3’24 earning season, SNOW included.

This is also why we believe that the stock does not offer interested investors with a compelling investment thesis, especially given the overly expensive FY2027 P/E non-GAAP valuations of 122x, based on the stock prices of $175.94 at the time of writing and the consensus FY2027 adj EPS estimates of $1.44.

As a result, we prefer to downgrade our Hold rating to a Sell instead. Take your gains here.

Risk Warning

Author’s Historical Rating

As observed in our historical rating for PLTR, it is impossible to time the market indeed, with the stock seemingly well supported by retail investors while consistently charting new heights despite our two Sell ratings.

The same may occur for SNOW as well, with our Sell rating potentially coming too early and investors taking their gains prematurely before the stock price reversal comes.

Even then, barring an acceleration in SNOW’s adj EPS growth in the triple digits, we believe that the current premium valuations are unwarranted, with the eventual selling pressure likely to be painful once buying momentum ends.

While SNOW may continue to offer a compelling SaaS investing story and robust bullish support, as most recent investors also enjoy rich capital appreciation (assuming Q3’24 entry points at between $100s to $120s), it is undeniable that there remains a minimal margin of safety at current levels – resulting in our Sell rating upon the exhaustion of the stock’s current upward momentum.

Do not chase overpriced stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.