Summary:

- Snap trades near recent lows despite record revenues and a booming subscription business.

- The company has innovation in AR and AI, including Spectacles and My AI chat, driving user engagement and revenue growth, yet the market remains skeptical.

- Snapchat+ subscription service, with 12 million subscribers, could reach $1.5 billion in run rate revenue exiting 2025, significantly boosting Snap’s financial outlook.

- The stock’s forward EV/S multiple makes Snap the cheapest stock in the social media space.

Vivek Vishwakarma/iStock via Getty Images

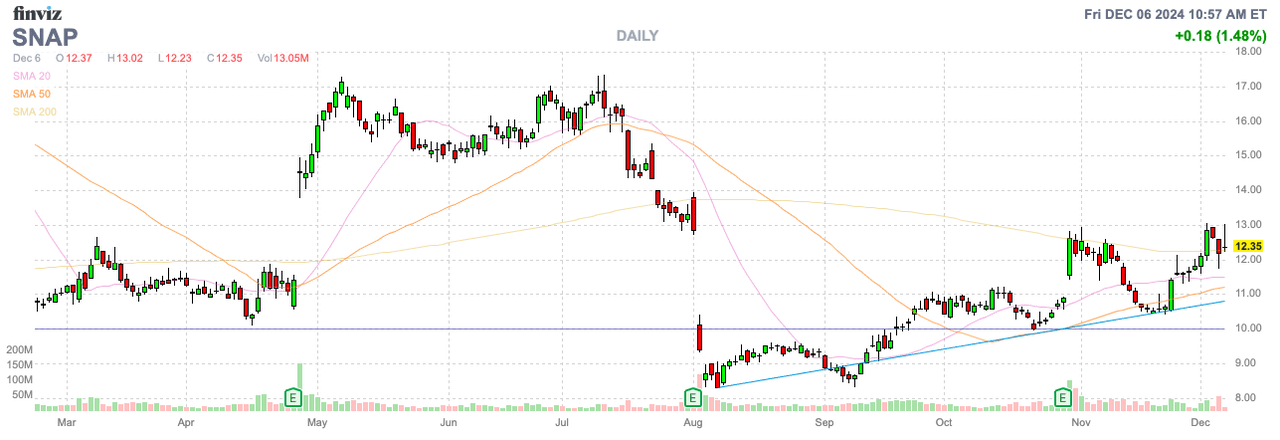

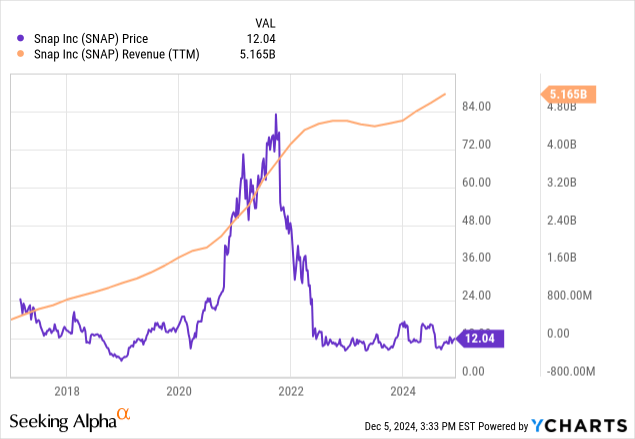

While the market has cruised to all-time highs, Snap, Inc. (NYSE:SNAP) actually trades closer to the lows after being public for nearly a decade. The social messaging company is even reporting record revenues and has a booming subscription business to provide more confidence the market likely has this wrong. My investment thesis is ultra Bullish with the stock trading at only $12 with the opportunity for big subscription revenues in 2025.

Leading Innovation

Snap reported Q3 revenues grew by 15% to reach $1.37 billion. Daily active users grew by 9% to reach 443 million.

The social messaging company has strong dynamics driving the business higher, but the market still seems to have strong doubts about the business. Snap is a leader in the AR and AI markets with the release of the 5th generation Spectacles and My AI chat.

The Spectacles AR glasses don’t get a lot of attention, but the see-through AR glasses powered by Snap OS continue to evolve. Users can use My AI, launch immersive Lenses and extend the Snapchat experience into 3 dimensions.

My AI incorporates generative AI into the Snapchat experience via Gemini on Vertex AI. The chat feature saw snaps triple QoQ for an experience that already was seeing millions of snaps per day.

Snap has constantly had issues with advertising, due in part to the Apple ID change, but the company continues to drive growth. Revenues are back on a growth trajectory, with the stock market constantly overlooking a history of higher revenues due to innovation.

The guidance for record Q4 revenues of at least $1.51 billion has annual revenues hitting $5.35 billion, far above the ~$1.5 billion from pre-Covid levels. In essence, Snap has more than tripled revenue levels since entering 2020, yet the stock is relatively flat over that period.

The market appears to give the company no credit for the positive picture due to Snap not always hitting financial targets, or matching the growth rates of social media sector peers. The Q4 guidance was for revenues of $1.53 billion at the midpoint, below the consensus of $1.56 billion, so the market just ignored the potential for the company generating 15% growth this quarter and sold the stock off.

Snap even has the very promising Snapchat+ subscription service, with over 12 million subscribers now contributing up to $123 million in quarterly revenue. The company had forecast reaching 14 million subs by year’s end.

The social messaging service has already at the $500 million run rate in annual subscription revenues with a logical path to exit next year at a $1.5 billion rate as follows:

- 20 million subs @ $4/month = $960 million

- 25 million subs @ $5/month = $1.5 billion

The base case is definitely growing subs from 12 million at the end of Q3 to 20 million by next year. If Snap ends the year with 14 million subs and the company has a push via Snapchat+ gift cards offered to retailers, a goal of reaching 20 million in 2025 is only 43% growth after Snap will have double subs this year.

The bull case is definitely reaching 25 million Snapchat+ subs for 78% growth next year. The ultimate bull scenario is for the company to hike monthly subscription prices to $5, though investors shouldn’t be in any hurry knowing this option exists over time.

Snap would reach $1.5 billion in subscription revenues at the point of 25 million subs at $5 per month. The company would have a recurring revenue stream equal to nearly 25% of the 2025 consensus revenue target of $6.1 billion.

Cheap Comps

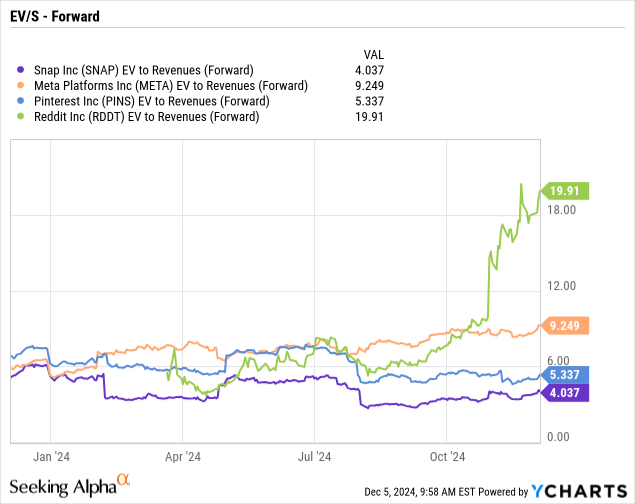

Back a few years ago, Snap was the Reddit (RDDT) of the social media sector. The stock traded at 20x forward sales at times, and now the stock trades at the lowest multiple in the sector. Meta Platforms (META) and Pinterest (PINS) trade at a midpoint of 7x forward sales.

In essence, the case exists for Snap to nearly double the forward EV/S multiple. Of course, this might never happen, but a company with a $1.5 billion subscription service has that ability to flip the switch with a more bullish investor base.

The consensus analyst estimates forecast annual sales growth in the 11% to 12% range, which appear conservative. The subscription revenues alone could generate these levels of sales growth, while higher advertising ARPU and more DAU growth should drive the current consensus estimates.

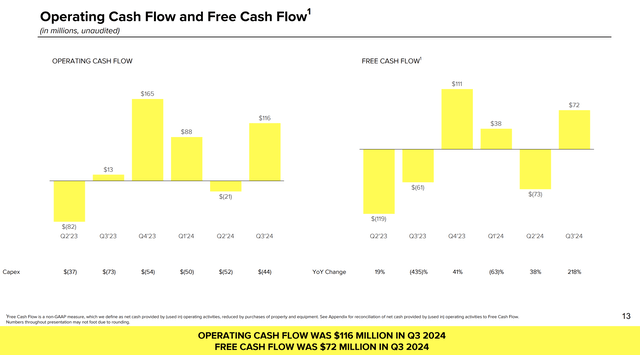

All while a lot of positive catalysts exist on the sales side, Snap is making decent progress on being cash flow positive. The company is regularly generating operating cash flows with limited capex in the quarterly range of $50 million.

Source: Snap Q3’24 presentation

The Q4 guidance is for adjusted EBITDA of $210 to $260 million, up from $159 million last year. Snap produced a record FCF of $111 million last year and the company should top that, feeding the $500 million share buyback.

The current market cap does sits at $20 billion, so a $500 million share buyback won’t have a drastic impact on the stock. Unfortunately, Snap has $3.6 billion in convertible debt to offset the $3.2 billion cash balance. The company does need to generate additional positive cash flows in order to repurchase a sizable number of shares while the stock is cheap here.

Takeaway

The key investor takeaway is that Snap remains the bargain in the social media space. The market constantly overly focuses on volatile quarterly results and ignores the positive innovation and ultimate sales growth.

Investors should use any ongoing weakness in the stock to buy Snap closer to the historical lows while the social messaging company is producing record results.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SNAP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market to start December, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.