Summary:

- Affirm has shown stellar execution even as it faces tough macro conditions.

- The company delivered 35% YoY GMV growth and 41% YoY revenue growth in the most recent quarter – once again crushing guidance.

- Growth stocks overall are looking overheated, it’s time to re-evaluate our rating on Affirm stock.

Kevin Dietsch

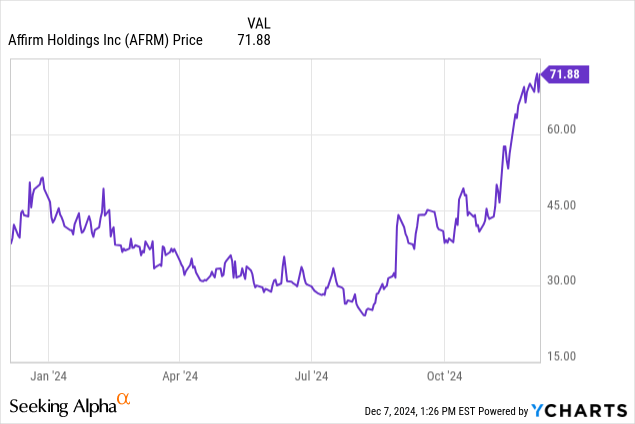

Affirm (NASDAQ:AFRM) has been a huge winner as of late. This is in large part due to the company’s strong fundamental performance as management has shown stellar execution amidst challenging macro conditions. I suspect that the stock has also benefited from an aggressive trading environment in which investors are adopting a more lenient stance towards valuation. While AFRM is executing amazingly and continues to be on track to reach GAAP profitability in due time, I can no longer stick by the stock due to the unattractive valuation. I am downgrading the stock to a neutral rating as I am closing my position.

AFRM Stock Price

I last covered AFRM in June where I explained I was bullish on the stock after Apple (AAPL) announced an exit from the buy now, pay later business. The stock is up an astounding 130% since then.

I did not expect this incredible stock price performance and am not in the habit of raising my price targets solely to follow the stock price trajectory.

AFRM Stock Key Metrics

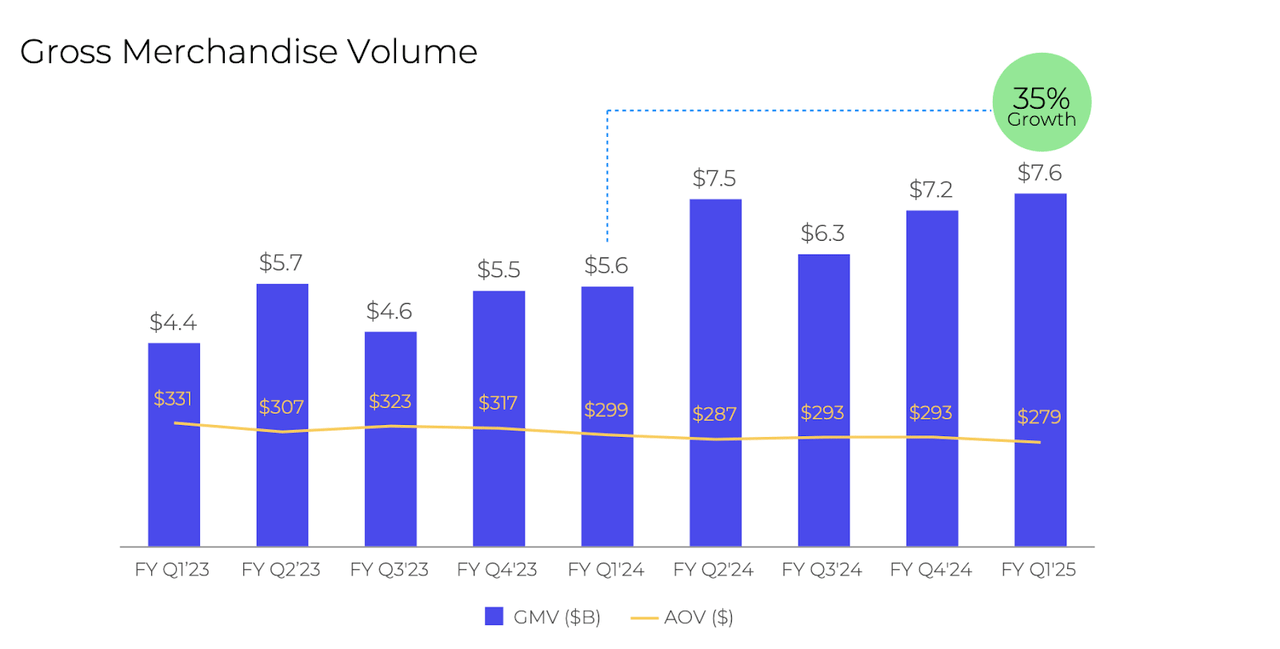

The buy now, pay later leader has developed a habit of posting “beat and raise” quarterly performances. The latest quarter saw the company deliver 35% YoY gross merchandise volume (‘GMV’) growth to $7.6 billion, surpassing guidance of between $7.1 billion to $7.4 billion. That represents sequential acceleration from the 30.9% YoY growth rate posted in the prior quarter. I find these results quite impressive but note that the company may begin to lap tougher comparables moving forward which might pose some headwinds to growth rates.

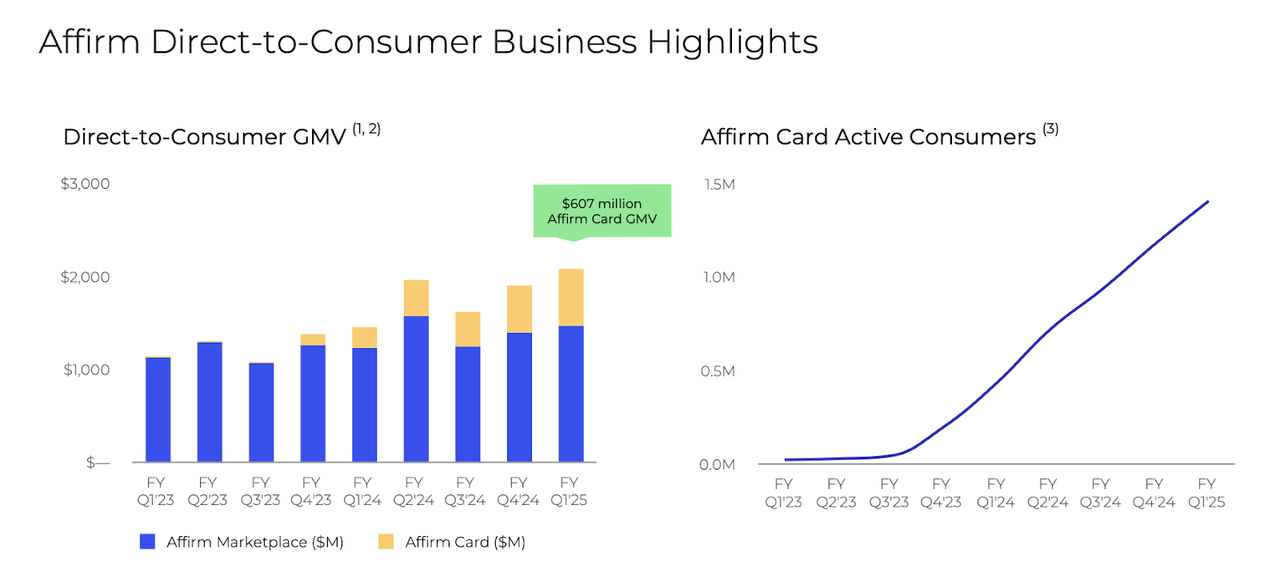

As usual, the company’s Affirm card contributed meaningful to growth rates and now represents a meaningful chunk of overall GMV.

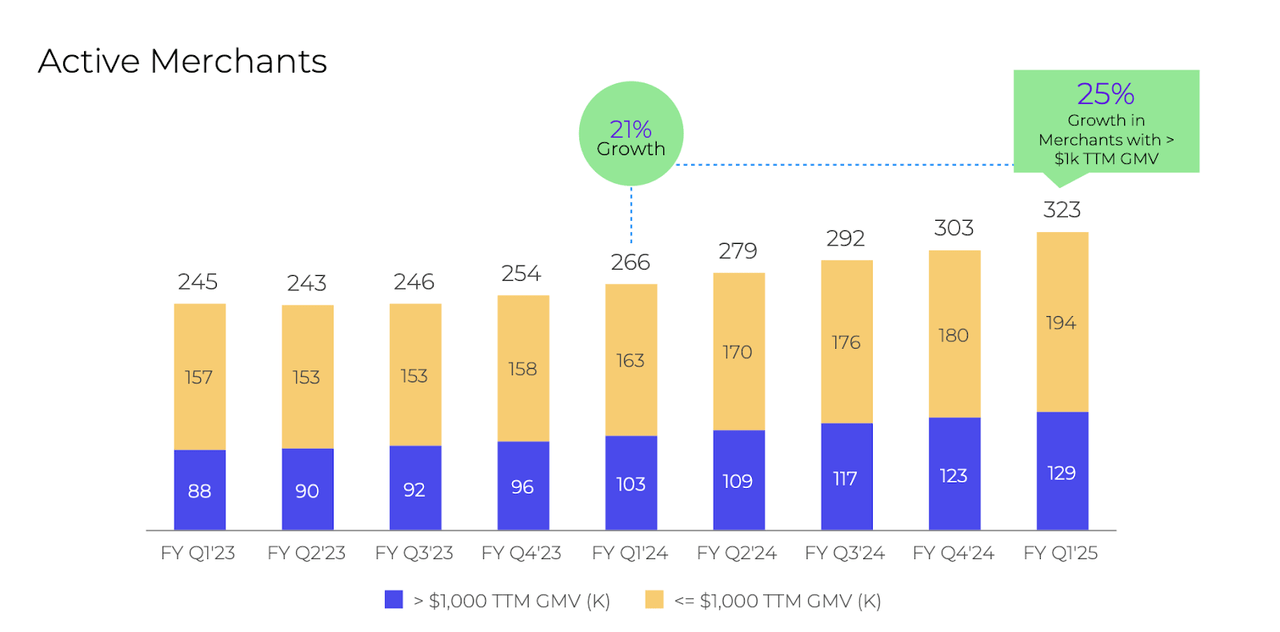

It is noteworthy that the company saw active merchant growth accelerate sequentially to 21% YoY. The company had seen merchant growth slow down meaningfully in the years immediately following the pandemic.

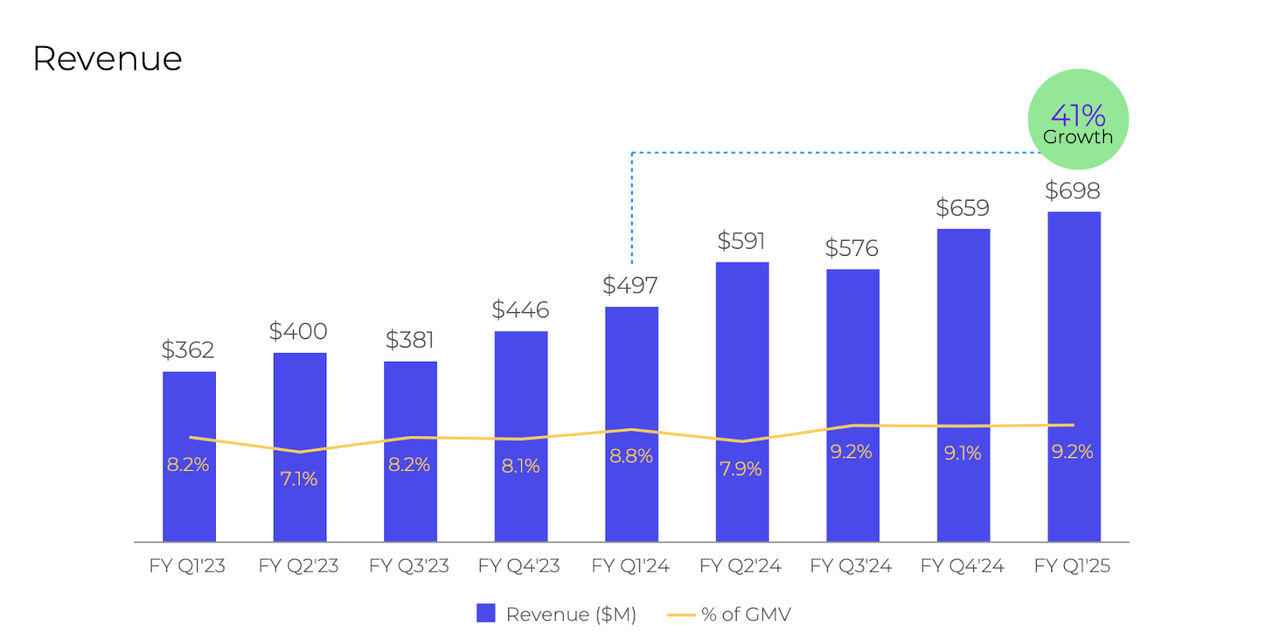

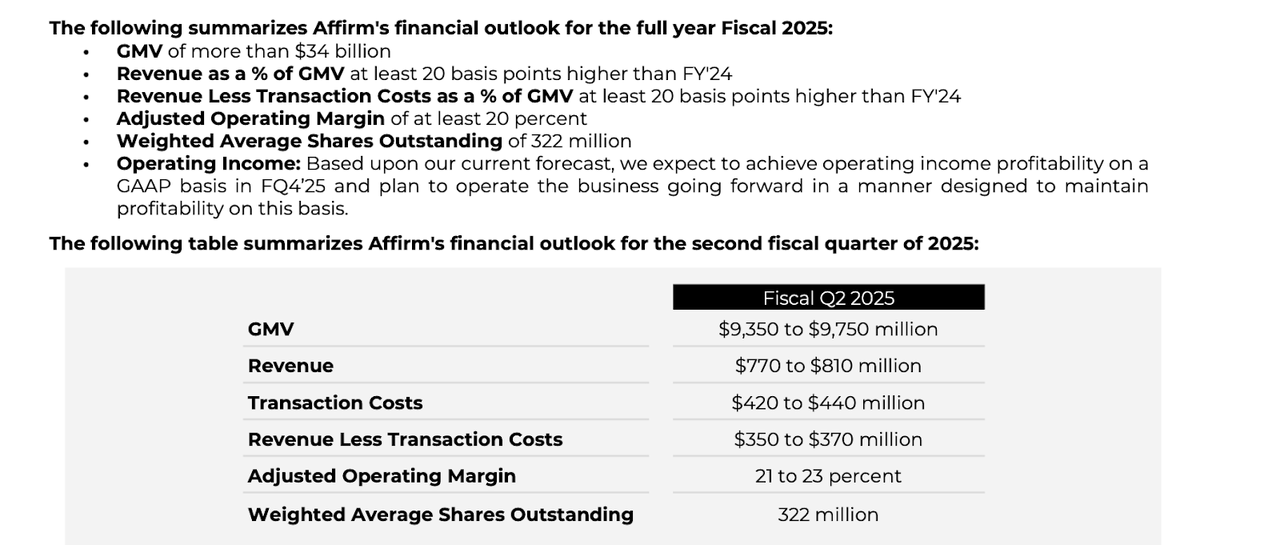

Revenue grew 41% YoY to $698 million, crushing guidance of between $640 million to $670 million.

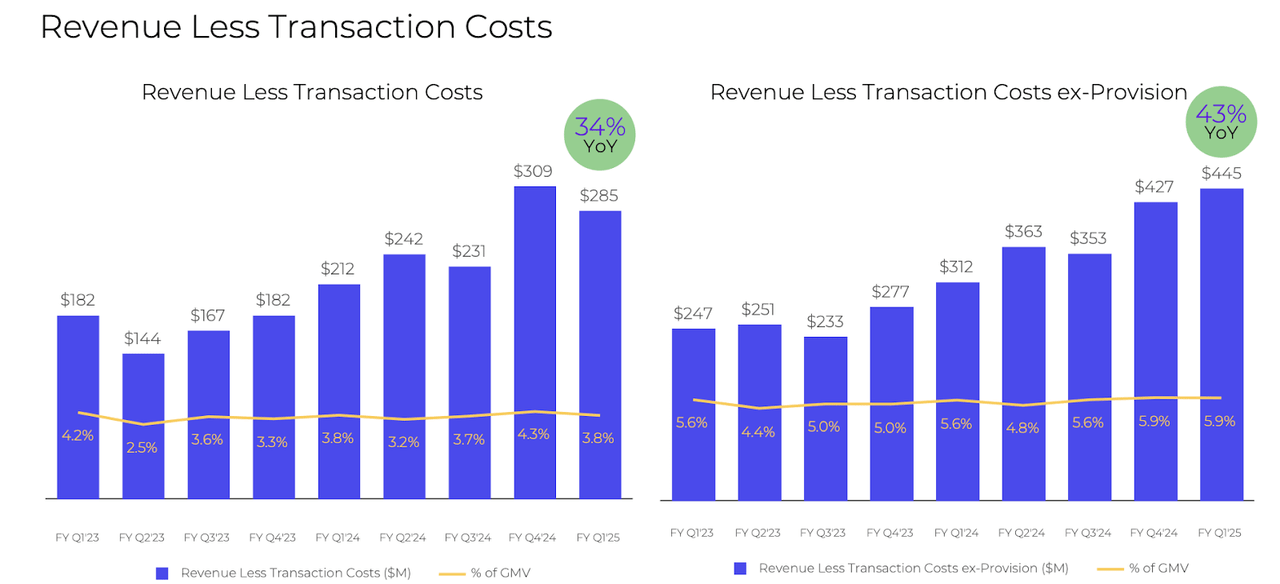

Revenue less transaction costs, the metric I consider to be closest to gross profits for this company, grew 34% YoY to $285 million, only slightly beating guidance as the company saw its RLTC margin dip back to more normalized levels after temporarily spiking in the prior quarter.

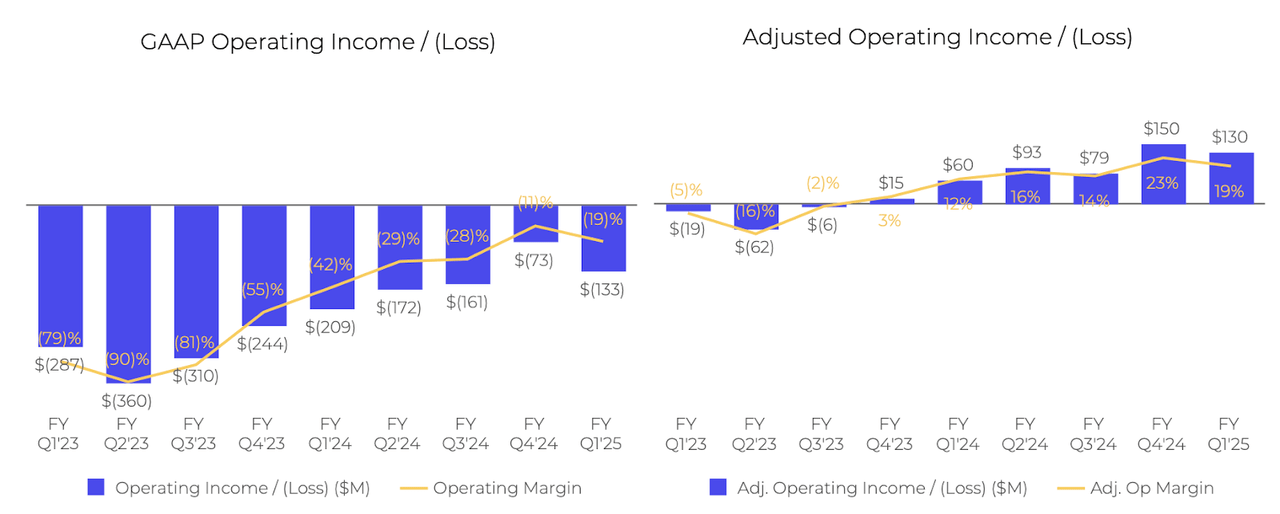

On the profitability front, the company beat guidance with a 19% adjusted operating margin. It is impressive that this company has managed to improve margins by this magnitude even under tough macro conditions of higher interest rates.

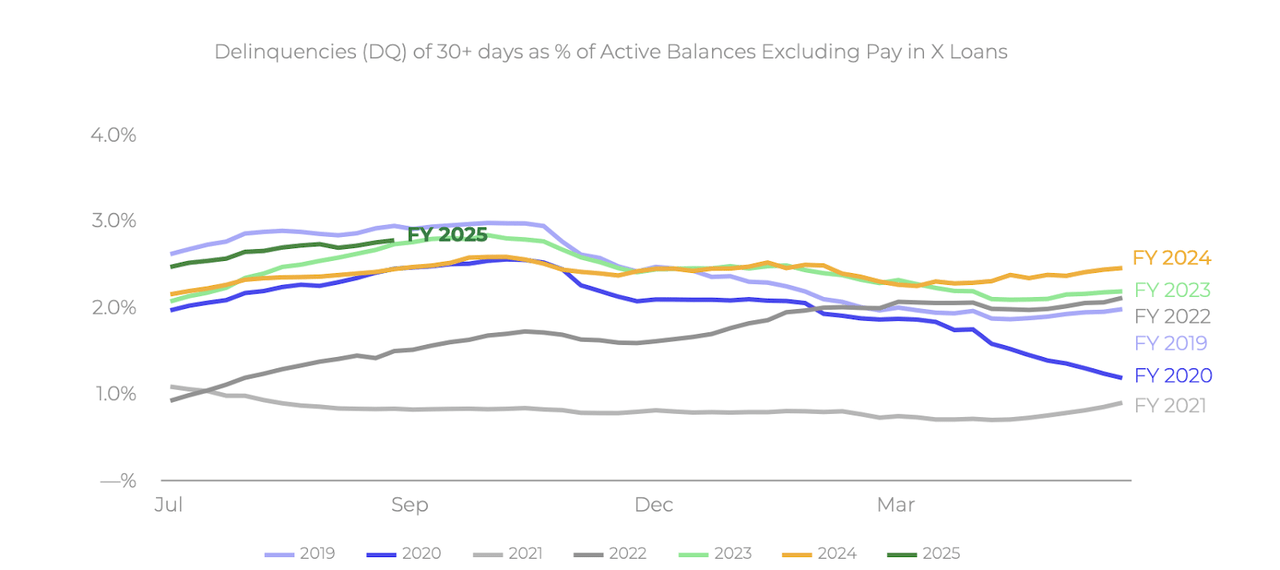

The higher interest rate environment has indeed changed the credit picture, but the company still appears to be operating around recent historical levels.

The company ended the quarter with $1 billion of cash, $1.1 billion of investment securities, and $6.3 billion of loans held for investments versus $1.2 billion in convertible notes and $5.7 billion of funding-related debt. That represents a solid net cash balance sheet. I also note that while some may view the industry as being risky, one can make an argument that the short duration of these consumer loans helps to offset some of that risk.

Looking ahead, management has guided for the next quarter to see up to 30% YoY GMV growth and 37% YoY revenue growth while seeing adjusted operating margins expand above 20%.

On the conference call, management noted that they had a “healthy amount of margin that we can invest in” and that they intend to reinvest that back in the business through “0% or APR incentive offers.” It is promising to see the company operate from a position of strength, which makes sense given the great progress that it has made on profitability as well as reigniting growth rates.

Is AFRM Stock A Buy, Sell, or Hold?

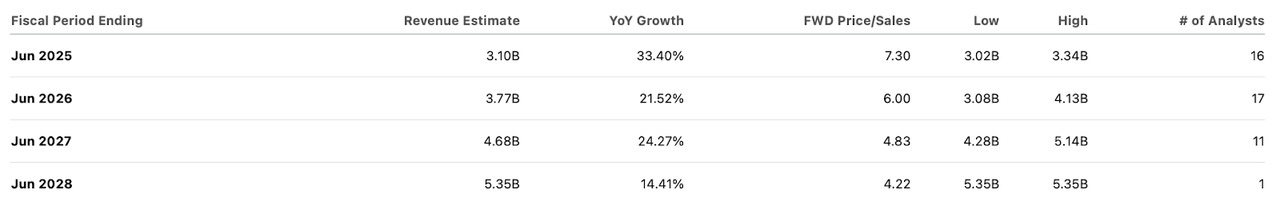

AFRM was one of the many interest-rate sensitive stocks which were pummeled when interest rates rose a couple of years ago, but have since recovered in dramatic fashion. As of recent prices, AFRM found itself trading at 7x sales.

This multiple is looking harder to defend. If we assume that the company can achieve 20% GAAP net margins over the long term, then that 7x sales multiple represents a 35x long-term earnings valuation. Based on consensus estimates, the stock is trading at around 21x 2028 long-term earnings estimates. I see little reason to believe that consensus estimates are conservative – if anything, they might even prove optimistic. I note that Klarna, despite a similar operating run-rate as AFRM, is growing at a slower 23% rate. Consensus estimates project a significant deceleration in growth rates moving forward, which makes sense given the likely protracted impact that the Affirm Card is having on growth. With these considerations in mind, we can try to determine the forward return potential from here. Given the considerable exposure to interest rate fluctuations and economic cyclicality, as well as the highly competitive playing field, I expect long-term valuations to settle more in the 12x to 15x earnings range, which might indicate that the stock is already richly valued based on 2028 estimates. But for the sake of argument, if we instead assume that the stock trades at 30x earnings in 2028, then the stock would be offering around 10% annual return potential over the next 3.5 years. I find that return potential to be insufficient given the aggressive underlying assumptions. I note that even if we assume that consensus estimates of 14.4% growth in 2028 are too conservative and instead use 20% growth, then the stock would only be offering 12% annual return potential – which is still arguably insufficient.

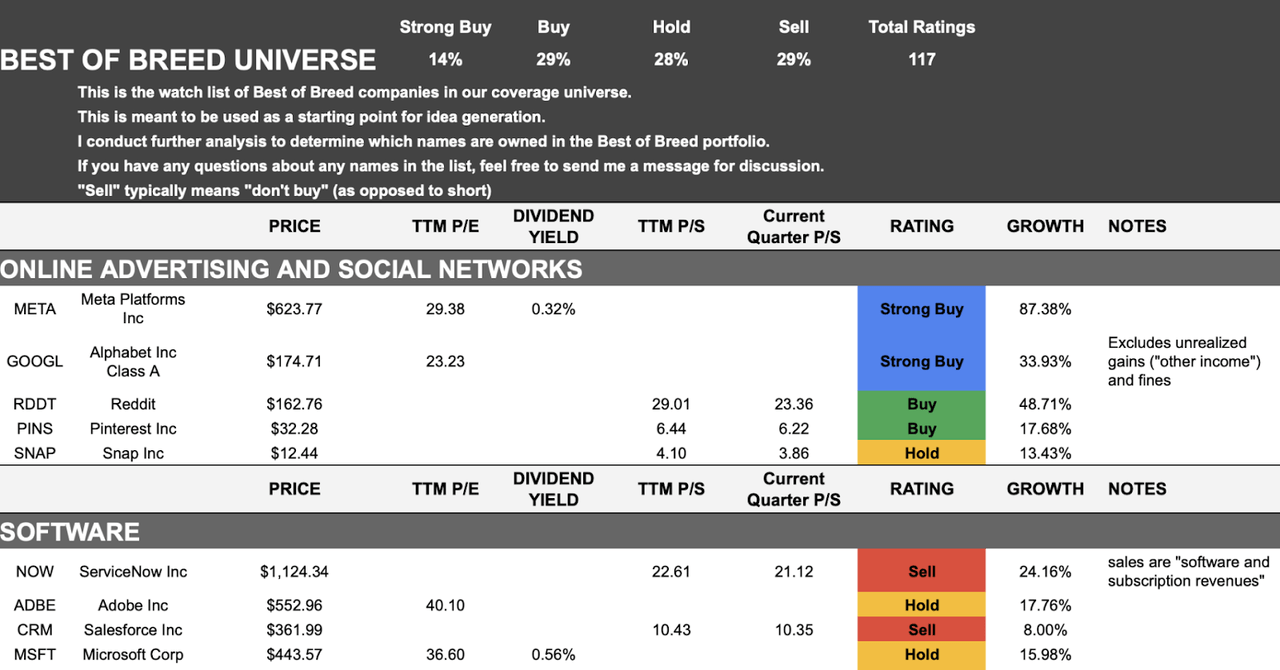

Why is AFRM trading so richly? I find it likely that AFRM’s valuation is merely a symptom of an overheated market. It was just a handful of years ago that around 80% of the growth stocks in my coverage at Best of Breed Growth Stocks were flashing “buy” or “strong buy” ratings. Nowadays, over 50% of the stocks are rated “hold” or “sell.”

While AFRM is far from the most richly valued stock, I do question whether it deserves to trade at a 200% premium to other comparable fintech operators in my coverage. There are some visible catalysts in the near to medium term in the form of GAAP profitability and eventually a potential inclusion in the S&P 500 index, but I am unconvinced that these do enough to justify the valuation.

AFRM Stock Conclusion

AFRM has executed incredibly and arguably has thoroughly answered many of the bearish concerns over the last several years. Investors who remained faithful to their investment theses have been clearly rewarded. However, with stocks continuing to levitate higher and higher, I am growing wary of overheated valuations. I continue to search for undervalued growth stories with strong balance sheets and strong execution for members at Best of Breed Growth Stocks. Due to the unattractive risk-reward profile, I am downgrading AFRM to a neutral rating as I am closing my position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!