Summary:

- Upgraded Meta to ‘Strong Buy’ with a fair value of $699 per share, driven by potential TikTok ban and advanced Llama 3.3 AI model.

- TikTok’s potential US ban in January 2025 could shift users to Meta’s platforms, boosting user growth by over 2.5%.

- Meta’s Llama 3.3 70B AI Model offers cost-effective, high-performance AI capabilities, strengthening Meta’s position in AI and social media markets.

- Meta’s robust financial performance and AI advancements forecast 22% revenue growth for FY24, with sustained growth driven by AI and digital advertising.

Kenneth Cheung

I upgraded Meta (NASDAQ:META) (NEOE:META:CA) to ‘Buy’ rating in October 2024, highlighting its Llama AI models. On December 6th, the appeals court rejected TikTok’s bid to overturn a possible US ban starting from January 19, 2025, which, in my view, could become a growth catalyst for Meta. On December 7th, Meta introduced its New Llama 3.3 70B AI Model, demonstrating Meta is making progress in its AI training models. I am upgrading to a ‘Strong Buy’ rating with a fair value of $699 per share.

Potential TikTok Ban

As reported by the media, a US appeals court upheld the law in a ruling on December 6th, denying TikTok’s argument that the law was unconstitutional. The ruling indicates that TikTok is close to facing a US ban starting on January 19th, 2025. After the deadline, US app stores and internet service providers could face hefty fines if TikTok is not sold to other buyers.

Since TikTok’s launch in 2016, the app has reached more than 1.5 billion users, with 16.75% of all visits coming from the US market, as reported by the media. Notably, TikTok is favored by younger generations, with 1 out 4 users being under 20 years old. As such, the rise of TikTok has created some growth challenges for Meta in the past.

As noted during the recent earnings call, video engagement continues to shift to short form content, and both Facebook and Instagram have been investing heavily in their short video contents. Therefore, the potential TikTok ban could become a significant growth opportunity for Meta in the near future.

TikTok has around 170 million users in the US market, according to the report. I think Instagram, YouTube and Facebook are the nature platforms for these users’ new homes. Meta has around 3.29 billion of total family daily active users (DAP) for September 2024. Assuming half of TikTok’s users will migrate to Facebook and Instagram, it could add more than 2.5% of total users, as per my calculations.

Launching Llama 3.3 70B AI Model

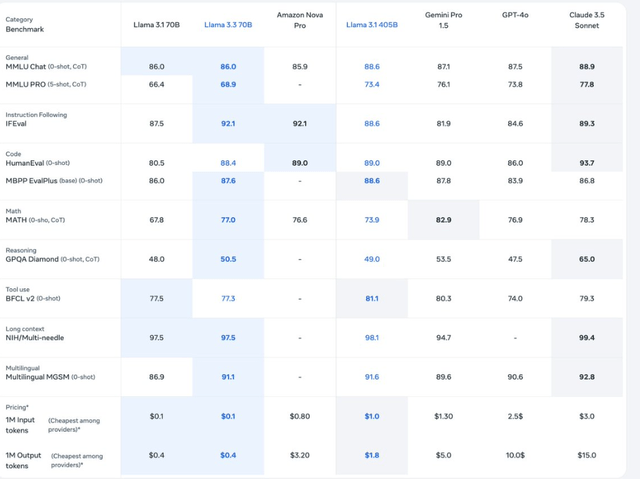

On December 7th, Meta introduced its New Llama 3.3 70B AI Model with refined cost efficiency. With 70-billion-parameters, the new model offers advanced performance in tasks like long context understanding, instruction following, and mathematical problem-solving, as reported.

As detailed in the table below, Llama 3.3 70B AI Model can provide similar performance to ChatGPT-4 Pro version. Notably, Llama 3.3 is specifically optimized for cost-effective inference, with token generation costs as low as $0.01 per million tokens, as disclosed in the release.

As discussed in my previous article, Meta’s Llama AI Model is mission-critical for Meta’s long-term growth, as it could strengthen Meta’s leadership in the social media markets and expand its business scope to AI computing. Powered by Meta’s Llama AI Model, enterprise customers could potentially perform AI inference computing and develop relevant applications at the end-customer level.

Recent Result, Outlook & Valuation

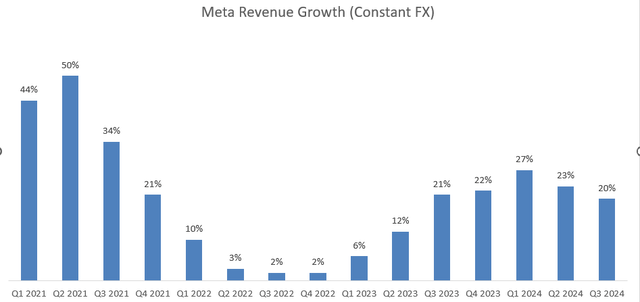

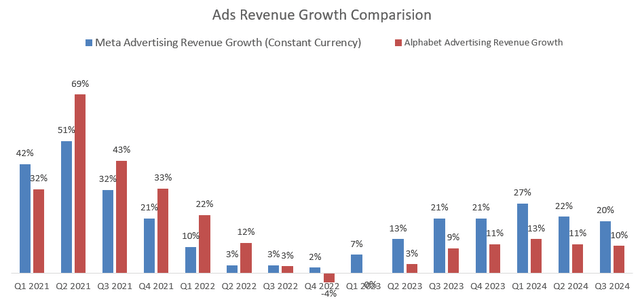

Meta announced its Q3 result on October 30th after the market close, reporting 20% constant revenue growth and 26% operating profit growth. As illustrated in the chart below, Meta has sustained 20%+ revenue growth over the past five quarters.

Compared to Alphabet’s (GOOGL) advertising business, Meta has outpaced its ads growth over the past few quarters, as depicted in the chart below. It demonstrates that Meta has been leveraging its AI capabilities to gain some market share in the digital advertising market.

Meta, Alphabet Quarterly Results

Meta expects the revenue in Q4 to be in the range of $45-48 billion, implying around 16% year-over-year growth at the mid-point. As Meta has delivered three strong quarters, I don’t anticipate the final FY24 result will significantly deviate from their guidance. As a result, I forecast Meta will deliver 22% revenue growth for FY24, marking a strong growth year.

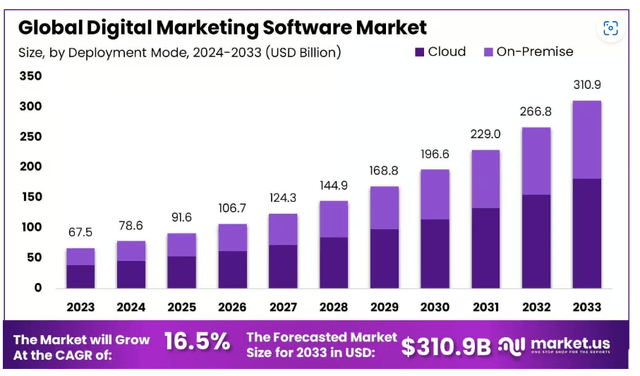

Market.us predicts the digital marketing market will grow at a CAGR of 16.5% from 2024 to 2033. I think the overall market will be driven by the ongoing shift from traditional media to digital platforms, including social media.

From FY25 to FY26, I predict Meta will achieve 17% revenue growth, comprising 16% market growth in the digital advertising market, 1% annual growth from market share gains from TikTok. As analyzed previously, I estimate TikTok user migration could add more than 2.5% of total users. As such, I estimate these user migrations could contribute an additional 1% annual growth to Meta over a two-year period.

From FY27 onwards, I assume Meta will grow in line with the market growth, delivering 16% revenue growth.

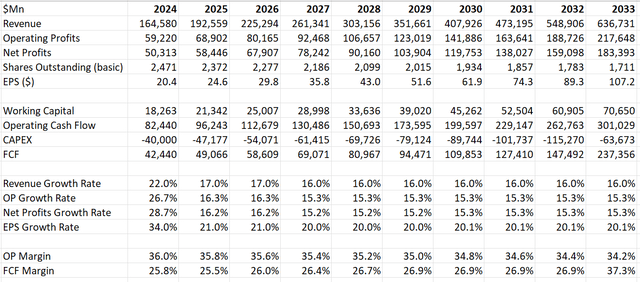

I continue to model 20bps margin contractions for Meta, driven by their increasing investments in AI and data centers. I calculate the total operating expense will grow by 16.3% annually, contributing to a margin of 34.2% by FY33.

The WACC is calculated to be 10.7% assuming: risk-free rate 3.6%; beta 1.32; equity risk premium 6%; cost of debt 5%; equity $153 billion; debt $18 billion; tax rate 16%.

The DCF can be summarized as follows:

Discounting all the future free cash flow at the rate of 10.7%, the fair value is calculated to be $699 per share, as per my estimates.

Key Risks

Their business growth in Asia Pacific decelerated from 28% in Q2 FY24 to 15% in Q3 FY24, due to the lapping of stronger demand from China-based advertisers. As discussed in my previous article, China-based advertisers, such as Temu, have spending heavily in the US market trying to grow their international cross-border e-commerce business. Considering the increasing geopolitical tensions, I believe it would be challenging for Chinese e-commerce players to compete in the US market, which could continually pose growth challenges for Meta’s advertising business.

Conclusion

The upcoming TikTok ban could become a major growth catalyst for Meta’s stock price. Their newly introduced AI model demonstrates Meta’s leadership in AI training and inference markets. I am upgrading to a ‘Strong Buy’ rating with a fair value of $699 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.