Summary:

- Box’s Q3 2025 results show moderate 5% YoY revenue growth, strong margins (gross: 82%, operating: 29%), but weak cash flows and limited cross-selling, with a slim moat amid intense competition.

- Conservative valuation estimates a 10-year 5% revenue CAGR, leading to $262.29M EBITDA and a $4.68B enterprise value in 2034, implying a -54.91% margin of safety at a 7.27% discount rate.

- Bull case assumes 7% revenue CAGR, $422.35M EBITDA, and $10.56B enterprise value, yet with a -1.63% margin of safety, supporting the Hold rating due to limited upside and competitive risks.

Paul Taylor/DigitalVision via Getty Images

Since my last analysis of Box (NYSE:BOX) stock, it has gained 14% in price. I allocated a Hold rating at the time, primarily because I did not believe the company would encounter any significant catalysts in the short term to rerate the business to a higher valuation. However, this happened to be wrong, and the market has indeed repriced the stock more positively since August.

Now, the company has had its Q3 2025 results, and while the results were quite strong, they still indicate a company that is unlikely to deliver outsized CAGRs in the coming years, and could be prone to a decline in the long term related to intangible value. As a result of this conclusion, my rating for the stock remains a Hold.

Q3 Earnings

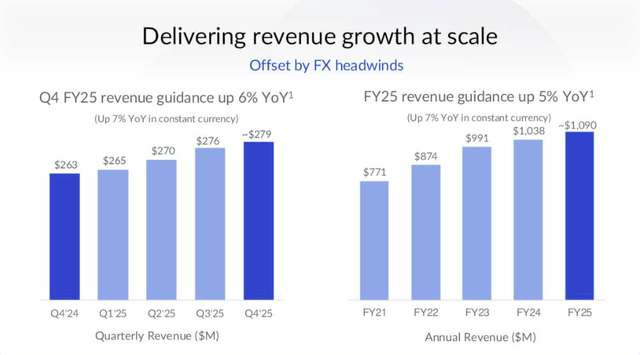

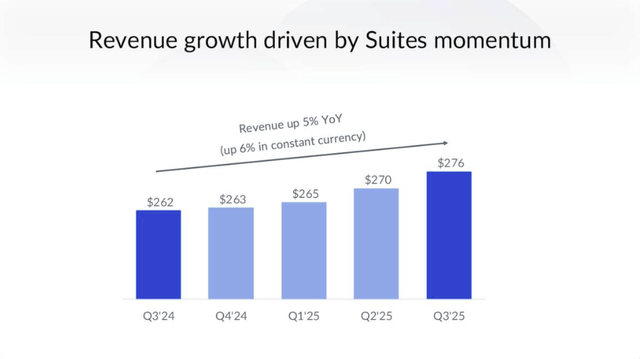

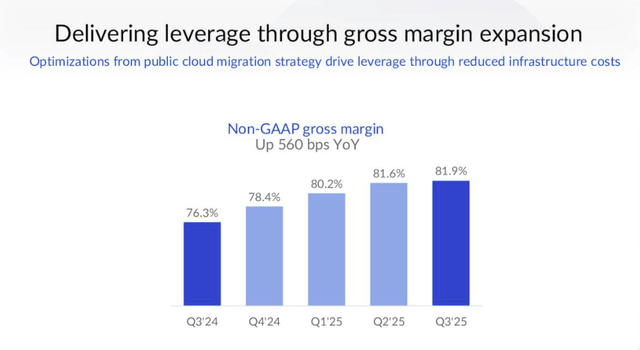

The company grew its revenue by 5% year-over-year in Q3 2025, also reporting a record gross margin of 82% and an operating margin of 29%. Its remaining performance obligations increased 13% year-over-year to $1.3 billion.

Box Q3 Earnings Presentation Box Q3 Earnings Presentation

Box continues to embed AI into its platform—this has enabled the company to deliver document summarization, multi-document querying, and custom AI agents through Box AI Studio. To strengthen these offerings, the company has developed partnerships with OpenAI, Google (GOOGL) (GOOG), Anthropic, and AWS (AMZN), and Box’s new SKU—Enterprise Advanced—is launching in January, targeting complex workflows with features like Box Apps and AI Studio. This advanced SKU has the potential to deliver up to a 40% uplift in pricing over Enterprise Plus. However, the market is not exactly a “blue ocean”, with many other competitors vying for market share, including Microsoft OneDrive (MSFT), Google Drive, and Dropbox (DBX), among others. However, Box does distinguish itself through an interoperable model allowing integration with third-party tools like Salesforce (CRM), Adobe (ADBE), and DocuSign (DOCU). However, I don’t consider Box to offer anything particularly distinct—unfortunately, its moat is relatively slim, and this puts me off as a potential investor.

There were also some notable negatives to the company’s Q3 results. For example, its free cash flow declined by 2% year-over-year and cash flow from operations was down 13%. In addition, its net revenue retention rate was reported at 102%. While this doesn’t reveal heavy churn, it does indicate a low level of cross-selling and up-selling affecting the company’s future growth prospects. This could indicate that the Box’s current product offerings, while effective, are not fully aligned with evolving customer needs by offering them more advanced and sought-after additional services.

Although there is a weakness in cash flow right now, Q4 revenue growth is expected by management to be 6% year-over-year. For FY25, the guidance is a 5% year-over-year growth. This shows moderate growth prospects and provides some incentive for new investors to purchase the shares.

Conservative Valuation Analysis

It’s not unreasonable to provide a 10-year horizon valuation model for Box because its business model is relatively straightforward and not subject to cycles other than because of general macroeconomic conditions. The company’s trailing 12-month revenue is $1,073.5 million. To be conservative, I am forecasting a 5% annual revenue growth rate over the next 10 years. The company’s five-year average revenue growth rate is ~11%, but it is currently just ~4%. The result of my forecast is a December 2034 revenue estimate for Box of $1,748.62 million.

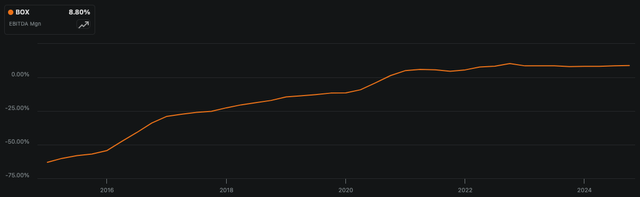

Box EBITDA Margin (Author, Using Seeking Alpha)

The company’s EBITDA margin has been in a long-term uptrend, but has recently plateaued. That said, there is likely more room for expansion as AI capabilities become more powerful. Therefore, I am estimating a conservative but optimistic December 2034 EBITDA margin of 15%. Therefore, my conservative estimate for the company’s EBITDA in December 2034 is $262.29 million.

The company’s forward EV-to-EBITDA margin is currently 15.73, and the sector median trailing 12-month EV-to-EBITDA margin is 19.99. I will be using the midpoint of these two figures—17.9—for my terminal multiple. Therefore, I estimate that the company will have a December 2034 enterprise value of $4,684.55 million. This indicates a 10-year decline of -9.04% from the current enterprise value of $5,150 million. You could argue that a higher EV-to-EBITDA multiple is likely, but I don’t find this justifiable when comparing its year-over-year revenue growth rate of 4.09% to the sector median of 4.42%, and its forward EBITDA growth rate of 8.07% compared to the sector median of 6.06%. Box and the sector median’s growth rates are also likely to converge over the next decade, which will likely pull the valuation into question.

Box’s weighted average cost of capital is 7.27%, with an equity weight of 89.56% and a debt weight of 10.44%. The cost of equity is 7.99%, and the cost of debt is 1.12% after tax. When discounting back my estimate for the company’s December 2034 enterprise value to present day over 10 years using the weighted average cost of capital as the discount rate, the implied intrinsic enterprise value is $2,322.12 million. As the current enterprise value is $5,150 million, this indicates a -54.91% negative margin of safety by conventional standards for investment.

Counter Valuation Analysis

The above valuation model is quite pessimistic, and I do find it plausible that the company sustains stronger sentiment, and indeed, engenders higher growth rates and margins. Therefore, let’s look at a more optimistic outcome.

- December 2034 revenue of $2,111.74 million based on a 10-year 7% CAGR.

- December 2034 EBITDA margin of 20% based on potential economies of scale, automation, and AI-based efficiencies.

- December 2034 EBITDA of $422.35 million.

- December 2034 EV-to-EBITDA multiple of 25, due to intangible value and higher growth rates than the broader sector.

- December 2034 enterprise value estimate of $10,558.70 million, indicating a 10-year 7.44% CAGR from the present enterprise value of $5,150 million.

- December 2024 intrinsic enterprise value of $5,233.93 million, when discounting back my bull-case estimate for its December 2034 enterprise value back over 10 years using a discount rate of 7.27%, equal to its weighted average cost of capital. The implied negative margin of safety is -1.63%.

Even in this bull-case outcome, the stock has a negative margin of safety. Therefore, I am not bullish on Box stock, and my rating is a Hold.

Conclusion: Hold

The big risk that Box has is that its offerings are not particularly distinct, and its narrow moat based on interoperability does not make me particularly convinced it will outperform the sector median growth rates and margins over the long term. My sensitivity analysis related to valuation shows that even in a bull-case outcome, the stock currently has a negative margin of safety. As this introduces too much risk into the long-term investment thesis, my rating is a Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.