Summary:

- INTC has dropped 10% since my last analysis, extending its year-to-date decline to 56%.

- CEO Pat Gelsinger’s exit intensifies uncertainty about Intel’s turnaround strategy, execution, and long-term leadership stability.

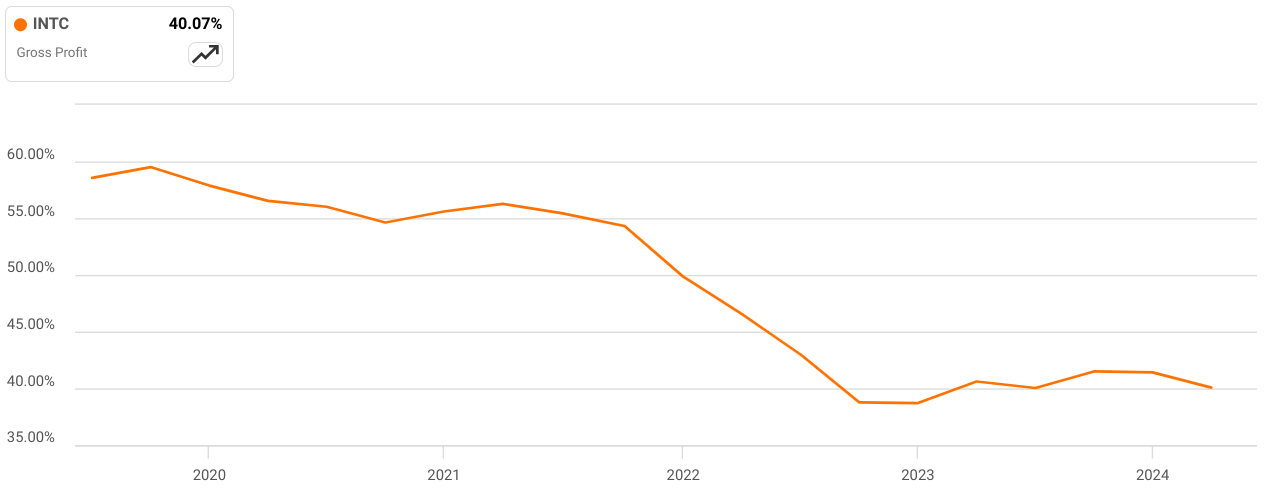

- Q3 gross margins hit 41%, but Q4 is projected to contract to ~39.5% due to rising costs and tailwinds fading.

- Intel targets $17.5B OpEx and $14B CapEx by 2025, reducing spending by $10B to balance growth and costs.

- Intel remains in oversold territory with weak volume and bearish trends, suggesting speculative buying opportunities.

FinkAvenue

Investment Thesis

Since our last analysis, Intel (NASDAQ:INTC) has dropped an additional 10%, extending its year-to-date decline to 56%. CEO Pat Gelsinger’s planned exit has intensified market skepticism, raising doubts about the continuity of Intel’s turnaround strategy, including its advanced node development and foundry ambitions.

The leadership transition adds uncertainty to Intel’s ongoing profitability struggles, competitive pressures, and execution risks. Despite cost-cutting efforts, rising costs, supply chain dependencies, and delayed foundry progress weigh heavily on its outlook. With shares continuing to decline, Intel has entered oversold territory at current levels as the market awaits clearer signs of stability and leadership continuity.

Gross Margins Hit 41% but Projected to Contract to ~39.5% in Q4 Amid Rising Costs

In Q3 2024, gross margins stood at 41% (excluding the charges) with a vital improvement but it is still below historical 50%-plus levels. The uplift of the bottom line has emerged from a better sell-through of previously reserved inventory. However, it is a one-time factor that is unlikely to recur. Looking forward, Q4 gross margins may hit ~39.5% with a minor contraction based on boosted startup costs on the 18A process node and a lack of inventory tailwinds. This ongoing compression is a struggle for Intel to maintain a stable bottom line against rising costs in upcoming quarters. Lunar Lake’s inclusion of memory in the package may lower the margins further in 2025 while Panther Lake could provide the margins through better wafer mix and internal production improvements in 2026.

seekingalpha.com

Moreover, the ramping of 18A in late 2024 may still incur solid OpEx with gross margin improvements that can be pushed into 2026. The investments in nodes solidify Intel’s lead in the foundry business by enabling in-house manufacturing. However, with a weak bottom line, these expansions hold a long payback period. Here, Intel’s moves to reduce its spending by over $10 billion ($1 billion in cost-of-sales for its foundry) may affect the capital structure moving forward. Why? Balancing the cost-cutting measures with aggressive tech investments requires high discipline, which is still not present in the numbers.

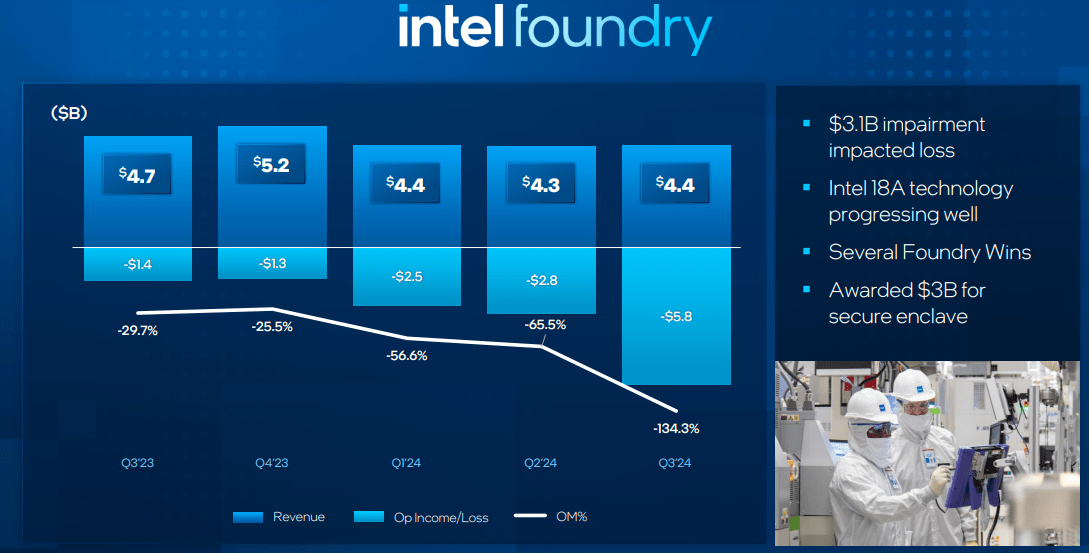

Although Intel Foundry Services (IFS) can be Intel’s most potent growth area, the segment is hamper by inherent issues. Gelsinger (now announced retirement) pointed to three new clients and related efforts to grow lifetime deal value (LDV). However, the progress here is largely qualitative and theoretical. There are no direct specific financial benefits that can be expected until at least 2026. After all those efforts, defect density metrics on 18A are “sub-0.4.” This indicates that even if 18A is in line with process development timelines, it is not ready (adequate defect density) for high-volume production. Critically, this precision element can delay client ramp-ups and reduce Intel’s credibility as a foundry alternative to TSMC and Samsung.

Q3 Presentation

Further, Intel has a prevailing dependency on partners like TSMC for certain tiles in products (like Panther Lake). However, Gelsinger stressed that 70% of the silicon area for Panther Lake is produced in-house but there is still 30% left to rely on external suppliers. This reflects existing capacity limitations on ‘bringing wafers home’. Coming to the long-term issue (opportunity!, also), Intel is having multiple transitions including moving to EUV wafers, scaling up advanced nodes, and ramping production in Arizona. Each of these moves is capital-intensive and holds execution risk. Any delays may ripple through its supply chain and financials. Additionally, the mix of in-house and outsourced manufacturing complicates cost management and leads to dependencies that could reduce bottom-line optimism.

Finally, while Intel is attempting to de-risk the supply chain by reshoring production, the geopolitics remain uncertain. Factors outside Intel’s control like Trump 2.0 and China/US/Russia tensions could impact chip demand and its internal manufacturing schedules. In short, Intel’s projections for Q1 seasonality have an 8%-10% average decline mark. However, this still may not discount the sudden external disruptions that may lead to further downside for the stock if the company fails to derive surprises over consensus.

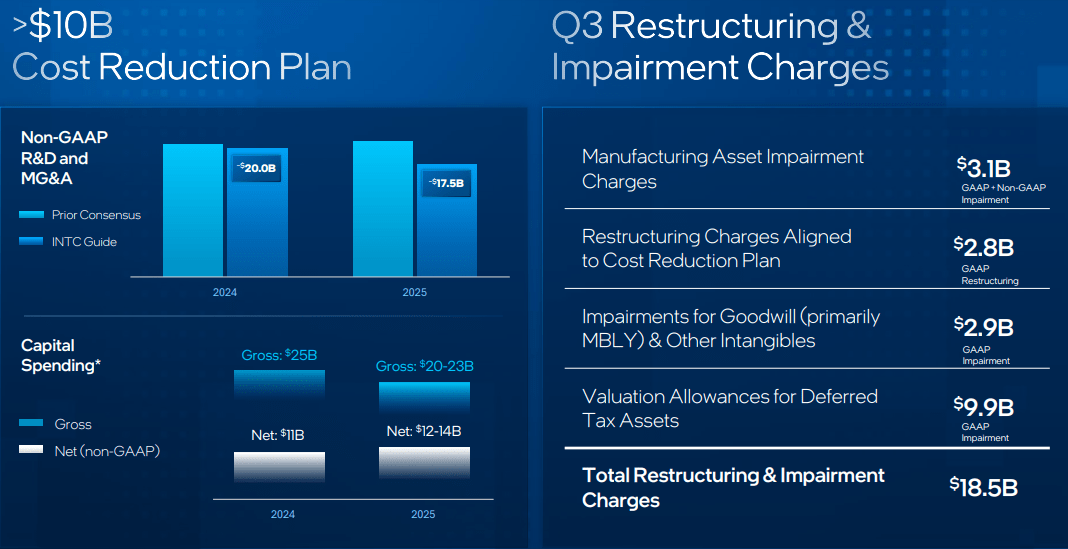

Intel Targets $17.5B OpEx and $14B Net CapEx by 2025 Amid Workforce and CapEx Cuts

On the positive side, Intel’s focus on cost reduction may yield progress as it has executed a 15% reduction in workforce that was largely completed in Q3. Here, the associated severance charge of $2.2 billion is required to streamline its organizational structure. As a result, this restructuring may lower OpEx to $17.5 billion in 2025. With that, Intel has reduced its CapEx by over 20% against initial projections for 2025. These adjustments are deriving gross and net CapEx targets of $20 billion–$23 billion and $12 billion–$14 billion for 2025.

The ability to attain these reductions while advancing technologically (the EUV transition and Intel 18A node developments) suggests that Intel has a sharp capital allocation capability. Looking forward, Intel’s tech pipeline may lead to a solid competitive edge. Intel’s transition to EUV processing is now complete and it may enable a more constant cadence in node delivery. The launch of 18A CPUs may boost profitability through improved performance-per-watt and by expanding Intel’s ecosystem for x86.

Q3 Presentation

Additionally, the x86 franchise remains a market differentiator for Intel on over four decades of ecosystem investments. Intel’s partnership with AMD to frame the x86 Ecosystem Advisory may advance scalability and software development standards. Founding members such as Google, Microsoft, and Oracle validated the relevance of this initiative, so this is an industry-wide development that will continue to maintain Intel’s x86 lead.

Similarly, Intel’s Data Center and AI (DCAI) segment had a 10% sequential top-line increase in Q3 based on improved server demand. However, the Gaudi 3 AI accelerator has seen slower adoption rates due to the transition from its predecessor and software usability issues. Despite missing the $500 million top-line target for 2024, the long-term potential of Gaudi cannot be ignored due to its total cost of ownership benefits and open standards.

Finally, IFS continues to expand its client base with Intel’s $80 billion tangible book value, which is currently tied to its foundry business. In Q3, it secured a multi-billion-dollar deal from AWS for custom chips on Intel 3 and Intel 18A. This complements the two additional wafer design wins from compute-centric comps. Moreover, Intel’s move to establish IFS as an independent subsidiary with a fiduciary board comprising semiconductor experts may expand the potential for capital optimization and external funding. This structural separation aligns with industry trends toward operational specialization and client-focused advancement that may continue to provide a bullish push to INTC’s stock.

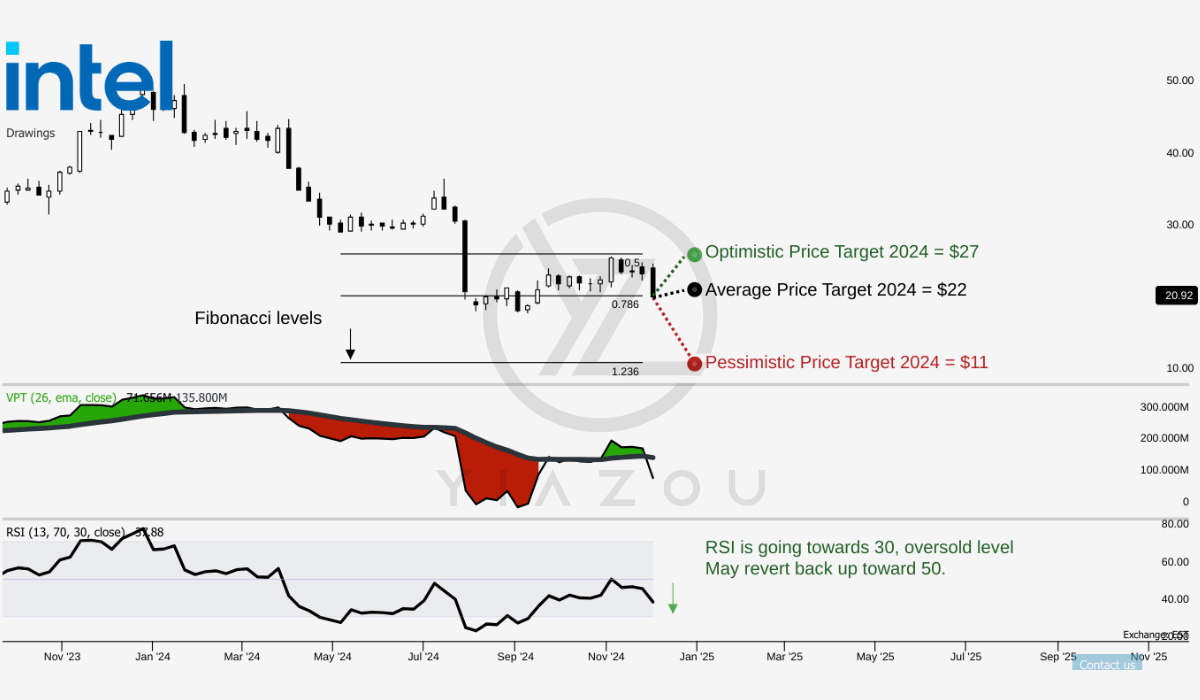

INTC Stock Stands 6% Below the Average 2024 Target with 55% December Upside Probability

INTC stock is currently priced at $20.90. This is in line with the average price target for 2024 of $22. This price target is based on the 0.786 3-point Fibonacci levels based on the current trend, indicating a modest upward potential. In a more optimistic scenario, the price target of $27 aligns with the 0.50 Fibonacci retracement level. This suggests a more considerable upward movement if street sentiments support its long-term potential. On the downside, the pessimistic target of $11, corresponds to the 1.236 Fibonacci level. It implies the possibility of a massive decline should bearish trends continue to prevail.

The RSI is at 37.88, indicating that Intel is currently moving towards oversold territory. This is typically a sign of potential reversal or stability. However, the RSI trend is downward, showing that there is no immediate bullish divergence to signal a reversal to the upside. The absence of a clear divergence leaves the RSI as a neutral factor in the short term. Intel’s Volume Price Trend (VPT) is also down, at 71.66 million, well below its moving average of 135.80 million. This indicates that trading volume is decreasing while the price is trending downward. This suggests a lack of high buying interest that further supports the potential for a bearish outlook.

Yiazou (trendspider.com)

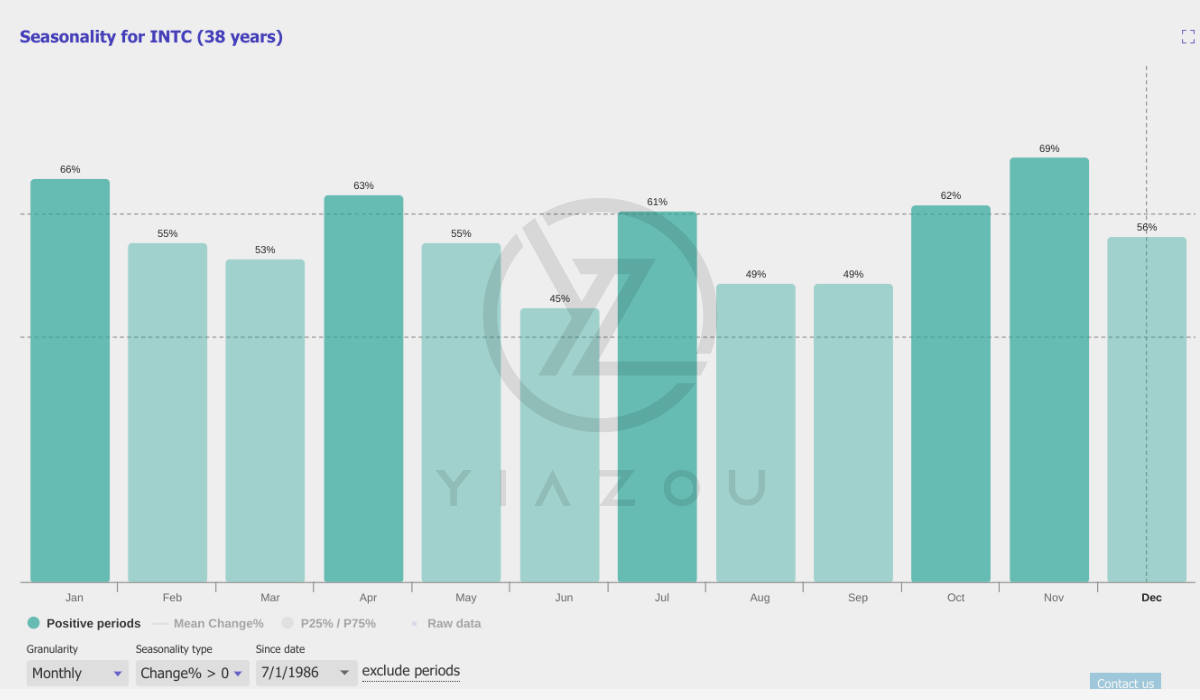

Lastly, based on monthly seasonality data, there is a 56% probability of a positive return if an investment is made in December. However, this doesn’t account for market conditions that may override seasonality trends.

Yiazou (trendspider.com)

Takeaway

Intel’s recent 10% drop, coupled with a 56% year-to-date decline, underscores persistent market pessimism, heightened by CEO Pat Gelsinger’s planned exit. While cost-cutting and restructuring efforts show potential, Intel faces significant challenges in profitability, execution risks, and leadership continuity. With shares in oversold territory, Intel is a speculative buy for risk-tolerant investors awaiting clearer operational and strategic stability.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.