Summary:

- Intel Corporation’s future hinges on the success of its 18A node and GPU competitiveness, supported by significant U.S. government funding and strategic partnerships.

- Despite recent setbacks, including the CEO’s departure and financial struggles, Intel’s long-term potential remains strong with strategic investments and cost reduction plans.

- Intel’s shift to TSMC’s 3nm process for GPUs and the development of Falcon Shores are crucial for regaining market competitiveness by 2025-2026.

- Investors must be patient, as Intel’s turnaround is a multi-year bet, reliant on technological advancements and continued government support.

FinkAvenue

Ousted Intel Corporation (NASDAQ:INTC) CEO Pat Gelsinger was in the news asking for people to “pray(ing) and fast(ing) for the 100K Intel employees as they navigate this difficult period,” The company’s share price is down more than 20% after tough news about the company’s 18A node given Pat’s previous admission to have bet the company on the node.

Despite Intel’s underperformance since our recommendation as a longer-term investment, the company still has strong potential.

Intel’s and the U.S. Government

Intel is arguably the most important company to the U.S. government today. Having cutting-edge chip technology is essential to the modern world, and today, one company leads there. That’s Taiwan Semiconductor (TSM) in the geopolitically unstable Taiwan. Taiwanese law allows only non-cutting edge chips to be manufactured outside of Taiwan.

That’s why the Biden administration signed the Chips & Science Act to make the U.S. once again competitive in that key industry. As a part of that, Intel is the largest beneficent, with almost $7.9 billion in direct funding. That’s in addition to both a 25% investment tax credit and a $3 billion contract funding to Intel for the Secure Exclave program.

Intel plans to invest $100 billion across multiple factories in the United States, for several opportunities. At the end of the day though, even with the support, the company needs to be able to regain node competitiveness once again. Still, the U.S. government’s support, as the most powerful economy in the world, presents a floor for the company.

Intel’s GPU

Among Intel’s ability to earn cash flow and become relevant again is the company’s ability to build a competitive GPU for the artificial intelligence age.

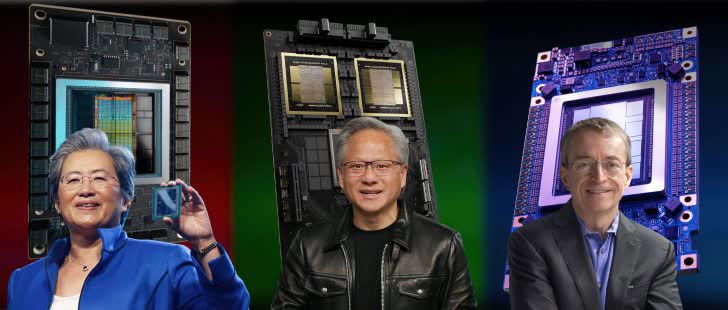

TSMC 3nm Set To Witness Massive Adoption From AI Tech Giants; NVIDIA Rubin, AMD Instinct MI355X & Intel Falcon Shores 1

Intel has made an intelligent decision in our view to ditch its foundry services and move to TSMC 3nm. That avoids the company’s GPU success not being tied to its foundry success. Building a functioning GPU and capturing the profits can enable the overall company to have the capital expenditures for future investments.

Intel has some advantage here versus other companies like Google and Amazon, where it has created the Gaudi / Gaudi 2 / Gaudi 3 accelerators. The company’s Gaudi 3 hasn’t done too well, with <$500 million in 2024 revenue, but with Falcon Shores, we expect improvement. How Falcon Shores pans out remains to be seen going into 2025.

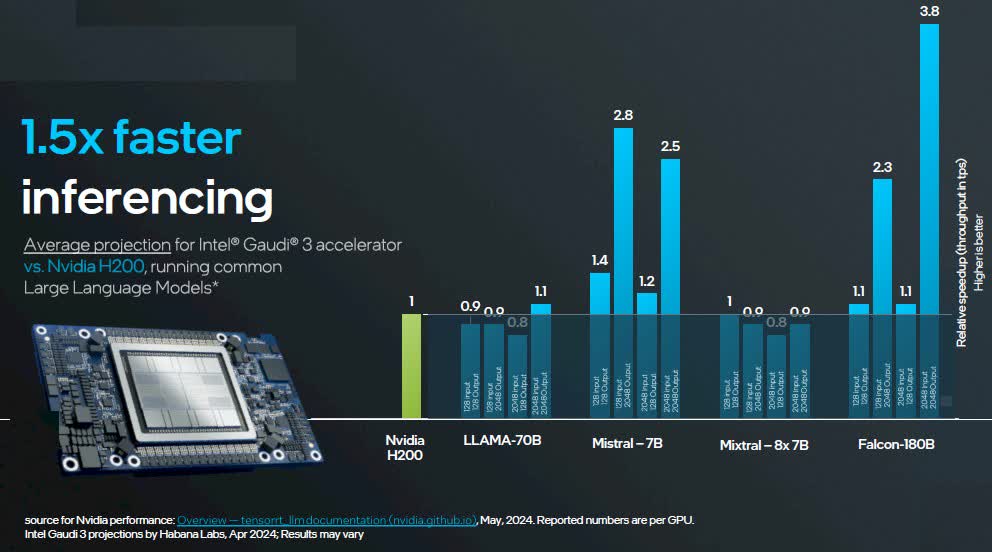

Intel Benchmark

Benchmarking above indicates that in inference, Intel is competitive with Nvidia (Gaudi 3 vs. H200). Of course, Blackwell is now rolling out and is estimated to be 2x as good versus the H200. However, Intel benefits from a Gaudi 3 price at 1/3 the cost of an H200. Switching to TSM for the Falcon Shores makes it much more likely the company can output a competitive product on time.

The company has strong industry relationships and an ability to roll out its products, and we’re optimistic that 2025-2026 will see strong growth in the GPU business relative to peers. It’s worth noting that the 3nm Falcon Shores will be on the exact same TSMC node as Nvidia’s Rubin in 2025 and AMD’s next generation, making the only difference in design.

Intel CEO Departure and 18A Foundry

Intel reportedly let its CEO go after becoming frustrated with his ability to change things. They appear to have done so without a clear succession plan, which is important because the 18A foundry is key to the business’ future.

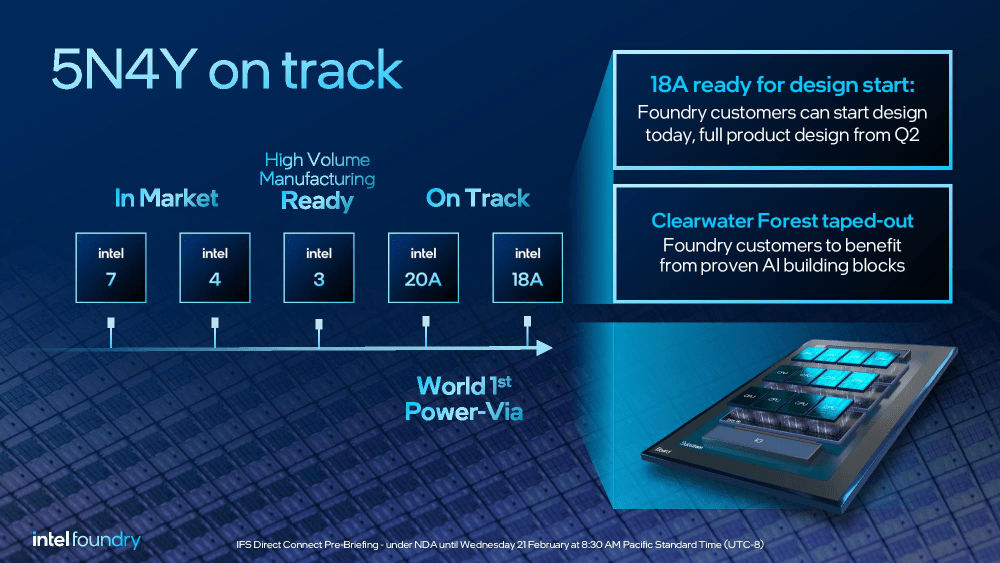

Intel Benchmark

Analyzing and wading through the rumors here is tough. Intel’s foundry GM has said the node is on track to ramp next year. In September, it was at 0.4 defects / cm^2, versus 0.33 for TSMC N7 and N5 3 quarters before ramp (18A is also 3 quarters before ramp). A 1Q delay to get defects and yield to an appropriate mass market level wouldn’t be the end of the world.

Compared to TSMC N2, which is expected to hit mass production YE 2025, it has lower SRAM density but backside power delivery, so the exact performance is unknown. Still having closer to TSMC’s N3 in SRAM density is a downside, given its importance to modern designs, however, 18A having BSPD and GAA transistors is key.

Success in 18A, with numerous new technologies, could easily enable Intel to once again make competitive incremental updates instead of needing to make a giant leap. The net takeaway here is we don’t have enough detail today. Intel’s performance in 2025 will be key to watch.

As a word of caution, reportedly initial 18A testing with Broadcom left Broadcom unhappy. Given the lack of clear communication from the company during its Intel 10 bungalow years ago that left it without process node leadership, it’s important to pay close attention to conversations like this that could indicate it’s fallen behind.

Broadcom’s concerns were about the defect rates in the process reportedly, not surprising given that Intel’s own stated defect rate is behind where TSMC was at this point. The company needs to work hard to continue reducing that number. Rumors on yield range from 10% to 60%, which makes it tough for anyone to know besides watching.

Intel Financial Position

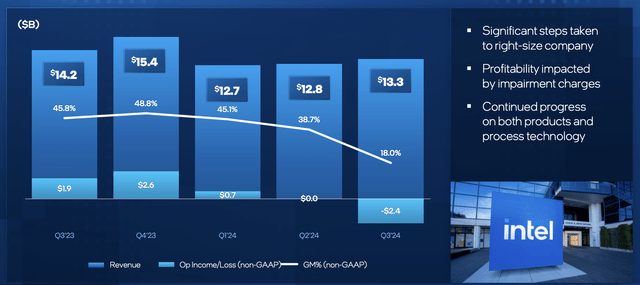

Intel’s financial position has seen both revenue and operating income decline as the company has worked to right size the company.

Unfortunately, the nature of the company’s goals are that it needs to invest $10s of billions in capital over years. The company can’t easily cut that capital spending with a short-term downturn in its business, which means profits can drop much faster than a decline in revenue. The company’s GM% has dropped from more than 40% to 18% in just a few quarters.

The company is focused on continued progress, but it’s clear that it doesn’t have forever.

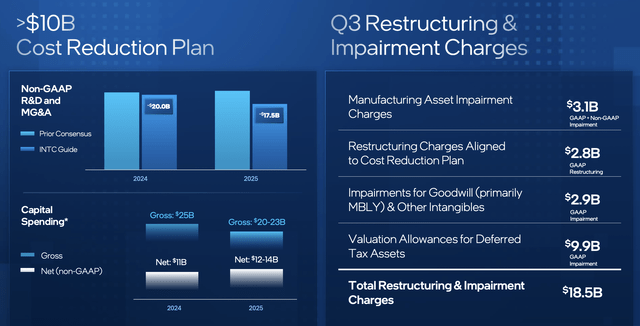

Intel needs to balance making employees care about the company and its future with a bleak stock prices and the layoffs of 15K employees. The company has detailed a >$10 billion cost reduction plan and is guiding for slightly lower R&D into 2025. With a slight increase in net capital spending but a decline in gross spending.

The company has undergone some unconventional decisions here, such as a partnership with Apollo for fab investing. The cost reduction plan of the company though is key to its ability to succeed.

Thesis Risk

The largest risk to our thesis is that Intel is still a $90 billion company, and branding can only carry you so far. The company needs to show an ability to generate profits and improve its business for the long term, moving to net positive profits without $10s of billions of capital spending and continuous impairments.

Conclusion

Intel’s former CEO clearly still loves the company he was ousted from. The board appears to have jumped the gun. However, he watched over the company during a major transition. Intel is now working to ramp 18A up, reducing the defects, and hitting mass product. The former CEO said the company was a bet on this node, so keep a close eye.

Ideally, Intel’s U.S. government support will help tide them over until Falcon Shores and 18A can help them make real revenue. That real revenue will support them being competitive once again as the company tries to compete with a trio of Nvidia (NVDA), Advanced Micro Devices (AMD), and TSMC, all of which are larger companies at this point. Investing in Intel is a multi-year bet, one we expect them to succeed at.

However, investors must be patient.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.