Summary:

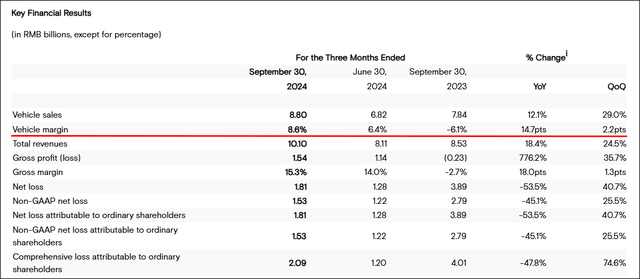

- XPeng’s deliveries are surging, driven by the Mona M03 and P7+ models, but the company’s vehicle margins are still below those of Li Auto and NIO.

- Despite a sequential improvement in vehicle margins to 8.6%, XPeng still lags behind Li Auto’s 20.9% and NIO’s 13.1% margins.

- XPeng’s Q4 delivery guidance is strong, projecting 87,000 to 91,000 EVs, translating to up 51% year-over-year growth.

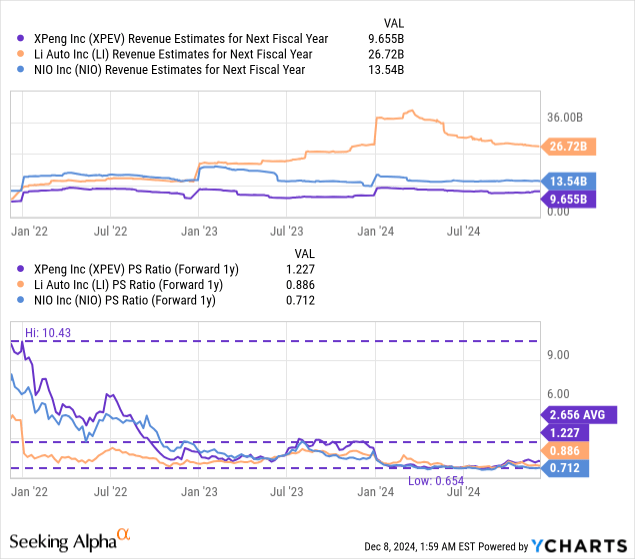

- I maintain a hold rating on XPeng stock due to its weaker margins and unjustified premium valuation compared to Li Auto and NIO.

hapabapa

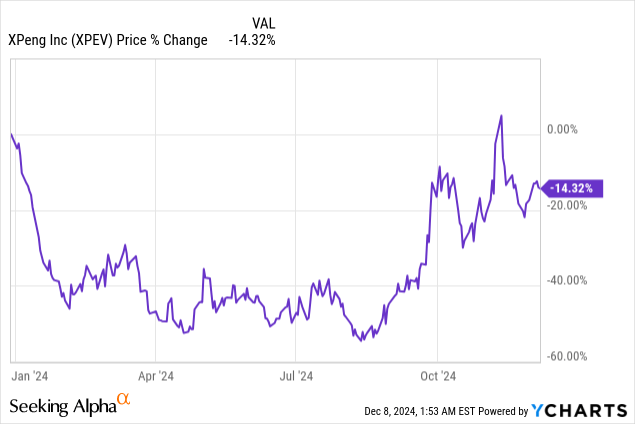

Shares of XPeng (NYSE:XPEV) have dropped off lately, despite the EV maker reporting a sequential improvement in its vehicle margins and benefiting from higher delivery volumes due to the launch of new EV models such as the Mona M03 and the P7+. November deliveries were also encouraging, with XPeng managing to deliver more than 30,000 electric vehicles, a record for the EV firm. Deliveries for the EV maker have been in an upswing lately and the company also submitted a strong guidance for Q4 deliveries. XPeng is still lagging behind its EV rivals in terms of vehicle margins, however, which is why I am not yet prepared to upgrade my rating.

Previous rating

I rated shares of XPeng a hold in my last work on the company — Inferior EV Investment Choice — because the electric vehicle company experienced pressure on its margins and experienced weak delivery growth earlier this year. Companies like Li Auto (LI) and NIO (NIO) offer significantly better investment propositions, in my opinion, due to their higher vehicle margins and stronger delivery growth. While XPeng’s delivery prospects are improving, in part because of the launch of the low-cost Mona M03 EV, I believe XPeng does not deserve to trade at a higher valuation than either Li Auto or NIO.

XPeng’s deliveries are surging, but margin profile remains inferior

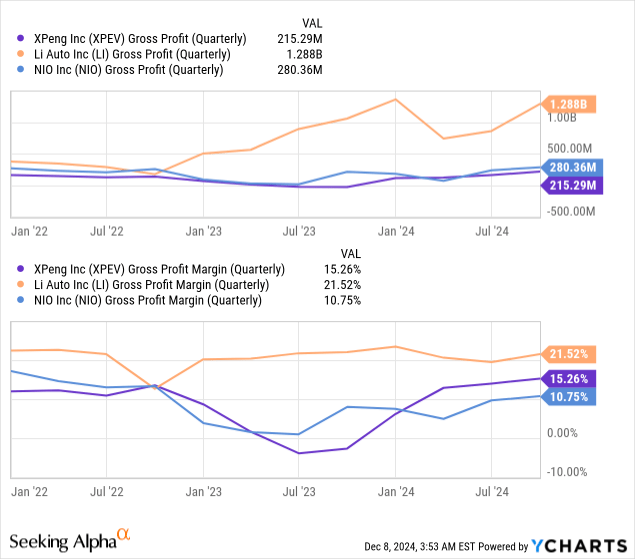

XPeng made considerable progress in the third fiscal quarter in terms of growing its vehicle margins, but the company is still lagging far behind the EV competition. XPeng generated vehicle margins of 8.6% in Q3’24, showing a 2.2 PP sequential margin gain. For context, Li Auto generated vehicle margins of 20.9% (+2.2 PP Q/Q) with which the EV maker is still leading the industry start-up group. NIO generated a vehicle margin of 13.1% for the third-quarter (+0.9 PP Q/Q).

In terms of gross margins, Li Auto is also leading is also leading, although both NIO and XPeng have narrowed the gap lately. At the current moment, XPeng has the second-highest gross margins in the industry group at 15.3%. While Li Auto still has the highest gross margin of 21.5%, XPeng has the potential to catch up, mainly because of surging volume production which is driven by both the P7+ model as well as the Mona M03.

The Mona M03 is an all-electric hatchback sedan that is seeing considerable growth momentum and is a key reason behind XPeng’s delivery surge lately. The P7+ is a battery-powered EV — which is a mid to large-size electric sedan with a retail price starting at 186,800 Chinese Yuan (~$26k) — and only started to be delivered to customers in October, so investors can expect a significant ramp here in the months ahead as well.

In the third-quarter, the company delivered 46,533 electric vehicles, which showed a 16.3% year-over-year growth rate. In November, deliveries surged for the first time ever above the 30,000 monthly delivery threshold: in the month of November, XPeng delivered a total of 30,895 electric vehicles, showing 54% growth year-over-year. The Mona M03 was launched in August 2024 and just had its third consecutive month of 10k+ deliveries. XPeng launched the Mona M03 mainly in order to offer consumers a lower-cost alternative to Tesla’s (TSLA) Model 3 which costs about twice as much.

XPeng’s delivery guidance for Q4

Due to the ramp in Mona M03 production and the recent launch of the P7+ electric vehicle, XPeng is benefiting from a considerable delivery boost that is expected to continue in Q4’24. According to XPeng’s Q3’24 earnings report, the EV firm expects to deliver a massive 87,000 to 91,000 EVs in the fourth fiscal quarter which translates to a Y/Y growth rate of between 45-51%.

XPeng’s valuation

Despite having weaker vehicle margins than the competition, XPeng has the highest valuation in the industry start-up group in terms of price-to-revenue ratio. Shares of XPeng are currently valued at a forward P/S ratio of 1.23X which is significantly above the valuation of Li Auto… which, due to superior execution (stronger growth, higher margins), would be deserving to lead the industry group in terms of valuation. That it does not was one reason why I called Li Auto a Best-Of-Breed EV Start-Up.

In my last work on XPeng I arrived at a fair value of $9.50 per-share based off of an average industry group P/S ratio of 0.8X. The industry group average P/S ratio has since risen to 0.9X, so I would raise my fair value target here to $10 per-share. With shares currently trading at $12.50, I consider XPeng more than fully valued. I don’t rate XPeng a sell, however, due to its impressive delivery trend and progress in terms of growing vehicle and gross margins.

Risks regarding XPeng

While XPeng is seeing a ton of interest for its Mona M03 hatchback sedan and deliveries are surging, the EV company is still lagging far behind its direct EV rivals Li Auto and NIO, both of which have stronger vehicle margins. Li Auto especially is crushing it in this regard. What would change my mind about XPeng, either to the positive or negative, would be a change in the vehicle margin trajectory. Further, a down-trend in margins would likely be a very serious valuation issue if a larger portion of deliveries is made up of lower-cost EVs going forward. In this sense, it remains to be seen in FY 2025 if XPeng can actually continue to grow its margins.

Final thoughts

XPeng is currently crushing it in terms of deliveries, and the company delivered a healthy Q3 earnings scorecard. In November, the company’s delivery growth surged, mainly due to growth momentum for the P7+ and the Mona M03 electric vehicles. While the delivery surge as well as the outlook for Q4 deliveries are positive, I still feel a little bit uncomfortable with XPeng’s margin profile… which I continue to see as inferior to those of either Li Auto or NIO. Further, I don’t see XPeng’s valuation premium with regard to other EV start-up companies as justified, especially because Li Auto and NIO are offering strong vehicle and gross margins themselves. For those reasons, I am going to continue to rate XPeng only a hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LI, NIO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.