Summary:

- MARA Holdings leads in bitcoin mining and energy-efficient computing through advanced technologies and strategic acquisitions, enhancing its computation capacity and cost-saving measures.

- The company’s expansions in Ohio and proprietary energy innovations, like two-phase immersion cooling, significantly reduce costs and improve efficiency.

- MARA’s hybrid strategy of retaining mined Bitcoin and leveraging debt for more Bitcoin positions it well for potential price appreciation.

- Despite strong growth and innovative strategies, MARA faces risks from Bitcoin price volatility and reliance on external energy markets.

Olemedia

MARA Holdings (NASDAQ:MARA) is currently at the frontier of the crypto boom. The company is capitalizing on advanced technologies and strategic acquisitions to cement its position as a leader in bitcoin mining and energy-efficient computing. Mara is successfully navigating the volatile and increasingly competitive crypto industry through large expansions in mining capacity and cost-saving measures.

Mining Operations

MARA’s recent expansion really shows its commitment to growing its scale and efficiencies. The company has increased its interconnect-approved capacity by 372 MW for three data centers in Ohio alone in Q3 of 2024. This puts MARA in a great position to expand its mining operations for the foreseeable future. The company also acquired its Hopedale and Hannibal facilities at just $270,000 per MW. This figure is far below the industry average of around $900,000-$1.5 million per MW. MARA is also developing a greenfield facility in Ohio, which should add another 150 MW of capacity.

These expansions are part of MARA’s strategy of growing its operations. They also allow Mara to reduce its dependence on third-party providers. MARA will be able to significantly minimize operation risks and improve cost by owning and operating 65% of its 1.5 HW of compute capacity. This vertical integration aligns with its goal to lead the digital asset sector while at the same time maintaining flexibility in energy sourcing.

Energy Innovations

Energy efficiency is very important in the energy-intensive Bitcoin mining industry. In fact, the overall energy consumption of Bitcoin mining is now comparable to the energy consumption of some smaller countries like Poland. MARA is successfully taking steps to address this challenge through technological advancements and a growing list of partnerships. The company has developed its own propriety Two-Phase Immersion Cooling technology, which greatly improves energy efficiency by increasing power density compared to traditional methods by up to four times. MARA has also successfully reduced cooling costs by up to 60%.

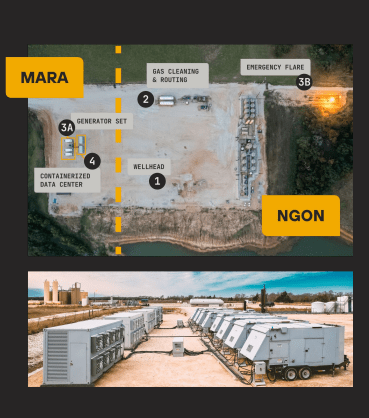

MARA has also established a partnership with NGON, which converts flared natural gas into electricity. This partnership has allowed the company to reduce electricity costs to nearly $0.01 per kWh. This figure is around four times less than the market average price, showing MARA’s ability to acquire energy generation at incredibly cheap costs. Because of these improvements, MARA is one of the most cost-competitive bitcoin miners in the industry by increasing efficiencies.

MARA

Bitcoin’s Rise and MARA’s Strong Strategic Positioning

Bitcoin’s change from a niche asset to a globally recognized digital store of value has provided companies like MARA the opportunity to thrive. MARA has seized upon Bitcoin’s growing popularity by expanding operations and growing its holdings. Bitcoin has unique attributes as the first major digital asset. For instance, it has an artificially capped supply and a decentralized nature. This has made it an increasingly valuable asset for investors seeking to diversify.

While companies like MicroStrategy (MSTR) have taken a more direct investment approach by accumulating Bitcoin as a corporate treasury asset, MARA is also focused on Bitcoin mining. MARA not only accumulates Bitcoin but also generates revenue from its production of Bitcoin by taking advantage of its increasingly large and energy-efficient mining operation. On top of this, MARA is also in a great position to copy MicroStrategy’s innovative playbook of accumulating debt to buy even more bitcoin.

MARA incorporates a hybrid strategy in which it retains much of the bitcoin it mines. This allows MARA to benefit from potential price appreciation while it focuses on its mining operations to ensure steady revenue generation. This also allows MARA to employ MicroStrategy’s “infinite money glitch” strategy of borrowing money at cheap rates in order to buy more bitcoin, hoping for bitcoin to appreciate, and making money off the difference.

Financials

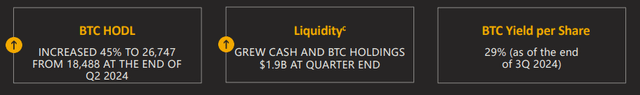

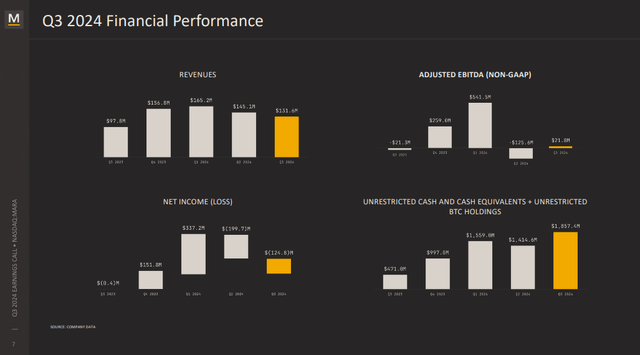

MARA reported good results in Q3. The company’s revenues increased to $131.6 million during the quarter, which represents a jump from $97.8 million YOY. MARA was able to maintain its production levels and mined 2,070 Bitcoins during the quarter, despite Bitcoin’s volatility during the quarter.

The company also holds a great deal of Bitcoin in reserve, with 26,747 Bitcoin valued at nearly $3 billion at current prices. This figure will undoubtedly increase as MARA appears to be following MicroStrategy’s lead in buying Bitcoin. The company is utilizing a long-term holding strategy as a leveraged play on Bitcoin’s long-term appreciation. However, investors should be wary that MARA’s strategy of shareholder dilution to fund its purchases is also a double-edged sword.

Risks

Despite its strengths, MARA is still a risky investment. The company is involved in an incredibly volatile industry where Bitcoin price fluctuations can significantly impact profitability in the positive or negative. Donald Trump’s presidential election victory has only increased volatility, given how much speculation has ramped up as a result. This risk is only increased by MARA’s strategy of holding a large number of Bitcoin. This Bitcoin holding is often used as leverage to buy even more Bitcoin.

Another major risk facing MARA is its dependence on stranded gas and external energy markets for cheap energy. If energy supply constraints or price increases occur, this can also have a negative impact on profitability, not to mention the additional risk of Bitcoin’s price itself falling. These cheap energy sources are also relatively hard to find. Furthermore, while MARA’s plans to move into AI are promising, it also leaves a lot of room for execution risks due to its untested nature.

Conclusion

MARA is taking a relatively new approach that has allowed it to do well in the digital asset space. While MARA is certainly not risk-averse, it represents a solid investment at its current valuation of ~$8 billion. While the company does have a relatively high forward PE of 40, MARA could see its market capitalization explode if Bitcoin continues to appreciate at its current rate.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.