Summary:

- Nvidia Corporation’s Q3 2025 earnings show exceptional growth, with revenues of $35.1 billion, driven by strong performance in the Data Center and Gaming segments.

- The stock has surged 208% year-over-year, fueled by its leadership in AI and machine learning technologies, and trades at a P/E ratio of 55x.

- Nvidia’s robust financial health is highlighted by $9.1 billion in cash, strong cash flow generation, and a net cash position of $0.7 billion.

- With a near-monopoly in AI hardware and a comprehensive software suite, NVDA stock is a strong buy for tech-focused investors despite supply chain risks that are, however, being mitigated.

BING-JHEN HONG

In this article, I will provide an overview of Nvidia Corporation (NASDAQ:NVDA) earnings of Q3 25, which were released a couple of weeks ago, on November 20th, 2024. Plus, I will express my view on the future of one of the companies that monopolized the financial discussions during 2024.

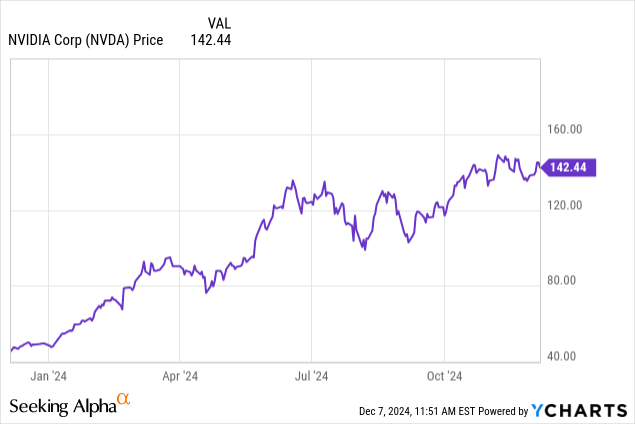

Stock Performance

Before jumping into the Q3 2025 results, I would like to provide an overview of Nvidia stock performance that – during 2024 – was characterized by strong volatility and a strong bull movement. Currently, Nvidia is trading at $144/share. This is equivalent to a market capitalization of $3.51T (yes, trillions not billions), with the minimum price of $45/share, recorded at the beginning of the year and the 52-week maximum price, $152.9/share, reached a few days ago after its Q3 results were published.

The stock is up 208% year-over-year and trades at a price-to-earnings (P/E) ratio of 55x. It is clear that Nvidia’s stock has experienced significant growth, partly driven by its pivotal role in advancing AI and machine learning technologies. Year-to-date, Nvidia has posted impressive returns, contributing substantially to the performance of major indices like the S&P 500 (SP500). This surge has largely been fueled by investor optimism surrounding Nvidia’s leadership in GPU technologies, which power AI models, and the company’s strategic moves in sectors such as data centers and automotive applications. The stock has been especially buoyed by its role in driving AI advancements, positioning Nvidia as a key player in the broader tech transformation.

This extraordinary performance in 2024 emphasizes Nvidia’s crucial position in the market but has also raised some questions about the sustainability of such high valuations.

Q3 2025 Nvidia Earnings

Revenues for Q3-2025 showed incredible growth both on a yearly (+94%) and quarterly (+17%) basis. Overall, Nvidia reported revenues of $35.1 billion, with the main contribution coming from the Data Center business segment. In particular:

- Data Center segment: reached $30.8 billion in revenues, reflecting a 17% quarterly increase and a 112% year-over-year growth, driven by robust demand for AI technologies and for the Ampere and Hopper infrastructures. It is also worth mentioning that — even though Nvidia does not disclose the data — an important part of Data Center revenues has been generated by the new Nvidia H200, that is turning out to be the fastest product ramp-up in Nvidia’s history. After being announced in August 2024, Nvidia H200 already reached “double-digit billion” sales.

- Gaming segment: generated $3.3 billion in revenues, up 15% compared to the same period of last year. It is worth noting that demand grew across all product clusters (notebook, console, and desktop).

- Automotive segment: generated $449 million in revenues, showing a 72% year-over-year increase due to partnerships such as the one with Volvo. Volvo Cars is indeed launching its new fully electric EX90 SUV built on Nvidia Orin and Drive OS.

What is even more remarkable, is NVIDIA’s capability to generate revenues and keep margins at high levels. Looking at the cost side, one can notice that the cost of revenue amounted to $8.9 billion, leading to a $26.1 billion gross profit (75% margin). Costs for R&D were $3.4 billion, while SG&As were $0.9 billion, resulting in an EBIT of $21.9 billion (62% margin). Net income was positive at $19.3 billion (+109 year-on-year, 55% margin).

A focus on R&D

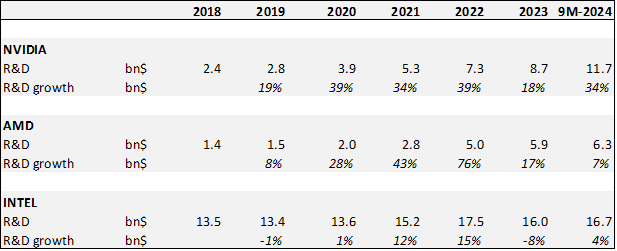

As stated, a few lines above, Nvidia spent $3.4 billion in R&D during Q3 2025. This figure represents a 48% yearly growth and a 10% increase versus the previous quarter. Indeed, to maintain its leadership in GPU technology and expand its capabilities in AI, data centers, and other high-performance computing areas, Nvidia has been constantly increasing the amount of R&D spend every quarter, as can be seen in the image below. Looking at Nvidia’s main competitors, Advanced Micro Devices (AMD) and Intel (INTC), one can see that AMD has been increasing its R&D spending even though remaining below Nvidia levels while Intel, despite having R&Ds higher than Nvidia, doesn’t show a clear trend.

Seeking Alpha and companies’ 10Q/10K

Nvidia Liquidity and Cash Flows

At the end of Q3 2025, Nvidia reported $9.1 billion in cash, which highlights its strong ability to manage operations and strategic investments effectively. In the first 9 months of the year, Nvidia generated $47.2 billion in cash flow from operations, demonstrating excellent cash generation capabilities supported by record-breaking revenues and high-margin businesses. Cash flow from investing activities was negative at -$13 billion, mostly due to purchases of marketable securities. Cash flow from financing was negative too at -$32 billion since $25.8 billion alone was used to repurchase common stocks and $5 billion was used for payments related to tax restricted stock units.

In terms of debt, as of Q3 2025, Nvidia reports $8.4 billion of long-term debt, leading to a net cash position of $0.7 billion. The repayment of this $8.4 billion debt will start in 2026 with the first $1 billion notes expiring.

Nvidia is a Strong Buy

There are many reasons that make me believe that Nvidia is a stock worth a strong buy recommendation. Firstly, it has a very strong positioning in the AI hardware market, with a large market share of about 80%, making competitors such as AMD and Intel almost irrelevant.

To give an idea, only recently, Meta Platforms (META) announced to acquire of 350,000 advanced Nvidia GPUs for a total of $100 billion invested in 2024 alone. In addition, the artificial intelligence market size is expected to grow by an almost 38% CAGR, going from $214 billion in 2024 to $1.4 trillion in 2030. Being the market leader in such a fast-growing market clearly gives Nvidia a huge competitive advantage versus peers and makes it the stock you want to buy if you would like to have an artificial intelligence-related investment in your portfolio.

Moreover, Nvidia GPUs can be used across different sectors and for different purposes. These range from data centers and AI platforms that enable businesses to implement predictive analytics and generative AI models to the gaming/entertainment industry, where enhanced graphics, real-time rendering, and AI-driven tools can become a game changer.

Another reason why I like Nvidia is that in addition to hardware, Nvidia offers a robust software suite, including its AI framework like the Nvidia AI and the Omniverse. These software tools can help Nvidia to lock in customers by enabling seamless development and deployment of AI applications going from hardware to software.

As an example of Nvidia’s ability to tap into the software and hardware market with an integrated approach, one can see that, recently, in September 2024, Nvidia launched the Nvidia AI Aerial. This is a platform that plans to merge wireless communications and AI computing in one unique platform consisting of accelerated computing algorithms, software, and dedicated hardware. The launch of this platform was done in partnership with T-Mobile (TMUS) and could be a new source of revenue streams both for Nvidia and for network operators that could integrate AI directly into their network operations.

Risks

Nvidia uses third-party companies (such as Taiwan Semiconductor Manufacturing Company aka TSMC (TSM)) to manufacture its products and, as Nvidia itself admits, it has long manufacturing lead times. Nvidia doesn’t have a guaranteed wafer (i.e.: a thin piece of semiconductor used as the substrate for microelectronics) and therefore, its product supply may not be linear from quarter to quarter. However, in recent news, Nvidia is in talks with TSMC to open an AI chip production facility in Arizona.

Final remarks

In conclusion, Nvidia’s Q3 2025 results highlight its extraordinary growth and market dominance, particularly in the AI hardware sector. Its strong financial performance and strong balance sheet, supported by exceptional revenue growth and robust margins, underscores its operational excellence and strategic positioning. With an almost unparalleled leadership in the rapidly expanding AI market and versatile applications across industries, I believe Nvidia is the proper investment for technology-focused investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.