Summary:

- PepsiCo shares have declined but offer value due to strong brand recognition, a 3.4% dividend yield, and potential macroeconomic tailwinds.

- Risks include regulatory changes under RFK’s potential leadership at HHS and commodity price fluctuations impacting margins.

- Favorable economic conditions, such as potential Fed rate cuts and lower oil prices, could reduce costs and boost PepsiCo’s earnings.

- PepsiCo trades at a lower valuation than Coca-Cola, with higher projected EPS growth and a more attractive dividend yield, making it a compelling investment.

PM Images

Shares of PepsiCo (NASDAQ:PEP) got very interesting at the beginning of the year after bouncing off the sell-off in October of 2023. Shares declined from around $195 to $160, and I started to get interested in whether they could form a bottom. I had previously been neutral on PEP as its margins and valuation were too far behind The Coca-Cola Company (KO) for me to turn bullish. Over the past year, shares of PEP climbed out of the $160s and into the $180s, but the share appreciation ended up vanishing. Since September 5th, shares of PEP have declined by -12%, falling from $179.30 to $157.79. I think that the short-term risks of Robert Kennedy Jr (RFK) focusing on processed foods are being overblown, and even if PEP must tweak some of its ingredient lists, this is a storm that will blow over. The reality is that PEP is one of the most recognizable brands on the planet, and this Dividend King is now yielding almost 3.4%. I think that a bottom may have been established at $155.85 as this was reached after the election results and shares started to drift off the bottom. The analyst community still sees forward EPS growth for PEP, and I believe there are many macroeconomic factors that make PEP a great long-term investment at these levels.

Following up on my previous article about PepsiCo

Back in January, I upgraded my stance on PEP to very bullish from neutral (can be read here) and the investment thesis was working for the majority of the year. Since that article was released, shares have declined by -5.67% compared to the market, which has appreciated by 27.62%. PEP has seriously underperformed the market, and when the dividend is factored into the equation, its total return is -3.47%. I turned bullish because PEP was finally in a position where it was trading at a better valuation than its largest competitor, KO, even if it had lower margins. In addition to the valuation, PEP’s dividend has crossed over the 3% level. I am following up with a new article because a lot has changed over the past year, and shares of PEP are trading near their 52-week lows. I think that the risks from a changing administration are overblown and that shares of PEP represent tremendous value despite short-term headwinds.

Risks to investing in PepsiCo

While I am bullish on shares of PEP, the investment case may not work out the way I envision it, as there are several risk factors to consider. Former President Trump is now President-Elect Trump, and he is bringing a wide range of people with him, from Elon Musk to RFK. President-Elect Trump has nominated RFK to be the head of the Department of Health and Human Services (HHS). RFK has repeatedly spoken out against the influence that large corporations have on the food industry, additives that are being put into our food, and the dangers correlated with ultra-processed food. If confirmed, RFK would have the power to regulate food safety as he would oversee the U.S. Food and Drug Administration (FDA). This could mean that PEP would have to make several changes to its product lines, which could cause a short- to medium-term headwind. It could also cause margin compression and impact earnings. I feel as if we are seeing a shift toward health and wellness, and this could impact PEP’s overall sales if it doesn’t adapt to changing consumer preferences. PEP is also dependent on commodity pricing from sugar to oil, and if fluctuations in commodity prices go the wrong way, they will negatively impact PEP’s margins. Investors should do their own research as there are significant risk factors to consider before investing in PEP.

PepsiCo is a strong company, and I believe that the macroeconomic environment is setting up well for them

PEP is a global leader in beverages and foods, which are consumed more than 1 billion times per day across 200 countries and territories globally. PEP’s portfolio includes iconic brands such as Pepsi, Doritos, Quaker, and Mountain Dew. These are iconic brands that have established strong allegiances with consumers. I believe that the macroeconomic environment is setting up well for PEP and could provide many tailwinds that may help shares rebound in 2025. CME Group is projecting that there is an 85.1% chance the Fed will cut rates by 25 bps at the next FOMC meeting. The Fed is still on track to take rates to 3.5% in 2025 and 3% in 2026. Crude is hovering around its 52-week lows, as barrels are trading for just over $67 and are well off their 52-week highs of $87.67. Part of the platform that President Trump ran on was deregulation and lowering oil prices through increased production. Another aspect of his platform was lowering corporate taxes to 15%, and after Republicans took control of all 3 legislative branches, there will likely be minimal opposition to his new tax plan. If these aspects happen, it should be bullish for PEP.

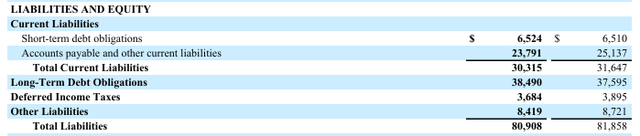

A lot has to go right, but these aspects could lead to a strong economic environment that benefits PEP. If the Fed cuts in December by 25 bps, they will have reduced rates by 100 bps in 2024, and it is expected to cut several times in 2025. PEP has $38.49 billion in long-term debt on its balance sheet and spent $912 million in interest expenses in the trailing twelve months. As the cost of capital declines, it incentivizes entrepreneurs to start businesses and current businesses to tap the debt markets for expansion. As this occurs, it should increase economic growth and lead to larger amounts of GDP. As companies expand, more capital will be spent on goods and services, and PEP is likely to benefit from this. In addition to a booming economic environment, lower rates will likely help PEP reduce some of its interest expenses.

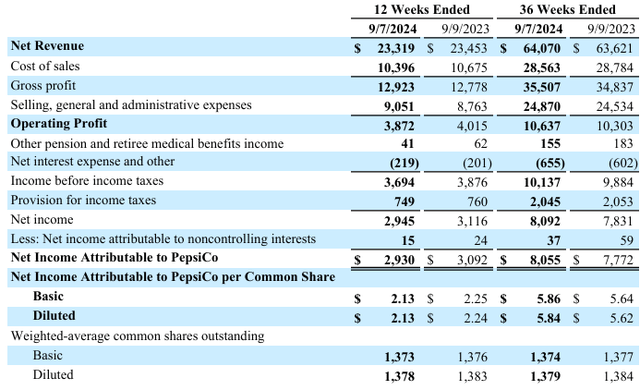

Crude has been declining, and we are about to see a pro-energy administration stateside and increased production overseas. Saudi Arabia reduced its oil production levels from 13 to 12 million bpd and is expected to increase production by 300,000 bpd over the next 3 years. Other OPEC+ nations are also expected to increase production. If crude production increases stateside and overseas, we could see crude prices drop to $60 or lower, which would be very bullish for PEP. In the first 3 quarters of 2024, PEP has spent $28.56 billion on the cost of goods and $24.87 billion on running its business. If oil prices go lower, PEP’s expenses should be positively impacted. PEP could see lower input costs as fertilizer prices decline, while benefiting from lower manufacturing and transportation costs due to lower oil prices. If this occurs, PEP could drastically benefit from lower costs, which would increase future EPS.

The last part of my economic setup is taxes. If President Trump does get corporate taxes to 15%, it would be very bullish for the market and for PEP. In the TTM, PEP has generated $11.67 billion in earnings before taxes and paid $2.25 billion in income tax expenses, putting their tax rate at 19.31%. If PEP is taxed at 15% and earnings from taxes were to stay the same hypothetically, their tax bill would decline to $1.75 billion, which would allow an additional $503.5 million to flow to the bottom line. PEP has 1.37 billion shares outstanding, so saving $503.5 million in taxes would increase its EPS by $0.37. There is a possibility that by the end of 2025, PEP could have a run rate of driving an additional $0.40 in EPS or from a beneficial economic environment without adding a single dollar of revenue.

PepsiCo looks very enticing from a valuation perspective, and dividend yield at these levels

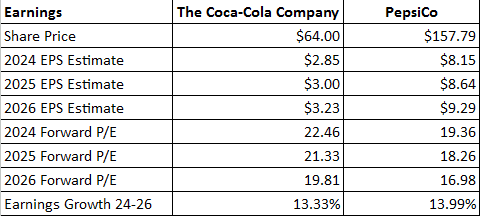

From a valuation perspective, PEP is very enticing at these levels. PEP is expected to generate $8.15 of EPS in 2024. There are 21 analysts expecting PEP to deliver $8.64 in EPS during 2025 and 13 analysts projecting $9.29 in EPS in 2026. KO is expected to deliver $2.85 of EPS in 2024 and $3.23 in 2026. PEP is trading at 19.36 times 2024 earnings compared to 22.46 times for KO. Looking out to 2026 earnings, PEP trades at 16.98 times earnings, while KO trades at 19.81 times. PEP has slightly more growth on the horizon, with 13.99% over the next 2 years compared to 13.33% for KO, and trades at a lower multiple. From a valuation standpoint, PEP looks enticing, especially if the macroeconomic tailwinds create a more bullish scenario in 2025.

Steven Fiorillo, Seeking Alpha

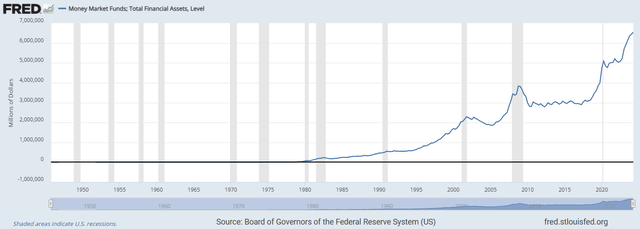

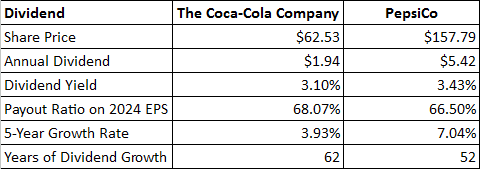

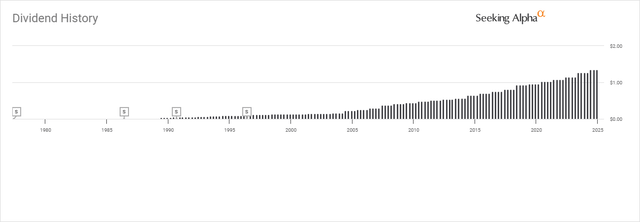

PEP now has a larger dividend yield than KO while providing more dividend growth. Investors are now able to get shares of PEP with a yield that exceeds 3.4%, while KO provides a yield of 3.1%. PEP also has a larger 5-year dividend growth rate of 7.04% compared to 3.93% for KO. Both of these companies are Dividend Kings, but PEP is finally in a position where its dividend is more attractive than KO’s, which could attract capital from the sidelines as the risk-free rate of return declines.

Steven Fiorillo, Seeking Alpha Seeking Alpha

Conclusion

I think that 2025 will be a strong year for value stocks, as many companies have expanded to large valuations during the bull market. There is almost $6.6 trillion sitting on the sidelines in money market accounts, and the risk-free rate of return is going to be much less enticing in 2025 than it is today. This is capital that doesn’t necessarily care about capital appreciation, considering there have been multiple opportunities to get into the market as rates fell. I think investors on the sidelines will be looking for value companies trading at depressed multiples with strong dividends. PEP checks off all the boxes, from being an iconic global brand to a Dividend King with a 3.43% yield. PEP could also benefit from several macroeconomic tailwinds that could lower their costs of goods, administrative costs, and tax expenses, which would drive additional EPS to the bottom line and improve the valuation. PEP trading at 19.36 times 2024 earnings and 16.98 times 2026 earnings is very interesting, and I think this investment opportunity will generate capital appreciation and dividend income.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.