Summary:

- Apple Inc. Q4 earnings report showed some unevenness and has led to lukewarm – to put it mildly – reviews from analysts.

- However, the dominant forces in my view are the installed base, the growth of service/subscription revenues, and also the margin expansion potential.

- In terms of valuation, its P/E based on owners’ earnings is not as high as the accounting P/E thanks to its stellar return on capital employed and capital-light model.

- As such, I upgrade my rating on the stock to a strong buy.

Kronick/iStock via Getty Images

AAPL stock: previous thesis and Q4 earnings

The last time I analyzed Apple Inc. (NASDAQ:AAPL) stock was a little more than a month ago before the release of its fiscal Q4 earnings. On October 24, 2024, I published an article titled “Apple Q4 Preview: The Positives Far Outweigh The Negatives” and argued for a buy rating on the stock based on the following considerations:

Latest iPhone 16 sales data from China showed robust growth in this key market. When combined with the record installed base and subscription revenue growth, this foreshadows a strong Q4. For the longer term, AAPL’s true economic earnings are much higher than its accounting EPS, thanks to its capital-light model (by about 24% based on my analysis).

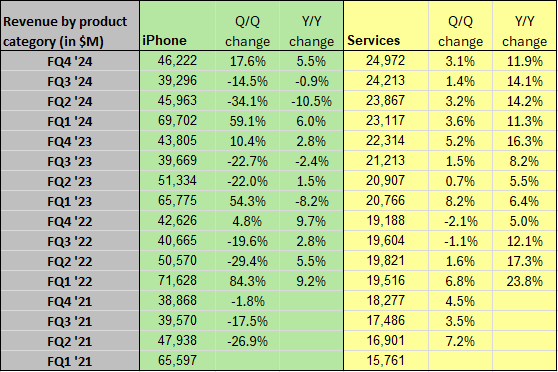

Since then, the company has reported its Q4 earnings, and the actual earnings – especially those areas where the numbers deviated from my preview – motivated this follow-up analysis. Overall, the company reported another strong quarter, largely as I expected. Total revenues increased 6%, to $94.93 billion. Although there is some unevenness. For example, sales of the flagship iPhone grew 5.5%, slightly slower than the overall growth. In the previous quarter, iPhone sales dipped about 1% (although with currency exchange rates adjusted, the sales grew by about 1%). Furthermore, there are some signs of margin pressure, to be elaborated on later.

Seeking Alpha

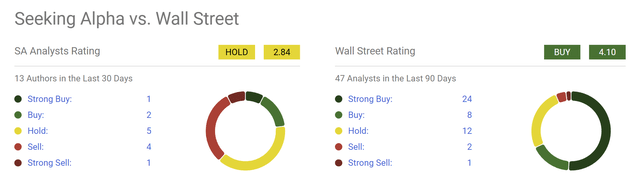

Due to these weaknesses, the Q4 ER was interpreted negatively by many other Seeking Alpha authors. As you can see from the following screenshot, Seeking Alpha analysts are currently rating AAPL as a “Hold” with a score of 2.84. In contrast, Wall Street analysts have given it a “Buy” rating with a score of 4.10. Over the last 30 days, 13 Seeking Alpha authors have weighed in (and most of them placed an emphasis on its Q4 numbers). Out of these 13 recommendations, only 1 is a Strong Buy and 2 are Buys.

Against this backdrop, the goal of this article is simply to explain why I disagree with the prevailing sentiment on the SA platform. I think the AAPL bears need to look past the iPhone sales, and I also anticipate robust margin expansion ahead. For these reasons, this article upgrades my rating on the stock to a strong buy from my earlier buy rating.

AAPL bears need to look past iPhone sales

As just mentioned, it is true that AAPL’s flagship iPhone sales are no longer the high-growth segment. However, note that other categories are growing fast, such as its iPads and its services. Sales of iPads are enjoying strong growth. The iPad sales rose about 8% in FY Q4. And in FY Q3, iPad sales jumped 24% YOY (to $7.2 billion) thanks, in part, to the launches of the new iPad Pro and iPad Air during Q3.

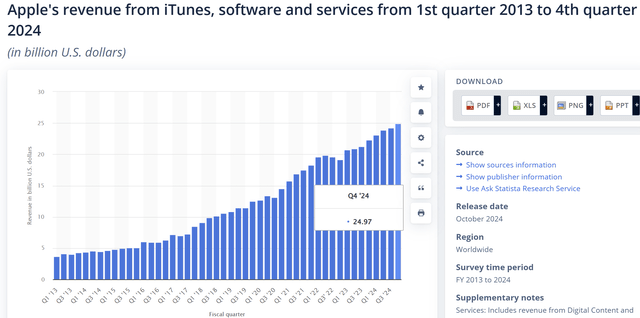

But I think the real growth driver for the years to come is the subscription categories (see the next chart below). The service segment is the second-largest segment and Q4 just witnessed another 12% growth, to $24.97 billion, setting an all-time high. The category includes some of AAPL’s most sticky applications and services in my experience such as iTunes, Software, Digital content, AppleCare, Apple Pay, Licensing, etc. These subscriptions and services also tend to have higher margins than Apple’s hardware business and are very likely to drive margin expansion going forward, as to be detailed next.

AAPL: margin expansion potential

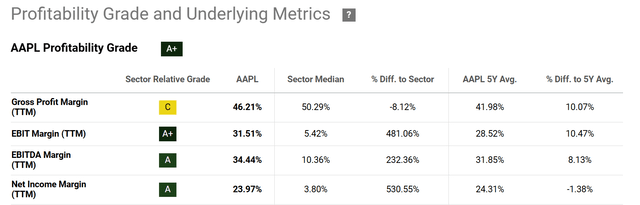

AAPL has been a textbook example of a high margin and high-profit business. As a reflection, AAPL receives an overall profitability grade of A+ as you can see from the next chart. The company’s margins vastly exceed sector medians. For example, its EBIT Margin sits at 31.51%, EBITDA Margin at 34.44%, and Net Income Margin at 23.97%. These metrics are higher than the sector medians by multiple folds, as seen. However, there are some signs of margin pressure lately. Its latest net income margin (on a TTM basis as of Q4) is about 23.97%, which is slightly below its 5-year average of 24.31% as seen.

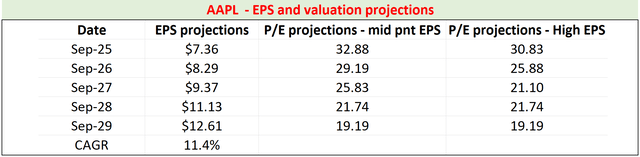

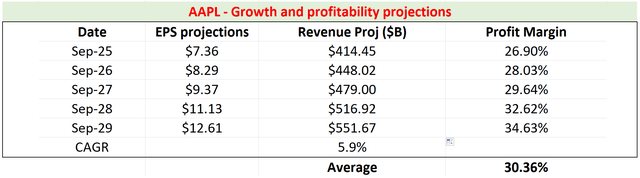

Such margin pressure is only temporary in my view as the role of its subscription/service further expands. As a reflection of such margin expansion potential, the current consensus EPS estimates expect its profit to increase from $7.36 in FY 25 to $12.61 in FY 29. This projection translates to an average EPS growth rate of 11.4% CAGR as illustrated by the first table below.

The second table below shows the consensus revenue estimates. As you can see, consensus estimates point to a revenue growth from $414B in FY 2025 to $551B in FY 2029. This projection translates into a CAGR of 5.9%, lower than its EPS growth rates. The differences in these growth rates point to two possibilities: share repurchases and margin expansion, both are good news for AAPL investors. As a simplification, the table assumed a fixed number of shares to isolate/illustrate the margin expansion potential. In this case, AAPL’s net profit margin would gradually expand to 34.63% in FY 2039, far higher than its past average of 24.1%. Actually, even the average expected in the next five years (which is about 30.3%) is noticeably above its current level and also past average.

AAPL stock: Other risks and final thoughts

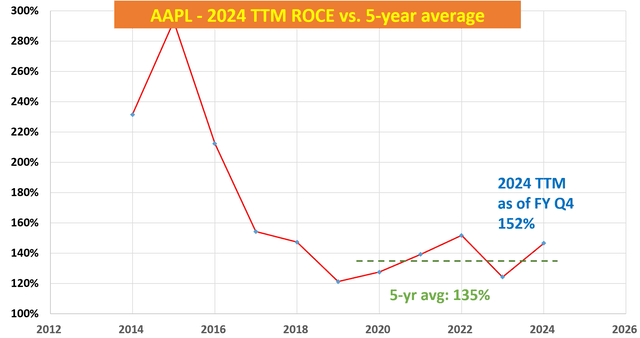

In terms of downside risks, the stock is trading at an elevated valuation, with an FWD P/E of almost 33x. However, as argued in my earlier article, thanks to its stellar ROCE (return on capital employed, see the next chart below), its true economic earnings are higher than its accounting EPS. Thus, its P/E based on owners’ earnings is lower than the 33x accounting P/E too (and my estimate for its P/E is about 25x based on owners’ earnings). Its ROCE has been on average 135% in the past 5 years. At such a high ROCE, even a 5% reinvestment rate could lead to about 7% profit growth. A 25x P/E based on owners’ earnings means about 4% owner’s earnings yield. Together with a 7% organic growth rate, the total return potential is still above 10% from the perspective of a business owner.

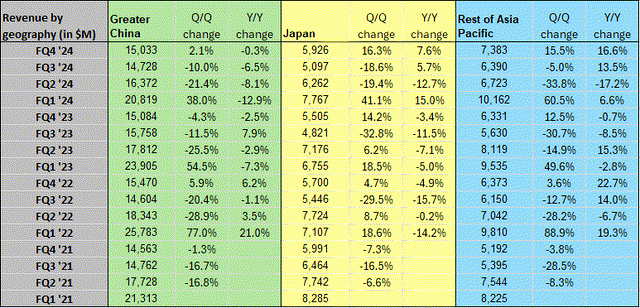

Another key risk in my assessment involves China exposure. The next chart shows Apple’s revenue by geography in Greater China, Japan, and the Rest of Asia Pacific. As seen, Greater China plays a much larger role than its other markets in the Asia Pacific region. However, sales from Greater China have been struggling recently. Sales suffered a 0.3% Y/Y decline in Q4, following a 6.5% decline in Q3 and an 8.1% decline before that. Looking ahead, I expect the trade tension between the U.S. and China to remain elevated and thus keep pressuring AAPL’s sales in this key market.

Although the growth has been healthy or even robust in other regions (such as the rest of Asia Pacific, the Americas, and also Europe). And overall, my verdict is that the upside potential far exceeds the downside risks. The dominant forces I am seeing here are a tremendous and loyal installed base to keep driving up its service/subscription revenues and also expand its future margin. These forces are the fundamental reasons that have led me to upgrade my rating to a strong buy on the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.