Summary:

- Upgrading Broadcom Inc. to a “Buy” rating due to positive developments in VMware strategy and promising 3.5D XPSiP AI chip technology, with a fair value of $209 per share.

- Broadcom’s 3.5D XPSiP technology significantly improves interconnect density and power efficiency, potentially accelerating custom AI chip growth.

- VMware strategy was revised to focus on the top 500 users, likely stabilizing relationships with channel partners and reducing customer loss risk.

- Broadcom’s AI revenue is expected to grow 10% sequentially, contributing $12 billion for FY24, with overall revenue projected to grow 45% in FY24.

JHVEPhoto

I previously assigned a “Sell” rating on Broadcom Inc. (NASDAQ:AVGO) in September 2024, highlighting my concern about their VMware integration. Recently, Broadcom reversed its controversial plan to work directly with the top 2,000 “strategic” VMware users and will instead focus on just 500, allowing their channel partners to participate in the virtual machine market. In addition, the company unveiled its 3.5D XPSiP technology, which could potentially accelerate its custom AI chip growth. I view these developments are positive, and I am upgrading to a “Buy” rating with a fair value of $209 per share.

New Custom AI Architecture -3.5D XPSiP technology

On December 5th, Broadcom announced its 3.5D eXtreme Dimension System in Package platform technology, allowing their custom-chip customers to achieve significant improvements in interconnect density and power efficiency compared to the Face-to-Back approach.

As discussed in my previous article, Marvell (MRVL) and Broadcom are key players in the custom AI chips, supporting major hyperscalers. Marvell has extended their strategic partnership with Amazon (AMZN) to support Trainium AI chips. Broadcom collaborates with Meta Platforms (META) and Alphabet (GOOGL) (GOOG). According to both Marvell and Broadcom’s recent earning calls, these AI chips are ramping up massive production, and are expected to mature by 2025. These hyperscalers are investing heavily in their AI chips to provide cost-effective AI chips for their cloud customers. While large enterprises and mission-critical AI workloads may continue relying on GPUs from Nvidia (NVDA) or Advanced Micro Devices (AMD), others are likely to opt for cost-efficient alternatives, in my view.

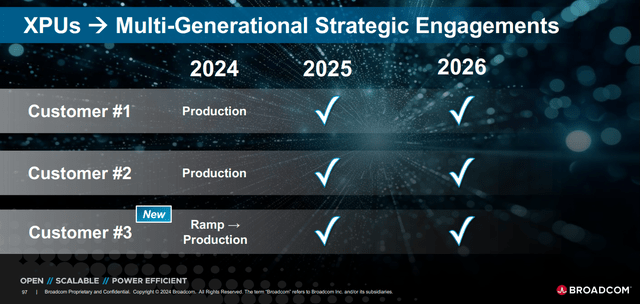

As depicted in the slide below, Broadcom provides custom chip solutions to three major customers, all expected to ramp up production significantly by 2025.

Broadcom Investor Presentation

In October 2024, the media reported that OpenAI is working with Broadcom and TSMC to build its first in-house chip designed to support its AI trainings. I am not surprised that OpenAI is considering designing its own AI chips, as it cannot rely solely on Nvidia to meet its massive GPU demands.

Strategy Reversal In VMware

In my previous analysis, I expressed serious concerns about Broadcom’s VMware integration. Following its acquisition of VMware, Broadcom has implemented several changes to upset their channels and customers. For instance, they terminated the perpetual license and changed all the offerings via bundle subscriptions, which led to price hikes. AT&T (T) even sued Broadcom for breaking VMware’s support extension contract.

As reported by the Register on December 5th, Broadcom has revised its strategy, narrowing its focus from the top 2,000 “strategic” VMware users to just 500. I believe the strategy change could potentially help VMware maintain its relationship with their existing channel partners and reduce the risk of losing customers. It appears that Broadcom has realized the dissatisfaction caused by its earlier changes and is taking corrective action.

Outlook and Valuation

Broadcom is set to release its Q4 FY24 result on December 12th after the market close. During the earnings call, I believe investors should be able to hear about their newly announced 3.5D eXtreme Dimension System, the production ramp-up for their custom AI chips, as well as the VMware’s revised strategy.

Broadcom is guiding for 51% revenue growth for Q4 FY24, with 64% of adjusted EBITDA margin. In addition, they expect the AI revenue will grow sequentially 10% to over $3.5 billion, representing around 25% of total revenue.

Marvell announced its Q3 FY25 result on December 3rd, and their data center business grew by 98% year-over-year and 25% sequentially, primarily driven by their custom AI chip growth. As such, I think Broadcom’s AI growth is quite conservative.

For their near-term growth, I am considering the followings:

- As the company has delivered three quarters of strong results, I don’t anticipate the FY24 result will deviate from their guidance. As such, I anticipate Broadcom will grow its revenue by 45% in FY24.

- Their AI revenue is expected to deliver $12 billion for FY24 ((per guidance)), representing around 23% of total revenue. Gartner predicts that the global AI chips will grow from $21 billion in 2024 to $33 billion in 2028, representing a 12% CAGR. Marvell’s management indicated the total addressable market for custom AI chips could reach $40 billion in the future, as noted in the recent earnings call. I estimate the overall custom AI chips market will grow at a CAGR of 70% in the near term, driven by both overall AI market expansion and increased adoption of custom AI solutions. I calculate that AI custom chip could potentially contribute an additional 17% growth to Broadcom’s topline from FY25 to FY27. In addition, I forecast the rest portfolios could contribute another 3% growth, aligned with their historical average. As such, I forecast Broadcom’s revenue will grow by 20% from FY25 to FY27. As AI matures, I estimate the revenue growth will decelerate to 15% from FY28 to FY30, then further decelerate to 10% FY31 onwards.

- I estimate the company will deliver 20bps annual margin expansion, driven by 10bp from gross profits, and 10bps from reduction in SG&A. I calculate the total operating expense’s growth rate will be 1% lower than the topline growth rate, contributing to a 20bps operating leverage.

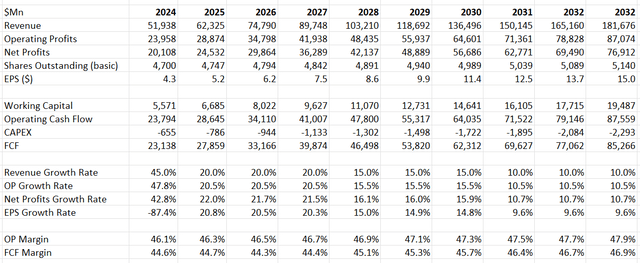

With these assumptions, the DCF can be summarized as follows:

The WACC is calculated to be 11% assuming: risk-free rate 3.6%; beta 1.36; equity risk premium 6%; cost of debt 5%; equity $717 billion; debt $74 billion; tax rate 10%. Discounting all the future FCF, the fair value is calculated to be $209 per share, as per my estimate.

Key Risks

While VMware’s recent strategy changes are encouraging, VMware is facing intense competitions from some key players, including Nutanix (NTNX), RedHat and Microsoft (MSFT). These players have capitalized on VMware’s earlier instability and taken market shares. It’s worth watching how Broadcom continues stabilizing VMware’s business growth in the near future. In addition, I remain skeptical about Broadcom’s other software businesses, such as Symantec and CA, which lack growth potential.

Conclusion

I think Broadcom’s revised VMware strategy and advancements in custom AI chip technology are promising. The custom AI chip technology will continue to drive Broadcom’s overall growth, in my view. I am upgrading to a “Buy” rating with a fair value of $209 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.