Summary:

- NIO’s deliveries are booming, with the new Onvo EVs driving a 25% share of run-rate deliveries and maintaining a 20K+ monthly delivery streak.

- Despite margin risks from low-cost EVs, NIO’s valuation is attractive, especially with a major delivery surge expected in 2025, potentially leading to 70% growth.

- NIO’s stock is undervalued, trading at 1.01x leading sales, with potential to double its valuation if the Onvo ramp-up succeeds and profitability is achieved by 2026.

- While NIO faces profitability challenges and potential margin pressures, its positive delivery trends and margin improvements make it a compelling investment opportunity.

Andy Feng

Deliveries of EV company NIO Inc. (NYSE:NIO) are skyrocketing amid a boost in demand for the company’s new slate of affordable electric vehicles.

NIO has started to ship its new Onvo electric vehicles recently, which are met by robust demand and the company maintained a delivery run rate of 20K electric vehicles per month for seven months straight. NIO’s margins, on a vehicle level, are expanding.

Though the mass production of low-price EVs represents a possible challenge for the electric vehicle company from a margin point of view, I think that NIO’s valuation makes the EV stock a big bargain, particularly with the electric vehicle company being at the cusp of a major delivery surge in 2025.

Thus, with deliveries scaling up and the company’s latest Onvo EV meeting success, NIO’s stock might be a top investment in 2025.

My Rating History

NIO’s deliveries are booming, and the margin profile is seeing some positive development as well, which is why I am reaffirming my bullish view on the electric vehicle company with a ‘Strong Buy’ stock classification. NIO’s deliveries kept surging in November, and Onvo EVs now account for a 25% share of run-rate deliveries.

In addition, the EV company is working hard on expanding its margins, with some reasonable success in the third quarter.

Due to an upscaling of low cost electric vehicles, NIO still has margin risks, but the overall setup here for investors is bullish, in my view.

NIO’s Onvo Deliveries Are Surging, Now Represent 25% Of All Deliveries

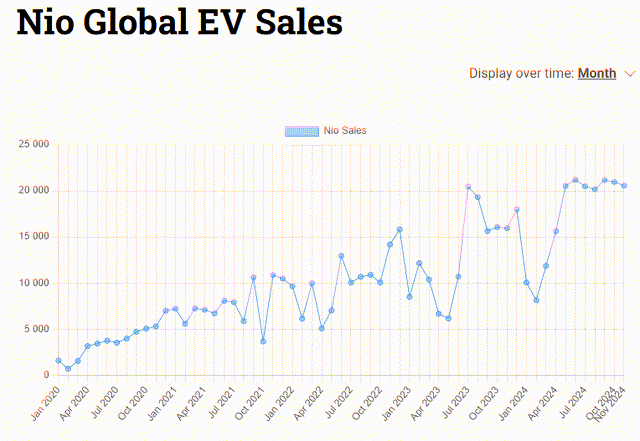

NIO has begun to deliver electric vehicles under the brand name of Onvo in September, which has already boosted the company’s sales and deliveries. In the third quarter, NIO delivered 61,855 electric vehicles in 3Q24, up 11.6% YoY. In the last month, NIO delivered 20,575 electric vehicles to its customers, up 28.9% and this growth has been fundamentally ignited by a surge in deliveries for Onvo EVs. NIO, thanks to Onvo, has now enjoyed seven straight months of 20K+ deliveries per month.

NIO Global EV Sales (NIO Inc.)

NIO started this brand only recently, in 2024, and deliveries have started at the end of September 2024. Onvo is a new brand that is targeting the low-cost electric vehicle segment, primarily in China.

In November, 5,082 out of a total of 20,575 deliveries were Onvo vehicles, which accounts for a 25% run-rate delivery share. NIO has said that it plans to scale up Onvo L60 deliveries to 10K in December, implying a doubling of the delivery volume MoM, and a further scaling to 20K units by March 2025.

If NIO can reach these milestones, the EV company could be on track to deliver a total of 225-235K Onvos and a total of 360-380K electric vehicles in 2025.

In 2023, NIO delivered a total of 160,038 electric vehicles and 190,832 vehicles between January and November, with another 20K plus EVs likely getting delivered in December. This implies that NIO could see 210-215K deliveries this year, reflecting a 32% growth in deliveries.

Due to the scaling up of Onvo deliveries, next year is going to be a much bigger year in terms of deliveries for NIO, though: If I am right with my prediction of 360-380k total deliveries, then NIO could work towards 70% or higher delivery growth in 2025.

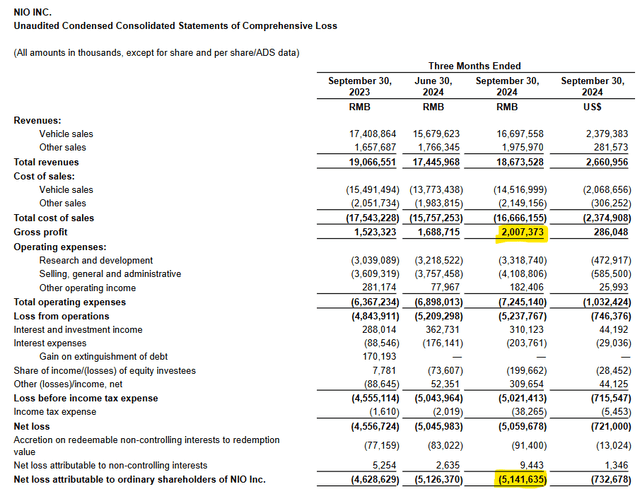

NIO does have a big shortcoming, however, which is that the EV company is not profitable. Though the company has said that it targets a profit break-even point in 2026, NIO still loses a lot of money, which most likely either means a dilutive equity raise or an equally dilutive convertible debt offering may be in the cards. In 3Q24, NIO was profitable on a gross profit basis, but continued to bleed a lot of money on a net income basis nonetheless: NIO lost 5.1 billion Chinese Yuan, which equates to $732 million.

In the short term, investors should not anticipate the profit situation to change dramatically either way, but I do expect the EV manufacturer to potentially raise more capital in 2025 in order to fund the ramp of its Onvo deliveries.

Unaudited Condensed Consolidated Statements Of Comprehensive Loss (NIO Inc.)

Low Valuation Is Reflecting NIO’s Profit Situation

Investors seem to have lost a big portion of their confidence in the electric vehicle company’s business model in the last couple of years: NIO traded above $60 during its heydays during the pandemic, but presently the stock is a penny stock, meaning it is selling for less than $5.

A number of issues can be blamed for NIO’s value destruction, including increasing competition, falling EV prices and a challenging macro backdrop in China due to long Covid shutdowns.

With that said, I think that the investment proposition looks much better than investors realize as NIO’s margin has positive momentum and Onvo deliveries have already started to make a big impact. NIO also guided for a break-even point in terms of profitability to be reached in 2026, which should be a big help in turning investor sentiment around.

As of right now, however, NIO is not producing any profits, which leaves us with a sales-based valuation approach.

NIO is presently valued at 1.01x leading sales (next twelve months) which stands in contrast to a sales multiple of 1.84x for XPeng (XPEV), 0.92x for Li Auto (LI) and 13.6x for Tesla (TSLA).

Tesla obviously is in a league of its own, and so a direct comparison to this EV company might not make too much sense. In its peer group, however, NIO is cheap, selling 20% below the average EV manufacturer.

In the long run, I think that NIO has considerable re-rating potential, particularly if its 2025 Onvo ramp goes according to plan. In my view, a 2.0x valuation target based on sales is entirely within the realm of reason, given the backdrop of NIO planning to be profitable in about 2 years and ramping up deliveries. This would put NIO’s long-term intrinsic value closer to $10, though this value may reset higher depending on the speed of NIO’s delivery upscaling.

A $10 price target could thus allow the electric vehicle company to more than double its valuation.

Why NIO Remains A Risky Investment For Investors

Though NIO’s deliveries for its latest Onvo electric vehicles are on an upswing, there is no guarantee that a higher delivery volume in the final analysis will equate to higher vehicle margins (or any other margins for that matter). NIO’s stock shot up after 2Q24 earnings, only to deflate shortly thereafter, as NIO is known to be a high-volatility stock and wild swings can happen in both directions.

Presently, NIO seems to be stuck in a sideways movement/consolidation pattern, but the general trend in deliveries is a positive one which, I think, will ultimately get reflected in NIO’s market valuation.

In terms of downside risks, the investment thesis could probably be undermined by the emergence of lower margins in NIO’s portfolio, as it is now scaling up lower cost electric vehicles that are going to be less profitable for NIO from a margin standpoint. Thus, there is a concern that 2025 may see softer margins for NIO.

As investors reacted sensitively to margin pressures in the past, I think that a margin deterioration is possibly NIO’s biggest challenge that the company needs to overcome next year.

My Conclusion

Firstly, NIO has seen some nice successes lately, which include the launch of new electric vehicles that are marketed and sold under a new brand name, Onvo.

Secondly, NIO has managed to expand its margins in the third quarter, which shows improving profitability.

Thirdly, NIO is anticipating this surge in deliveries to continue in December 2024 and 1Q25, which in turn implies that we are going to enter 2025 with considerable growth momentum in terms of both production and deliveries.

Lastly, NIO has clarified that it seeks to be profitable in 2026, which makes the investment proposition even juicier, in my view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NIO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.