Summary:

- I expect the commercial segment growth to accelerate as enterprise AI adoption increases in the next years, eventually overshadowing government revenue.

- So far, I see strong signs of momentum in enterprise AI adoption. Palantir’s US commercial customer base has grown to 295 clients, an 83% YoY increase.

- I see a company with great fundamentals, including triple-digit net income growth over the last four quarters, 81% gross margins, and record 60% adj. FCF margins.

- Future corrections may occur due to short-term speculators, but I expect pullbacks to be short-lived, as I believe there are many investors ready to buy once prices dip.

- Despite Palantir’s current modest 1.2% share of a $230 billion total addressable market, I maintain a Strong Buy rating based on compelling evidence of market penetration and growth potential.

Klaus Vedfelt

Someone said (I believe it was Buffett) to be fearful when others are greedy, and be greedy when others are fearful.

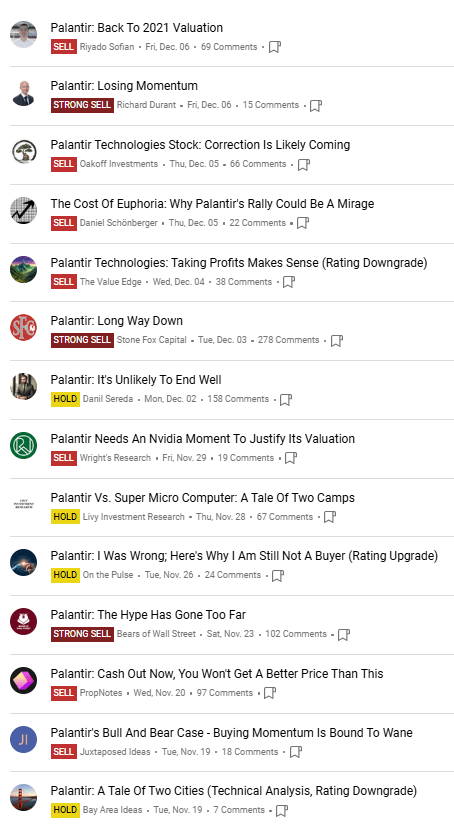

Well, looking at the latest SA analyst ratings for Palantir Technologies Inc. (NASDAQ:PLTR), it appears this could be one of those moments to buy.

Seeking Alpha

Of course, Buffett was referring to the share price, not analysts’ ratings. However, I find the ratings, particularly those on Seeking Alpha, to be an interesting gauge of market sentiment for a particular stock, regardless of what the share price is doing.

Despite being a contrarian, I do agree with the current analyst consensus that, from a traditional valuation perspective, the share price looks absurdly overpriced. In fact, as a value investor, I rarely see P/E ratios over 380 in my stock screener. However, when I look beyond the current share price and basic valuation ratios, I recognize that there’s a real, strong business behind those four letters — PLTR — that makes sense to me.

In this article, I will provide the rationale for why I believe this company makes sense, not just from a fundamental perspective (i.e. looking backward) but from a broader market perspective, with a longer timeframe extending beyond 5 years.

Considering that the company has a market share of just 1.2% (of a TAM of $230 billion), I strongly believe that 5 to 8 years from now, the $75 price mark will seem quite cheap, much like how the $25 price (Palantir’s share price 6 months ago) appears cheap today.

I’ll clarify upfront that my bull thesis considers potential near-term pullbacks, which I see as opportunities to average down my cost basis. However, given the current interest in this stock — not just from speculators but also from those recognizing its strong fundamentals, profitability, and market tailwinds — I firmly believe that a 20% to 30% pullback wouldn’t last more than a few quarters. The business itself, along with the broader market factors driving its growth, makes complete sense to me, which is the main reason I rate Palantir as a Strong Buy.

Nonetheless, I remain mindful of some risks to my bull thesis, which I will discuss in this article.

Palantir Is Barely Scratching Its Total Addressable Market

As you may know, Palantir operates through two main segments:

- Government: this segment helps government entities analyze data for defense, intelligence, and public sector operations.

- Commercial: this segment provides data analytics and integration solutions to private sector clients.

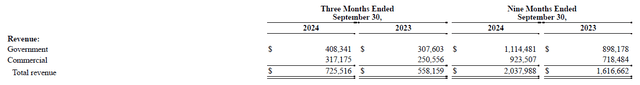

So far, the government sector makes up a bigger part of the company’s total revenue. According to the latest earnings report, it accounted for 56% of total revenue in Q3 and 54% for the first nine months of 2024.

I predict this will drastically change in the near term. Let me explain why.

Palantir’s first customers in the 2000s were government agencies, including the likes of the CIA, FBI, NSA, CDC, and various military branches. Their commercial expansion began in 2009, with JPMorgan Chase being their first commercial customer.

For a brief period, between 2018 and 2019, the commercial sector led the company’s revenue. However, after the pandemic, the government sector took the lead again. I believe this shift was due to higher government spending for emergency response during the COVID-19 crisis, and because many private companies cut back on their spending during the onset of the pandemic.

However, with the rise of AI in 2023, things have drastically changed for enterprise companies. To put things into perspective, Palantir’s US commercial customer count at the end of last quarter was only 295 (an 83% YoY increase), with a commercial segment revenue of $317 million.

I say only because at the time of its IPO in 2020, Palantir identified a total addressable market for the commercial segment alone of $56 billion, and that’s likely significantly larger today due to the emergence of generative AI in 2023.

How larger?

Well, some analysts predict a TAM (including the government segment) of $230 billion by 2025 and $300 billion by 2030. Considering their 2024 revenue guidance of $2.8 billion, the company has a market share of just 1.2% (considering a TAM of $230 billion).

I strongly believe that as AI continues to be adopted by the private sector, the commercial segment will eventually overshadow the government segment in revenue. Right now, we are in the very early stages of private companies embracing AI. Many are still in the discovery phase, trying to figure out what the buzz is all about and how they can profit from it. On top of that, a large number of companies (particularly traditional businesses, outside the tech industry) still remain skeptical of leveraging AI due to certain issues, the main one being hallucinations in the AI’s output — a challenge that Palantir actively addresses through their ontology system.

Finally, by the looks of it, it seems that I am not the only one who believes that the company will continue to capture market share. The analyst consensus for Palantir shows significant growth in the company’s revenue, reaching $10 billion by 2031-2032.

Strong Fundamentals

If there is one thing that catches my eye when looking at the fundamentals of the company is its rapid growth in profitability.

To be specific, net income has increased in the triple digits consecutively over the past 4 quarters. Looking at the profitability margins, the company has a gross profit margin of 81% and a GAAP net income margin of 18%.

If you are into growth stocks in the tech sector, you may be already aware of the Rule of 40, popularized by venture capitalist Brad Feld in 2015. This is a score that adds the revenue growth and profitability margin of the company (usually EBITDA margin if the company is at an early stage, otherwise, either net or operating margin). Generally, investors like to see this metric above 40%.

In Palantir’s case, they achieved a Rule of 40 score of 68 in Q3 2024 (30% revenue growth + 38% adjusted operating margin). As a side note, the adjustment comes from excluding stock-based compensation and related employer payroll taxes. Considering the GAAP net margin in the past quarter of 20%, Palantir’s score is 48.

From a cash flow perspective, Palantir looks quite good, with a 214% YoY increase in operating cash flow in the past quarter. Additionally, in Q3, the adjusted FCF margin was 60%, representing its highest quarterly free cash flow margin to date.

From a fundamental analysis standpoint, Palantir clearly makes sense. It has strong double-digit revenue growth, solid profit margins, negative net debt, favorable industry tailwinds, optimistic guidance, and the analyst consensus is pointing to further growth.

Now, let’s address the big elephant in the room.

Is All of This Already Priced In?

I will be blunt: I believe the answer is no.

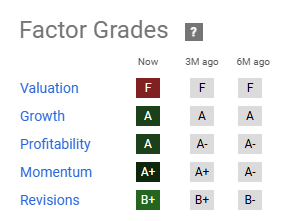

To understand why, please take a look at the image below, that illustrates the history of Seeking Alpha’s factor grades for Palantir.

Seeking Alpha

Half a year ago, when the share price was trading at just $25, Palantir’s valuation metrics were graded as an F (i.e., overvalued compared to its sector and historical range).

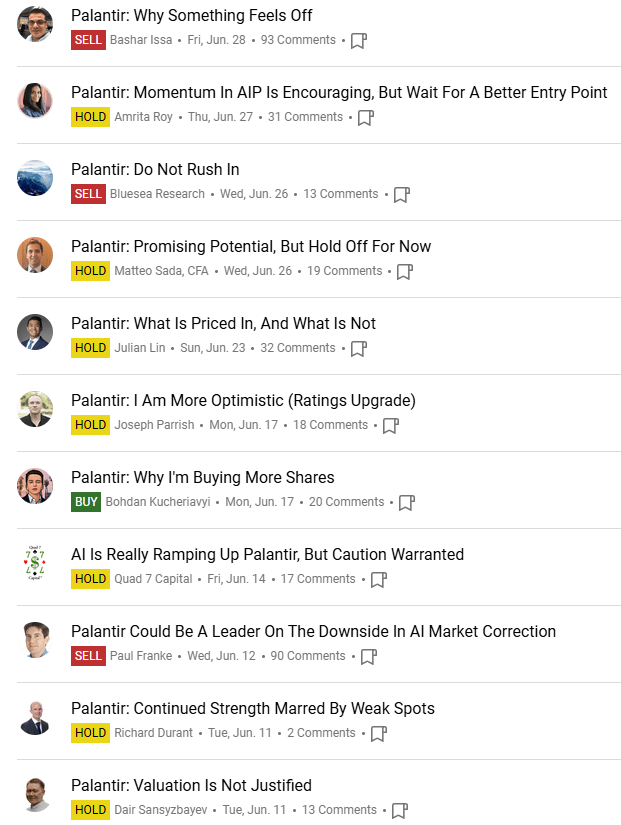

At that time, analysts on SA were mostly recommending a Hold rating.

Seeking Alpha

Yet, over the past six months, this stock returned 226%, despite (emphasis on this last word) the Hold consensus, mainly justified by the fact that the company looked overpriced from a valuation perspective.

Look, I agree with absolutely every bear in the market that the valuation ratios are absurdly high and the increase in the share price is mainly driven by speculators, with a shorter investment timeframe. I also believe that a pullback (20% – 30%), is more than inevitable, especially if the company misses a quarter or delivers weak guidance.

However, in the long run, with a view toward 2030 or beyond, the current share price of $76 may seem like a bargain in hindsight, in the same way $25 looks now.

Why?

Simply because the company and the headwinds make sense. As I mentioned in the previous section, its fundamentals are impeccable and the growing adoption of AI by enterprises, not as a luxury but as a necessity, is undeniable.

Additionally, I believe there is a large volume of investors waiting for a pullback to start a long position in this stock. Therefore, when the pullback happens (and, again, it will happen), I believe the share price will take less than a quarter or two to recover from its previous decline unless there is a major macroeconomic event that could affect the entire broader market in the US, which leads me to the next point.

How Can I Be Wrong?

One more time, I will be blunt with my answer.

My bull thesis could be obliterated if large enterprises, particularly in the US (considering the company has a high revenue concentration of 70% in this region), decide to slow down their discretionary technology spending in AI and cut back on non-essential expenses.

Currently, I fully agree with the bears that AI in large enterprises is not essential to keep the lights on (i.e., to maintain operations). While leveraging data can help companies make more informed decisions, it doesn’t necessarily result in higher revenue or better margins. However, in the near future, I believe this will drastically change as custom AI models will become more specific to particular industries, and enterprises that fail to leverage their data through AI may face significant challenges from competitors who do.

Another risk factor to consider is that a pullback could be sharper and longer-lasting than I previously anticipated. This could happen for several reasons, with the main one being that investors may wait for the company’s valuation ratios to cool off to more attractive levels. Considering its P/E ratio of 382, this would imply a 10x decline in the share price (considering the same TTM earnings), to better align with a P/E ratio in the mid-30s, which is the sector median.

Conclusion

To wrap up, I rate Palantir as a Strong Buy, as I have a high conviction this stock offers a compelling long-term investment opportunity (over 5+ years) despite its sky-high current valuation ratios.

On the positive side, the company has demonstrated spectacular financial performance with triple-digit net income increases over four consecutive quarters, and a record-breaking 60% adjusted FCF margin in the past quarter. From a fundamental and profitability perspective, I believe this company makes sense.

Looking ahead, I expect the commercial business to maintain, and even accelerate, its growth, as more enterprises in the US recognize the value (which will be a necessity in a few years) of leveraging their data using AI. What I find most compelling is their minimal market penetration, just 1.2% of an estimated $230 billion total addressable market by 2025.

On the risks side, there is no doubt the company looks overpriced from a valuation perspective, with an absurdly high P/E ratio of 382x. I believe the main risk to my bull thesis is future (now unseen, i.e., black swans) macroeconomic events that could lead to enterprise spending slowdowns on AI initiatives. Additionally, the stock remains vulnerable to sharp market corrections if the company misses earnings estimates, as I believe many recent investors are speculators with shorter investment horizons.

However, I have high conviction that any pullback will not last more than one or two quarters, as the underlying business behind this stock makes sense, supported by favorable market tailwinds, strong profitability, and solid growth potential.

To back up my rating with some skin in the game, I have initiated a position in Palantir and plan to average down if a pullback happens.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.