Summary:

- Rocket Lab’s Neutron rocket offers cost efficiency for payloads under 13 tons, outperforming Falcon 9 in dedicated launches but not in rideshares or heavier payloads.

- Neutron’s flexibility in launch frequency and precise orbital injections provide significant advantages, reducing risks and offering more control over timelines and orbits.

- SpaceX’s Falcon 9 and Starship have a strong track record, but Neutron’s design caters better to smaller payloads, making it a viable competitor.

- Despite Rocket Lab’s stock being overvalued currently, I maintain a long-term buy rating, recommending adding to positions at prices below $20.26.

Alones Creative

Rocket Lab (NASDAQ:RKLB) has performed impressively well with a 400% since my buy rating in November 2023. Since my report from last month, the stock is up another 13.6%. The stock has retreated from its highs, and I believe that this is some healthy profit taking. And while I have a long position in RKLB, for the time being, I do believe that the valuation is stretched and I will only incrementally add to my position.

One thing that I noticed about Rocket Lab is that it’s the talk of the day among many investors and even many analysts. However, while readers and analysts are tumbling over each other, marking this as their best pick ever (I cannot make such claims because even after a 400% increase in the stock price Rocket Lab is not my highest performing pick), I don’t see a deep dive in the business itself and that leaves some important questions for critical investors unanswered. One question that I see popping up quite regularly is how the Neutron rocket can compete with SpaceX. In this report, I will explain why comparisons on launch costs per unit payload (launch costs per kilogram) are too much of a simplification to conclude that Neutron will be expensive to launch.

The Philosophy Of Satellite Design

Swedish Space Company

To understand things on a deeper level, I do believe that one has to understand the design philosophy for satellites. More is not always better, but just to give you an impression of the complexity of space mission engineering: In my time as aerospace engineering undergraduate I had a book called Space Mission Analysis and Design, or SMAD, and that book was more than 1,000 pages. So, if as an investor you are convinced you can reduce space missions to a launch costs per unit weight figure, I urge you rethink your view.

When you start the process, as a company, you have established there’s a certain requirement that needs to be met. You are likely to have a timeline as well as a budget, divided over development (including design and manufacturing) and operating costs. So, from the start, you already have two constraints imposed in place for the simple reason you’re not going to explore a design option if it can’t fulfill your time to market or does not fit the budget or funds that can be arranged. So, indeed costs including launch costs are important. At the moment you define your mission objective, it’s likely already clear that you will require a space-based solution, such as a satellite. At that moment, you could already have a first very rough idea of the costs. From your mission requirements that need to be defined, you likely also will know which orbit is required. The orbit is simply the height to which the satellite will be launched, the inclination, which body the satellite will orbit and the eccentricity or shape of the orbit. At this point, you can already do a first down select of launch providers based on their launch availability and whether the launch provider launches to your target orbit. So, the preliminary orbit design parameters already serve as a down select.

If you for instance require the satellite for imaging purposes, you select a camera resolution and an imaging frequency. That camera has a power requirement and each picture has a certain data size. From there you start sizing the communication budget determining the communication bandwidth and that also feathers into the power budget of the satellite. The communication uplink and downlink limitations also drive the need for antennas, and as a result, the physical shape of the satellite. For imaging and communications, you will require a certain pointing accuracy, and that drives the design requirements for the attitude control and determination system or ACDS as well as how much propellant is required for in-orbit maneuvering. With the budget for the power in mind, you can also size for instance the solar panels. At this time you have a downlink/uplink budget, a power budget and a weight budget and you might already know the physical shape of the satellite if that already had not been determined by the availability of payload fairings.

So, you have your target orbit, satellite weight, shape of the satellite and the targeted launch date. With all of these inputs you can start selecting a launch provider.

Neutron Does Not Have The Lowest Launch Costs On Paper

As you already might see, before you even get to the stage of really looking at the launch costs and simplifying things to a simple table of launch costs per kg, you have already gone through many other steps.

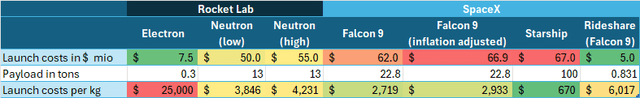

The Aerospace Forum

I have collected launch cost data to a low-earth orbit or LEO for various launch vehicles. As a reference I have added the Electron rocket as well and what can be seen on the Electron rocket is that it has by far the highest costs per kg. The Starship, which is the super heavy-lift launch vehicle that’s currently being developed by SpaceX, has the lowest costs. The Neutron rocket will be more expensive compared to the Falcon 9 launch costs.

One thing that should be kept in mind is that if we look at the payload capabilities. Just dividing the costs by the payload capability makes little to no sense. Each rocket in the list handles a vastly different payload class. The Falcon 9 already lifts 75% more than the Neutron and the Starship lifts nearly eight times the Neutron payload. So, solely looking at the launch costs per kg is an apples-to-oranges comparison. That’s like comparing a Boeing 737’s 250 kg per seat weight and conclude that it’s a better aircraft than the Boeing 747-800 because that aircraft has a 471 kg per seat weight. Different class of aircraft and different missions and the same holds for launch vehicles.

There also is a very important note on the Falcon 9 launches. The highest launch payload I have observed from that launch vehicle is 17.5 tons. And assuming most of the launch costs remain fixed, that would bring the launch costs per kg to $3,821 which is actually in line with the Neutron rocket on the low end of the range. Furthermore, most of the Falcon 9 launches carry Starlink satellites. The highest launched payload I could find in the launches in 2024 is 7.5 tons. This puts the per kg costs at $8,916 or 110%-131% higher than a dedicated launch on the Neutron or 22% to 34% when we adjust the launch costs to the payload weight for the Neutron rocket as well. So, for dedicated launches, the Falcon 9 is not the cheaper solutions. Maximum payload on a rideshare for the Falcon 9 is 831 kg for which SpaceX charges $5 million. A rideshare is simply a launch vehicle carrying multiple payloads, quite often composed of a secondary and primary payload. This brings the launch costs to $6,000 per kg, which is more expensive than the launch costs for the Neutron. However, if we do follow the reasoning of ride sharing being twice as expensive compared to simply dividing the launch costs by the payload mass, the Neutron rocket would be 30% to 40% more costly. Compared to the Starship Rideshare, the Neutron without doubt is going to be extremely expensive.

So, as a dedicated launch vehicle, the Neutron rocket is more cost efficient compared to the Falcon 9 and the Starship is simply not comparable. The Falcon 9 already lifts significantly more and frankly we have not seen that additional launch capacity being utilized on launches other than the Starlink launches. Putting it simply, for any dedicated payload less than 15 to 17 tons, the Neutron rocket is the more cost efficient launcher, and since the maximum payload for the Neutron rocket is 13 tons it will launch more efficiently over its entire payload capability. A dedicated Starship launch at 13 tons would be 22% to 34% more costly. So, as a dedicated ride, the Neutron rocket is the better fit.

As a rideshare, the Neutron rocket will likely be more expensive, but we have no pricing data on rideshare rate for the Neutron rocket. Just assuming the rates are twice that of a dedicated launch at full payload, the Neutron rocket will likely be more expensive.

Neutron Rocket Has Advantages On Other Considerations

Rocket Lab

Launch cost considerations play an important role. Satellite launches remain expensive, given it’s a costly effort to launch a kilogram into space. However, launch costs per kg are not the only considerations. There several more which could result in the Neutron rocket being favored. The first one is that rideshare capacity is not huge. For instance, this year, there have been two launches. There are two rideshare launches per year and it seems that by 2026 there will be three launches a year. So, if you have a launch window, the rideshare capacity of the Transporter rideshares on the Falcon 9 might become the limiting factor. Furthermore, all launches are scheduled for sun-synchronous orbit or SSO which is a low-earth orbit with a specific set of characteristics. If you want to launch in a different low-earth orbit, SpaceX simply does not offer it. Most of the launches these days for satellites with a mass less than 100 kg are in the SSO. However, the satellites with a mass higher than 100 kgs most of the time are launched in a different low-earth orbit. So, the launch orbit that SpaceX launches in could potentially rule out SpaceX as a launch provider altogether and in that case it does not even matter that its costs are superior to those of the Neutron. Something that’s cheaper but does not match your requirements is useless unless you can change the design to work in a SSO. Sun-synchronous orbits have some advantages such as global coverage and consistent lighting conditions and passing over the same location at the same local solar time. Furthermore, power generation is more predictable which allows for easier design of the power storage and generation systems.

With most satellites being 100 kgs or more, the lift class for Falcon 9 as well as the Neutron could cover launches from mini-satellites up to extra-heavy satellites for LEO. Most launches, however, will likely be launches of multiple satellites. In September, SpaceX launched five satellites weighing 1.5 tons each into orbit but generally we see that most of the launch activity is centered on Starlink launches, but we don’t see many non-Starlink launches and that could be driven by the fact that the pricing or capabilities are not attractive. I do believe that for launches on the 22-ton capable Falcon 9, the prices as a dedicated launcher are high and the Neutron would in fact be the better choice. This highlights the potential enabling nature of the Neutron rocket.

If you do not launch as a primary payload, your launch is subject to risk. If the primary payload is delayed, so will your launch. On rideshares, SpaceX does offer refunds but charges a rebooking fee. If you’re a company that developed a satellite and you want to be in control of the timeline, launching as a secondary payload might not be preferred since the costs for development and launch are one thing but you also have dedicated teams and equipment on the ground that are fully scheduled to meet the timeline, and if a launch slips you are stuck with those costs.

Apart from that, Rocket Lab is known for precise orbital injection which is also of importance for the mission success and the pricing for the rideshare is based on SSO. And since SpaceX usually does not offer rideshares to other orbits, the rates could be significantly higher, or SpaceX potentially cannot even offer a ride. So, rideshares have advantages but also have disadvantages and that’s a reason why some companies looking to launch satellites would like to consider dedicated launch operations in which case the cost advantage again swings toward Neutron. Dedicated launches leave you in control of the timeline and the orbit injection. Having to inject 100-plus satellites into an orbit can be trickier than having to do this for one or five or 20 at a time.

So, the Neutron rocket offers flexibility in terms of orbit and timing and thereby reduces risks. One question I have heard a lot is whether there’s a paying audience for that. It seems there is. The Electron rocket is the testimony to the fact that as long as you are able to tailor your launch vehicle to a certain payload class, there are parties that are going to opt for this to reduce schedule risks. Furthermore, being a smaller launch vehicle, the Neutron rocket even as a rideshare could be preferred because it should take less time fill up a 13-ton launch vehicle compared to the 22.8 tons for the Falcon 9, which could allow Neutron to offer more launches in a year, which provides additional flexibility compared to the launch cadence of rideshares for the Falcon 9.

What Are The Pros And Cons For The Rocket Lab Neutron Rocket?

Generally, I do believe that SpaceX and Rocket Lab both have huge opportunities, and I do believe that both will succeed. Demand for launches is significant and the market for space launch services is expected to grow from $9.2 billion to $35.5 billion by 2033. Handling that by bigger launches is not the sole solution – being able to offer frequency on smaller launchers can be beneficial. Additionally, the Neutron rocket could serve as a blueprint for future launch vehicle developments.

So, putting it all together we end up with several pros and cons for the Neutron Rocket.

Pros of the Neutron Rocket:

- The Neutron rocket could potentially fill more rideshares a year offering more flexibility and reduce risks.

- Rocket Lab is known for precise orbit injections.

- Neutron launch cost per kg are lower in its payload regime, meaning that launching any payload less than 13 tons should be cheaper on a Neutron than on a Falcon vehicle. Rocket Lab’s lower payload capability means that its design is also better fit for lower payloads and that translates to more efficient costs per kg in its class.

- While unlikely that a secondary load on a Falcon 9 would be a primary load on the Neutron rocket, if that still were to happen it would also allow greater control over the timeline and orbit injection.

- Against the Starship, a dedicated large satellite launch offers more flexibility than a rideshare on the Starship.

Cons of Neutron Rocket or Pros of SpaceX with Falcon 9 and Starship:

- SpaceX has an extremely strong track record on launches in its class.

- Neutron rocket is still in development and unproven.

- For heavier launches, such as big constellation launches exceeding 13 tons, SpaceX options are cheaper.

- The Starship payload capability and superior costs per kg could potentially drive the weight classes as a satellite could be 5-6.5 times the weight while having the same launch costs. I believe that’s actually the biggest threat. Neutron is superior over its entire payload regime but if the launch costs outside of that payload regime would be lower we could see satellite developers opt for bigger satellites since developing small and lightweight satellites is a challenging task.

Conclusion: Neutron Rocket Should Not Be Judged On its Unit Costs

I think one important takeaway for investors is that judging the Neutron rocket solely on its costs per kg and stack that cost against launch vehicles in higher payload classes provides a skewed projection of the reality. In its class, the Neutron rocket performs better as a dedicated launch vehicle and as a rideshare it could potentially offer more flexibility due to the possibility that it can offer more launches to launch the same total payload. Frequency at times is important. There will be a market for both and I believe that government agencies will also be pleased with having the option to use several launch services rather than being dependent on SpaceX.

It will not be an easy market for Rocket Lab to active in since SpaceX is extremely dominant and it could in fact change the mindset on weight reduction in satellite design by reducing the launch cost per unit kg, but there should be more than enough space (no pun intended) for both launch providers. As a result, I maintain my buy rating for the long-term on RKLB but do note that the stock has run up a bit too much and any price below $20.26 should be a good one to start adding to positions and prices below $10.63 which I believe we are unlikely to see create a strong buy opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RKLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.