Summary:

- Airbnb’s stock continues to struggle in the face of macroeconomic headwinds and a potential supply-demand imbalance.

- If this situation intensifies, Airbnb’s revenue and margins could drop significantly, sending the stock to all-time lows.

- Looking beyond this risk, Airbnb’s current valuation isn’t overly demanding given the company’s likely margins at maturity.

- International expansion alone probably justifies Airbnb’s current share price, with success in adjacent markets potentially creating significant upside.

Klaus Vedfelt

Despite the strong performance of the business since Airbnb (NASDAQ:ABNB) became a public company, the stock has struggled. This situation has persisted in 2024, with Airbnb’s share price remaining volatile without really going anywhere.

While Airbnb’s current valuation isn’t overly demanding given the company’s likely margins at maturity, future success is largely dependent on Airbnb’s ability to diversify its geographic footprint and expand into adjacent verticals. It is too early to make a judgement on this front, but I tend to think that Airbnb will have considerable success off the back of its brand and strong execution capabilities.

I previously suggested that macro headwinds were beginning to bite, and I continue to believe that this is the case. The growth of supply and demand on the platform looks unfavorable, which is likely to weigh on Airbnb’s growth and margins. There is also a risk that economic weakness increases the severity of this situation.

Market Conditions

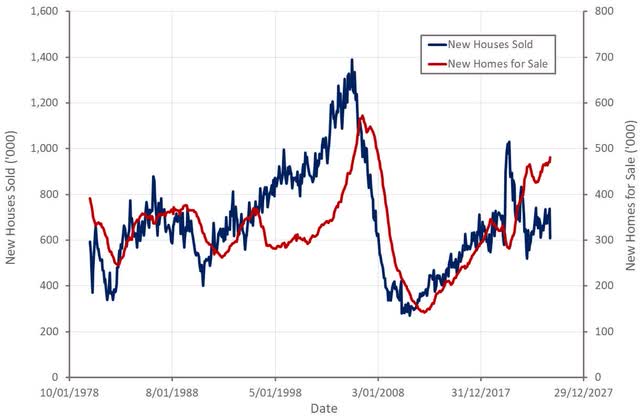

Growth in the supply of short-term rental properties has been robust in recent years, a situation that has been enabled by a robust demand environment. A weaker demand environment and rapid growth in the supply of new homes is creating pressure though, something that Airbnb is actively managing by removing supply from its platform.

Growth in the number of new homes will remain robust going forward, which will need to be balanced across the short and long-term rental markets, likely leading to higher vacancy rates in both markets. Importantly, a construction downturn is likely to lead to lower employment levels, which could lead to a recession.

Figure 1: New Homes Sold and New Homes for Sales in the US (source: Created by author using data from The Federal Reserve)

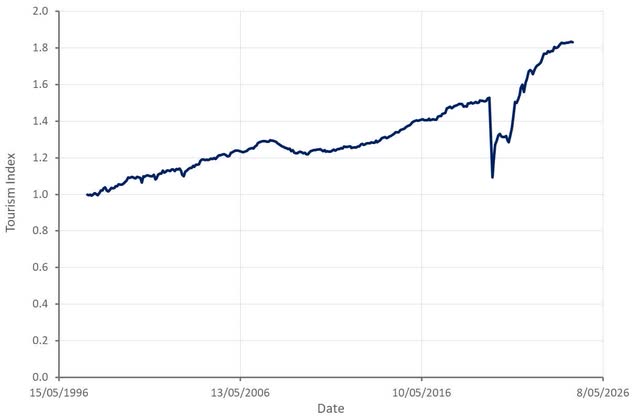

While tourism in the US remains robust, growth has been fairly weak over the past six months. This can be seen from Airbnb’s growth, which continues to moderate, despite the company’s success in international markets. Airbnb is now also starting to invest more aggressively in marketing to offset demand weakness. The risk is that weaker economic conditions will lead to a contraction in demand which pressures Airbnb’s revenue and margins.

Figure 2: Tourism Activity Index (source: Created by author)

Guest demand accelerated through the third quarter, although this was primarily the result of normalization after a soft July. This process reportedly accelerated after the Olympics, with improved demand seen across all four of Airbnb’s major regions.

Airbnb Business Updates

Airbnb has three strategic initiatives:

- Making hosting mainstream

- Perfecting the core service

- Expanding beyond the core

In support of making hosting mainstream, Airbnb recently introduced a co-host network, which connects property owners with people that can help manage their properties. Support services provided by co-hosts range from listing setup, booking management and guest communication. The co-host network was launched with 10,000 co-hosts across 10 countries. In the weeks following its launch, Airbnb received interest from over 20,000 potential co-hosts. Given the number of properties on Airbnb’s platform, these numbers suggest that co-hosting is likely to have a fairly modest impact. In addition, demand is more of an issue than supply at the moment.

Airbnb remains underpenetrated internationally, with its core markets (US, Canada, Australia, France, and the UK) contributing around three quarters of gross booking value. Airbnb is currently focused on driving growth in a number of expansion markets:

- Americas – Mexico and Brazil

- Europe – Germany, Italy and Spain

- Asia – Korea, Japan, India and China

These countries currently only represent around 15% of gross booking value, but growth is healthy. For example, the growth of nights booked in expansion markets more than doubled growth in Airbnb’s core markets in Q3.

While international markets could be a meaningful source of growth in coming years, the company’s expansion into adjacent verticals is critical to future growth. Airbnb is targeting the launch of 1-2 new businesses each year that will generate in excess of $1 billion incremental revenue. Little detail has been given on what these businesses will be though.

Financial Analysis

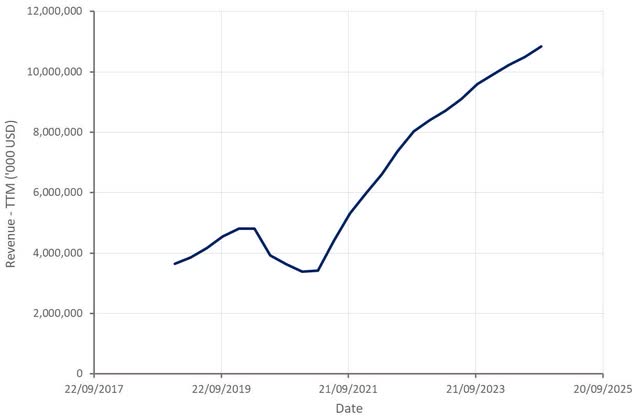

Airbnb generated $3.7 billion revenue in the third quarter, an increase of 10% YoY. While this growth is fairly solid, Airbnb has recorded a continuous growth slowdown over the past three years, and this seems likely to persist.

Paris is Airbnb’s most important city globally in terms of listings and nights booked. Despite this, Airbnb managed to increase supply in Paris by over 30% for the Olympics, housing over 400,000 guests through the event. This could have provided something like a $50 million boost, although it is unclear how the Olympics impacted demand in other regions.

Airbnb expects $2.39-$2.44 billion revenue in the fourth quarter of 2024, representing 9% YoY growth at the midpoint. It should be noted that Airbnb benefitted from the recognition of revenue from unused gift cards in Q4 2023, creating a 2% headwind due to the difficult comparable period.

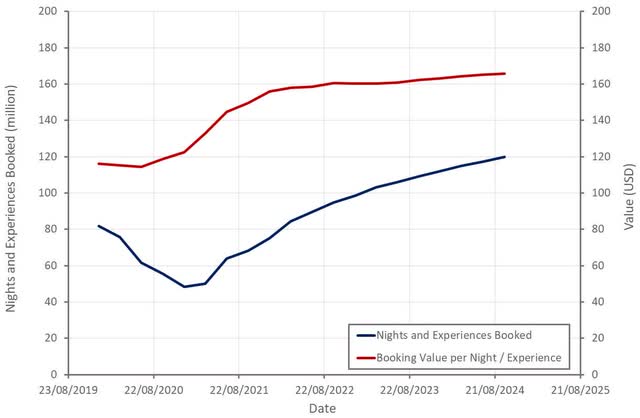

Figure 3: Airbnb Revenue (source: Created by author using data from Airbnb)

Around 123 million nights and experiences were booked in Q3, an increase of approximately 9% YoY. While demand growth continues to soften, pricing remains a modest tailwind. Airbnb has suggested that after accounting for mix shift, its prices have remained fairly consistent, whereas hotel prices have risen considerably. This is supported by the fact that Airbnb has removed more than 300,000 listings in 2024 in an attempt to manage supply and improve average quality. Despite this, supply growth continues to exceed demand and was up more than 10% YoY in Q3. The fact that Airbnb’s prices have remained stable in the face of rising supply is somewhat surprising, particularly given the company’s initiatives to control pricing (similar listings tool, etc.).

Figure 4: Airbnb Nights and Experiences Booked (source: Created by author using data from Airbnb)

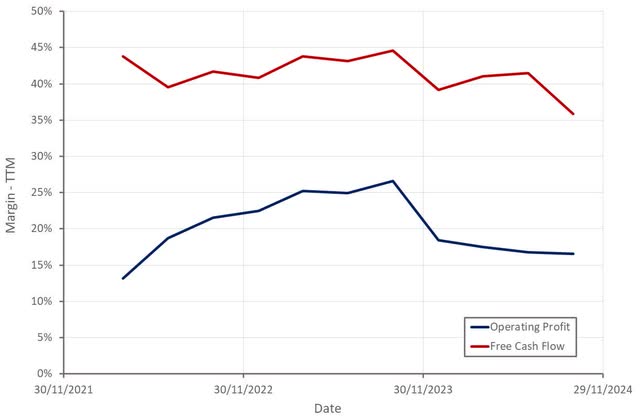

Airbnb’s operating income was around $1.5 billion in the third quarter and free cash flow totaled $1.1 billion. While this is healthy, the third quarter is Airbnb’s seasonally strongest quarter by a wide margin. On a trailing twelve-month basis, the company’s margins and cash flows continue to deteriorate as pandemic tailwinds fade.

Figure 5: Airbnb Margins (source: Created by author using data from Airbnb)

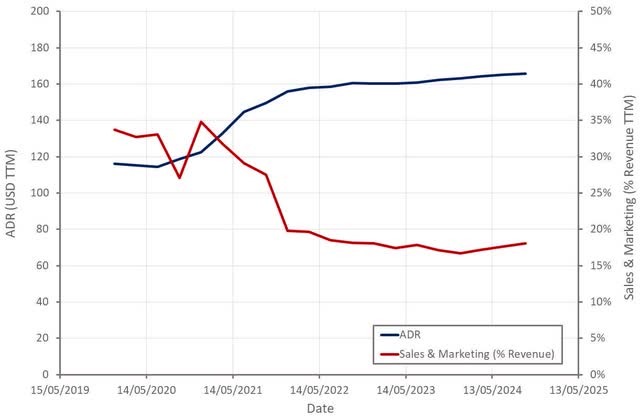

In particular, Airbnb is beginning to increase its marketing investments as demand growth wanes. Increased marketing is also required to support the company’s expansion markets. On a positive note, nights booked through Airbnb’s app increased 18% YoY in the third quarter and now accounts for 58% of nights booked. Churn should be lower for app users, helping to lower the burden of customer acquisition costs.

Figure 6: Airbnb ADRs and Sales and Marketing Expense (source: Created by author using data from Airbnb)

Conclusion

Airbnb’s valuation appears fairly reasonable given the company’s likely margins at maturity. Analysts are currently anticipating low double-digit annual revenue growth over the next decade, which can likely be achieved just through international expansion. If Airbnb has success in adjacent verticals, growth is likely to be in the high teens, making the company deeply undervalued.

The near-term remains cloudy though due to the robust supply of new houses and tepid growth in demand. This is a dangerous situation for Airbnb due to the leverage inherent in the business. A supply/demand mismatch could pressure ADRs, and in turn Airbnb’s gross margins. Weaker demand could also require Airbnb to significantly step up its marketing spend.

Figure 7: Airbnb EV/S Ratio (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.