Summary:

- Amazon is making significant strides in AI, focusing on cloud services and consumer applications, but remains slightly overvalued, maintaining a hold rating on AMZN.

- Amazon’s $8B investment in Anthropic, focusing on AI safety, positions AWS as Anthropic’s primary cloud training partner, potentially boosting AMZN’s valuation.

- Amazon’s Trainium chips offer a cost-effective alternative to Nvidia’s GPUs, optimized for AWS, ensuring AMZN’s dominance in the cloud space.

- Despite AI advancements, AMZN’s intrinsic value is around $179 per share, trading at a premium, suggesting it’s not an ideal time to start a position.

hapabapa

Introduction

Amazon (NASDAQ:AMZN) has been performing quite well this year. Not as well as other AI players, but it seems that the company is stepping up its game in the AI space dramatically. I wanted to cover some of the developments that, I think, will help it keep performing just as well or even better over the next few years. The AI revolution is still ramping up, however, since we don’t have solid numbers on how AI will affect these big corporations in the long run, it is hard to model a very optimistic outlook. Even with decent improvements modeled for the next decade, the company is still slightly overvalued right now and will have to monitor the developments in AI over the next few quarters. I maintain a hold rating on AMZN.

Big steps forward in AI

Amazon is no stranger to AI. Over the last couple of years, the perception of Amazon regarding AI has been somewhat underwhelming. Many investors believed that the company was playing it too slow and that it was falling behind on when it comes to competent AI features like many other players in the space, for example, Open AI’s ChatGPT, Alphabet’s (GOOG) Gemini, Microsoft’s (MSFT) Co-Pilot, while Meta Platforms (META) has Llama. I believe this is not the case any longer. While the mentioned AI peers have a multipronged approach, offering many different AI products for cloud, business, and consumer applications, Amazon put most of its attention into cloud AI services, specifically within its cloud computing division, AWS, its biggest revenue catalyst. Although it is not a bad strategy given that AWS continues to dominate the cloud space, I believe that consumer applications seem to be a decent revenue catalyst going forward also. At the recent AWS Re: Invent conference, Amazon’s CEO Andy Jassy mentioned that the company has “a few hundred million” customers, which is nothing to scoff at. That is a massive customer base, one that might be very difficult to monitor without properly applying some sort of AI capabilities that can help the customer and the company itself.

Over the last while, AMZN has been improving its AI customer service, and recently, I had a run-in with it when I was trying to return an item that I didn’t know had no returns policy. Naturally, that got me a little frustrated. I was very surprised to see how fluid the whole interaction with the chatbot was. It quickly recognized which item I was referring to out of the many I had ordered on that day and although it didn’t help me with the problem outright because the item said no returns, I had to be connected to a human assistant, which then helped me get to the bottom of it. Had the matter solved within half an hour of back and forth and got my refund within the day. Before this encounter with the chatbot, I remember specifically that the AI chatbot was nowhere near as fluid or capable as it is now.

Anthropic Investment

Back in September 2023, Amazon committed $1.25B to the biggest ChatGPT competitor, Anthropic. Anthropic’s focus on AI safety is what I think Amazon focused on the most when it started a partnership because, with a “few hundred million” client base, AI safety would be very much at the forefront at this scale. Over the next year, Amazon invested another $2.75B into the partnership, bringing its total to $4B at the time. It didn’t stop there, however. Just last month, the company announced it has doubled its investment in Anthropic by injecting another $4B into the company, bringing its total investment to $8B. Amazon said to retain its minority position within it. With this announcement, Anthropic has said that AWS will become the company’s primary cloud training partner.

Although, ChatGPT is a household name right now across the world and has a substantial lead in general. Anthropic is growing at a rapid pace, with its Claude models gaining traction in many industries. Just as ChatGPT got a massive $10B boost from its partner Microsoft, $8B from Amazon is a significant help. I don’t think this is the last of the investment we will see from AMZN. Given Anthropic’s focus on AI safety, this niche could be very advantageous for both players as it can give Anthropic an edge in specific markets, like consumer-facing ones. Further growth will translate to a higher valuation and a win for AMZN.

Trainium Chips- A Serious Competitor to Nvidia Chips?

So, the darling of AI hype, Nvidia (NVDA) has been dominating the industry for quite a few years when it pivoted its strategy towards data centers and AI chips. Some metrics show that NVDA’s dominance in the AI chip market is anywhere from 70% to 95%. Amazon’s first foray into AI chips was back in 2020, with its first chip being Trainium Trn1. Amazon execs believe that customers would benefit from having multiple choices when it comes to their AI needs, and believe that their cost-effective alternative to NVDA’s GPUs will be just that. NVDA’s GPUs come at a massive cost, so a cost-effective alternative is going to be a welcome addition to the AI space. Apple (AAPL) is said to have embraced Amazon AI chips. Another player seemed to have fallen behind in the AI race, but I think it is taking a completely different approach than the mentioned AI juggernauts. I don’t doubt NVDA will continue to dominate the market for years to come, but many enterprises are looking to cut costs while retaining the raw power needed, especially if they are using AWS, which the Trainium chips are specifically designed to work best in AWS. AMZN optimized these chips with AWS in mind, which means AWS will be the dominant player in the cloud space for years to come.

The mentioned AI juggernauts, including Amazon, are all spending absurd amounts of capital on the AI race. In the latest transcript, Andy Jassy said that the company expects to spend around $75B in capex, most of which will be going towards AWS and GenAI. The company is expecting to spend even more than that in 2025, which means it is still in a rapid growth stage and AMZN is not going to fall behind in the race. AI spending is expected to exceed a quarter of a trillion dollars next year, with AMZN and MSFT most likely attributing to most of that spending, followed closely by META and GOOG. So, there is no shortage of capital in the AI race and if these companies are spending so much here, that means there is a reason for that. They expect it to massively pay off.

Valuation

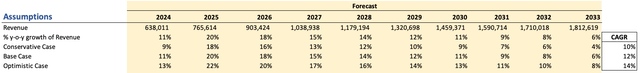

Let’s look at some assumptions.

For revenues, analysts aren’t expecting much for now, which makes sense, however, it is hard to predict what kind of impact the AI hype will continue to deliver for AMZN. I’m sure it is going to be positive overall, which could lead to higher revenue growth than what is currently predicted. I went with around 12% CAGR over the next decade, which assumes that FY25 will be a year of decent growth that will start to taper off over time, to keep it conservative. These numbers are just ridiculous, and even with a 12% CAGR, the company will reach $1.8T in sales, which is crazy in my opinion, but not impossible over a decade.

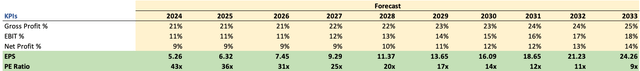

For profitability, I decided to improve the company’s margins quite a bit, which gives me a very little margin of safety, but let’s say AI and AWS continue to improve the company’s efficiency and profitability. Most of the company’s operating income already comes from AWS, so it is not unreasonable to assume that we will see further improvements as technology advances. We could see even further improvements than what I am modeling here, however, to keep it a little more conservative I went with the below:

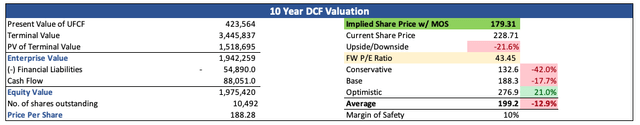

Furthermore, I went with the company’s WACC of 8.5% as my discount rate and 2.5% as my terminal growth rate. Additionally, to keep it a bit more conservative and give me some room for error in my estimates above, I added a 10% discount to the company’s intrinsic value. With that said, AMZN’s intrinsic value is around $179 a share, which means it is trading at a premium.

Closing Comments

Any time I look at AMZN, it is never trading under its intrinsic value. It always seems like the company is overvalued, and yet, it continues to reach new highs as investors continue to pile on. It is a great company, however, even with my assumptions of improving gross margins by 400bps over the next decade as well as 700bps in operating margins, the company seems to be too expensive currently, and it is not an ideal time for me to start a position. You may come to another conclusion given the catalysts I mentioned above. However, the AI play is still quite a bit way away from yielding improved revenue growth, especially for a company the size of AMZN. If all goes as modeled, AMZN will hit $1T in sales in the next two years. The company is still poised to grow at double digits, however, to justify the valuation, the growth rates will have to be larger and efficiency improvements greater.

For now, I will continue to monitor what is coming for AMZN and how its AI strategy will play out over the next couple of quarters to see if I need to adjust some of my assumptions for the better (or worse), depending on what’s going to happen.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.