Summary:

- Alibaba’s recent earnings result failed to excite Wall Street, but it showed strong positive trends, which can deliver bullish sentiment in the next few quarters.

- The cloud business has reported good margin improvement while also showing 7% YoY revenue growth.

- There is still a massive margin gap between Amazon’s AWS and Alibaba’s cloud business, which should allow further margin improvement.

- Alibaba purchased 2.1% of outstanding shares in a single quarter while also giving a healthy 2.25% dividend yield.

- The ultra-hawkish foreign policy of the next Trump presidency could be a tailwind for Alibaba similar to the first term as geopolitical uncertainty is reduced.

maybefalse/iStock Unreleased via Getty Images

Alibaba’s (NYSE:BABA) recent earnings failed to excite Wall Street, and the stock has dropped to the mid-80s. However, the earnings report showed strong tailwinds, which could build a bullish sentiment in the stock over the next few quarters. The annualized EBITA of the cloud business has increased to $1.5 billion, which is almost twice the rate it had in the year-ago quarter. The annualized cloud revenue has reached $17 billion and is showing good potential in some AI-related products. In the previous article, it was mentioned that fiscal support by Chinese government has started to make an impact on Alibaba’s core performance.

The international commerce business is growing at a rapid pace and is already 13.5% of the consolidated revenue. At the current growth trend, the revenue share of international commerce could increase to 25% by the end of 2026. This trend should reduce the geopolitical risk associated with the stock. Alibaba has also invested heavily in buybacks and has bought 2.1% of outstanding shares in the last quarter. Buybacks along with a healthy 2.35% dividend yield should support good investor returns.

Many analysts have mentioned that the next Trump presidency could be a challenge for Alibaba and other Chinese stocks. However, I believe an ultra-hawkish foreign policy by the White House should reduce the geopolitical uncertainty, which could create better sentiment towards Alibaba stock. The stock continues to trade at a forward PE ratio of less than 10 making it a good option for investors looking to make a value purchase.

Green shoots in the earnings

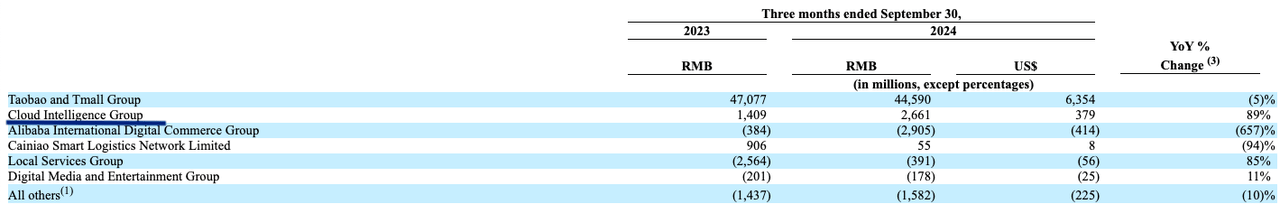

The recent earnings did not impress Wall Street, but we can clearly see some green shoots for Alibaba. The cloud business has reported EBITA of $380 million in the recent quarter. The annualized EBITA rate of the cloud business is now more than $1.5 billion, which is a big number considering Alibaba was quite late to the party. The EBITA margin of the cloud business is 9% when we look at the revenue base of $4.2 billion in the last quarter. This is good profitability, but it is still significantly below the 30% margins reported by Amazon’s AWS.

Figure: Improvement in Cloud margins in the recent margin. Source: Alibaba Filings

The 7% YoY revenue growth of Cloud business was very modest, but the company mentioned that it is seeing “triple-digit growth” in some AI-related products in the cloud business. Alibaba seems to be making a very strong effort to improve its AI services. It recently challenged OpenAI’s reasoning model and has launched a number of services based on AI within its e-commerce platform. We could see these efforts show good results in 2025 as more clients leverage AI services to improve their productivity.

The revenue share of fast-growing AI services should continue to increase within Alibaba’s cloud business. It is certainly possible that the company is able to deliver 15%-20% YoY revenue growth in Cloud business within a few quarters. Along with a strong margin improvement, the good revenue growth trajectory of cloud business should significantly improve the sentiment towards the stock.

Lower geopolitical risk

One of the key factors keeping Alibaba stock low is the geopolitical risk associated with the region. Many analysts have pointed out that the next Trump presidency could be a major headwind for Chinese stocks. However, I believe an ultra-hawkish foreign policy by the White House could end up reducing some of the geopolitical uncertainty around Taiwan. Higher tariffs on Chinese goods could also force the Chinese government to announce bigger stimulus to support the economy.

Despite tariff threats and other rhetoric, the overall performance of Chinese stocks was much better during 2017-2021. Alibaba stock had a bull run and the stock price went close to 3X within that period. The regulatory pressure on Alibaba is already reducing, and a better geopolitical climate should support the stock price.

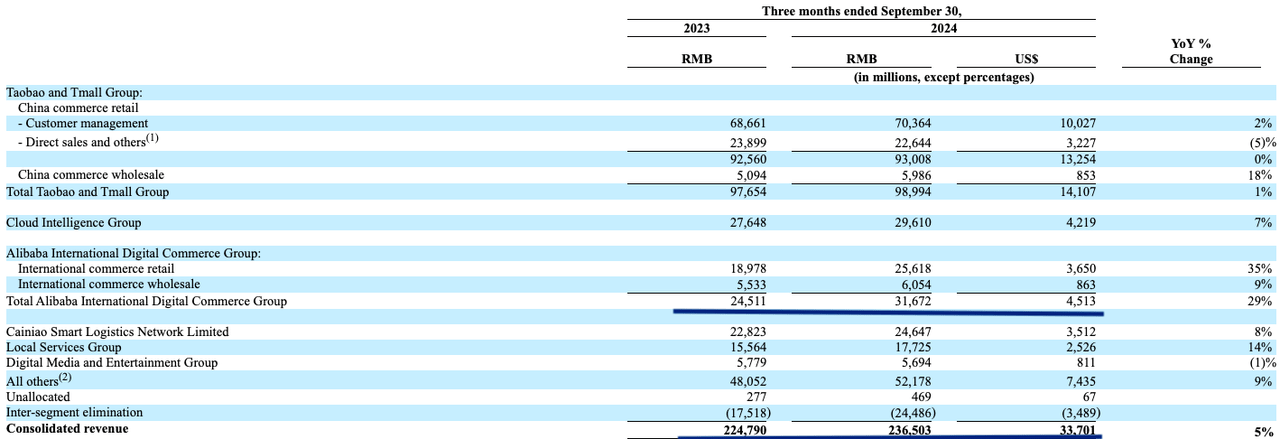

Another major change for Alibaba is the rapid increase in revenue share of the international business. In the recent quarter, the international commerce segment contributed $4.5 billion in revenue out of a total consolidated revenue of $33.7 billion. Hence, the revenue share of international business is 13.5%. The international business contributed RMB 7 billion in incremental revenue out of the total consolidated incremental revenue of RMB 12 billion. The international business is contributing close to 60% of the incremental revenue for Alibaba. The YoY revenue growth of this segment is 29% which is significantly higher than the 1% growth of Taobao and Tmall group.

Figure: Rapid growth of international commerce. Source: Alibaba Filings

At the current trend, international commerce revenue could increase to 25% of the consolidated revenue by the end of 2026. Alibaba’s international business is already a market leader in several international regions like Turkey, and we could see further expansion over the next few years. The growth runway of this segment is very long, and it should help Alibaba diversify its revenue base outside China.

Risk for the Bullish Thesis

One of the biggest risks for Alibaba stock is the possibility of a complete decoupling of the Chinese economy from world trade. This will have a significant negative shock for domestic consumption within China, which will hurt the e-commerce business of Alibaba within China. A complete decoupling can also hurt Alibaba’s international growth plans. Earlier this year, Bloomberg mentioned that even a blockade of Taiwan could lead to a bigger global recession compared to the 2008 financial crisis. However, I believe that this is still a very low-probability case. The unpredictable foreign policy of the next White House is also a risk. Investors could wait for the next administration to lay out its foreign policy priorities in China to reduce this risk.

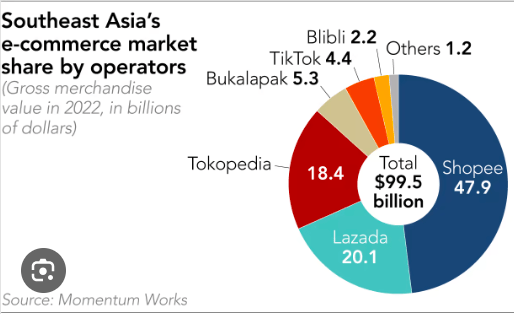

Another headwind for Alibaba is the rapid growth of TikTok in the e-commerce business. TikTok directly competes with Alibaba’s Lazada in Southeast Asia, where it is investing heavily to increase its market share. TikTok is using its social media presence to gain new customers for the e-commerce business. The massive profits through ad sales have allowed TikTok to offer huge discounts within the e-commerce business. A CNBC report mentioned that TikTok Shop will be doubling its GMV to $50 billion in U.S. this year.

Nikkei

Figure: Alibaba’s Lazada is competing against Shopee and TikTok. Source: Nikkei, Momentum Works

This growth rate in a mature e-commerce market like the U.S. shows the strength of TikTok’s model. Alibaba is also investing in new AI features, but it does not have a social media presence similar to TikTok. However, the recent ruling by the Appeals court in U.S. has unanimously upheld the upcoming TikTok ban. If the TikTok ban in the U.S. goes according to schedule, it will remove one of the lucrative ad markets for TikTok and limit the ability of the company to give massive discounts in the e-commerce business. TikTok also faces headwinds in the European Union, which could follow the U.S. in restricting TikTok’s app.

Upward EPS revisions

Alibaba’s EPS is projected to increase to $10.65 for the fiscal year ending Mar 2027. It is forecasted that the next two years will show close to 10% EPS growth. However, we could see strong upward EPS revisions as the profitability of various segments improves. Alibaba has also spent $4.1 billion in the latest quarter to buy back 2.1% of the outstanding stock. This is a massive buyback pace for a single quarter. It should also be noted that Alibaba still pays 2.35% of dividend yield, which is quite healthy when we look at the overall profitability of the company.

Seeking Alpha

Figure: EPS projection of Alibaba for next few years. Source: Seeking Alpha

Stronger margins and higher buybacks can deliver a much faster EPS growth for the company. The stock is still trading at less than 10 times the EPS for fiscal year ending Mar 2025. This looks like a very modest number considering how expensive other Big Tech stocks are.

Investor Takeaway

Alibaba is showing better profitability in the cloud business, and it could help the management invest more in other growth segments. The annualized EBITA of the cloud business has reached $1.5 billion, and we could see further growth as new AI services are launched. The geopolitical risks from the next Trump presidency could be lower, which could help improve the sentiment towards Alibaba and other Chinese stocks.

The international business is also growing rapidly, which provides another growth opportunity for the company and allows for geographic diversification. The forward EPS growth projections of Alibaba are very modest, considering the massive buybacks and better profitability in key segments. We could see EPS surprise in the next few quarters, which could deliver a bullish momentum to the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.