Summary:

- Ford Motor’s stock is undervalued with a 6x P/E ratio and offers a 6% dividend yield, presenting a compelling risk/reward opportunity.

- Despite current losses in the EV division, robust EV sales growth and future profitability potential make Ford an attractive long-term investment.

- Supplier disruptions have led to a lowered profit forecast for 2024, but resolving these issues could boost future earnings and stock performance.

- November sales data shows strong momentum in EV deliveries, suggesting potential for a positive turnaround in the coming years.

Vera Tikhonova

The stock price of Ford Motor (NYSE:F) has not yet recovered from the 3Q24 earnings-related selloff which, in my view, sets investors up for a buying opportunity.

Ford Motor is seeing robust electric-vehicle momentum, but the auto company slashed its full-year profit forecast in October in light of some supply disruptions that has led investors to ditch the stock.

I think that Ford Motor’s stock is so cheaply valued, that an investment in the stock brings with it a very positively skewed risk/reward relationship, as well as an enticing dividend yield of 6%.

Ford Motor’s electric-vehicle division is presently losing money, but this is going to change in the future.

A positive trajectory in the EV segment could be a crucial turning point for Ford Motors and catalyze an upmove in the stock. In the meantime, passive income investors get to collect a juicy 6% dividend yield.

My Rating History

I issued a cautious outlook for Ford Motor in April amid slowing momentum for EV sales and challenges in terms of EV adoption. In response to such challenges, Ford Motor curtailed the number of F-150 production shifts at the start of the year in order to manage its production volume.

Ford Motor also lowered its profit forecast for 2024 amid supplier snags, but I generally think that the value proposition has improved here as of late.

EV sales momentum in November was not bad at all, and I see a low valuation multiple could be a main attraction point for any potential Ford Investor if investors see lowing losses in the EV division moving forward.

Ford’s November Sales Suggests Decent Sales Momentum, EV Division Will Remain In Focus

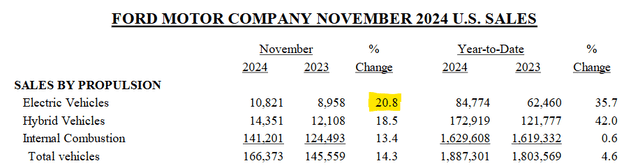

Ford Motor sold 166,373 vehicles in the month of November, up 14.3% YoY. Of those, 10,821 were electric-vehicles, or 6.5% of all sales. In the year ago period, only 6.1% of total sales were electric-vehicles, so while Ford Motor has slowed down its production lines for its EVs in 2024, deliveries are actually on a good run-rate. Ford Motor’s total electric-vehicles sales grew 20.8% in November and thereby 45% faster than total vehicle sales in November.

Ford November 2024 U.S. Sales (Ford Motor)

Electric-vehicles are still a loss-leader for Ford Motor, which is one of the reasons why the stock of the automaker has so poorly performed so far in 2024.

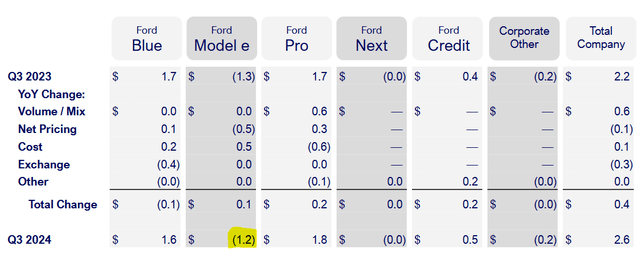

In the most recent quarter, 3Q24, Ford Motor lost $1.2 billion on building its electric-vehicles and has forecast to lose as much as $5.5 billion on EVs this year. In the coming years, however, investors should see these losses gradually reduced.

A profit in the EV division, which I anticipate is possible in 2027, would probably mark not only a critical milestone for Ford Motor, but also be an important catalyst for the automaker’s stock.

Ford Motor Slashed Its Adjust EBIT Guidance Amid Supplier Snags

Ford lowered its expectations for its full year adjusted EBIT forecast and anticipates to earn about $10 billion in adjusted EBIT in 2024. In the prior quarter, the automaker anticipated to earn between $10 billion and 12 billion, so the latest update is a steep downside revision.

Ford said that it lowered its full-year profit forecast due to supplier snags that have exerted pressure on earnings expectations.

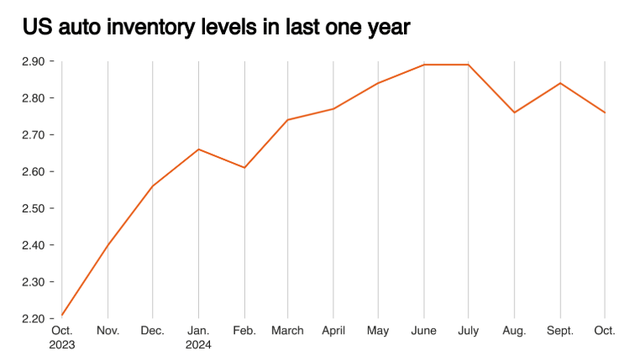

U.S. companies are also dealing with higher-than-usual inventory levels as automakers and dealers deal with changing consumer preferences (slowing demand for EVs and a transition to more affordable compact cars).

U.S. Auto Inventory Levels In Last One Year (Ford Motor)

Why Ford Motor Is Still A Steal: 6x P/E And 6% Dividend Yield

Ford Motor has a few things going for it including double-digit EV delivery growth, the company is still very much profitable and, last but not least, Ford Motor is paying passive income investors a healthy 6% dividend yield annually.

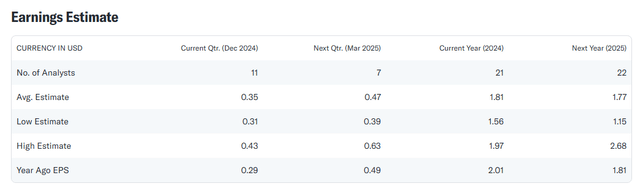

Presently, profit expectations for Ford Motor’s present year are anchored at $1.81 per share, which implies a YoY profit drop of 10%in 2024. Next year earnings expectations are muted as well: The market anticipates a 2% decrease in profits.

However, if Ford Motor’s supplier problems get resolved and electric-vehicle deliveries continue to grow at the present 20% plus Y/Y run-rate, chances are that the automaker could see a reboot of its profit estimates and actually catalyze a healthy amount of delivery growth in 2025. Based on present year profit estimates, Ford Motor is selling for just a 6x earnings multiple. General Motors Corp. (GM) is even cheaper and sells for a P/E of 5.0x.

Both automakers are bargains, but I like Ford Motors particularly because of its very healthy 6% dividend yield that provides passive income investors with a very good reason to buy the stock, independent of what happens to EV deliveries.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Could Hurt Investors

Supplier snags were named as a reason by Ford Motor’s CEO why the company is not yet fully tapping into its earnings power and why it was forced to lower its forecast for adjusted EBIT.

While supplier disruptions tend to be of temporary nature, longer-lasting snags could impair Ford Motor’s earnings potential in 2025 also and potentially extend the timeline it takes to drive the EV segment towards profitability. Obviously, these are the main risks with Ford Motor that could prevent a re-rating next year.

With that said, if Ford Motor continues to grow its deliveries (while simultaneously lowering its EV segment losses), I do anticipate the stock of Ford Motor to react favorably to those fundamental improvements.

My Conclusion

The stock of Ford Motor has fallen into a downturn and into a consolidation pattern in 2024 amid short-term supplier disruptions that have weighed on market sentiment.

In my view, Ford Motor’s November sales were very positive, however, with electric-vehicle sales growing 21% YoY, much faster than the growth of total vehicle sales. Ford’s EV segment is poised to remain money-losing at least to 2025, but a turnaround here in the 2026-2027 period could potentially flip investor confidence to the positive side.

Last but not least, Ford Motor’s low 6.0x P/E strong reduces the risk for passive income investors of overpaying for the 6% dividend yield. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.