Summary:

- Super Micro Computer has suffered from accounting irregularities going all the way back to 2018.

- Currently, investors are concerned about the company’s revenue recognition practices.

- Super Micro paid a $17.5 million settlement related to these issues at one point.

- The financial reporting issues, corrections of financial statements and auditor resignations are all red flags.

- The fact that these issues keep coming up again and again over the years, is an especially large red flag.

Ahmad Darmansyah/iStock via Getty Images

Super Micro Computer (NASDAQ:SMCI) made headlines last week when it announced that it had wrapped up an internal investigation into its accounting practices. The stock shot up 30% in a single day when that news came out. If Super Micro Computer can overcome the concerns about the reliability of its financial reporting, then its stock is likely a good value today, as it is at just 20 times earnings while growing revenue at 109%.

Unfortunately, SMCI’s press release announcing the wrap up of the investigation is not proof that its numbers are accurate. The investigation was not an audit, but rather an internal review based on: A) legal advice from Cooley LLP; and B), a forensic accounting consultation done by Secretariat Advisors and paid for by SMCI.

Legal advice is not meant to uncover truths useful to investors; instead it is meant to help the one paying for the advice (i.e. management) navigate legal risks to achieve a desirable outcome. Financial consultations can at times inform an investment decision-making process; however, they are not governed by the rigorous regulations that govern audits, which means that there is not much oversight with them. Additionally, a consultant’s subject matter expertise is not usually financial health but rather helping clients achieve financial goals. The opinion of an auditor, such as the one that raised concerns about SMCI’s financial statements earlier this year (Ernst & Young) therefore carries greater weight than that of a consultant when financial health is in question.

The above paragraph is intended to convey that SMCI’s internal review was not based on the standard procedure used to evaluate financial reporting quality (i.e. auditing), but rather on a series of legal and financial consultations that SMCI management found appropriate. SMCI’s board ultimately had the final say in how the outside experts’ advice was interpreted, which is not the case in an audit. For this reason, I consider SMCI stock a weak hold, despite its apparently cheap valuation and high growth.

Background Story

Super Micro Computer is one of those stocks that investors either love or hate. On the one hand, bulls tout the company’s lightning fast growth and vital role in the generative AI industry. On the other hand, bears say that the company’s long history of accounting concerns casts doubt on everything bulls say about it.

As a value investor, I take the second position. SMCI does, in fact, have a long history of accounting issues, and worse still, the specific issue that keeps coming up again and again–incorrect revenue recognition–has direct bearing on top line growth as well as profitability. If a company’s revenue figure is off, then its earnings figure is by definition also off. Furthermore, SMCI has in the past paid fines stemming from its financial reporting issues. For example, the company paid out $17.5 million when the SEC found issues with revenue recognition and expense accounts in the company’s financial statements.

I can certainly see what investors like about SMCI. The company trades at 20 times earnings, while having:

-

A 108% revenue growth rate.

-

An expected 119% revenue growth rate next quarter, followed by slower but still positive growth throughout 2025.

-

75% y/y earnings growth.

-

66% y/y EBIT growth.

-

A 32% return on equity.

-

A 15% return on capital.

These are all very solid numbers–ones that would make SMCI a clear buy if its numbers could be trusted. The problem is that its numbers might be incorrect. We know for a fact that SMCI put out incorrect numbers at least once, because the press release it published after settling with the SEC spoke of it having corrected its previous statements–the word ‘corrected’ implies that the original statements were incorrect. Today we have SMCI’s former auditors saying that they still find the company’s representations unreliable. This is important because the figures the auditors refer to are materially impactful ones like revenue and earnings–we aren’t talking about slight issues in the footnotes here. Revenue in a given period gives you the revenue growth rate, a key growth metric. It also gives you half of the profit picture. Expenses, also an on-again off-again problem for SMCI, give you the other half of the profit picture. So the data in SMCI’s financial reports that many investors doubt, is some of the most important financial data on the company.

Is SMCI Putting Out Low Quality Financial Reports?

Having looked at the reasons why SMCI is not worth owning if its earnings are low quality or misstated, we can proceed to the next question, “are they really misstated?”

A quick and basic test we can use is the ratio of accounts receivable (AR) to revenue. This is a major indicator of earnings quality. If a company’s AR is rising faster than its sales, then the latter is considered low quality. A rising AR/sales ratio does not prove that an income statement is misstated, but does indicate that revenue is of low quality (because some of it is not yet collected). In SMCI’s case, it indicates that cash revenue will end up lower than reported revenue, because AR comes from credit sales, and SMCI’s allowance for doubtful accounts is usually greater than 0%. In 2019, it went as high as 2.21%.

Over the last 10 years, SMCI’s AR/sales ratio increased. Its revenue increased 22% CAGR, from $1.954 billion to $14.942 billion. Its accounts receivable increased 23.5% CAGR, from $322 million to $2.668 billion. The ratio of AR to sales increased from 0.165 to 0.178. The ratio itself is not all that high, but the fact that it is trending upward is a red flag. It is consistent with the claim that SMCI’s earnings are of low quality.

As for the possibility that SMCI’s earnings are not just low quality, but misstated, we can point to auditor Ernst and Young’s statement that it could not rely on “management’s and the audit committee’s representations.” A company’s management and audit committee together are responsible for the company’s financial statements. Its ‘representations’ therefore include the financial statements it puts out, a financial statement being a representation of a company’s financials. It would appear that Ernst and Young saw issues with SMCI’s financial statements after it resigned as the company’s auditor.

SMCI’s Internal Investigation

The most compelling counterargument to my claim that SMCI’s financial statements are unreliable is the fact that the company’s recent internal investigation cleared it of wrongdoing. The fact that the company hired outside experts–Cooley Law and Secretariat Advisors–to advise the investigatory panel lends some credence to the claim that the investigation was impartial. However, there are issues with using legal advice and financial consultations to determine financial reporting quality. Also, SMCI ultimately retained the ‘final say’ in how to interpret Cooley and Secretariat’s findings, meaning the investigation was not fully ‘independent.’

First, the legal advice. Lawyers deal with questions of law; a law firm finding that a company’s financial statements are fine indicates that the statements are compliant. That’s not nothing; however, it’s not the same as finding that the statements are correct. There is a category of financial report that is GAAP or IFRS compliant but nevertheless low-quality due to biased choices or earnings management. A legal review would not be expected to uncover that type of accounting issue.

Secretariat Advisors’ investigation might have identified such issues, but would not have been required to do so. The company’s review was not an audit, meaning that it was not governed by the many regulations that hold auditors accountable. For example, it was not subject to review by the Public Company Accounting Oversight Board (PCAOB). These occasional reviews, along with the fact that audits are required by law, are what keeps auditors reasonably objective despite the fact that they are paid by their clients. Basically, there is regulatory oversight over audits. There is no such oversight over forensic accounting consulting services, which are in the category of unregulated financial services. For this reason, the possibility that Secretariat itself made errors can’t be discounted.

The Risks to Shorts

Despite considering SMCI a sell, I do not think the stock would be suitable for shorting, the reason being that the company could be doing well. What is at issue with SMCI is the accuracy of its financial reports, not whether the reported figures are good or bad. The numbers themselves are quite strong, showing high growth as well as reasonably good margins. Below, I will explore the positives that SMCI has going for it, which make it a risky bet for shorts if its accounting concerns blow over.

Growth and profitability

In its most recent quarter, SMCI’s growth and profit metrics were quite good. The figures we have seen so far are only preliminary ones: Super Micro’s Q1 fiscal 2025 earnings have been delayed due to the accounting issues. With that said, here is what SMCI expects for the quarter:

- Net sales of $5.9 to $6.0 billion, down from previous guidance of $6-$7 billion, up 99.7% if reached.

- A 13.% gross margin. This implies about a $787 million gross profit, which will be a 122% y/y increase if reached.

- $0.75 to $0.76 in EPS, up 150% if reached.

As you can see, the growth rates here are lightning fast, and while they are not confirmed facts yet, they will become material if SMCI’s next auditor does a good job and finds them sound. Should that scenario play out, then SMCI will prove to have been cheap today.

Valuation

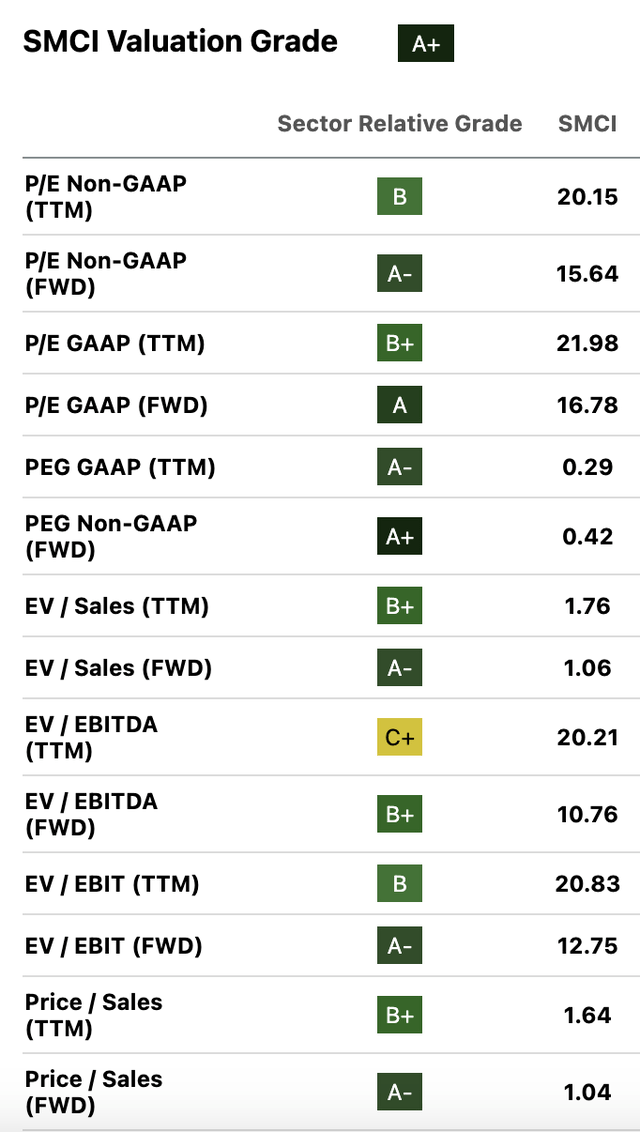

Speaking of ‘cheap,’ let’s look at SMCI’s valuation numbers. The stock currently trades at the following multiples:

SMCI multiples (Seeking Alpha Quant)

These are all quite low by the standards of “AI” companies these days. They are lower than the same multiples for Apple (AAPL), Meta (META) and Microsoft (MSFT), despite those companies not growing anywhere near as quickly as SMCI appears to be growing. So SMCI is a buy if its numbers are real.

Now of course, if SMCI’s numbers are being reported incorrectly, then its entire growth story could be false. The revenue figure that resulted in SMCI paying a $17.5 million settlement in 2020 was $150 million, and the revenue was recognized for 2015-2017 tax years. According to Seeking Alpha Quant, SMCI did between $1.95 billion and $2.4 billion in annual revenue in those years, so the $150 million improperly recognized was a non-negligible percentage of the company’s total revenue.

The Bottom Line

The bottom line on SMCI is that it’s a beaten down stock that’s been beaten down for a reason. The company’s accounting concerns are serious ones, and will be thesis-breaking to longs if proven true. At the same time, SMCI has enough things apparently going for it to be a big risk to shorts. For this reason, its stock is best simply avoided.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.