Summary:

- GameStop’s Q3 2024 earnings exceeded expectations, but revenue declined by 20.2%, highlighting ongoing challenges in the hardware and software segments.

- Despite a 29.4% stock increase since September, long-term performance remains poor, with shares down 69% since January 2021.

- Improved gross profit margins and interest income boosted net profits, but EBITDA continues to decline, indicating core operational struggles.

- Given overvaluation and persistent revenue issues, I maintain a ‘sell’ rating for GameStop stock, despite some positive financial metrics.

NicolasMcComber

After the market closed on December 10th, the management team at video game retailer GameStop (NYSE:GME) announced financial results covering the third quarter of the company’s 2024 fiscal year. Even though the stock had fallen for the day, shares recovered somewhat in after hours trading, rising up by roughly 3%, in response to management reporting earnings per share and adjusted earnings per share that came in higher than what analysts anticipated. Obviously, this is a positive, as is the fact that cash flows are improving on a year-over-year basis. However, I view this as a big nothingburger in the grand scheme of things for the business.

You see, I have long been bearish about the firm. Recently, that bearishness has not exactly played out well. Since I last reaffirmed the company as a ‘sell’ candidate back in September of this year, shares have jumped by 29.4%, handily outpacing the 9.8% increase seen by the S&P 500 over the same window of time. But over the longer run, I have been quite accurate. Since I originally turned bearish on the firm, rating it a ‘strong sell’ back in January 2021, the S&P 500 is up an astounding 60.9%. But over the same window of time, GameStop is down 69%. While I do acknowledge that things are improving for the firm in some respects, continued declining revenue and how expensive shares currently are is problematic. Even if the company survives, shares look drastically overvalued. Because of this, I’m keeping the firm rated a ‘sell’ for now.

A decent quarter, all things considered

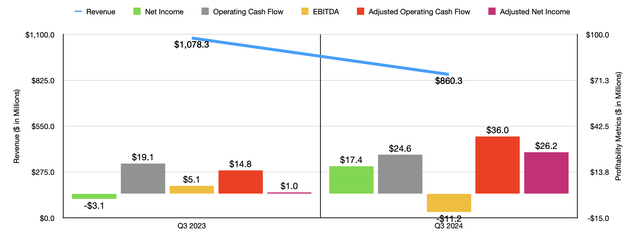

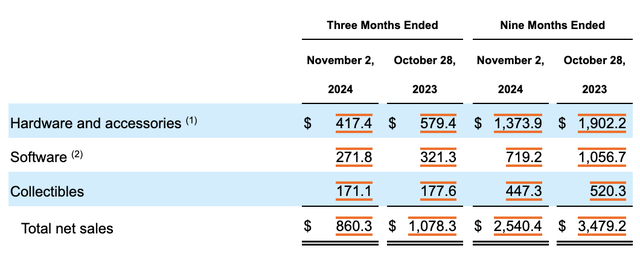

For the third quarter of the 2024 fiscal year, GameStop achieved some rather impressive wins. But not everything about the company went well. As an example, we need only look at revenue. During that quarter, sales for the company came in at $860.3 million. That’s down 20.2% compared to the $1.08 billion the company reported for the third quarter of 2023. Furthermore, it represents a miss compared to what analysts expected. They thought that revenue would be $27.7 million higher than it ultimately came in at.

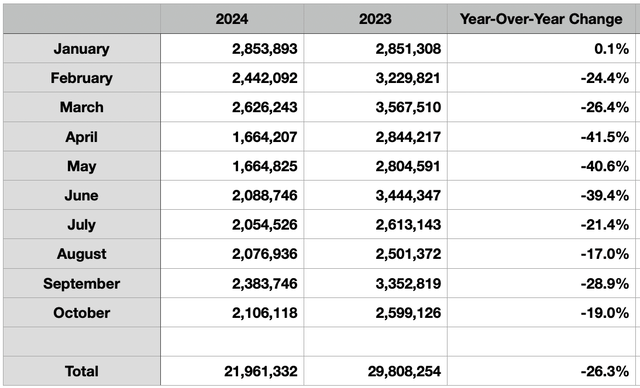

During this time, the video game retailer saw weakness across all three of its major product categories. Hardware and accessories revenue, for instance, dropped by 28% year over year from $579.4 million to $417.4 million. To be fair, the hardware space has been rather difficult this year. From January through October, total global console sales for the video game industry came in at 21.96 million units. Although that sounds impressive, it actually represents a decline of 26.3% compared to the 29.81 million reported for the same time last year. When it comes to the months that represent the third quarter for the company as a whole, console sales came in at 6.57 million units. That’s down 22.3% compared to the same window of time for 2023.

*Global

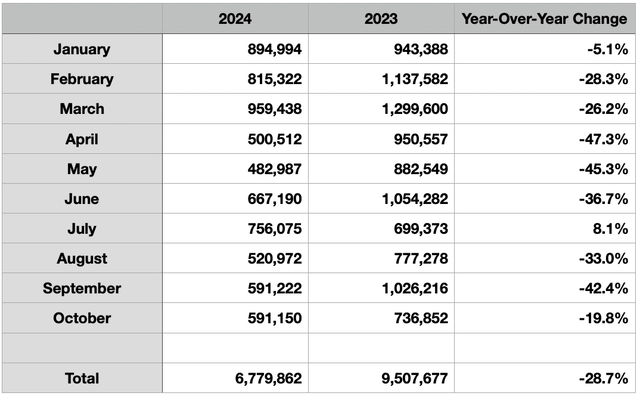

We have seen similar weakness when focusing on the US only. From January through October of this year, console sales totaled 6.78 million units. That’s a drop of 28.7% compared to the 9.51 million reported at the same time in 2023. And for the windows of time that represent the third quarter for the company, we end up with 1.7 million units, that’s down a whopping 32.9% compared to the same three-month window in 2023. The reason why I’m looking at U.S. sales on their own is because, during the latest quarter, 64.1% of the firm’s revenue came from the US market.

*US Only

This wasn’t the only weakness for the company. Software revenue also took a hit too, declining by 15.4% from $321.3 million to $271.8 million. It has long been my opinion that if GameStop is going to survive in the long run, it must do so by moving more in the direction of software, specifically offering up its own. And as I pointed out in my previous article about the company, the overall global gaming industry is expected to continue climbing for the foreseeable future, rising from $183.9 billion last year to $187.7 billion next year before ultimately growing to $213.3 billion in 2027. Much of this will be in the form of software revenue. So to see the company report a decline in software sales is certainly discouraging.

If there was a bright spot for the business from a revenue perspective, it would involve its collectibles. When the company first moved heavily into this space, there was optimism that it would allow the firm to change. However, recent results have been disappointing. In the latest quarter, sales for the business came in at $171.1 million. That’s down only 3.7% compared to the $177.6 million the company reported from collectibles revenue the same time last year. To give credit where credit is due, management has been working to improve these operations.

In October, for instance, the company announced that it was entering into a collaboration with PSA, which is the largest trading card and autograph authentication and grading service on the planet, whereby GameStop will operate as an authorized PSA dealer and will also provide authentication and grading services throughout the US. This is an interesting business. But it also makes me think back to some of the other moves the business has made that ultimately failed, such as its NFT marketplace, which ultimately shut down two years after it was originally announced.

Even though revenue for the company took a hit, the bottom line did come in better than expected. During the quarter, the company reported a profit per share equivalent to $0.04. That happens to be $0.07 greater than what analysts were hoping to see. It’s also comfortably higher than the $0.01 loss per share the company reported the same time last year. This improvement marked a turnaround for the company in the sense that, instead of generating a $3.1 million loss last year, it generated a $17.4 million gain this year. This is in spite of the fact that the firm had $8.6 million worth of impairment charges in the third quarter of this year.

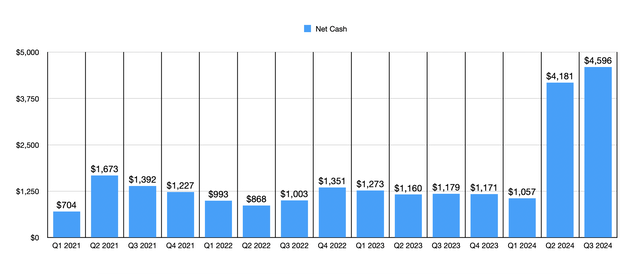

This improvement on the bottom line was driven in part by an improvement in the company’s gross profit margin from 26.1% to 29.9%. Even though the company saw some improvements on that front, its selling, general, and administrative costs worsened from 27.5% of sales to 32.8%. As revenue falls, this part of the company is going to continue to struggle. However, the company did benefit tremendously from a surge in interest income from $12.9 million last year to $54.2 million this year. This is because, as the chart below illustrates, the company’s net cash position has improved drastically. This can really be attributed to significant share issuances.

The largest of these occurred back in June of this year and involved the sale of 75 million shares of stock for $2.137 billion. The most recent, however, involved the sale of 20 million shares in exchange for $400 million. While this certainly lowers the risk for shareholders and creates additional opportunities for management to make some transformative move, this does come at a hefty cost. From the third quarter of last year through the third quarter of this year, shareholders were diluted by a whopping 3.3%.

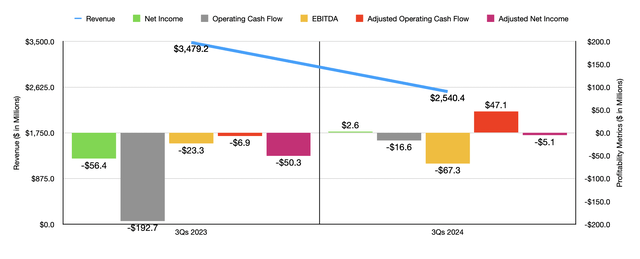

And also keeps track of adjusted earnings per share. This figure also came in higher than what analysts were expecting to see. During the quarter, it totaled $0.06. That’s up from the $0.00 the company reported the same time last year, and it happens to be $0.06 greater than what analysts were anticipating. This translated to a rise in adjusted net profits from only $1 million last year to $26.2 million this year. Other profitability metrics also improved for the most part. Operating cash flow grew from $19.1 million to $24.6 million, while the adjusted figure for this expanded from $14.8 million to $36 million. However, this was really only because of the growth in interest income. The real health of the company in this respect can be seen by looking at EBITDA. It contracted year over year from $5.1 million to negative $11.2 million.

In the chart above, you can also see results for the first nine months of this year compared to the first nine months of 2023. The same factors that impacted revenue in the latest quarter pushed sales down significantly this year compared to last year. While it is true that the company’s net profits and cash flows improved nicely during this time, we once again see a decline in EBITDA from negative $23.3 million to negative $67.3 million. One could argue that the operating cash flow figures are more relevant for the business because they do represent true cash flows. And that is technically true. However, with interest rates now falling and with EBITDA showing a continued decline in the core operations of the company, the company suddenly turns from looking like a turnaround play in action to a sandcastle waiting for the tide to flow in.

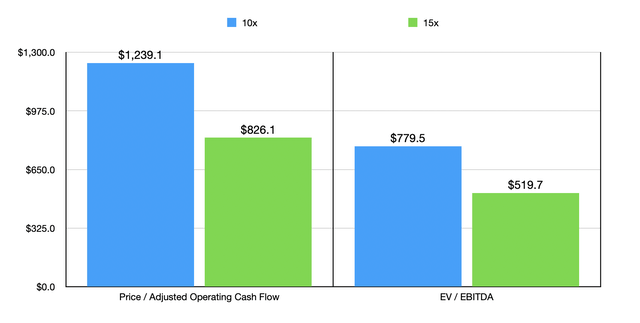

To be fair, it is theoretically possible for GameStop to stage a turnaround. But it is a heck of a long shot. Let’s take an example where the company does actually improve. Even in that case, it’s difficult to imagine upside for investors. In the chart below, you can see just how much adjusted operating cash flow the company would need to generate in order to be fairly valued at a price to adjusted operating cash flow multiple of 10 or 15. And I did the same thing with EBITDA in relation to the firm’s enterprise value. In essence, the firm would need to see its cash flow figures rise materially just to be worth what shares are currently trading at, not to mention what investors would like it to be worth if they are buying at these prices.

Takeaway

I have fond memories of GameStop growing up. I really did enjoy spending a good portion of my youth going in and out of its doors. But unfortunately, when it comes to investing, it’s important to put personal feelings aside. The fact of the matter is that while GameStop has shown some improvements, it’s far from being a good opportunity for investors. Because of this, I believe that keeping it as a ‘sell’ candidate makes the most sense

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!