Summary:

- My next purchase of Meta Platforms stock could take my weight beyond that of its S&P 500 index weight.

- The company topped analysts’ estimates for both revenue and diluted EPS in Q3.

- Meta’s net cash and marketable securities position swelled to more than $42 billion as of September 30th.

- Shares of the tech juggernaut could still be priced at a 9% discount to fair value.

- Meta looks set up to continue delivering solid total returns in the next couple of years.

Instagram, WhatsApp, and Facebook apps shown on a screen. stockcam

As a dividend growth investor, my investment approach is becoming more heavily rooted in world-class quality. What do I mean by quality? I mean companies operating as leaders in vast and growing industries. I also define quality as a business with a firm investment-grade credit rating, so preferably around the high-BBB range and up. Finally, where applicable, I look for a well-covered payout with room to keep growing.

In my opinion, the social media and digital advertising giant, Meta Platforms (NASDAQ:META), perfectly fits the bill. As I noted in my August strong buy rating article, Meta is a leader in the digital advertising industry that’s expected to surpass $1 trillion in annual revenue by 2030 per Grand View Research. At the time, I also liked Meta for its immense free cash flow and strong net cash and marketable securities position. Finally, shares also looked to be moderately undervalued relative to my fair value estimate.

Today, I’m downgrading the stock to a buy rating. This has nothing to do with Meta’s fundamentals: The company remains admirably positioned for future growth and the balance sheet remains sound. In the time since my last article, shares of Meta have soared 20%, more than doubling the 8% gains of the S&P 500 index (SP500) in that time. From my perspective, that has somewhat diminished the value proposition of shares from the current valuation.

Meta Keeps Delivering For Shareholders

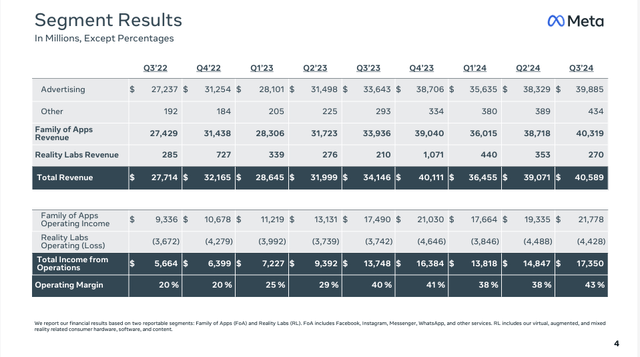

Meta Q3 2024 Earnings Presentation

On October 30th, Meta released its third-quarter earnings report. The company didn’t disappoint, either. On the contrary, I was very pleased with its results. Meta’s total revenue jumped 18.9% year-over-year to $40.6 billion. For perspective, this beat Seeking Alpha’s analyst consensus by $280 million.

This respectable topline growth was driven by two components: First, Meta’s growth in daily active people to 3.2 billion drove ad impressions to rise by 7% over Q3 2023. As I outlined in my previous article, this was because of higher disposable income in key emerging markets around the world. That led more people to sign up for Meta’s social media platforms.

Second, the company fetched 11% higher prices versus the year-ago period. That pricing growth was fueled by a mix of increased advertiser demand and improved ad performance from the continued integration of AI into ads.

Shifting gears to the bottom line, Meta’s diluted EPS climbed 37.4% year-over-year to $6.03. This topped Seeking Alpha’s analyst consensus by $0.74. Thanks to careful cost management, the company’s expenses rose at a much slower rate than revenue (+13.9%). That helped Meta’s net profit margin to expand by 470 basis points over the year-ago period to 38.7%. This led the company’s diluted EPS growth to easily outpace revenue growth for the period.

Looking at the future, Meta should have plenty of double-digit annual diluted EPS growth left in the tank. For one, Instagram Reels is continuing to see good traction per CFO Susan Li’s opening remarks during the Q3 2024 Earnings Call. This was evidenced by more than 60% of recommendations being sourced from original posts in the U.S. According to Li, that’s helping people find unique content and earlier stage creators get discovered. These are distinct positives for monetization in the years ahead.

Another plus for Meta is that video engagement continues to trend toward short form. This is leading to organic video impressions growing faster than overall video time on Facebook. Li points to this as more chances to serve ads, which means more overall revenue for Meta.

Finally, improving monetization efficiency is driving better performance for the company. Since Meta adopted new learning and modeling techniques in the first half of this year, it has already observed a 2% to 4% increase in conversions based on testing in selected segments per Li.

For these reasons, the FAST Graphs analyst consensus projects that Meta’s diluted EPS will compound by 12% in 2025 to $25.41. Another 13.3% jump in diluted EPS to $28.79 for 2026 is the current analyst consensus.

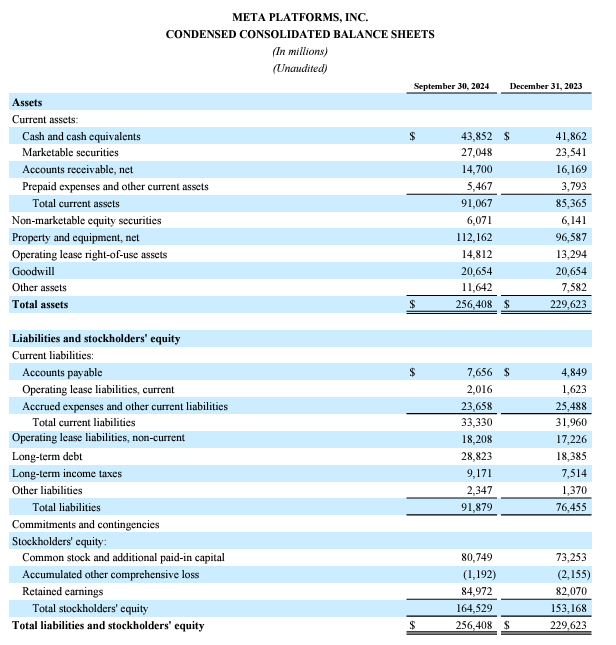

Meta Q3 2024 Earnings Press Release

Meta is a force to be reckoned with financially, too. As of September 30th, 2024, the company possessed a $42.1 billion net cash and marketable securities position. This puts the company on pace to record around $1.6 billion in net interest income in 2024. That’s why Meta enjoys an AA- credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to Meta’s Q3 2024 Earnings Press Release, Meta’s Q3 2024 Earnings Presentation, and Meta’s Q3 2024 10-Q Filing).

Fair Value Is Approaching $700

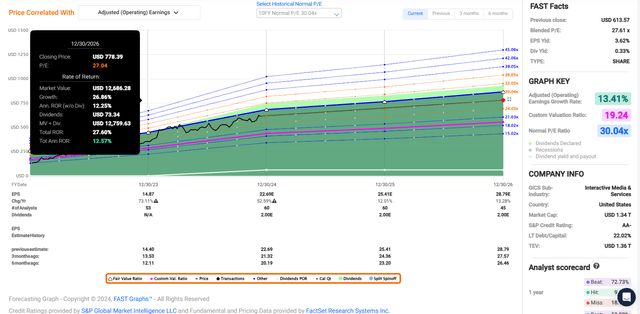

FAST Graphs, FactSet

Meta may not be as strong of a buy as it was a few months ago. However, I do still believe that it is buyable here. That’s because the stock is trading at a forward P/E ratio of just 24.5. For context, that’s substantially lower than its 10-year normal P/E ratio of 30 per FAST Graphs.

To be clear, I don’t believe that 30 represents a realistic fair value multiple for Meta’s shares moving forward. This is because the law of large numbers dictates that the company’s future growth won’t be quite as strong as its growth logged in the past. At the same time, though, Meta is consistently expanding its margins and becoming more profitable than ever. That’s why I believe that fair value is one standard deviation below the 10-year average, which would be a P/E ratio of approximately 27.

The calendar year 2024 is 94% complete. That leaves another 6% of 2024 and 94% of 2025 ahead in the next 12 months. This is how I arrive at a forward 12-month diluted EPS input of $25.25.

Applying a fair value multiple of 27, I get a fair value of $682 a share. That equates to a 9% discount to fair value from the current $622 share price (as of December 10th, 2024). If Meta meets the growth consensus and reverts to my fair value, it could be set to generate 28% cumulative total returns through 2026.

A Dividend Powerhouse In The Making

The Dividend Kings’ Zen Research Terminal

Meta’s 0.3% forward dividend yield is well below the communication services sector median forward yield of 3.4% per Seeking Alpha’s Quant System. Because of my age, I’m willing to overlook this minimal starting yield, though.

That’s because Meta’s diluted EPS payout ratio for 2025 from the current annualized dividend per share of $2 would be approximately 8%. According to The Dividend Kings’ Zen Research Terminal, this is substantially lower than the 60% payout ratio that rating agencies prefer from the company’s industry.

Meta’s dividend also appears poised to be easily covered by free cash flow as well. The FAST Graphs analyst consensus free cash flow per share of $19.78 for 2025 points to a payout ratio of roughly 10% from the current annual payout. This is yet another reason that I believe Meta’s dividend growth will at least moderately outpace diluted EPS and free cash flow per share growth for the foreseeable future. That’s why I am optimistic that the company’s dividend per share could compound at a double-digit rate annually for many years. For my time horizon, this type of growth potential fits my investment objectives well.

Risks To Consider

Meta is a remarkable company. Even so, every stock faces risks. There’s no potential for alpha without risk after all. Meta is no different.

One risk that I touched on in a previous article was the high-risk activities in which Chairman and CEO Mark Zuckerberg partakes. These include surfing and combat sports. If Mr. Zuckerberg were hurt or otherwise unable to fulfill his duties as Chairman and CEO, that could leave Meta without its visionary. This could prove to be a setback to the company.

Another risk to Meta is a reversal of the network effect tailwind that has benefited it over the past two decades. If users leave the company’s platforms for other social media platforms, this could begin a difficult-to-break cycle of user declines. That could hurt the company’s fundamentals.

One last risk facing Meta is the information that it has about billions of users around the world. There are few if any troves of data that contain as much sensitive information as that which is stored on Meta’s servers. If these are hacked, that could compromise the sensitive data of users. This could result in a loss of trust among users and lead to sizable legal settlements against Meta.

Summary: Not Quite A No-Brainer Buy Now But Still Compelling

Since my initial purchase in July, Meta has quickly climbed to 2% of my portfolio and my 13th-biggest position. In the coming weeks, I am considering upping this position by about 40% to bring it up to a nearly 3% weight. That would be a bit above the S&P 500’s 2.6% weight. This would also bring me closer to my ultimate target weight of between 4% and 5%.

Meta checks all the boxes for me. The business has promising growth prospects. The balance sheet is unbelievably strong. The dividend has a path to potentially grow at a high rate for many years. The valuation is no longer at bargain levels, but it’s still a decent deal. That’s why I’m updating my rating to a buy rather than a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.