Summary:

- Consumer discretionary stocks have struggled but are rebounding with recent FED rate cuts, with XLY outperforming SPY and DIA significantly.

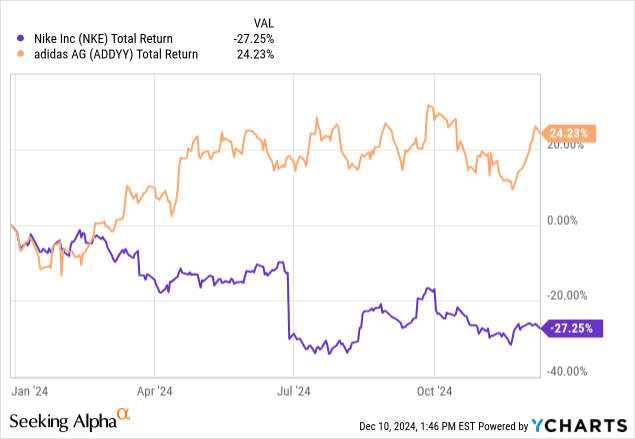

- Nike, despite its brand dominance, has seen a 27% loss YTD, while Adidas has delivered a 24% gain, post-Yeezy settlement.

- Adidas shows stronger recent performance with increased sales, profits, and a promising turnaround plan, while Nike faces a challenging transition under new leadership.

- Both companies have similar valuations and debt metrics, but Adidas’ growth-oriented portfolio and current momentum make it a more compelling investment.

We Are

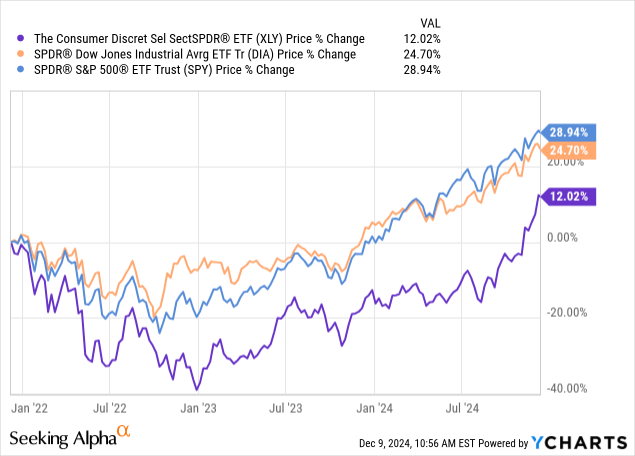

Consumer Discretionary stocks have been struggling over the last few years. With interest rates on the rise, consumers have been forced to tighten their belts, and directing their purchases towards more essential items.

As a result, revenues have been under pressure, and margins have dropped due to both higher costs and the need to cut prices to reduce inventories.

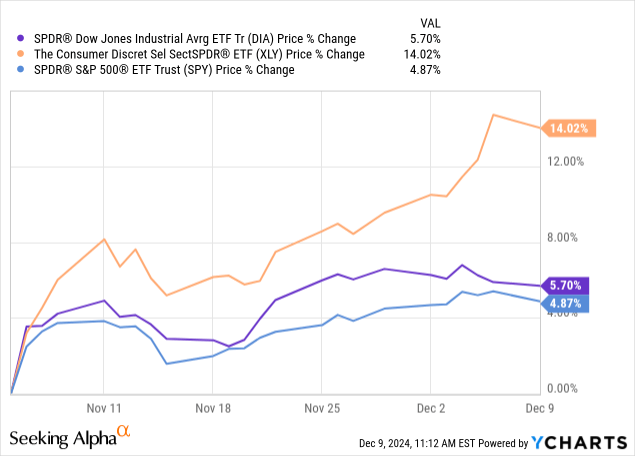

Investors have rotated out of the sector, as shown by the lagging share price growth of the sector ETF (XLY) compared to the Dow Jones (DIA) and S&P 500 (SPY).

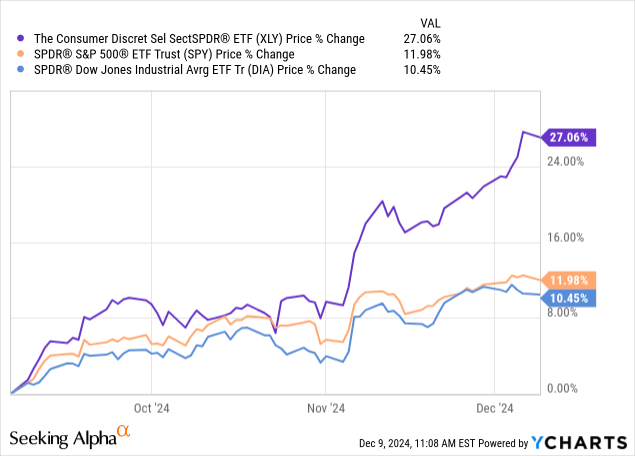

However, in recent months, with the Fed shifting into a rate cutting cycle, and general signs of consumer lead economic resilience, consumer discretionary stocks have been playing catch up. Over the last three months, XLY has returned 27% vs 12% for SPY and 10.5% for DIA.

XLY outperformance has accelerated in the month since the U.S. Election, with XLY returning 14% in just the last month.

Today I want to zoom into a sub-segment of the consumer discretionary sector, the sports shoe and apparel segment. We are going to go head-to-head with two leading brands, Nike (NYSE:NKE) and Adidas (OTCQX:ADDYY).

Nike vs Adidas

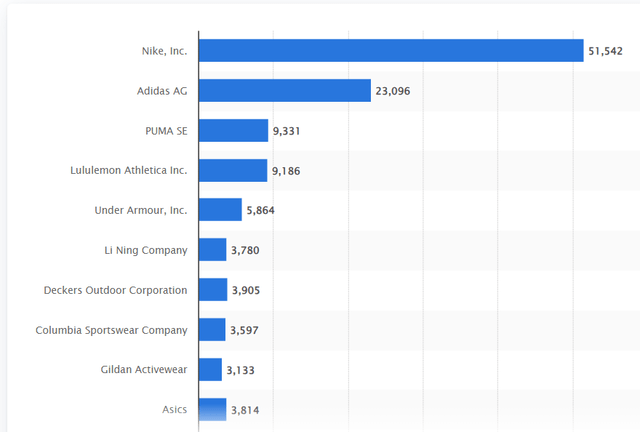

Neither brand needs much of an introduction, being the two largest companies in the sector by revenue. Nike is the giant in the room, with more than double the revenues of Adidas. However, Adidas itself is twice the size of Puma, its nearest competitor.

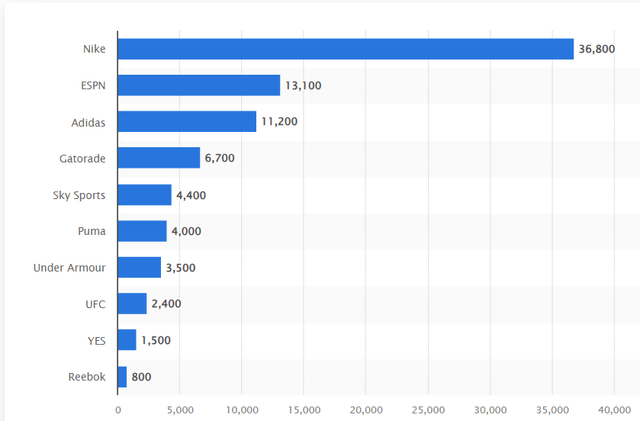

In terms of brand value, Nike is the undisputed king, with an estimated brand value of $37bn, more than triple the estimated brand value of Adidas, which comes in at $11bn.

Brand Value 2019 $m (Statistica)

So Nike wins both in terms of sheer scale, but also in the critical field of brand recognition. But does that make it a better investment than Adidas today?

Let’s have a look at somehow the two businesses have been performing for investors.

Shareholder Returns

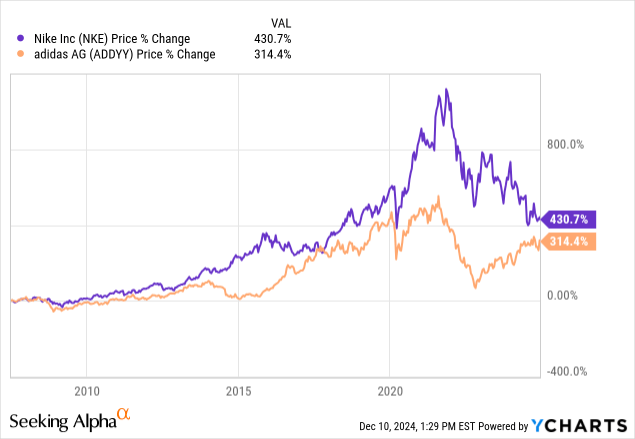

Over the long term, Nike has certainly delivered for shareholders, with a total return of 430% compared to just 314% for Adidas over 20 years.

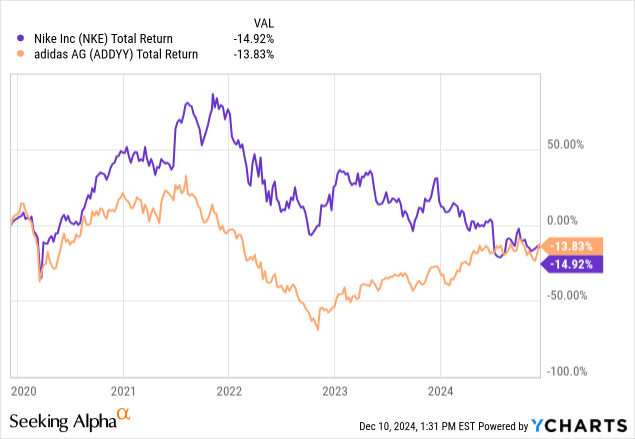

However, over the last five years since the Covid era, relative performance has normalised. While neither has been a happy place to invest, along with the rest of the consumer discretionary space, Adidas has just pipped Nike to the post in terms of a slightly smaller drawdown.

One big factor in the Adidas relatively sharper decline from 2022 – 2023 could be the collaboration with controversial rapper Kanye West. They had a JV brand ‘Yeezy’.

West hit the headlines in 2022 due to some alleged anti-semitic comments. Adidas, as a German company, in an industry where brand matters first, was extremely sensitive to this. Although Adidas responded swiftly, the Yeezy settlement dragged on until earlier this year, when it was finally resolved, as reported here by the BBC.

While other factors are surely at play, Adidas has made a great comeback vs Nike since settling the case. In fact, year to date, Adidas shareholders have enjoyed a total return of 24%, compared to a 27% loss for Nike investors.

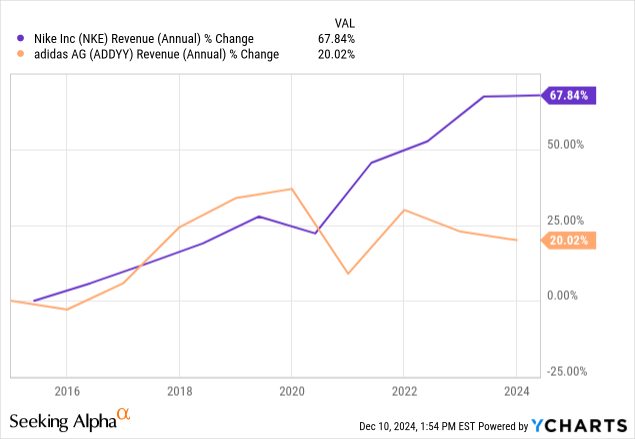

Revenues

In terms of overall sales, Adidas has had two distinct periods of under-performance. First was during Covid, in which Nike sales were impacted far less. This can be explained by the portfolio differences. Nike is more of a pure play sports brand, whereas Adidas combines sport with a stronger leisure footwear and apparel business. Post Covid Adidas recovered quickly until 2022 when sales dropped off again.

Net Income

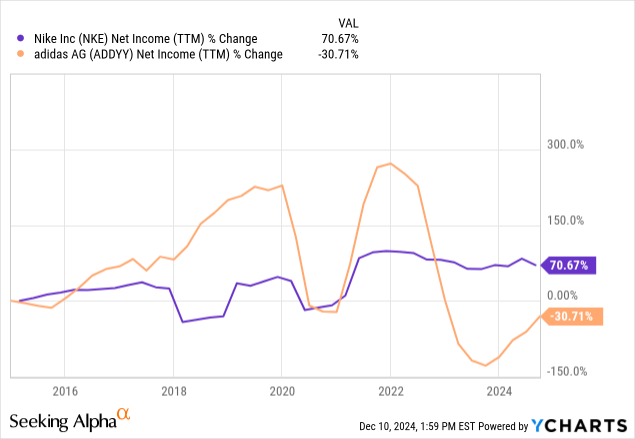

A similar pattern emerges here, with Adidas net income growth outpacing Nike until Covid, recovering sharply, then falling off a cliff in 2022.

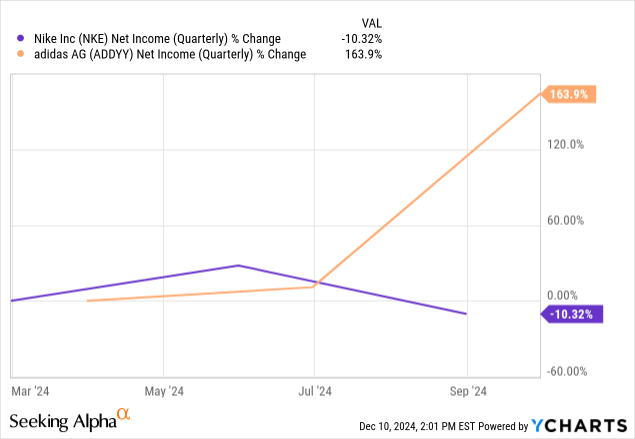

And just look at the recovery year to date:

Nike has stagnated, while Adidas has grown net income dramatically.

Most Recent Performance

Nike

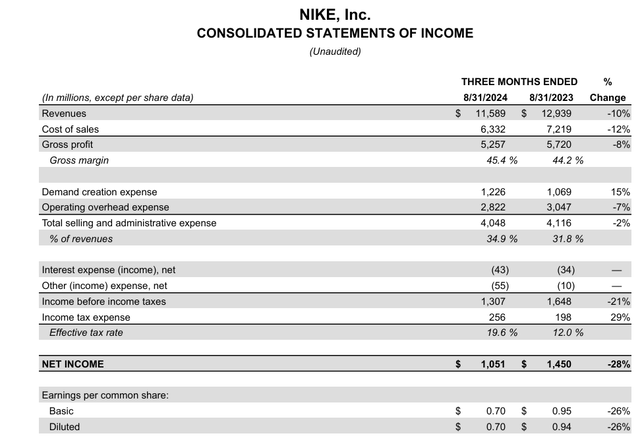

Nike reports on a June 1st Financial Year. The most recent earnings release was on October 7th. This was the first earnings release under a new CEO, Elliott Hill.

The company is clearly struggling. Revenues for the latest quarter were down 10%, and while gross margins improved slightly, gross profits were down 8%.

Nike has been investing heavily in marketing, with a 15% increase in costs, while cutting overheads. The equation didn’t balance, with a 2% increase in SG&A.

Pre-Tax income was down 21%, and, to put the icing on the cake, the effective tax rate increased by 29% from 12% to 19.6%.

Net income was down 28%, and EPS down 26%.

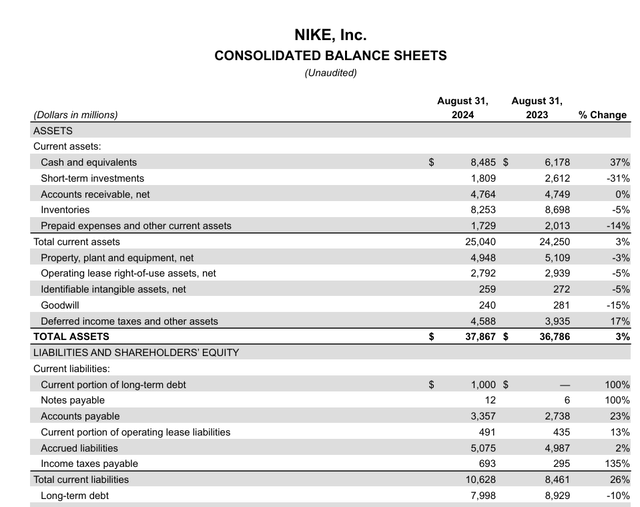

The balance sheet grew overall by 3%, while long-term debt was reduced by 10% to $8bn.

On the conference call, guidance for the coming quarter showed little promise. Expectations were set for a continued 8-10% drop in sales, a flow through to net income, and a continued ‘high teens’ tax rate. All new CEOs like to set low expectations, and exceed them, but even accounting for this there seems little to cheer about.

The overwhelming message is of a business entering a turnaround.

Adidas

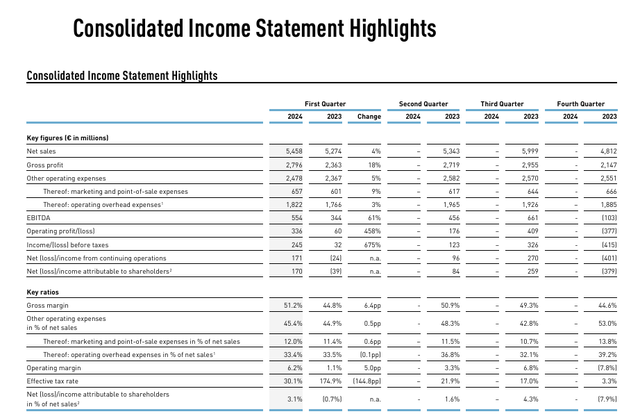

At Adidas, the picture is markedly different, as detailed in the results factsheet.

Net sales for the quarter were up 4% year-on-year. Gross profit increased by 18%. EBITDA increased 61%. The operating profit and net income increased by 4.5x and 6.5x, respectively.

Granted, the comparison was from a year in which Adidas was only marginally profitable, however, the turnaround at Adidas seems to be in.

Net Income was still just 3% of sales, whereas Nike’s net income to sales was over 8.6% for the quarter.

Clearly, this leaves a lot to be done by Adidas in terms of continued margin improvements.

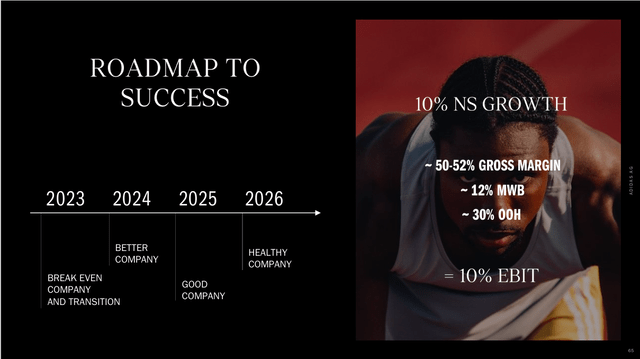

Their shareholder presentation lays a roadmap to a 10% EBITDA to sales by 2026. This is via a combination of double-digit sales growth and reductions in the marketing budget and overheads to drive margins.

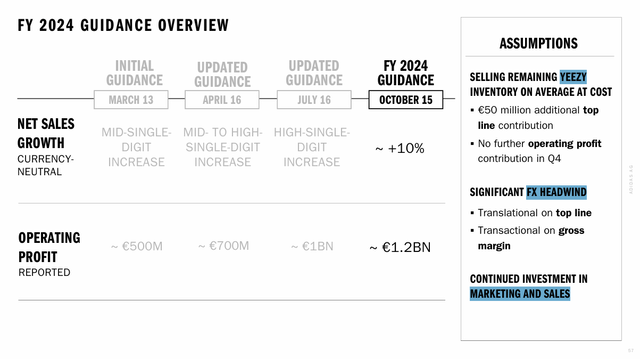

While these targets seem ambitious, it is encouraging to see how 2024 has been a year of consistent increased guidance from management.

Valuation

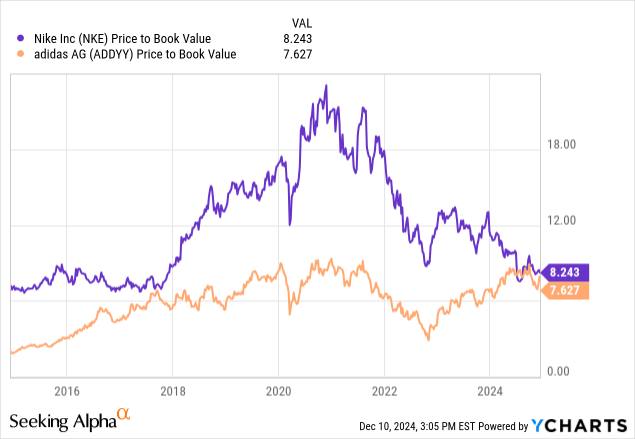

On a price to book value, the two are pretty close, with Nike’s valuation having been brought down to earth.

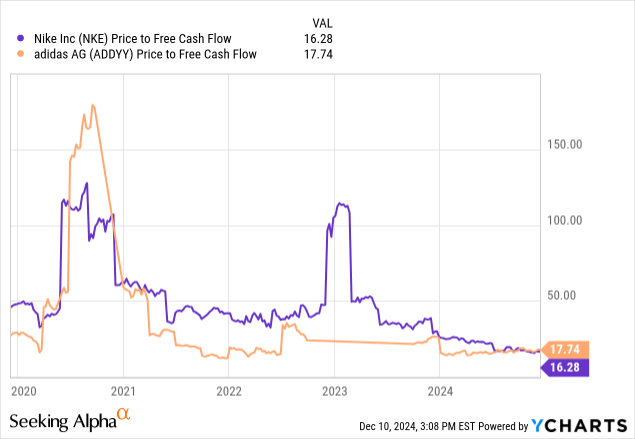

Price to Free Cash Flow shows a similar picture. They are neck and neck after the recent share price convergence.

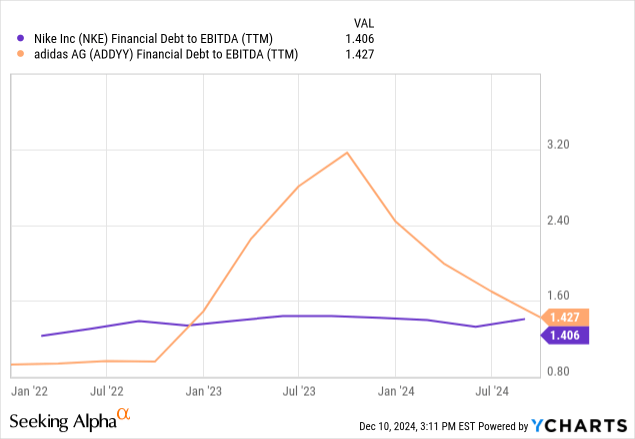

Balance Sheet In terms of financial leverage, again, at current the pair are running neck and neck, as Adidas earnings improvements have converged the debt metric.

Conclusion

- Both Nike and Adidas have suffered from constrained consumer demand.

- Adidas shot a brand management ‘own goal’ with the Kayne West ‘Yeezy’ episode.

- Adidas has settled with West, and are well on the road to performance improvement.

- Nike is just entering a transition phase with a brand-new CEO.

- The share price momentum is in favour of Adidas.

- While Nike has a more valuable brand, Adidas arguably has a better growth oriented portfolio.

- Both have improving and acceptable debt metrics.

- While it is a close race, in this one my decision is in favour of Adidas, who seems to have a head start.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The author is not an investment advisor, and offers no advice. He shares his analysis solely for the interest of readers.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.