Summary:

- JPMorgan is best of breed and long-term shareholders have done exceptionally well holding the stock.

- JPMorgan is a defensive, flight-to-quality and outperforms both in recessions and in the long term.

- The key risk currently is rapidly rising capital requirements.

- The most concerning aspect is the recent speech by the Fed’s new Vice Chair for Supervision.

- JPM capital requirements may need to increase materially in the next few years.

subman

JPMorgan (NYSE:JPM) is clearly best-in-class in the U.S. banking industry. It has been referred to as “Fortress Dimon” and the “Lebron James of banking” for very valid reasons. JPMorgan is a defensive, flight-to-quality play, aided by higher capital, superior risk management, and outperformance during market drawdowns.

In my view, JPMorgan is like the Apple (AAPL) of banking. Investors should hold, buy dips, and not trade the stock. It is solid as a rock as it successfully targets to deliver 17% RoTCE throughout the cycle which is an astonishing rate to compound book value over time. Even in a very deep recession, expect the stock to remain solidly profitable.

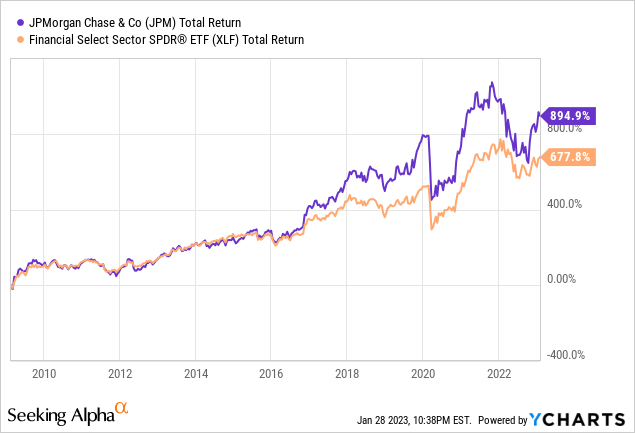

The relative performance since the 2008/2009 global financial crisis (“GFC”) clearly demonstrates the value position. JPM outperformed the Financial Select Sector SPDR ETF (XLF) by a considerable margin:

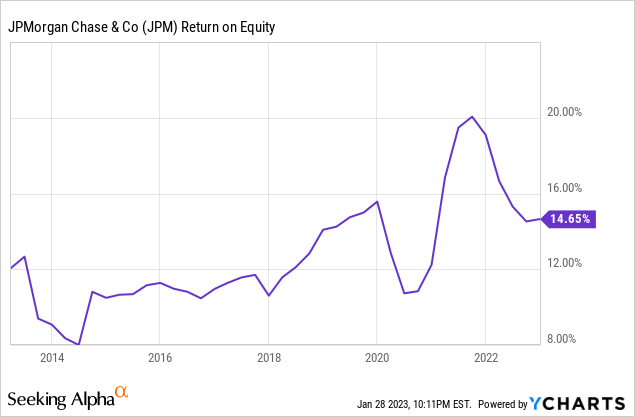

The above chart shows the ROE during the last 10 years. Note that RoTCE is generally ~3% to 4% higher for JPM (so investors should add that to the chart) as the equity denominator includes a large amount of goodwill from prior acquisitions. As noted above, JPM targets to achieve 17% RoTCE throughout the cycle. The outperformance (i.e. ROE) in recent periods reflects a positive trading environment in both FICC and Equities trading as well as rising interest rates environment.

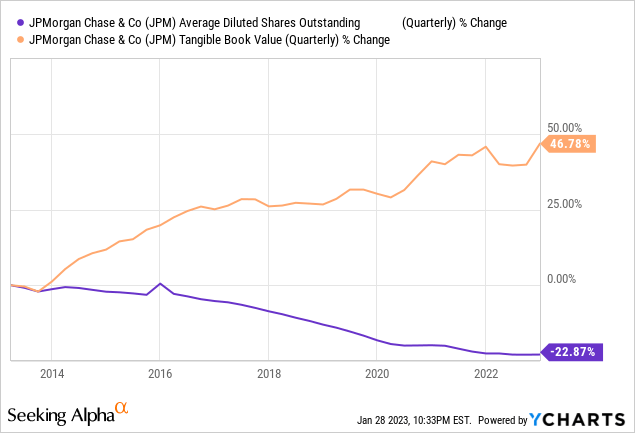

As can be seen below, JPM has been steadily growing book value and reducing share count whilst still paying a dividend with an average yield of ~2.5% to 3%.

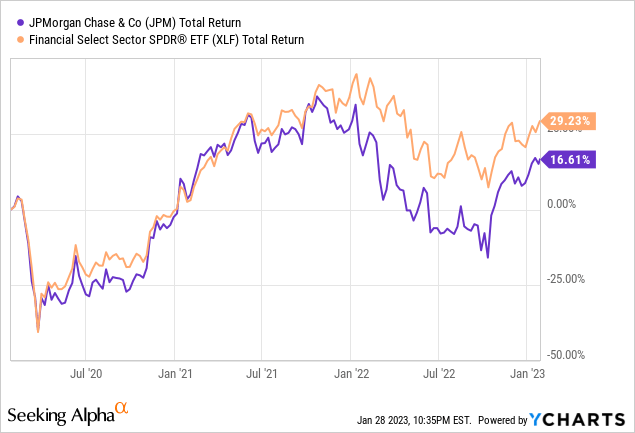

However, in the last 3 years, JPM has underperformed the XLF despite very strong earnings prints. This is due, in my view, to expected higher capital requirements in the next few years as opposed to underlying performance of the firm.

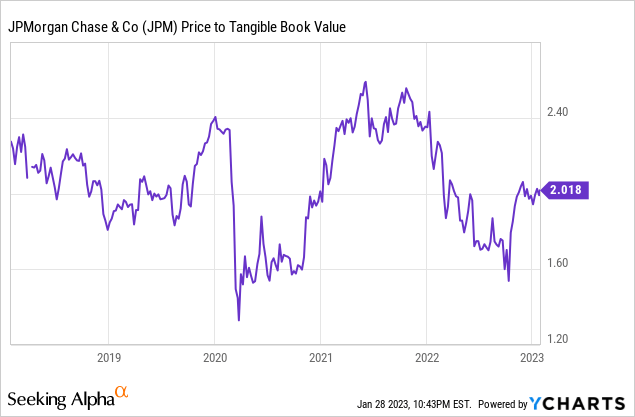

JPM valuation is best assessed through price to tangible book value metrics:

As can be seen from above, JPM is now trading at the low range of price to tangible book valuation metric (excluding the pandemic and market drawdowns). This is in spite of it delivering stronger RoTCE prints that are powered by higher rates and a strong trading environment.

So what is holding back the share price?

The key concern is JPM’s increasing targeted capital ratios. Higher required capital ratios are typically viewed by investors as a negative, as these, all else being equal, reduce the RoTCE a bank generates. It also slows down the amount of capital distributed to shareholders in the form of buybacks and dividends.

The potential headwinds on JPM’s capital ratios are multiple, material and include the following items:

1) Stress Capital Buffer (“SCB”) as computed yearly by the Fed’s CCAR stress test. In 2022, JPM’s ratio has gone up to 4% from the previous 3.2%. I expect JPM to optimize for SCB in the 2023 stress test cycle and hopefully keep it steady or reduce it from current levels.

2) JPM’s G-SIB score has steadily gone up and is now the G-SIB surcharge is now expected to be as high as 4.5% in 2024, compared with 3.5% previously.

3) The Federal Reserve Board is expected to release the final Basel III regulatory framework rules in Q1’2023 which is expected to apply to US banks from January 2025. These are expected to result in higher capital requirements for banks.

4) The Fed’s new Vice Chair for Supervision, Michael Barr, has expressed his view in a recent speech that the banking system needs higher levels of capital and revealed that the Fed embarked on a “holistic review” of capital standards.

So putting this all together, investors are rightly fearful that JPM’s capital ratios will need to increase materially in the next several years.

What Should Investors Make Of This?

This is clearly very meaningful for the investment thesis and the outcomes are highly uncertain. I am less concerned with items 1 to 3 above, where JPM has a proven track record and ability to manage by adjusting the business. The speech from Mr. Barr is more concerning given that it is a known unknown (but more on that later).

Naturally, the analysts were laser-focused on this topic in the recent earnings call and JPM’s CFO described some of the optimization work being carried out to offset Basel III RWS inflation:

Ebrahim Poonawala

Noted. And I guess just as a follow-up on you’ve managed RWA growth pretty well when you look at like loan growth year-over-year versus RWA, stayed relatively flat. As we think about just managing capital, how should we think about the evolution of RWA? Are there still opportunities to optimize that going into whatever the Fed comes out with on Basel? Thank you.

Jeremy Barnum

Yes. So there are definitely still opportunities to optimize. We’re continuing to work very hard, and it’s a big area of focus. Some of that is reflected in this quarter’s numbers, but some of the other drivers of this quarter are what you might call more passive items, particularly in market with RWA. And yes, but we should be clear that although we’ve said that the effects of capital optimization are not a material economic headwind for the company, they are also not zero. There are real consequences due to the choices that we’re making as a result of this capital environment. And in a Basel III outcome, that is unreasonably punitive from a capital perspective. There will be additional consequences to that. We obviously are hoping that’s not the case and believe that it’s not appropriate, but we will see what happens.

Betsy Graseck, the highly respected Morgan Stanley analyst, summed up the markets’ concern with the stock:

Betsy Graseck

Okay. And part of the reason for asking is one of the debate points on JPMorgan stock has been around the capital charges, the capital march. And will capital be a bigger burden for you to bear as we go through the next couple of years? ………And maybe that’s an unfair question today, and it’s a better question for Investor Day, but that’s kind of the debate that’s out there on the stock.

Jeremy Barnum

Got it. I mean it’s a fair question. It’s a good question. I am not going to answer it super specifically. And Jamie may have some views there too. But let me just quickly say, we have kind of said that we feel quite confident about this company’s ability to generate 17% in the cycle. And that’s incorporating our sense of the current environment, the operating leverage that you talked about, and the expectation of higher capital requirements with the 13.5% target in the first quarter of ‘24. The question of whether Basel III end game and other factors increase that number and how much of that we can absorb and still produce those returns is of course, impossible to answer right now. But I would remind you that it’s not just the denominator of our expansion, unreasonable capital outcomes will increase costs in the real economy, which goes into the numerator too. It’s not what we want, but that is the possible outcome.

The Speech From The Fed On Banking Supervision

In my view, this is the known unknown that can potentially upset the apple cart. In his speech, Michael Barr, clearly outlines his preference for higher capital requirements for large U.S. banks. The rationale is that nobody can predict the nature or severity of crises, it’s prudent to have larger buffers against unexpected outcomes. The likely path of implementing this is through incorporating a wider range of risks in the Fed’s stress test than currently factored in. This was summed up by Mr. Barr in the following paragraphs from the speech:

Capital provides a cushion against unexpected risks and unforeseen losses, those a humble and skeptical person might be careful to not try to predict with too much precision. Those a humble and skeptical person might guard against.

That is the spirit in which I am approaching the Fed’s holistic review of capital standards. There is a body of empirical and theoretical research on optimal capital, which attempts to determine the level of capital that equalizes the marginal benefits of capital with the marginal costs. While the estimates vary widely, and are highly contingent on the assumptions made, the current U.S. requirements are toward the low end of the range described in most of the research literature

The approach suggested by Mr. Barr suggests that large banks may not be able to “workaround” any changes to the rules by tweaking the business model. This seems to be a more fundamental requirement for higher capital on an absolute basis. One possible approach this could be implemented is by adding an incremental “operational risk” category to the CCAR test. In such a scenario, the banks would have very little maneuverability to optimize the outcomes leading to an absolute and material increase in capital requirements for the large U.S. banks.

Final Thoughts

The uncertain trajectory for capital requirements for JPM is currently the key reason the share price is held back. JPM is the most vulnerable large U.S. bank to such changes given its size and breadth of business model. Citigroup (C) is embarking on becoming materially smaller and pivoting to a less risky business model which should provide some offset. Goldman Sachs (GS) and Morgan Stanley (MS) wealth and asset management businesses are much less likely to be impacted and still have other levers to offset such requirements (e.g. GS can dispose of $59 billion of proprietary debt and equity investments currently on the balance sheet).

In an adverse scenario, where the Fed’s holistic review results in much higher capital requirements, I expect JPM’s management to look to offset it through the numerator (i.e. profits it generates). This will probably entail charging clients more (where possible) for services to compensate for higher capital ratios as well as implementing a deep and disciplined cost reduction program.

For me, JPM has always been and still is a long-term hold and not a trading position. I expect it to continue and compound book value for the next decade or so. Investors are advised to closely track the debate on the capital trajectory for the large U.S. banks and perhaps also consider investing in very attractively priced European banks such as Deutsche Bank (DB) and Barclays (BCS) who are strongly outperforming the U.S. banks currently.

Disclosure: I/we have a beneficial long position in the shares of JPM, C, MS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.