Summary:

- Tesla has rallied 77% since my bullish call, driven by strong fundamentals, and remains a ‘Strong Buy’ due to multiple positive catalysts.

- The upcoming budget Model Q, priced under $30,000 after-tax credits, is expected to significantly expand Tesla’s market reach and compete with top-selling vehicles like the Toyota Corolla.

- Tesla’s diversified ventures in energy and AI, along with stable legacy models and the promising Cybertruck, further justify its attractive valuation and strong growth prospects.

Veronique D/iStock Editorial via Getty Images

Introduction

I feel good because Tesla (NASDAQ:TSLA) has rallied by 77% since my bullish call on September 10. I think that the rally was fueled by robust fundamental factors and there is still more potential for the business to demonstrate further expansion. The company remains at the forefront of the EV revolution, and the expected budget Model Q release next year will extremely likely help the company to significantly expand its reach. The Cybertruck is expanding its footprint rapidly, while market positions of legacy models like Y and 3 remain stable as table. Let us also not forget that TSLA is not a purely automotive player. There are robust positive developments in the Energy segment and the company’s AI endeavors. The upside potential is not as wide as it was in September, but my valuation analysis suggests that TSLA is still attractively valued. I believe that all these reasons are strong enough to make me reiterate a ‘Strong buy’ recommendation.

Fundamental Analysis

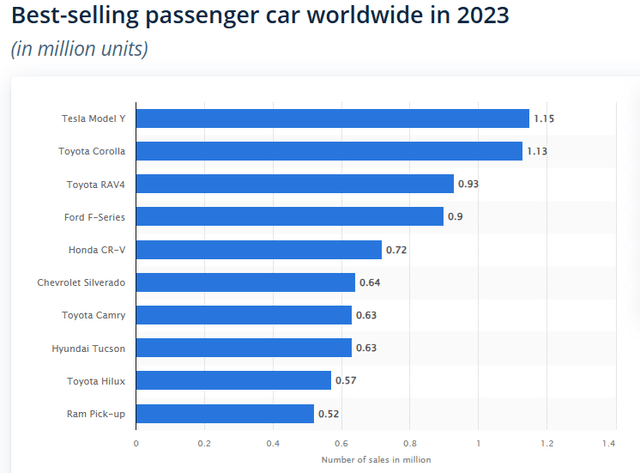

One of the most exciting 2025 catalysts that I see is the anticipated release of the budget Model Q. This is a sub-$30,000 vehicle after-tax credits, and expansion to this pricing segment cannot be underestimated. Model Q will become the direct competitor of a car that has consistently been among the world’s best-selling vehicles since the 1970s. Of course, I am talking about Toyota Corolla, the legendary model that surpassed total deliveries of 50 million over twelve generations.

Tesla’s Model Y already proved its ability to compete with Toyota Corolla, and the cheaper Tesla model will highly likely also conquer a notable portion of Toyota’s market share.

As Statista’s above chart suggests, Tesla Model Y was the best-selling passenger car worldwide in 2023. This is absolutely fantastic because the model’s production was launched only in 2020. Therefore, I have a firm conviction that due to targeting a large market of price-conscious customers, Model Q also has solid potential to become one of the best-selling vehicles worldwide over just a few years.

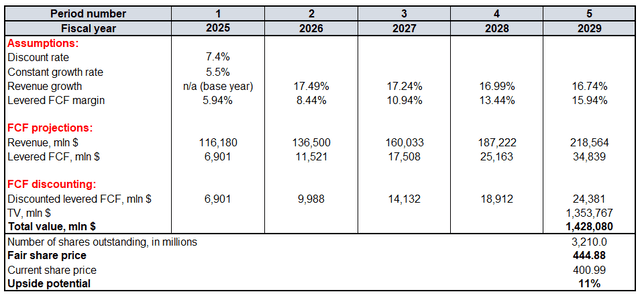

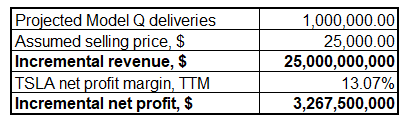

Calculated by the author

This model can become a huge contributor to the company’s profits should they ramp it up as promptly as Model Y. If we assume that TSLA will achieve a million Model Q deliveries within the next couple of years, it will add approximately $3.3 billion of incremental net income. Tesla’s TTM net income is $12.7 billion, meaning that Model Q has the potential to boost the bottom line by more than 20% over the next few years. My calculations are outlined in the above table.

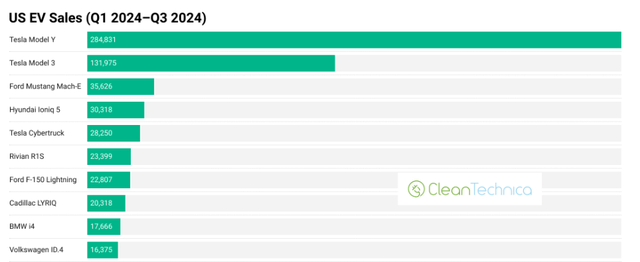

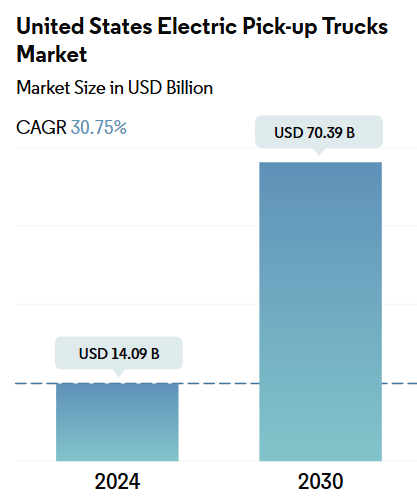

Apart from promising prospects of aggressive expansion into the segment of budget models, there are several other reasons to remain bullish. For example, Tesla’s bold move into the pickup truck market where Ford has been dominating for decades, is also developing well. Despite being a very young model, the Cybertruck has already gained a third spot in the U.S. Q3 2024 EV sales. With around 17,000 deliveries during the quarter, Tesla’s pickup has outsold all main competitors including Ford’s F-150 Lightning, Rivian’s R1T, and Chevrolet Silverado EV. This is an extremely bullish sign for Tesla’s investors because cementing its place as the leader in EV pickup sales will certainly bring long-term benefits as the industry is expected to compound with a 30.75% CAGR by 2030.

Mordor Intelligence

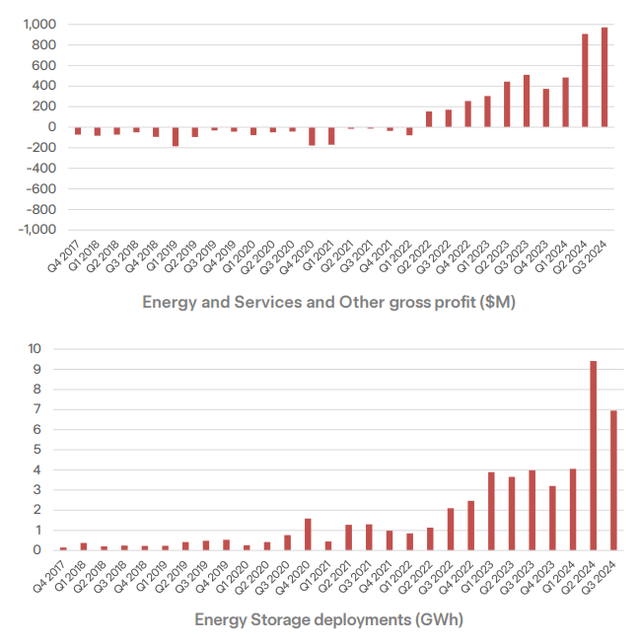

Tesla’s Energy segment is another promising area that often flies under the radar of many investors and readers. The company’s energy generation and storage solutions, including solar panels, Solar Roof, and Powerwall, are gaining traction in both residential and commercial markets. According to TSLA’s Q3 earnings presentation, the Shanghai Megafactory remains on track to begin shipping Megapacks in Q1 2025. This will highly likely unlock a new solid revenue growth driver for TSLA.

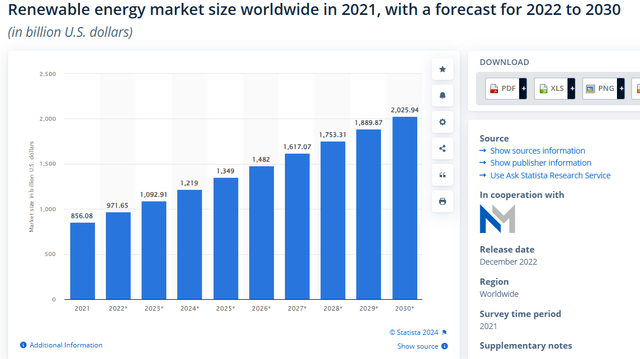

The industry might be volatile due to its relatively young age over the short term, but secular trends are apparently favorable in this domain as well. The renewable energy market’s value is expected to almost double between 2024 and 2030, which is another strong tailwind for TSLA.

Despite its relatively small scale (compared to Automotive), the Energy segment of Tesla is already profitable and has demonstrated robust positive trends in gross profits. With that being said, further expansion of volumes in this segment will highly likely lead to increased profitability, which will add more value for shareholders.

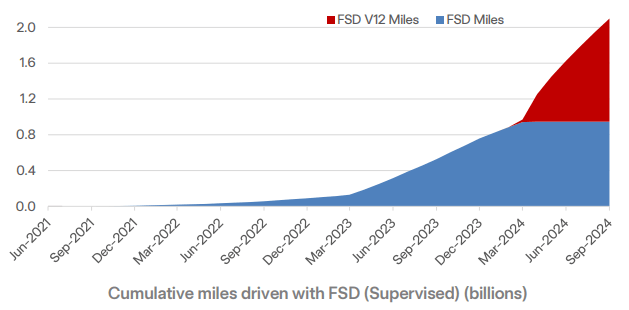

Elon Musk would not be Elon Musk if he did not invest aggressively in Tesla’s AI potential. I have said plenty about my bullishness regarding the autonomous driving FSD feature and do not want to repeat the same information. I just want to say that this project is steadily developing and the company already rolled out the brand-new V13.2 version, which is currently tested by a group of users. I have no doubt that the algorithm is consistently improving with the exponential growth in a number of miles driven with FSD and Tesla will be able to deliver an unparalleled autonomous driving experience to its customers. Industry tailwinds are also poised to be robust over the next several years as the market is expected to deliver a 33% CAGR over the next decade.

TSLA

Despite Tesla’s Models 3 and Y being quite young, they are already kind of legacy cash cows for the company. Positions of these two models remain stable as table. During the first nine months, these two models were by far the top-selling EVs in the U.S. and the gap between second and third spots is wide, softly speaking. These two models not only ensure Tesla’s intact positioning in the domestic EV market but also help to maintain a leading 17.5% global market share among auto alliances that sell 100% battery-electric vehicles.

Valuation Analysis

My fundamental analysis emphasized the fact that Tesla has exposure to multiple large and rapidly growing industries, which makes it an absolute growth champion. This makes Tesla’s high valuation ratios explainable. The stock’s valuation has always been extremely growth-oriented because of the company’s ability to deliver on its bold growth promises.

Therefore, I prefer to rely the most on the DCF model in Tesla’s case. Tesla’s WACC is 7.4%. The FY 2025-2026 revenue projection relies on consensus because it is an average opinion of more than 30 Wall Street analysts which I believe is a strong representative sample. For the years after FY 2026, I forecast a steady revenue growth deceleration by 25 basis points per year. Tesla’s FCF margin average for the last five years is 5.94%, which is the base-year assumption. Due to Tesla’s exposure to several thriving industries and the company’s historically strong ability to expand profitability as the business scales up, I expect the FCF margin to expand by 250 basis points every year between FY 2025 and FY 2029.

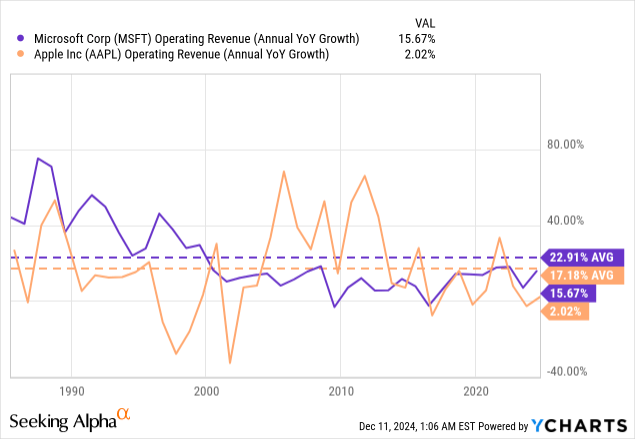

The constant growth rate is aggressive at 5.5%, but companies like Apple and Microsoft proved that it is possible to maintain a high double-digit revenue CAGR for 40 years. According to Seeking Alpha, the number of shares outstanding is 3.2 billion.

TSLA’s fair share price is $445. Thus, despite a solid rally in the last few weeks, there is still an 11% discount offered by the stock. For a stock like Tesla with strong exposure to multiple mega-trends and dominant positioning in the EV space, I think that an 11% discount is a golden buying opportunity. Moreover, experienced investors know that the FOMO effect can add up a significant premium over the fair share price.

Mitigating Factors

The U.S. economy is doing well. This is acknowledged by the Fed’s Chairman, Jerome Powell, who recently said that the Fed might be ‘cautious’ about further interest rate cuts. A tight monetary environment presents a temporary yet significant headwind for Tesla, as most cars in the U.S. are purchased through leases or loans. Prolonged higher interest rates could make consumers more cautious about spending on high-ticket items, which would weigh on overall demand for new vehicles. As a company that dominates the U.S. EV market, Tesla might suffer significantly from this headwind. Though, it will be temporary.

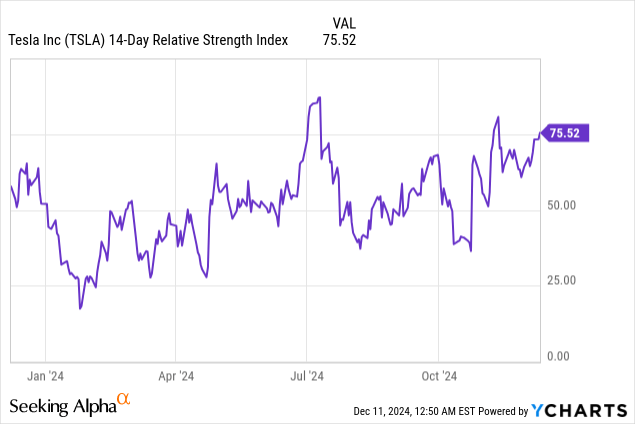

The stock is overbought, which I see from a high 75 RSI indicator. When a stock gains tens of percentage points over a relatively short term, there is always a substantial risk of a correction. The set of positive catalysts for TSLA is powerful, but it does not mean that short-term gains are guaranteed.

Conclusion

Tesla remains a solid buying opportunity. The valuation is still attractive with an 11% upside potential and the company is surrounded by several robust positive catalysts.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.