Summary:

- AbbVie Inc. has rebounded from setbacks with a strong pipeline, including the promising Parkinson’s drug Tavapadon, which shows blockbuster potential.

- Key growth drivers like SKYRIZI and RINVOQ are boosting sales, while AbbVie maintains leadership in immunology and diversifies beyond Humira.

- With a 3.7% yield, steady dividend growth, and strong earnings recovery, ABBV stock offers attractive value and long-term upside potential for investors.

Nudphon Phuengsuwan

Introduction

The most common fear in the world is acrophobia, which is the fear of heights. According to Baptist Health, more than 6% of the global population has it.

I found out I had it during a field trip to a large outdoor climbing facility many years ago. Needless to say, I did not enjoy that trip.

With that said, have you ever heard of cremnophobia?

It’s the fear of “cliffs.”

If you’re a healthcare investor, odds are you suffer from it.

In this case, I’m talking about patent cliffs. This is extremely serious in the healthcare sector. It is the reason drug developers can never sit back and enjoy the fruits of their labor—at least not beyond the typical 20 years, their patent is protected in the United States.

Essentially, it’s a good thing this system exists.

Because of patent protection, companies have a financial incentive to develop new (life-saving) drugs. For example, breakthrough developments can lead to long-term monopolies.

Nonetheless, patent losses are also a good thing, as they eventually stimulate competition and bring down the cost of major drugs. This helps to fight healthcare inflation and makes many drugs more accessible.

The problem is that these patent cliffs can be very steep, as some blockbuster drugs have become key sources for many drug producers. The overview below shows this quite well.

For example, in 2026, Eliquis will lose its patent, which is a drug that generated north of $12.0 billion in sales last year. In 2028, Merck (MRK) will face the KEYTRUDA patent loss, a $25.0 billion drug with elevated growth.

X (@jmsadowska)

Last year, AbbVie Inc. (NYSE:ABBV) lost the Humira patent, a drug that accounted for 37% of its sales in 2022(!).

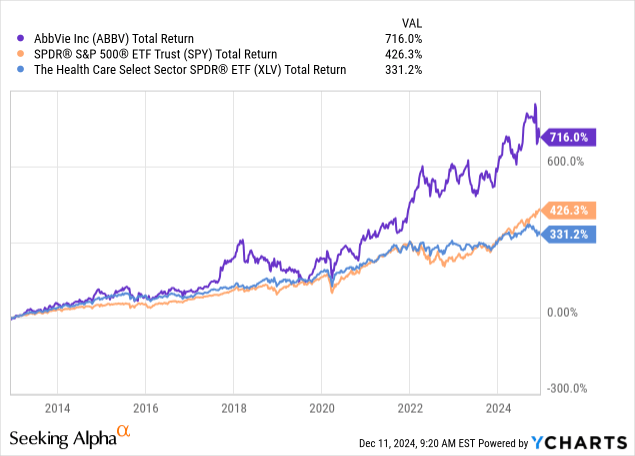

With that said, AbbVie has figured out how to balance patent loss risks and investments in growth, as its stock has returned 716% since its spin-off from Abbott Laboratories (ABT) in 2012. This has beaten both the S&P 500 (SP500) and the healthcare sector by a considerable margin!

However, since I posted my most recent article, titled “Why AbbVie Remains One Of My Favorite Dividend Growers,” the stock has fallen by roughly 10%, pressured by the news that a major schizophrenia drug failed in trials. That’s a big blow, as they were part of the $8.7 billion takeover of Cerevel Therapeutics.

The good news is that the company is seeing tailwinds from successful trials in related areas — on top of a strong core business.

In this article, I’ll update my thesis, give you an update on recent tailwinds, and explain why I continue to like the risk/reward.

So, let’s get to it!

AbbVie Is Back On Track

The bad news from Emraclidine, the schizophrenia drug, was a big hit.

However, sometimes, these companies need to gamble. If AbbVie had waited with the takeover until after the news, it could have risked a successful outcome and a much higher buying price. Buying companies before their key drugs hit the market is simply a risk these companies have to take.

After all, aggressive M&A is required for the “big guys,” as their patent cliff risks are simply too high to solely rely on internal R&D. I added emphasis to the quote below:

The North Chicago-based drugmaker pursued big M&A deals over the past few years to build out its pipeline in the wake of fading sales of its biggest product, the anti-inflammatory drug Humira. Analysts surveyed by Bloomberg had predicted emraclidine would bring in $1.1 billion in annual sales in 2029, based on the benefits seen in early-stage testing. – Bloomberg.

Although the company missed $1.1 billion in potential sales, there’s plenty to be upbeat about. For starters, the company’s Parkinson’s drug is doing well.

During the December 3 Citi Global Healthcare Conference, the company got some “nice readouts” from its Tavapadon drug, which was confirmed on December 9, when the drug completed a hat trick of phase 3 wins.

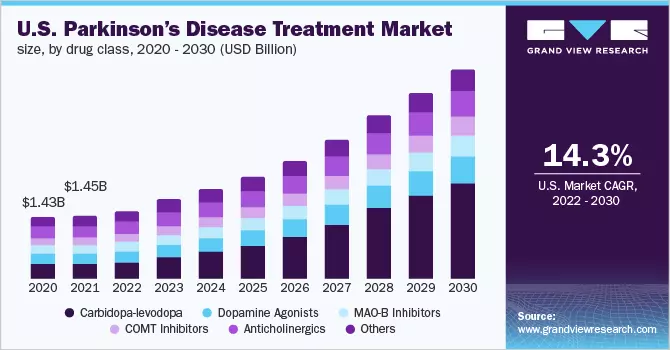

As reported by Fierce Biotech, patients on Tavapadon had significant improvements compared to placebo candidates, with a strong safety profile. This means that the one-dose-a-day drug could become a blockbuster in what is still a market with elevated unmet needs.

“The results from TEMPO-2, and across the entire TEMPO clinical development program, add to the growing evidence which suggests that tavapadon has the potential to offer an important new option for individuals living with Parkinson’s disease.” -AbbVie.

Once approved, this drug could generate close to $700 million in annual sales by 2030 in a market with 14% annual growth potential through at least 2030.

Grand View Research

While the numbers above are rough estimates, the company’s rebound after the initial trial failure is very promising.

A Clear Path To Consistent Growth

In general, AbbVie is doing an impressive job, as it has exceeded expectations for both the top and bottom lines in each of the first three quarters of this year. It has also raised its sales outlook by $1.8 billion, supported by its non-Humira growth platform.

According to the company, its growth platform accounts for more than 80% of its sales, with 18% growth in 3Q24.

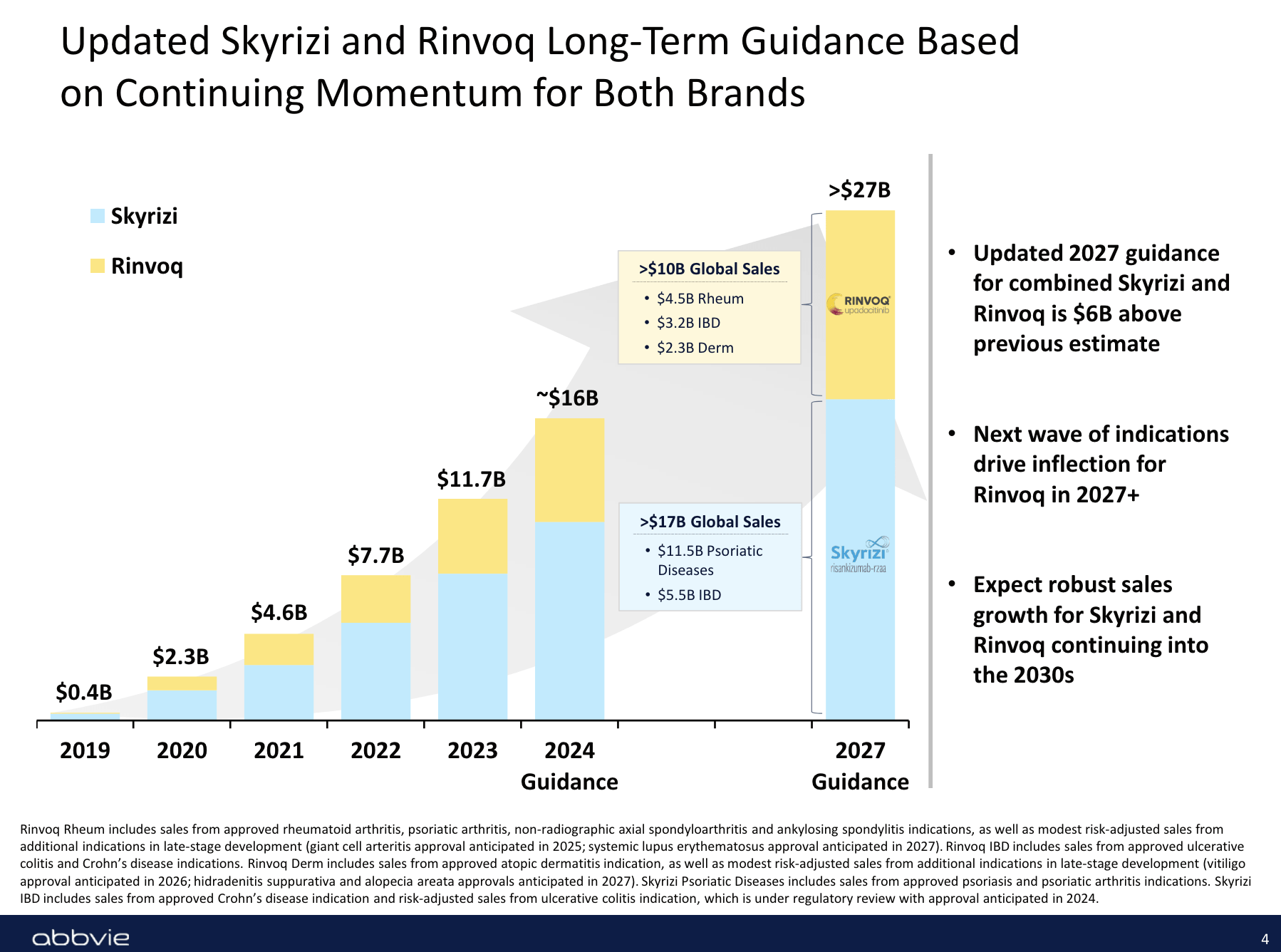

This growth has been supported by blockbuster drugs like SKYRIZI and RINVOQ, which have seen growth rates close to 50%.

AbbVie

Essentially, these drugs are part of AbbVie’s strategy to maintain leadership in the immunology market. They have been approved for indications that Humira covers, allowing the company to capture market share in psoriasis, arthritis, and other inflammatory diseases.

For example, according to AbbVie, RINVOQ is also performing well in the dermatology space, especially in the treatment of atopic dermatitis, which is a condition that causes chronic inflammation and itching of the skin.

Looking ahead to 2025, AbbVie remains optimistic, as it expects mid-single-digit growth despite the ongoing Humira erosion.

In 2025, the company also expects progress in its oncology business.

One of the most exciting prospects is their work on ELAHERE, which is an innovative therapy for platinum-sensitive ovarian cancer. AbbVie is advancing this program, with ongoing Phase III trials.

Additionally, AbbVie is developing Teliso-V, which is under review for approval in non-small cell lung cancer. While the indication size is modest, it represents an important step in the oncology strategy of AbbVie, according to its comments during the aforementioned conference.

Dividends & Valuation

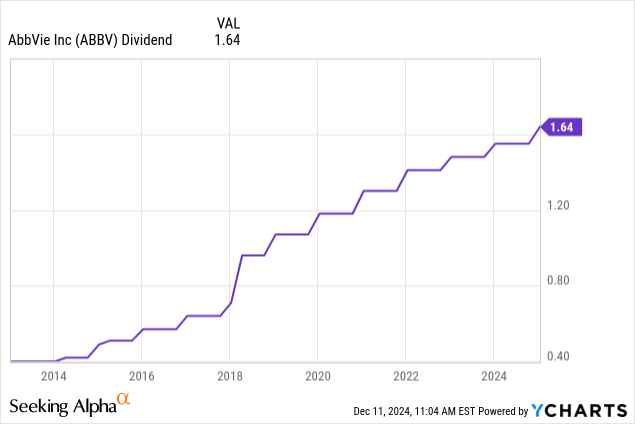

The company’s upbeat expectations are supported by another dividend hike. On October 30, the company hiked its dividend by 5.8%, extending its uninterrupted dividend growth streak since becoming independent in 2012.

Currently, the company yields 3.7%, which comes with a 57% payout ratio and a five-year CAGR of 7.7%. That’s a good mix of income and growth.

Going forward, we can expect consistent dividend growth to last and the payout ratio to drop, as analysts are just as upbeat as AbbVie.

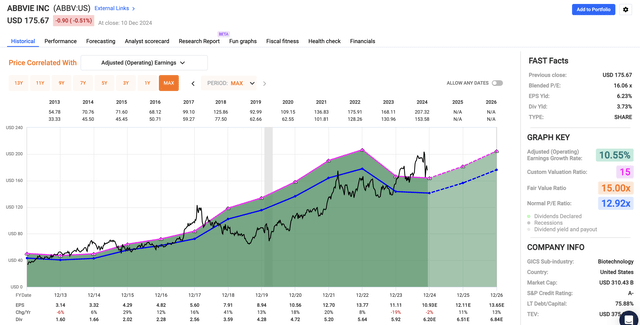

Using the FactSet data in the chart below, we see that the market expects ABBV to grow its EPS by 11% and 3% in 2025 and 2026, respectively. This would mark a strong rebound after slightly more than 20% contraction in the 2023-2024 period due to Humira.

Valuation-wise, I’m applying a 15x multiple to these expectations. While this is a few points above ABBV’s long-term average of 12.9x, it is still substantially lower than the sector median of 19.0x.

This implies a fair stock price target of $205, which is 16% above its current price and roughly in line with consensus estimates.

It is also a very conservative estimate, as we are likely looking at prolonged double-digit annual EPS growth, making ABBV a great pick at current prices.

Takeaway

AbbVie’s recent developments highlight why it remains a compelling long-term investment. While the Emraclidine trial failure was a setback, the company’s strong pipeline, especially with Tavapadon for Parkinson’s, shows its resilience and strategic focus.

With blockbuster drugs like SKYRIZI and RINVOQ driving impressive growth and a diversified portfolio that mitigates patent cliff risks, AbbVie is in a great spot for sustained success.

Moreover, its commitment to dividend growth, supported by a strong earnings recovery, further supports its appeal.

At the current valuation, I see attractive upside potential, with a fair price estimate of (at least) $205.

Hence, for dividend growth investors like myself, AbbVie continues to deliver a powerful combination of income, growth, and innovation.

Pros & Cons

Pros:

- Strong Growth Platform: AbbVie’s non-Humira portfolio is thriving, with blockbuster drugs like SKYRIZI and RINVOQ growing by roughly 50% year-over-year.

- Promising Pipeline: Drugs like Tavapadon and oncology progress (e.g., ELAHERE and Teliso-V) highlight AbbVie’s ability to benefit from other high-growth markets.

- Reliable Dividend Growth: A 3.7% yield, a low payout ratio, and consistent dividend hikes make AbbVie a top choice for income-focused investors.

- Attractive Valuation: At a P/E of roughly 15x, the company has roughly 16% upside — conservatively speaking.

Cons:

- Patent Cliffs Loom: While the company has done a great job absorbing the Humira patent cliff, long-term patent loss risks are always an issue in the industry.

- R&D and M&A Risks: Trial failures like Emraclidine highlight the risks of aggressive acquisitions and pipeline bets.

- Competitive Market: Heavy competition in immunology and oncology could limit the growth potential of key drugs. However, given the size of the market and innovation progress, these risks are subdued.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.