Summary:

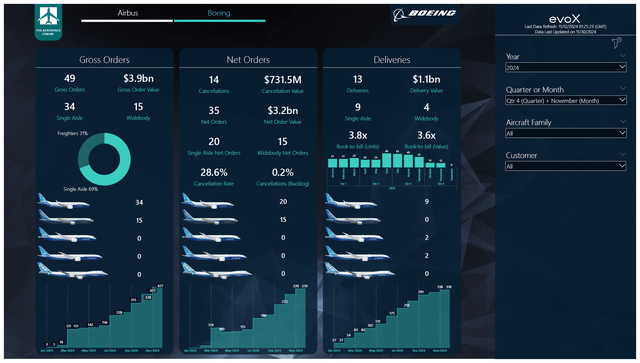

- Boeing’s November orders dropped to 49 airplanes, with 34 single-aisle and 15 wide-body jets, totaling $3.9 billion in value.

- Deliveries hit a multi-year low due to a strike, with only 13 airplanes delivered, significantly impacting Boeing’s output.

- Year-to-date, Boeing’s net orders fell sharply to 370, valued at $30.4 billion, highlighting production and supply chain challenges.

- Despite setbacks, Boeing’s new leadership and KPI focus on manufacturing quality and stability are promising for future recovery.

Jon Tetzlaff

On the day The Boeing Company (NYSE:BA) restarted production on the Boeing 737 MAX program, the US jet maker also posted its order and delivery figures for the month of November. The two news items marked the reality of deliveries hitting a multi-year low simultaneously with production getting restarted, and the hope is that we should see things get better for Boeing. In this report, I discuss the most recent orders and deliveries.

Boeing Wins Boeing 737 MAX And Tanker Orders

T

In November, airplane orders decreased sequentially from 63 orders to 49 airplane orders. Boeing added orders for 34 single-aisle jets and 15 wide-body jets with a combined value of $3.9 billion:

- Alaska Airlines ordered five Boeing 737 MAX airplanes.

- The US Air Force ordered 15 Boeing KC-46A tankers.

- BOC Aviation ordered 14 Boeing 737 MAX airplanes.

- An unidentified customer ordered 15 Boeing 737 MAX airplanes.

During the month, the following changes were made to the order book:

- National Airlines was identified as the customer for four Boeing 777Fs.

- An unidentified customer cancelled orders for 12 Boeing 737 MAX airplanes.

- TUI Travel cancelled an order for two Boeing 737 MAX aircraft.

In November, Boeing continued booking orders for the Boeing 737 MAX while it also secured orders for the KC-46A. The company booked 49 orders and 14 cancellations bringing the net orders to 35 airplanes valued at $3.2 billion. In the same month last year, Boeing booked 114 gross orders and 10 cancellations, bringing its net orders to 104 aircraft valued at $18.7 billion. So, the order inflow is down year-on-year driven by the timing of airshows. In November 2023, the Dubai Airshow was hosted, which provides a more challenging comp. With airplane manufacturers facing uncertain delivery schedules, and even more so for Boeing, there also is little reason to order airplanes at this point in time.

Year-to-date, Boeing has gathered 427 gross orders and 57 cancellations, bringing the net orders to 370 valued at $30.4 billion. In the same period last year, the company logged 1,085 gross orders and 140 cancellations, bringing the net order tally to 945 orders valued at $87.8 billion. Year-to-date numbers show a significant slip in the orders, but at this point streamlining production and the aerospace supply chain to deliver the existing backlog is a higher priority for OEMs and customers.

During the month, the ASC 606 adjustments tally, which records orders for which a purchase agreement exists, but additional criteria are not met, decreased by 15 units. Doubtful orders for 14 Boeing 737 airplanes were indeed cancelled, doubtful orders for two airplanes were added and a doubtful order for one Boeing 787 was added. Currently, slightly more than 12% of the backlog does not satisfy all Boeing’s criteria to be counted toward the backlog.

Boeing Deliveries Sink Due To Strike

The Boeing Company

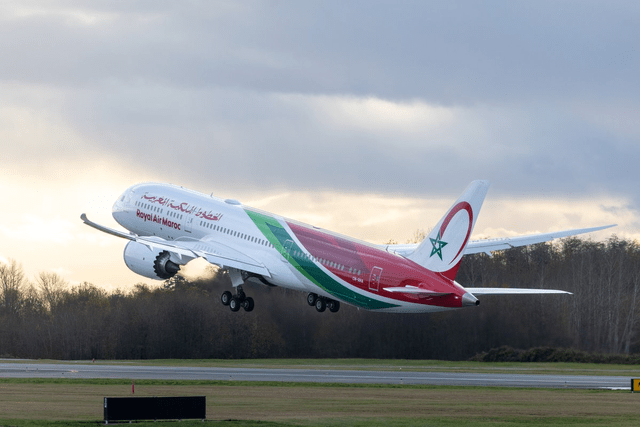

In November, Boeing delivered a total of 13 airplanes, consisting of nine single-aisle airplanes and four wide-body airplanes valued at $1.1 billion:

- Boeing delivered nine Boeing 737 MAX airplanes.

- Boeing delivered two Boeing 777Fs.

- Boeing delivered two Boeing 787-9s.

Last month I expressed my expectation that with a labor agreement being reached in early November, the delivery numbers for Boeing would be better. However, Boeing used the moment to also train their workers and as a result, the production of the Boeing 737 MAX program did not restart until December. So, the delivery figures were actually weaker than expected and were at the lowest point since November 2020.

In November last year, Boeing delivered 56 airplanes valued at $3.9 billion. So, we clearly see the impact of the strike on the delivery numbers. To date, Boeing has delivered 305 airplanes with a value of $22.3 billion compared to 461 deliveries valued at $34.3 billion a year ago, indicating a decline of 34% in units and 35%.

In November, the book-to-bill ratio was 3.8x in terms of orders and 3.6x in terms of value. However, the numbers clearly reflect that Boeing is lacking production output and the 1.3x and 1.5x figures year-to-date are also hovering above one for that same reason. So, we do see book-to-bill ratios exceeding one, but that’s mostly driven by the fact that Boeing cannot deliver airplanes as scheduled, and that inflates the ratio.

Conclusion: Boeing Wasted Another Year

If you look at the deliveries then the painful conclusion is that with one month in the year remaining, Boeing has wasted another year to meet demand. It painfully shows what happens if leadership is not squarely focused on fixing the problems that a company has but remains focused on free cash flow instead. The moment things backfire all positive free cash flow turns negative again. The good thing I’m seeing is that Boeing has changed leadership and the company has put in place KPIs to determine whether a factory is operating outside of its control limits. That KPI change being driven by the quality of manufacturing and stability rather than by free cash flow targets is extremely important. Those are the fundamentals on which Boeing can build its output in 2025, but 2024 and also this month just were yet another reminder of how a company and its financials can fall apart the moment leadership is not focused on the right thing. I maintain my buy rating as I do believe that, even though slow, Boeing will turn things around again.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.