Summary:

- I believe Bank of America Corporation is poised for growth in 2025 due to a favorable market environment and lower regulation, despite appearing overvalued.

- Q3 results show solid performance in key segments, with digitalization and AI integration driving future margins and customer growth.

- BAC’s strong balance sheet, prudent capital management, and expected EPS growth make it an attractive investment despite current valuation concerns.

- The back winds from a rising yield curve and the recovering capital markets environment position BofA to provide better earnings and shareholder returns in future quarters.

- I don’t think BAC stock is as overvalued as many people on the market fear to date. So I initiate a “Buy” rating and expect the stock’s rally continuation into 2025.

sshepard

Intro & Thesis

With over 4,000 branches throughout most of the United States, Bank of America Corporation (NYSE:BAC) is one of the world’s biggest financial institutions, with a market cap of over $350 billion at the time of writing.

Although the BAC stock appears to be quite expensive compared to its historical norms and, more broadly, to individual banks in the U.S. and globally, I believe that BAC is likely to continue growing during 2025. This is largely due to the highly favorable market environment, supported by lower levels of regulation. As a result, the current EPS forecasts priced in by the market will likely be underestimated, making the stock not as pricey as it seems at first glance.

Why Do I Think So?

As I usually start my articles, let me analyze the most recent financial and operational results to see what’s going on under the hood of the bank.

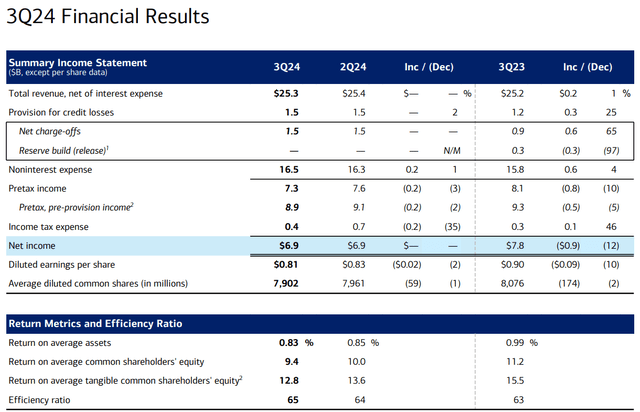

Bank of America’s Q3 FY2024 quarterly revenues amounted to $25.35 billion, up 1% YoY as higher fee income (+5% YoY) partially offset a decline in net interest income of -3% YoY. Earnings per share at $0.81 were down slightly from $0.90 in the previous quarter but better than the consensus of $0.76. The NII actually turned around in Q3, rising 2% over sequential periods after bottoming out in Q2 — just like management predicted before. So the bank apparently was able to stay ahead of a slower economy while also keeping an eye on “reasonable growth.” On the other hand, the EPS was down -10% YoY and -2.4% QoQ:

BofA’s IR materials for Q3 FY2024 Seeking Alpha, BAC

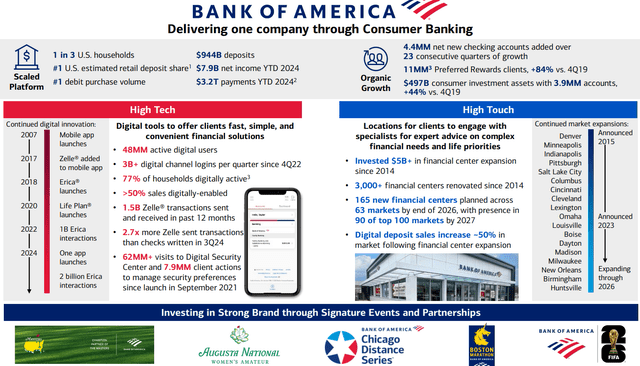

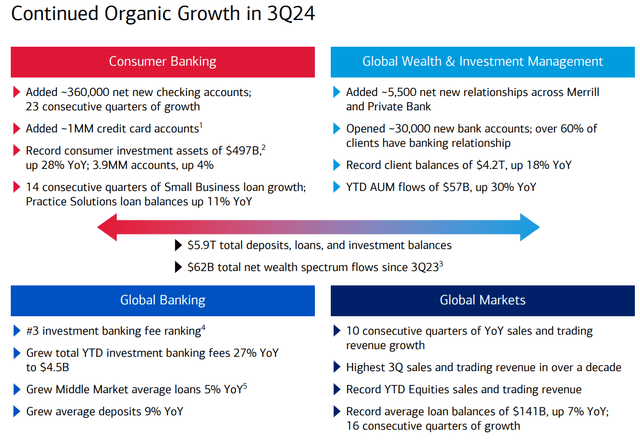

Net income of $2.7 billion came from Consumer Banking — the foundation of BAC’s business — which declined by 6% YoY, mainly from a 1% decline in revenues (deposit balances decreased) and a 5% increase in expenses (more wages and continued investment in digital tools). The segment grew robustly organically despite these challenges, creating 360,000 net new checking accounts during the quarter to make the year-to-date total 880,000. Consumer assets of investment climbed 28% to $497 billion “due to client inflows and healthy market conditions.”

This is driving digitalization as well — 54% of consumer purchases are now made online and the bank’s AI-based assistant Erica has had ~2.4 billion client transactions since its inception, according to the management’s commentary. I believe the integration of AI assistance technology into the consumer banking unit promises higher margins for BAC in the medium term if the pace of tech adoption remains consistent with Q3 levels over the coming quarters.

[Source].

The Global Wealth and Investment Management (GWIM) segment turned in solid numbers as net income increased 3% YoY to $1.1 billion and revenue increased 8% YoY. This growth was supported by a 14% growth in asset management fees “due to solid client flows and increased market valuations.” Client balances reached $4.2 trillion, up 18% compared to the previous year, which proves that the bank is adept at cultivating high-net-worth customers. However, the operating expenses in this line increased by 10% owing to the revenue-based incentives and talent acquisition investment (+5,000 net new client relationships added). The segment’s pretax margin fell a bit to 25% from 26% a year earlier, but management appears to be bullish about its long-term prospects as more clients take up banking products alongside investment products.

Global Banking division’s net income declined 26% YoY to $1.9 billion as its revenue slid 6%, driven by lower NII and higher loan loss provisions (up to $229 million from $119 million last year). Investment banking revenue was one bright spot, though — up 18% YoY thanks to “strong debt and equity capital markets.” Treasury services also did their part, to balance out higher fund-cost pressures. The management believes that investment banking will continue its uptrend into 2025 driven by a recovery in capital markets.

BAC’s Global Markets segment did a fantastic job in Q3, with net income up 23% to $1.5 billion and revenue up 14% from last year. The revenue of sales and trading was up 12% YoY, Equities increased 18%, and FICC increased 8% YoY. Fees on investment banking increased too as the bank had a good position in capital markets. The Republican Party’s more friendly stance toward M&A activity is going to provide more deals and underwriting premiums in the next 4 years, in my view. But already in Q3, the GM segment had a core efficiency ratio of 64.1% which surpassed the Street’s forecast, and management credited continued investments in technology and talent as contributing to its success.

BofA’s IR materials for Q3 FY2024

On a consolidated basis, BAC had ~$3.3 trillion of assets on the books at the end of the quarter, up $66 billion from Q2. Deposits averaged $1.9 trillion (up $45 billion YoY — for the fifth consecutive quarter). The bank’s global liquidity assets were at $947 billion, an increase of $38 billion QoQ. The CET1 ratio of 11.8% — which is higher than the regulatory requirement of 10.7% — should allow for good capital returns going forward without getting into risky territory. In fact, during Q3 2024, BAC managed to return ~$5.6 billion to shareholders ($2 billion in dividends and $3.5 billion in share repurchases), and the bank’s tangible book value per share was up 10% year-on-year to $26.25, which is nice. The management reiterated its aim of a conservative, “well-diversified capital allocation with growth, dividend increases, and share buybacks” at the top of the priority list.

At the same time, we saw that BofA’s asset quality held steady at $1.5 billion net charge-offs (up compared to Q2), and a net charge-off ratio of 0.58% (down one basis point in sequential numbers). Losses in consumer credit were contained, and commercial real estate (CRE) losses were low, indicative of the bank’s prudent underwriting practices. As the management noted on the latest earnings call, BAC remains conservatively insured against an eventual 5% unemployment rate through the end of 2025 (from 4.1% now) to keep its doors open for unforeseen economic forces.

The management also projects NII to increase further during Q4, and the number is forecasted at least $14.3 billion from $14.0 billion in Q3. This growth should be powered by ~$20 billion in quarterly fixed asset repricing, a $200 million offset from the suspension of the BSBY reference rate, and low loan and deposit growth. But these tailwinds will partially be canceled out by the rate cuts expected for November and December. For FY2025, management sees positive operating leverage “supported by an NII increase, fee income growth, and disciplined expense control.”

As we look into 2025, with an expected return of NII growth and through our expense discipline, we expect a return to operating leverage, an improvement in our efficiency ratio.

Source: Alastair Borthwick’s [CFO] comments on the Q3 2024 call.

I think that a steepening yield curve (enhancing NII) and a more benign regulatory environment under the new Basel III Endgame proposal should provide BAC with some favorable tailwinds (a decrease in capital requirements). Furthermore, as I’ve already mentioned above, BAC’s investment in digital tools like AI assistance and its efforts in growing customer relationships put it in a strong position for long-term success. While there are still some barriers such as high costs of funding, low loan growth, and possibly unforeseen macro risks, BAC’s management is playing defense on those fronts and I don’t expect any major catastrophes with earnings (and especially with the balance sheet).

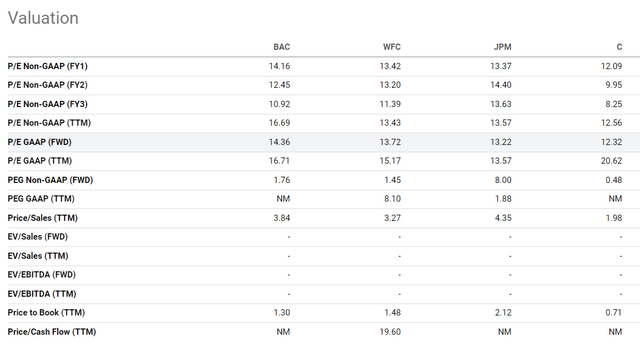

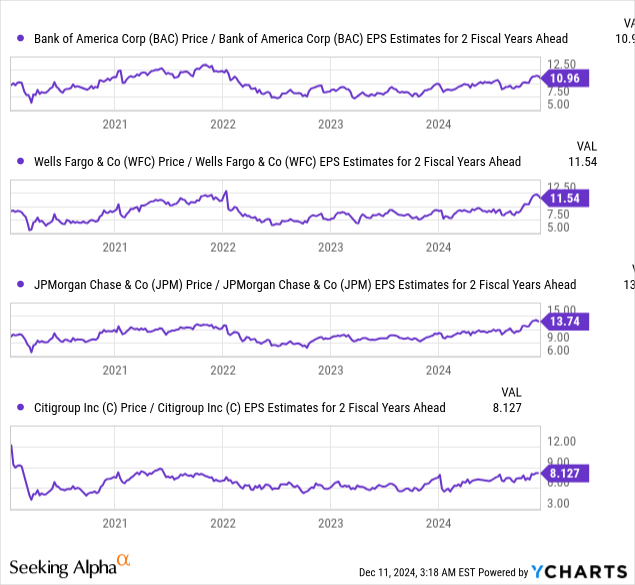

So given all that, I think the primary challenge for the BAC stock presently is its overvaluation, not only relative to its historical averages but also when compared to its key peers:

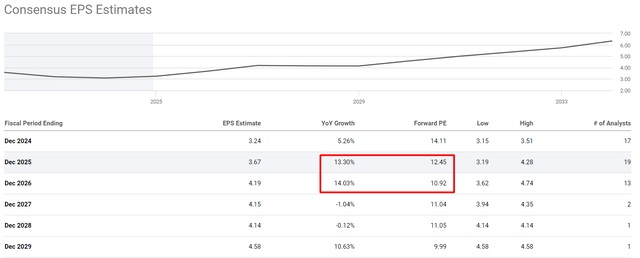

However, the issue of overvaluation diminishes when looking a few years ahead, such as to FY2025 and FY2026. Analysts project BofA’s EPS growth of 13.30% for FY2025 and over 14% YoY for FY2026, so effectively it’ll bring the P/E ratios down to 12.45x and ~11x, respectively. These figures are one of the lowest values in the peer group analyzed.

Seeking Alpha, BAC, notes added

As you can see, BAC’s valuation ranks second only to Citigroup Inc. (C), which carries its own idiosyncratic risks, including concerns related to management quality (I heard about it many times). So I see a valuation discount in BAC stock compared to peers like Wells Fargo & Company (WFC) or JPMorgan Chase & Co. (JPM).

In my view, this creates an interesting opportunity for investors to capitalize on this. The rally in BAC stock will likely continue through FY2025, provided no significant events occur that might alter the consensus EPS estimates or drastically lower current expectations. In fact, the regulatory tailwinds mentioned earlier are likely to provide BofA with further opportunities to exceed forecasts, as it has done in 6 of the last 8 quarters, according to Seeking Alpha Premium data.

Based on all that, I issue a “Buy” rating on BAC stock despite its seeming overvaluation.

Where Can I Be Wrong?

There are a few spots where my thesis could be challenged.

First, I may be mistaken that my view of a favorable regulatory landscape is accurate. Although the revised Basel III Endgame plan doesn’t seem nearly as tough as originally feared, it’s still a regulatory minefield. Politics and/or changes in regulatory conditions may cause capital to rise or new compliance costs, which would impact the bottom line.

Second, while I’d like to see the pro-business Republican Party’s embrace of M&A and less regulation, any deviation from this direction would be detrimental to the tailwinds I’ve incorporated into today’s thesis.

The third potential bugbear of my argument is that I suppose NII will grow steadily in the future. Management had forecast growth in NII in Q4 and beyond, but that would depend on several factors, such as how quickly the Fed will lower rates and whether the bank can re-price fixed assets successfully. Whether the rate cuts are deeper or faster than expected, or the deposit costs are too high, then the expected NII growth might be less than what is expected. Further, despite BAC having seen record deposit growth over the last couple of quarters, any decrease in deposit inflows or increased deposit competition could erode margins. It would destroy one of the main factors behind my bullishness, considering BAC’s valuation already assumes operating leverage in 2025.

Fourth, major macro hazards could throw my BAC’s thesis into the fire. The bank has already hedged its bets on 5% unemployment, but in the event of a deeper recession, the number of creditors is likely to go up, especially for consumer and commercial portfolios. Furthermore, the optimism about the future capital markets rebound and investment banking expansion may not be right if market conditions get worse or deal flow dies down.

The Bottom Line

Despite the above-listed risks, to me, Bank of America’s Q3 FY2024 results show it can be flexible and make solid cash flows in a competitive environment. The bank’s business mix, sound balance sheet, and well-managed capital structure set it up for growth in the future. Furthermore, the management’s focus on sustainable growth, plus back-winds from a rising yield curve and the recovering capital markets environment, positions BAC to provide better earnings and shareholder returns in future quarters.

I don’t think BAC stock is as overvalued as many people on the market fear to date. So I initiate a “Buy” rating and expect the stock’s rally continuation into 2025.

Thank you for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BAC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!