Summary:

- I am downgrading Nvidia Corporation from a “Strong Buy” due to recent antitrust investigations in China and potential geopolitical risks affecting the stock.

- Nvidia’s stock has broken critical support levels, indicating the potential for further declines, possibly even below $100, heading into 2025.

- Despite short-term bearish signals, I remain long-term bullish and will consider adding to my position if prices approach the $129.60 support level.

- Investors should adopt a guarded stance and monitor momentum changes in trend waves, as geopolitical events could further impact Nvidia’s share price trajectory.

da-kuk

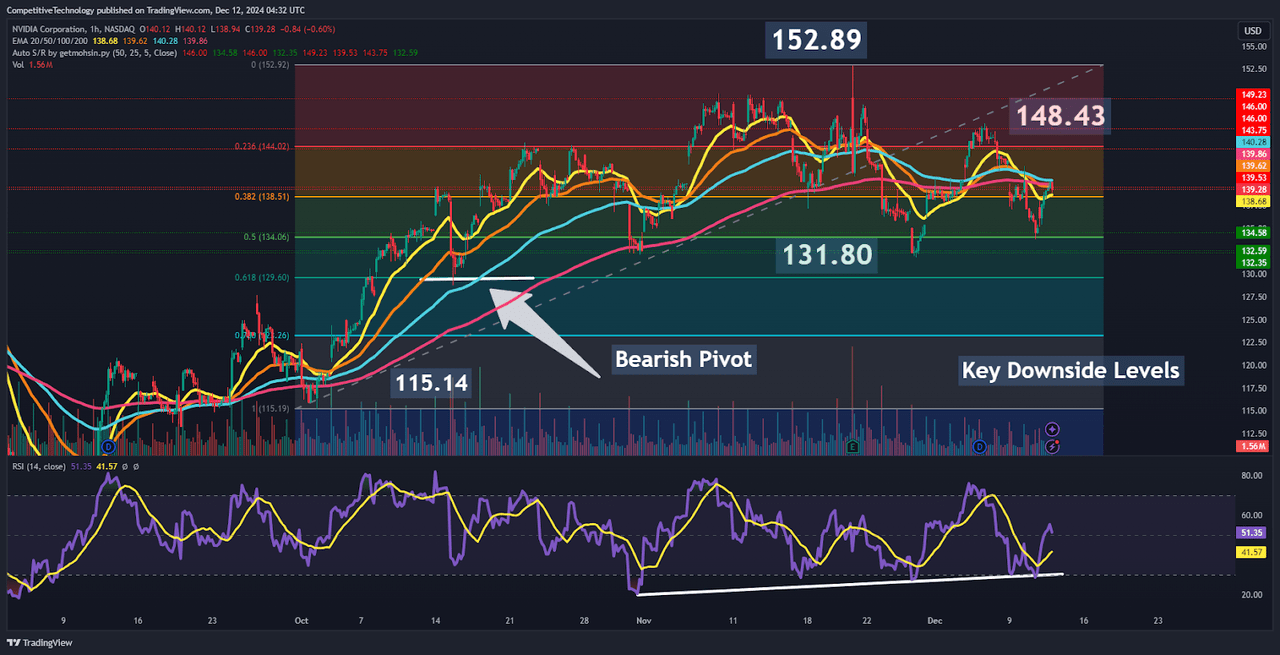

When I last covered NVIDIA Corporation (NASDAQ:NVDA) with my article “Nvidia: I Am Buying The Drop,” the stock was falling quite sharply after reporting third quarter earnings results. Broadly speaking, the vast majority of my stock trading strategies are contrarian in nature, which means I tend to look for investment opportunities that stem from what I consider to be market overreactions to pivotal news or earnings events. Since Nvidia’s post-earnings market reaction forced NVDA stock through important support zones while falling to near-term lows of $131.80 on November 11th, 2024, my prior article argued that sufficient criteria had been met to justify an elevated rating outlook.

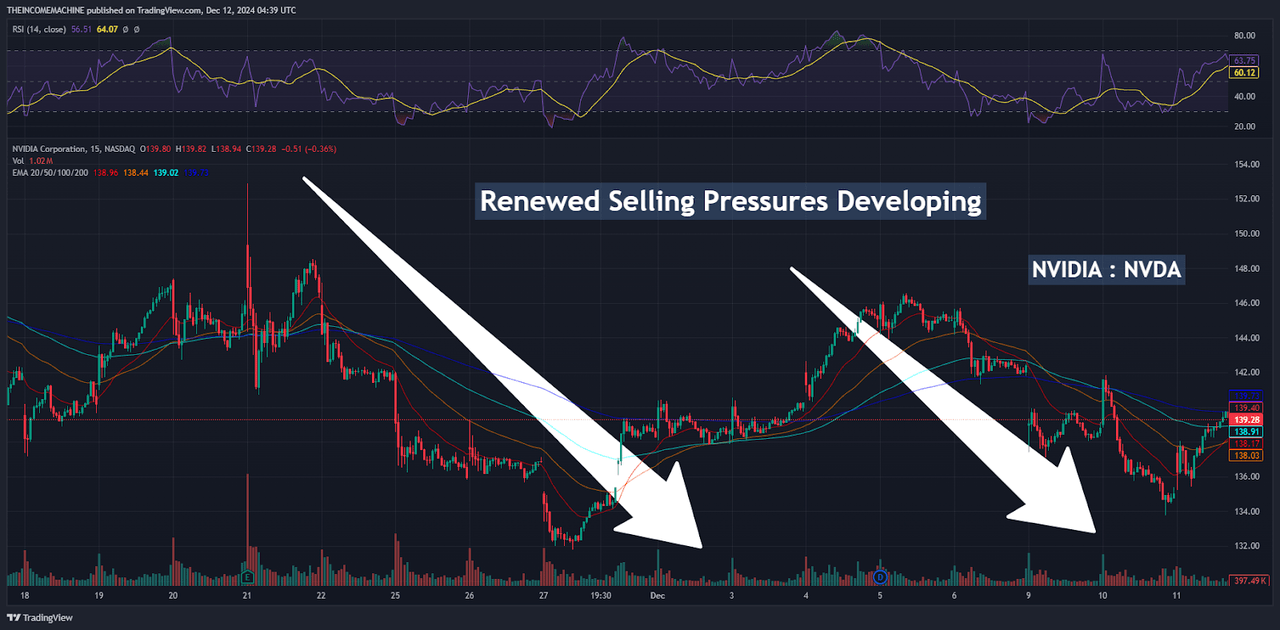

To be fair, Nvidia shares did encounter a relatively substantial bounce after my prior coverage was posted. However, recent bombshell news developments out of China have changed the outlook in ways that could be long-term in nature, and we are already seeing a significant amount of selling pressure being levied against NVDA shareholders. As a result, my prior “Strong Buy” outlook is no longer justified, and I will be reducing my position rating because I believe that the stock might now be in the position to fall to lower levels before the end of 2024.

NVDA: Renewed Selling Pressures Developing (Income Generator via TradingView)

Recent reports out of China have pointed out that Nvidia is being investigated by mainland antitrust regulators in connection with the firm’s 2020 acquisition of Israel-based Mellanox Technologies, a designer of chips that was purchased for $6.9 billion. Thus far, the negative effect on NVDA share prices has been palpable, with the stock falling again toward the lows that were seen during the market’s prior post-earnings reaction.

In my view, some of these new concerns are a bit overblown, given the fact that the Chinese market is relatively minor in terms of its overall contributions to Nvidia’s total sales figures. Over the last four quarterly periods, only 12% of Nvidia’s worldwide sales figure was derived from Chinese markets (at $13.5 billion) and this marks a sharp decline from the 21% revenue regional contribution that was seen during the prior year. In part, these declines have been impacted by government bans preventing Nvidia from shipping certain high-end hardware components into China.

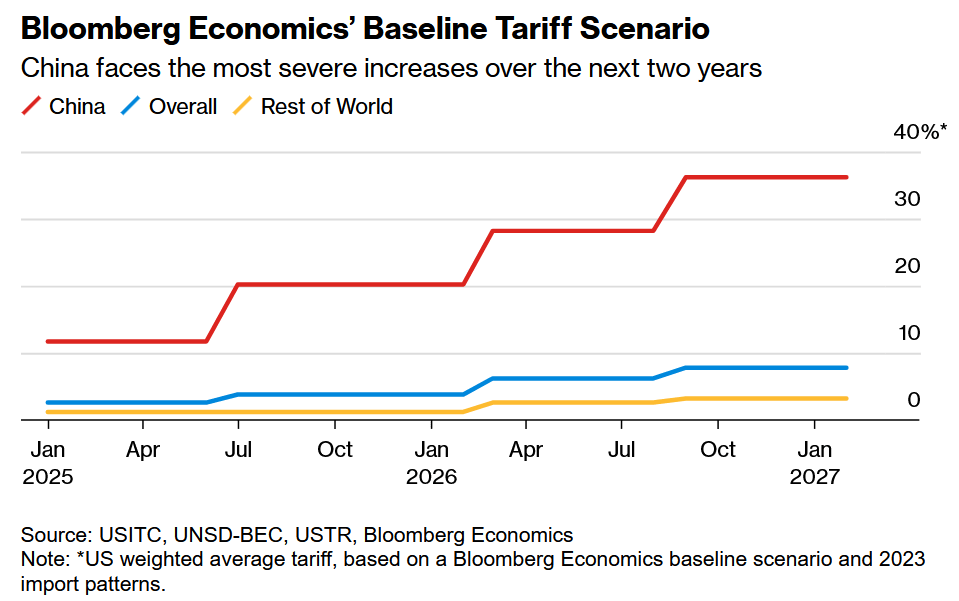

Bloomberg Economics Baseline Tariff Scenario (USITC, UNSD-BEC, USTR, Bloomberg Economics)

However, the timing of these latest developments seems conspicuous, given their proximity to similar rhetoric out of the United States suggesting trade war policy might become an early characteristic of the upcoming Trump administration. In the chart above, we can see the Bloomberg Economics baseline tariff scenario and its implications that China might be the new administration’s primary focus facing the most severe tariff increases over the next two years. Ultimately, if these dueling trade war policy threats continue to escalate as we head into 2025, I think that companies like Nvidia might have the most to lose. This is even if the company’s total sales exposure in China has already shown evidence of a recent decline. Negative market reactions sending NVDA share prices into the low $130s have already given us a sense of what to expect if this type of rhetoric continues. I am starting to believe that these factors might have the potential to lead to further price-target downgrades for this stock in the quarters ahead.

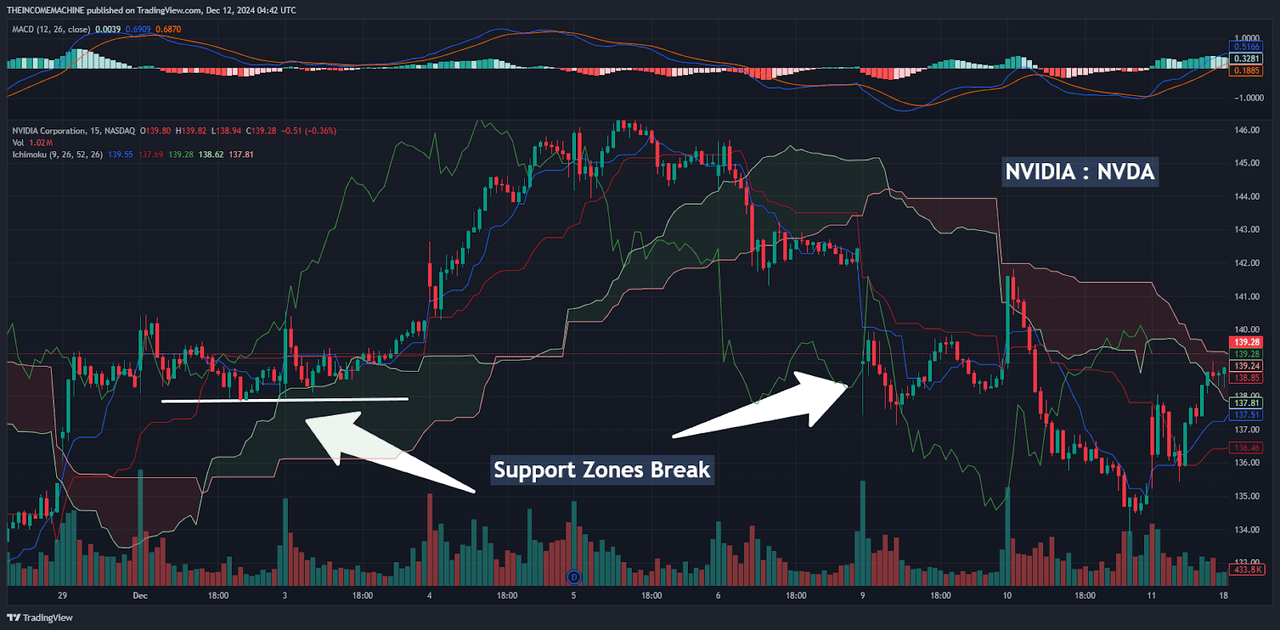

NVDA: Key Support Zones Have Broken (Income Generator via TradingView)

From a technical perspective, Nvidia’s recent share price declines have now broken critical support levels, and these changes in share price action have the potential to limit bullish momentum into the end of 2024. Specifically, a major downside price gap formed during the December 9th trading session, and this activity sent share prices through the December 2nd lows of $137.83 (which was the price level that represented my downside pivot point indicating bearish trend-wave development). Follow-through from this region has already been substantial, and this price action has invalidated the bullish intermediate-term trend-wave structure that had been in place before these latest news events out of China.

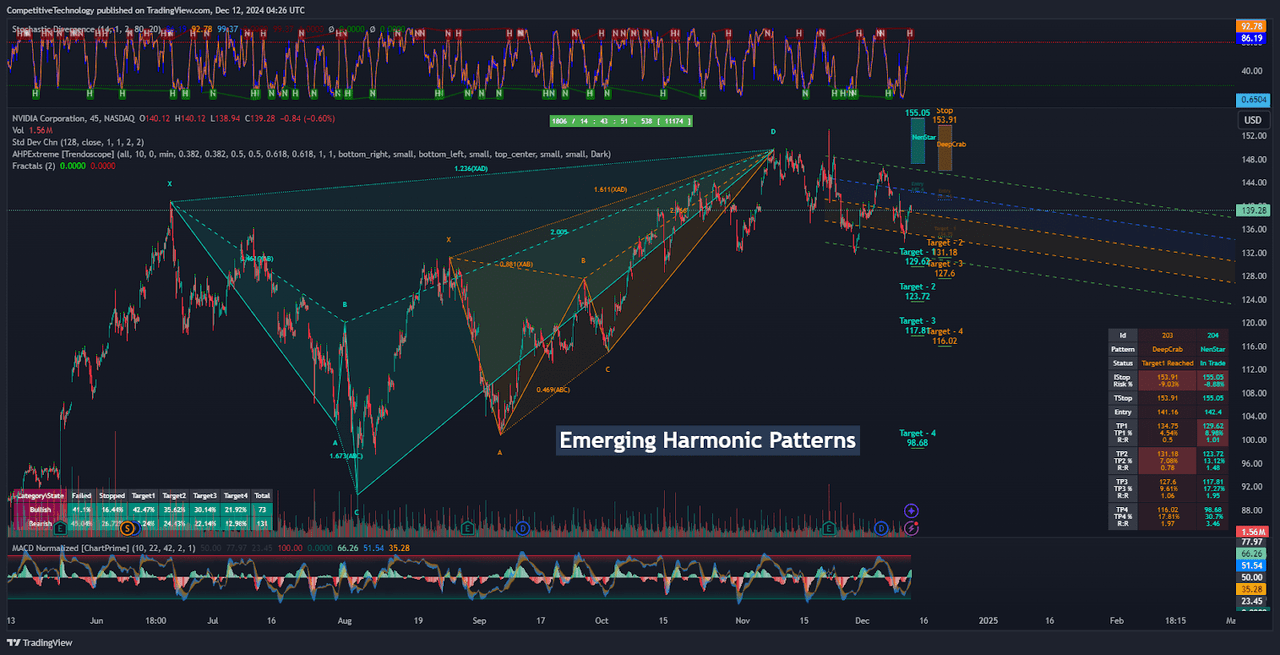

NVDA: Emerging Bearish Harmonic Patterns (Income Generator via TradingView)

In addition to this, we are starting to see the development of two harmonic price patterns on the shorter-term timeframes, which suggests that recent reversals might be in the process of forming. Specifically, these structures are referred to as the Deep Crab and NenStar patterns and these structures have formed in line with negative divergence readings that are present in the stochastic indicator based on the same time horizon. Overall, these are structural formations that are large enough to stretch into the 2025 trading period, and this does suggest that further declines have the potential to fall below the $100 level.

Of course, this would mark a fairly significant price movement to the downside. However, the standard deviation price channel (which is composed of two positive/negative standard deviations) remains positioned in the bearish direction, and indicator readings in the moving average convergence divergence have had a tremendous amount of difficulty holding in positive territory since the middle of November. On balance, this is a collection of signals that represents a confluence of bearish influences that might have the potential to break additional support levels before the end of 2024.

NVDA: Downside Pivot Price Levels (Income Generator via TradingView)

Longer-term, I do want to be clear that I remain bullish on this stock. I will not be closing my long position unless I see share prices fall through the 61.8% Fibonacci retracement of the rally from $115.14 (price lows from October 2nd, 2024) to the stock’s all-time highs of $152.89 (posted on November 21st, 2024), which is located near $129.60. Interestingly, this price zone rests in close contact with the stock’s price lows from October 15th. This helps to strengthen the validation of this price region as an area of potential consolidation if we do eventually see the NVDA shares continue to decline. As a result of all of this information, I think that it is important for investors to adopt a more guarded stance regarding this stock.

As we have seen over the last few weeks, geopolitical news events have the potential to cause fairly significant changes in the overall trend trajectory of this stock. When we consider China’s latest actions alongside additional antitrust probes in the United States, the continued prospect for further price declines seems possible before the end of this year. Thus far, recent changes in price action trend structure have not yet reached the point where I would begin to further revise my stance and adopt a bearish rating outlook.

Given these recent developments, I think the most likely scenario is a moderately negative share price trend continuation that might actually be a favorable opportunity for investors to add to long positions relatively soon. However, it will also be critical for investors to monitor changes in broader momentum readings because the potential for an accelerated move to the downside might start to build if additional support zones fail to contain newly emerging selling pressures. As things currently stand, I will be downgrading my outlook from my prior “Strong Buy” rating, but I plan on adding to my current long position if NVDA share prices approach the aforementioned support levels near $129.60.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.