Nikada

Most U.S. bank stocks dipped in Thursday trading after the Consumer Financial Protection Bureau finalized a rule that essentially caps overdraft fees at $5 per instance. The new rule applies to banks and credit unions that have at least $10B in assets.

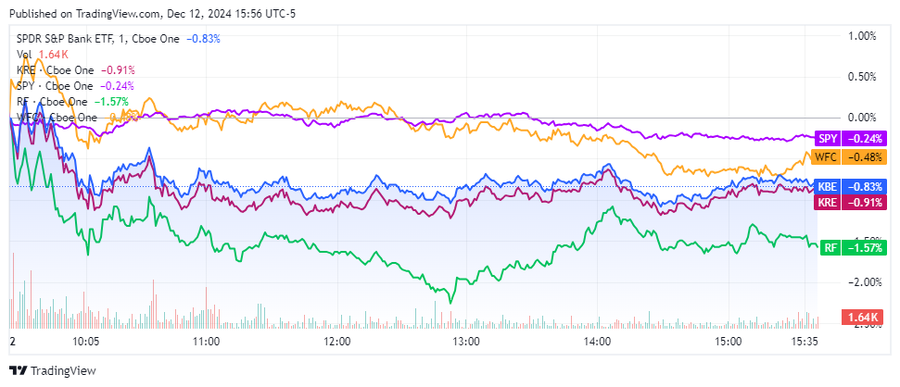

In late Thursday trading, the SPDR S&P Bank ETF (NYSEARCA:KBE) fell 0.8% and the SPDR S&P Regional Banking ETF (KRE) dropped 0.9%, both steeper than the SPDR S&P ETF’s (SPY) 0.4% decline.

The only megabanks that didn’t trade in the red are Morgan Stanley (MS), +0.5%, Bank of America (BAC), +0.5%, and Goldman Sachs (GS) roughly flat.

Other money center banks: Wells Fargo (NYSE:WFC) -0.9%, JPMorgan Chase (JPM) fell 0.5%, and Citigroup (C) -0.4%,

The biggest drops in regional bank stocks included: Flagstar Financial (FLG), formerly New York Community Bancorp, -1.8%; Regions Financial (NYSE:RF) -1.3%, Huntington Bancorp (HBAN) -1.2%, and Citizens Financial Group (CFG) -1.2%.

Bank stocks decline after CFPB finalizes overdraft rule (Seeking Alpha)