Summary:

- Northrop Grumman’s EBITDA growth is projected to be mid-single digits, while free cash flow growth is expected to exceed 15% annually through 2026.

- Despite share repurchases, Northrop Grumman’s stock price has declined, but the company has a strong 21-year dividend growth track record.

- Key growth drivers include strong demand for defense equipment, space-based defense solutions, and involvement in hypersonics and major defense programs.

- Northrop Grumman stock is undervalued compared to peers, with a conservative price target of $550 for 2025, providing a 15.6% upside.

KGrif

Northrop Grumman (NYSE:NOC) increased its share repurchase authorization by $3 billion on the 11th of December. This brings the company’s share repurchase authorization to $4.2 billion. In this report, I will be discussing my price target for Northrop Grumman going into 2025 as I previously also did for other aerospace and defense companies.

I will be discussing the following topics in this report:

- EBITDA and Free cash flow growth.

- Dividends and buybacks.

- Risks and opportunities of Northrop Grumman.

- Stock price target for Northrop Grumman.

Northrop Grumman EBITDA To Grow At Mid-Single Digits But With Double Digit Free Cash Flow Growth

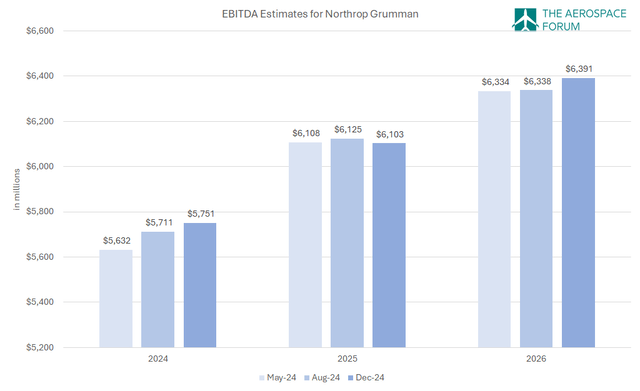

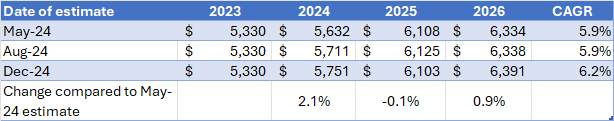

As discussed below, the EBITDA estimates show a single-digit growth rate through 2026. Free cash flow is expected to grow even faster, with annual free cash flow growth exceeding 15%.

The Aerospace Forum

In 2023, Northrop Grumman generated a $5.3 billion EBITDA. For 2024, the most recent estimates point to an EBITDA of $5.75 billion. That 8% increase in EBITDA is mostly driven by higher output on ammunition programs and sales growth in all segments. For 2025, Wall Street analysts expect another significant step up with 6.1% growth in EBITDA, but for 2026 the growth is expected to be 4.7%. So overall, we do see nice growth, but year-over-year growth is expected to taper in the years ahead.

The Aerospace Forum

Overall, we see that for 2024 the estimates on EBITDA have been up 2.1% compared to prior estimates and flat for 2025 and up about 1% for 2026. This has lifted the EBITDA growth rate in the coming years from 5.9% to 6.2%.

The Aerospace Forum

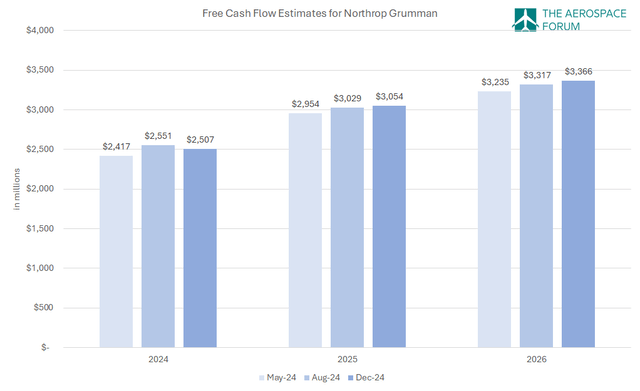

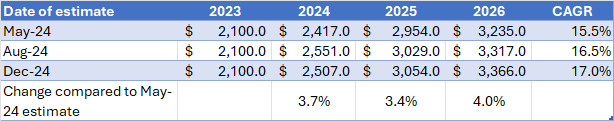

Doing the same for the free cash flow, we see that free cash flow estimates for 2024 have come down a bit sequentially but have increased for 2025 and 2026. Perhaps more important, year-on-year free cash flow growth is expected to grow 19% in 2024, 21% next year and 10% in the year after. So, while EBITDA growth resides in the mid-single digit range, free cash flow growth will be significantly better.

The Aerospace Forum

For 2024 through 2026, free cash flow growth estimates have increased three to four percent, lifting the already strong estimates of 15.5% in annual growth to 17%. With the envisioned growth rates, the company is one of the pure defense names with a double-digit growth rates.

Northrop Grumman Share Repurchases Have Not Helped Stock Prices To Increase

The strong growth in free cash flow also supports Northrop Grumman to continue repurchasing shares. Though it should be highlighted that the company will likely refinance its existing debt because its free cash flow will largely be returned to shareholders in the form of share repurchases and including dividends, the shareholder returns are expected to exceed the free cash flow generation. So, there will be need for refinancing debt and adding debt.

Since 2023, Northrop Grumman stock has been a clear underperformer with a 12.8% price decline, while the S&P 500 gained 58.5%. Over that time frame, Northrop Grumman has bought back nearly 5% of its shares, bringing the organic price development to -17%. So, Northrop Grumman’s share repurchases have not helped the share price to increase, but merely limited the decline. It should be highlighted that while lower share prices are not what we are looking for, especially when the stock price trades below its projected prices, it does make a lot of sense to repurchase shares, so I am optimistic about the company’s share repurchases.

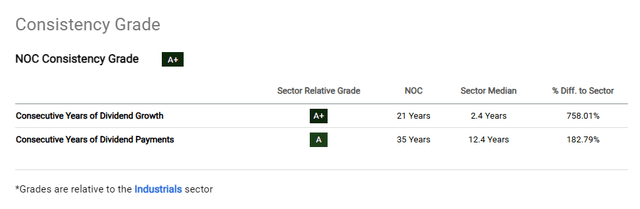

Northrop Grumman Has Grown Dividends Consistently For 21 Years

Seeking Alpha

Northrop Grumman stock prices might be down since 2023 and flat year-on-year, the company boasts a strong dividend payment track record of 35 years with 21 years of dividend growth. Dividend payments have grown by 9.3% annually over the past 5 years, which is significantly better than other industrial companies but lags the 11.5% 10-year growth rate. Dividend yield current is 1.7%, which definitely is not great, but for consistent dividend growers like Northrop Grumman, I like to look at the 10-year yield on cost which is 5.5%. Most likely there are better yield plays, but I consider defense companies to be long-term investment opportunities that provide some lower risk income growth opportunities.

What Are The Growth Drivers For Northrop Grumman

Northrop Grumman

Northrop Grumman has various risks and opportunities that, I believe, could provide a net positive for long-term returns.

The opportunities for Northrop Grumman:

- Strong demand for defense equipment including air missile defense, missiles, and fighter jets.

- Increased global interest for defense equipment.

- Growth in space-based defense solutions.

- Involvement in hypersonics weapons and hypersonics defense systems.

- The company is involved in key programs such as the B-21, F-35 and Sentinel.

The risks for Northrop Grumman:

- Aerospace supply chain challenges, which do affect working capital efficiency and output.

- Nature of some contracts which do not accommodate for inflation adjustment.

- Complex nature of aerospace products that could drive cost overruns and delays.

- Sentiment swings for defense stocks.

- Geopolitical tension with allies of the US that could drive some European countries to revitalize the defense modernization effort through European companies rather than US contractors, although I do believe that European development budgets and defense industry capacity remain insufficient to completely stop doing business with US defense contractors and there also is no easy way to make changes to equipment and procurement procedures overnight.

- The aim to cut costs in the government mechanisms, which could either directly affect defense procurement processes and drive down costs or at the very least put a damper on sentiment.

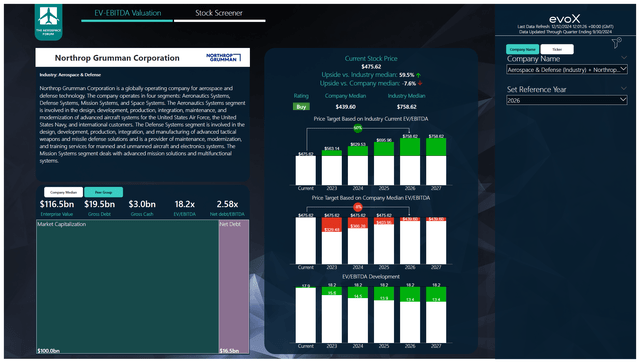

Northrop Grumman Is Undervalued Against Its Peers By A Wide Margin

To determine multi-year price targets, The Aerospace Forum has developed a stock screener that uses a combination of analyst consensus on EBITDA, cash flows, and the most recent balance sheet data. Each quarter, we revisit those assumptions and update the stock price targets accordingly. In a separate blog, I have detailed our analysis methodology.

The Aerospace Forum

I do have a buy rating on Northrop Grumman, and that buy rating is not just one that I put, but calculated within my model. The investment case, however, is not necessarily a straightforward one. Northrop Grumman stock is trading ahead of its median EV/EBITDA multiple, providing 8% downside with 2026 earnings in mind. At the same time, the stock is tremendously undervalued compared to peers, while Northrop Grumman is active on major defense programs. Adding space defense exposure and hypersonics to the equation, I do believe that this is a critical company for the US defense and deterrent capabilities and an expansion of the EV/EBITDA multiple is definitely justified.

The conservative price target using FY2025 earnings would result in a $550 price target when we average the price target using the peer group and the price target based on the company’s median EV/EBITDA valuation. This would provide 15.6% upside and in an upbeat scenario the stock price target would be $600, providing 26% upside.

Conclusion: Northrop Grumman Stock Is Critical To US Defense Capabilities

While Northrop Grumman stock is trading ahead of its median EV/EBITDA multiple valuation, I do believe that a valuation which is below that of peers does not accurately reflect the company’s critical positioning within the defense industry complex and its importance to the US deterrent capabilities. Over the past years, the company has won important programs and while many indeed are in a challenging cost position, the exposure with service support tails that run decades underpin Northrop’s importance. Furthermore, the company is also positioned for supporting hypersonics development as well as hypersonic defense solutions and space-based defense solutions. That is also why I have a buy rating on the stock, and I am buying more shares myself.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NOC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.