Summary:

- I recommend buying Alphabet stock due to its competitive advantages in search and video advertising and strong financial health.

- Alphabet’s valuation is attractive among the Magnificent 7, with the lowest P/E ratio, offering a favorable risk/reward ratio.

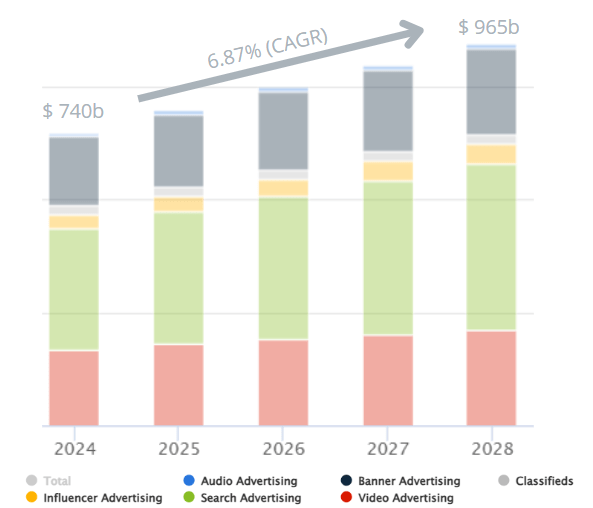

- The digital advertising market is projected to grow at a 6.87% CAGR, with AI investments enhancing productivity and ad effectiveness.

- Alphabet’s robust operating margins, driven by economies of scale and network effects, position it well for continued growth and market leadership.

Boy Wirat

Investment Thesis

I recommend buying Alphabet (NASDAQ:GOOGL) stock. Over the years, Alphabet has developed a complementary business model with unique assets. In this article, I intend to provide an in-depth analysis of the company’s core advertising business, which AI has the potential to further leverage.

We will also see that the company is the cheapest among the magnificent seven and also has an attractive valuation compared to its own history. This seems like an opportunity given the executives’ commitment to resolving the main business risks, in addition to the new prospects for 2025.

Sectoral Scenario

The global digital advertising market is expected to grow at a CAGR of 6.87% and reach $965 billion by 2028. The main means of advertising will be search and video, in which Alphabet has competitive advantages.

Ad Spending (The author, adapted from Statista)

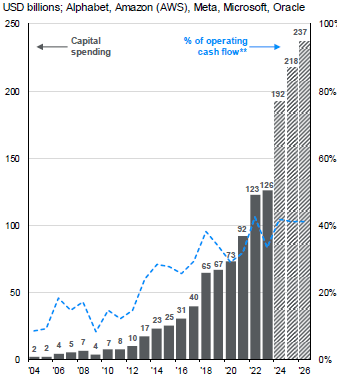

Given the market potential, before we talk about the company and its business model, it is worth noting that Magnificent 7 is investing heavily in AI, which has the potential to bring about significant productivity gains.

Capex from the major AI hyperscalers (Bloomberg, Factset, JP)

When we bring this productivity gain to the company, it means that its ads will potentially become increasingly assertive, tending to reach the right audience with minimal investment, and this can further increase the market growth we saw above. This brings an initial positive view.

History and Business Model

Google is a global leader in the digital advertising market. The introduction of AdWords in the 2000s (later called Google Ads) allowed ads to be displayed on searches based on keywords. This pay-per-click model confirmed the company’s pioneering role in the market.

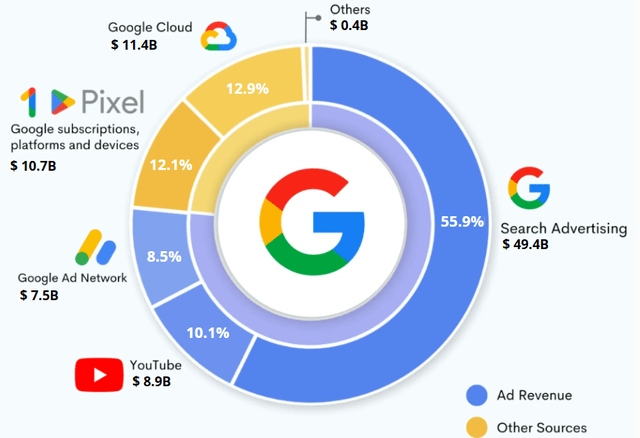

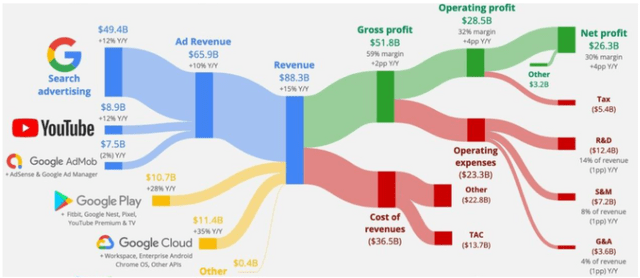

Alphabet Inc. was created in 2015 from a restructuring of Google. Headquartered in California, the company has a broad portfolio of technology products and services. Let’s look at the breakdown of their revenues.

Revenue Breakdown (The Author and Visual Capitalist)

All these developments have led to the current business model, which operates in an ecosystem integrated by several complementary platforms, such as Google, YouTube, Android, and Google Cloud, among others.

This has become a major competitive advantage, as advertisers can run campaigns across multiple channels with multiple objectives, providing a great user experience. Now, let’s take a deep look at these businesses.

Search Advertising Business Analysis

Search Advertising Business represents almost 56% of Alphabet’s revenue. I will divide the Search Advertising analysis into three subchapters: Dominance and Market Share, Return on Investment, Trends and Opportunities.

Dominance and Market Share

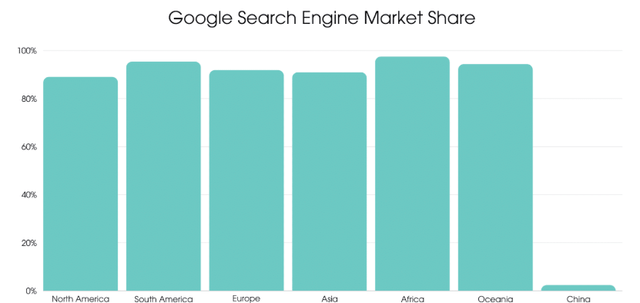

Google has 90% of the global search engine market. The company is not a leader in China, a more closed market that is dominated by Baidu (BIDU) with 2/3 of the market. Let’s look at the market share below.

Google Search Engine Market Share (Demandsage)

In 2024, more than 8.5 billion searches were performed on Google, and engagement with the platform is high, with 84% of users performing at least three searches per day.

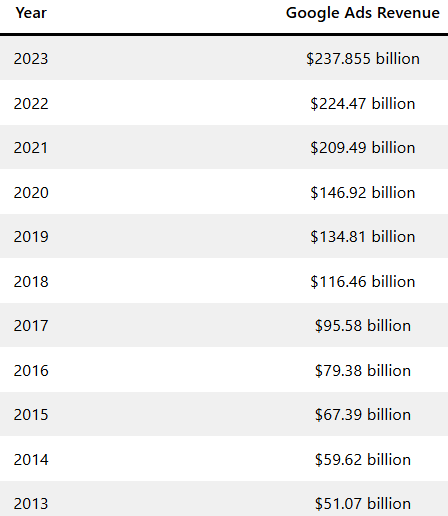

Estimates indicate that more than 80% of companies worldwide use Google Ads. This excellent and profitable business has caused Google Ads revenue to grow 365% in the last ten years, an excellent growth in my opinion.

Google Ads Revenue (Statista)

The average ROI for Google Ads campaigns is 200%, while average conversions are 3.75% for search. Search ads generate up to 65% of clicks on related keywords.

This dominance has even become the subject of an antitrust lawsuit filed by the DOJ. We will talk more about this in the risks chapter, although I believe that the approach to this case with Trump could favor Alphabet.

Return on Investment

The average ROI for Google Ads campaigns is 200%, while average conversions are 3.75% for search. Search ads generate up to 65% of clicks on related keywords.

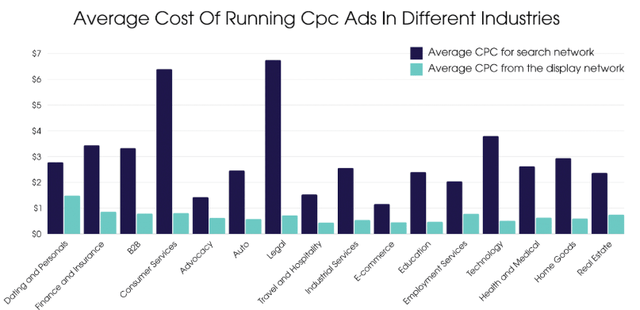

Paid ads increase awareness by 33%, and 43% of consumers buy after seeing relevant ads. Finally, the average cost per click (CPC) is just $4.22 and can vary between $1.43 and $6.75 depending on the niche. SMEs represent 65% of the platform’s users.

Average Cost Of Running Cpc Ads In Different Industries (demandsage)

Trends and Opportunities

Finally, there are three trends in this market. The adoption of artificial intelligence to optimize campaigns. The use of voice and mobile searches, which already represent 63% of clicks from mobile devices. I will address this topic again later.

We have seen how Google executives were efficient in creating the search engine and monetizing it. However, the ecosystem is made up of several platforms, and we will now take a closer look at YouTube.

The Growth Engine Called YouTube

YouTube was acquired by the company in 2006 and became the largest video platform in the world. Below, we will also do a general analysis of usage and revenue data in YouTube’s business. We will divide these studies into global dominance, monetization, trends and challenges, and final impressions.

Global Dominance

YouTube currently has 2.5 billion monthly active users in 2024. It is considered the 2nd largest social network in the world, reaching 46% of all internet users. Other data is noteworthy: 39.5% of users are between 25 and 44 years old, 54.3% are men and 45.7% are women. The daily time spent on the platform is an incredible 48 minutes and 42 seconds.

Monetization

Here’s an interesting fact: YouTube reached 2.5 billion monthly active users in 2024, a drop of 200 million compared to 2023. However, YouTube Premium subscribers jumped from 80 million in 2022 to 100 million in 2024.

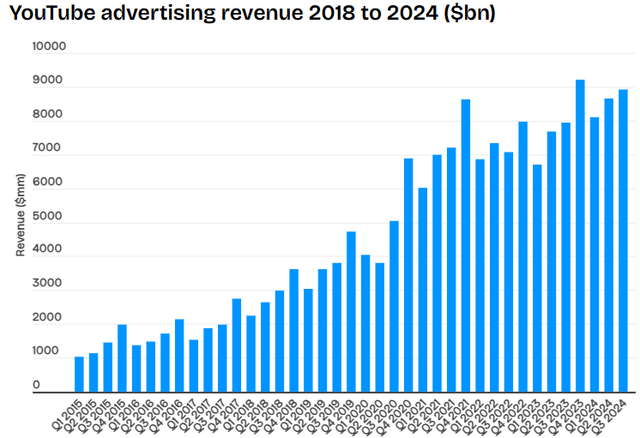

Once again, this attests to the efficiency of the company’s executives. We can also see this through the growing trajectory of YouTube’s revenue from ads between 2018 and 2024.

YouTube advertising revenue 2018 to 2024 ($bn) (Business of Apps)

Trends and Challenges

Trends for this business include the growing use of short video content, which has become famous on platforms such as TikTok. Studies indicate that Gen Z spends up to 86 minutes a day on TikTok, consuming this type of content.

Additionally, the same study indicates that 38% of these consumers report having already purchased a product influenced by some short video content, which indicates the influence of this model on consumer decisions.

In this scenario, YouTube launched Shorts in 2020, in a clear move to take market share from TikTok. The platform, which also serves ads, allows content creators to post vertical videos of up to 60 seconds.

Final Impressions

The platform’s asset-light model generates high operating leverage and a high return on capital. Through YouTube, Alphabet has managed to create a major competitive advantage, the so-called network effect.

This means that more content creators attract more users, who in turn generate more data to optimize the algorithm, thus increasing the attractiveness for advertisers.

Finally, I see a big trigger for YouTube Shorts and Alphabet, the banning of TikTok in the US. TikTok’s 170 million US users would seek alternatives to short-form content, which could benefit YouTube Shorts.

TikTok content creators who lose their platform could migrate to YouTube, bringing their entire audience (the network effect we discussed above). This would definitely benefit YouTube.

TikTok advertisers would have to reconsider their budgets for other platforms. Estimates say that TikTok would generate over $12 billion in ad revenue in the US, and this could be captured by YouTube. Given this possible scenario, let’s put all the data into perspective and compare Alphabet against its American competitors below.

Competitor Analysis

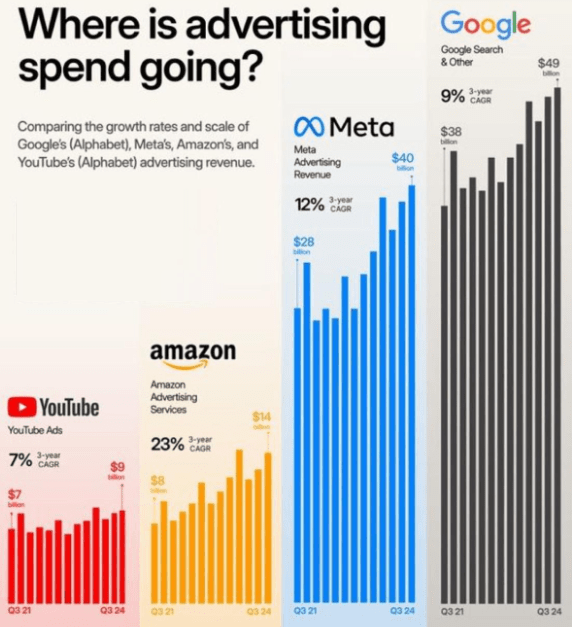

Among the MAG 7, Google’s comparable peers in the Ads market are Amazon (AMZN) and Meta (META). Below, we will see an infographic that shows the size and growth of the Ads business of each company.

Growth Rates and Scales (Quartr)

Analyzing the data above, it is interesting to note that Amazon and Meta have shown higher growth than Alphabet (Google and YouTube). But this is acceptable, since Alphabet is the pioneer in this market.

Something that caught my attention is that Google and YouTube have a higher combined revenue than Amazon and Meta, and this corroborates a positive view of the company. Additionally, Google has been using new strategies to increase the gap.

Alphabet recently launched campaigns such as Performance Max. This model uses AI to optimize advertising campaigns, promoting an increase in return on investment for advertisers. Speaking of AI, let’s move on to the next chapter.

Alphabet’s Positioning on AI

Remember the chart I included at the beginning of the article about big tech investments in AI? Alphabet’s positioning in AI is relatively different from its competitors.

Gemini AI, as it is known, was designed from the beginning to be integrated and multimodal, improving the user experience. Gemini AI’s integration with major products such as Search, Android and YouTube has led it to reach 2 million monthly users.

The generative AI market, which includes Gemini, ChatGPT and Copilot, is expected to reach $1.3 trillion by 2032 and could grow 42% per year until then, which supports a positive outlook for this segment as well. Now, let’s talk about the financial analysis.

Financial Analysis

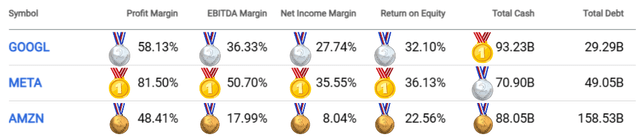

Using the comparison above, we will analyze the financial health of companies that have large ads businesses such as Alphabet, Meta and Amazon. Let’s see the comparison of the main indicators below.

Financial Analysis (The Author and Seeking Alpha)

We can see that Alphabet has robust operating margins. This is due to businesses such as cloud infrastructure, which are characterized by high margins, but mainly to the economies of scale that the company has achieved due to the aforementioned network effects.

Regarding the comparison, it is also important to note that the business models are quite different, especially for Amazon. However, I once again have a positive view of Alphabet.

Valuation

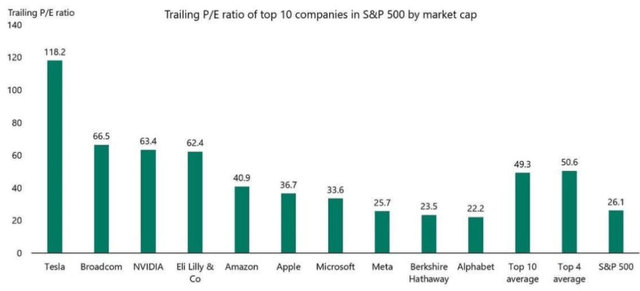

Alphabet is a company that has few peers with similar businesses, and given its size, I think it’s interesting to compare it with the other magnificent 7 using the Price to Earnings multiple. Let’s see below.

The average P/E ratio of the top 10 companies in the S&P 500 is almost 50 (Apollo)

As we can see above, Alphabet is the cheapest among the magnificent seven, and among other companies. Even if we do some averages or compare the company with the S&P 500, it will be cheaper.

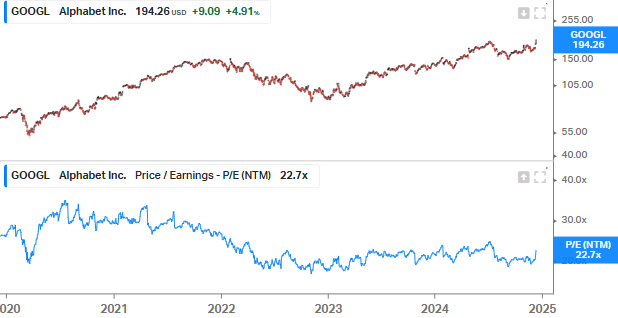

If we consider that Alphabet will trade again at the S&P 500 multiples, there is an interesting upside of 17%. Another method of evaluation is to compare the P/E against its own history. In this sense, in the last 5 years the company traded at its highest point at 35x earnings and at its lowest point at 17x earnings, making an average of 26x earnings.

P/E (Koyfin)

The company is currently trading at 22.7x earnings, an upside of 14.5%, very close to what we saw above. By weighing the methods, we arrive at an upside of 15%, which corroborates my buy recommendation.

Latest Earning Results

Alphabet released its 3Q24 results on October 29. Once again, the company managed to exceed market expectations for revenue and earnings per share, as we can see below.

The interesting infographic below provides a summary of the company’s results. However, some aspects of the result raised doubts and skepticism among investors, and I will talk more about them below in the risks.

Alphabet Q3 Income Statement (App Economy Insights)

Potential Threats To The Bullish Thesis

There are two major risks to this thesis. The US Department of Justice (DOJ) recently filed an antitrust lawsuit against Google, alleging that the company maintains a monopoly in the advertising and search market.

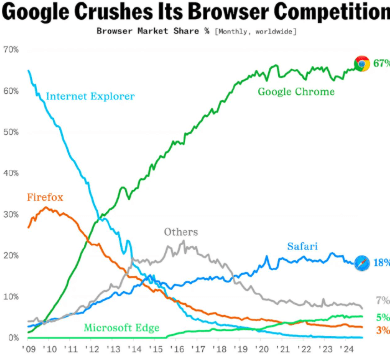

One of the proposed corrective measures was the sale of the Chrome browser, which is the global leader among browsers. The CEO addressed this issue in the conference call (page 18), where he mentioned that the company is vigorously defending itself in court.

Google Crushes Its Browser Competition (Charts)

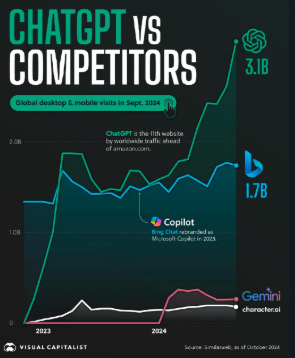

Another relevant risk is the rise of Generative AI startups that are rapidly taking over the market, such as OpenAI and ChatGPT, and investors are wondering whether they can take Google’s place in search engines.

ChatGPT vs Competitors (Visual Capitalist)

In this sense, Pichai responded (page 17) that the company continues to invest in the integration of Gemini in several products and in the growing volume of APIs. The focus is to scale quickly to compete directly with ChatGPT.

The Bottom Line

Alphabet has unique assets, a versatile and complementary business model, and executives who have already proven their competence. AI can further leverage the advertising business, while positive surprises may come with Trump’s new term and his focus on antitrust actions and the banning of TikTok.

Based on this analysis, I recommend buying Alphabet shares. In my view, the company’s financial health and the complementarity of its businesses do not match the discounted valuation in relation to its own history and that of its competitors. In my view, the risk/return ratio is quite attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.