Summary:

- RIVN has received much needed cash lines from VWAGY at $5.8B and the US Department of Energy at $6.6B, given the ongoing cash burn at an annualized rate of ~$3.4B.

- Despite the management reiterating FQ4’24 positive gross margins, it is only attributed to $300M of regulatory credit, with FY2025 quarterly gross profit likely to be lumpy.

- Given the idling production capacity and elevated operating expenses, it is unsurprising that Rivian has yet to achieve manufacturing and operating scale thus far.

- On the other hand, RIVN seems to be on a rather successful path for long-term EV success, given its outperformance in customer satisfaction rating compared to TSLA.

- RIVN is also likely to benefit from the second round of EV boom, once EVs reach parity to ICE platforms and it releases mass market models in 2026.

photoschmidt

Rivian: Bright 2026 Prospects Despite Near-Term Headwinds

We previously covered Rivian Automotive (NASDAQ:RIVN) in August 2024, discussing the stock’s lack of bullish support continues despite the $5B investment from VWAGY, attributed to the former’s projected lack of profitability until 2027 and ongoing cash burn.

Combined with the “Normal facility will not be producing vehicles for more than one month during the second half of 2025 year,” we had reiterated our Hold rating then.

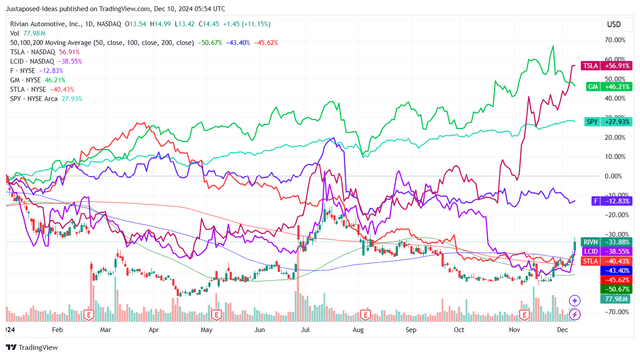

RIVN YTD Stock Price

Since then, RIVN has further retraced by -30.3% at its worst, before moderately recovering by late November 2024, thanks to the $6.6B of conditional loan approved by the US Department of Energy’s Advanced Technology Vehicle Manufacturing (ATVM) Loan Program.

This is a critical development indeed, given the automaker’s deteriorating balance sheet with a cash/investments of $6.73B in FQ3’24 (-14.3% QoQ/-26.2% YoY). This is inclusive of $1B from Volkswagen International America, Inc. (OTCPK:VWAGY), attributed to the new joint venture with a total deal size of up to $5.8B.

These additional cash lines will naturally allow RIVN to survive the next few years of capex investments and cash burn at an annualized rate of ~$3.4B, as the management continues to reiterate their target of achieving only “positive gross profit for fourth quarter 2024.”

If anything, EV demand remains impacted, given the automaker’s underwhelming delivery-to-production ratio of 76.2% in FQ3’24 (-67.2 points QoQ/-19.2 YoY), based on the 10.01K units delivered (-27.4% QoQ/-35.6% YoY) and 13.15K produced (+36.8% QoQ/-19.3% YoY).

At the same time, RIVN’s inventory on balance sheet remains elevated at $2.68B as well (+3.8% QoQ/+5.9% YoY), worsened by the ongoing inventory write downs worth $130M in the latest quarter (-12.1% QoQ/-55.4% YoY).

Combined with the underwhelming FY2024 delivery guidance of 51.25K at the midpoint (+2.2% YoY), compared to the production capacity of 150K, it is apparent that the automaker has yet to achieve manufacturing scale, based on the FQ3’24 gross margins of -44.8% (-5.9 points QoQ/-9.2 YoY).

The same has been highlighted by the management in the recent earnings call, with a gross loss per vehicle at approximately -$39.1K, including $18.6K of depreciation and amortization expense, $600 of stock-based compensation expense, and $3.7K of cost of revenue efficiency initiatives.

If anything, we expect to see RIVN’s operating losses to further deepen, as the management launches new charging outposts, with it building upon the Rivian Adventure Network’s ongoing fast charger build out, currently at over 3.5K chargers.

The same has been observed in its FQ3’24 operating margins of -133.7% (-15 points QoQ/-26 YoY), with any operating scale/break even likely still far away.

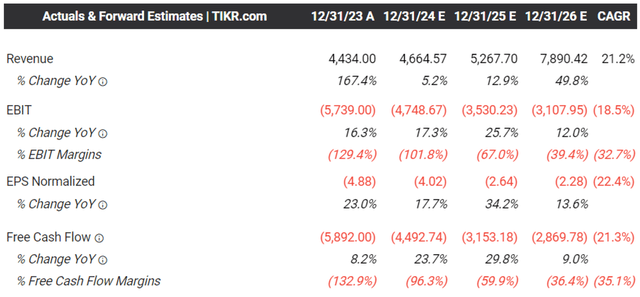

The Consensus Forward Estimates

Therefore, while RIVN may have reiterated their positive gross profit target in FQ4’24, thanks to $300M of regulatory credit, we expect their FY2025 quarterly gross profit to be lumpy as well.

The same has been observed in the consensus forward estimates, with cash burn likely to remain a norm until the second half of the decade.

As a result, RIVN investors may want to temper their near/intermediate-term expectations indeed.

So, Is RIVN Stock A Buy, Sell, or Hold?

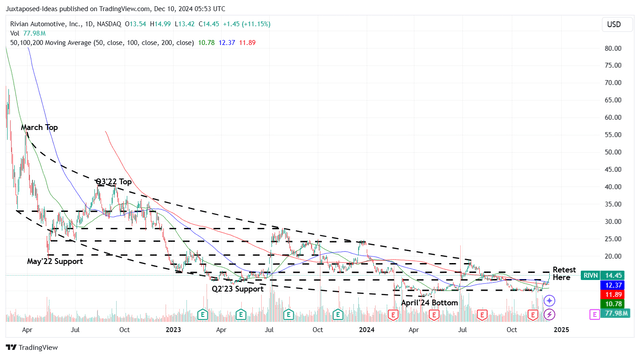

RIVN 2Y Stock Price

For now, the same pessimism has already been embedded in RIVN’s stock prices, as the stock consistently charts lower lows and lower highs over the past few years, with it seemingly finding a bottom by April 2024 and trading sideways since then.

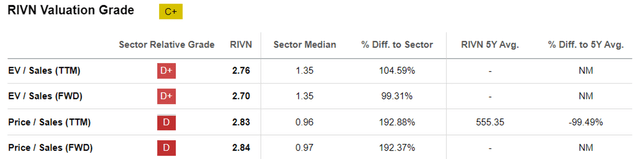

RIVN Valuations

For now, with break even and profitability still far away, the only two metrics we may use to value RIVN will be the FWD EV/Sales valuations of 2.70x and FWD Price/Sales of 2.84x, elevated compared to the sector medians.

Based on the current Enterprise Value of $14.05B and the consensus FY2026 sales estimates of $7.89B, it appears that the stock may be somewhat compelling for those with a long-term investing trajectory, given the estimated FY2026 EV/Sales valuations of 1.78x compared to the sector median of 1.35x.

When compared to its direct EV peers, including Tesla (TSLA) at 12.32x and Lucid (LCID) at 9.02x, it is undeniable that RIVN looks somewhat attractive here, albeit elevated compared to other legacy automakers, including Ford (F) at 0.99x, General Motors (GM) at 0.91x, and Stellantis (STLA) at 0.20x.

On the other hand, RIVN seems to be on a rather successful path for long-term EV success, given that it has achieved “some of the highest customer satisfaction despite being among the least reliable vehicle brands, according to Consumer Report’s 2025 Automotive Report Card.”

For reference, Rivian owners has given the automaker 86% in owner satisfaction rating, outperforming TSLA at 72%, with it likely to benefit from the second round of EV boom, once EVs reach parity to ICE platforms by sometime in 2026.

If anything, the US EV sales continues to grow to 346.3K units in Q3’24 (+5% QoQ/+11% YoY), with EV share expanding to 8.9% (+1.1 points YoY) – partly attributed to the higher incentives and discounts at ~12.2% (+2.2 points QoQ), based on the latest report by Kelley Blue Book in October 2024.

These developments point to RIVN’s potential trough year in 2024 and 2025, as the automaker finally “start deliveries of R2 (at a mass-market price point starting at $45,000) in the first half of 2026,” significantly aided by the boost in cash lines discussed above.

Combined with the robust support observed in the November 2024 bottom, we are cautiously upgrading the RIVN stock to a Buy.

Risk Warning

Even so, we must repeat our warning that RIVN is likely to remain volatile, attributed to the elevated short interest of 14.8% at the time of writing, the ongoing shareholder equity dilution at +6.5% YoY, and the likely-to-be-prolonged cash burn, as similarly observed in the pessimistic consensus forward estimates.

This is also why we believe that it may be more prudent for interested investors to wait for a moderate retracement to its October/November 2024 trading ranges of $10 before adding for an improved margin of safety, attributed to the uncertain turnaround over the next few years.

Patience may be more prudent in the meantime.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.