Summary:

- I reiterate a buy rating on Visa due to strong profit growth, robust consumer spending, and a solid technical chart setup.

- Visa’s Q4 results showed a 12% YoY revenue increase, with EPS beating estimates, and a 13% dividend hike signaling optimism.

- Key risks include regulatory challenges and potential impacts from the pro-crypto stance of the incoming Trump administration.

- Visa’s technical chart suggests a bullish trend with a price target of $330 to $335, supported by a rising 200-day moving average.

hatchapong

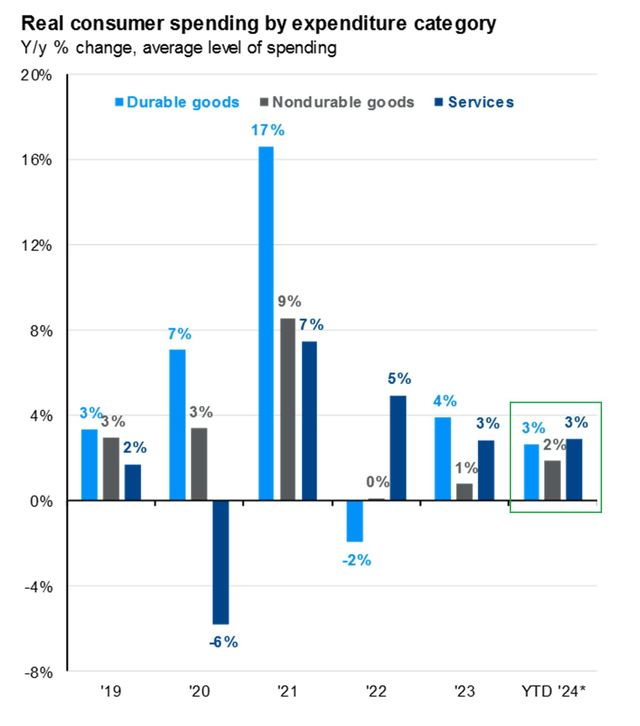

Amid what appears to be a very strong holiday shopping season, expectations for FY 2024 real consumer spending looks sanguine, and out-year forecasts are about on par with the current trend. According to data put together by J.P. Morgan Asset Management, consumption in both the goods and services areas is seen between 2-3% above prevailing inflation.

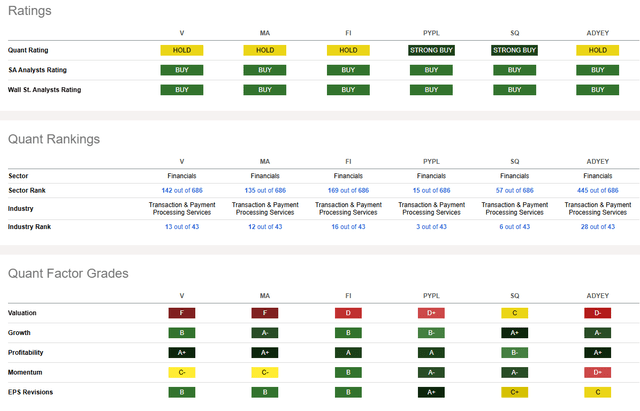

That bodes well for both retailers and credit card companies. Thus, I reiterate a buy rating on Visa (NYSE:V). I see the $615 billion market cap Transaction & Payment Processing Services industry company within the Financials sector as featuring a decent, but not outstanding, valuation. Its technical situation is particularly strong, however.

Shares are up 18% since my January buy rating, buoyed by strong profit growth and robust consumer spending and travel activity. I had a $316 fundamental target on the stock in Q1 2024, and that’s where the stock trades today. I am lifting my intrinsic value objective, but the valuation gap is less favorable today.

Real Consumption Spending Seen Solid in 2024

Back in October, Visa reported a solid set of quarterly results. Q4 non-GAAP EPS of $2.71 topped the Wall Street consensus target of $2.58 while revenue of $9.6 billion, up 12% from the same period a year earlier, was a material $130 million beat.

Growth in payments volume, cross-border volume, and processed transactions all helped propel operating profits; net revenue rose 12% YoY on a constant currency basis. Interestingly, despite ongoing macro weakness in Europe, Visa’s cross-border volume in that region jumped 13% in the three months ending September 30, signaling strong strategic execution.

The quarter was healthy enough for the firm’s management to raise the quarterly dividend by 13% to $0.59. Among the few concerns in the report was a notable increase in operating expenses from $2.96 billion in Q3 to $3.27 billion in the most recent quarter; it was a 7% cost jump YoY. The company also reported a tax benefit, which of course is a non-operating activity.

As for guidance, Visa’s management team expects EPS growth in the low double digits in the quarter to be reported in February, with operating expense growth in the high-single-to-low-double digits range.

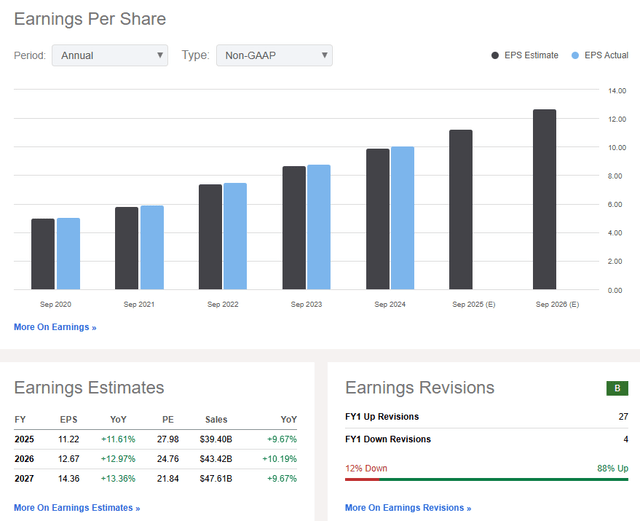

On the earnings outlook, it’s steady as she goes in terms of bottom-line trends. EPS growth is seen between 11-12% in the current fiscal year, with a slight profit-increase rise forecast in the out year and through FY 2027. There will be some dependence on operating leverage, though, considering that Visa’s top line is seen rising by just 9% to 11%.

But there has been a slew of sell side EPS revisions over the past 90 days, no doubt helped by the strong Q4 report in October. There have been 27 upgrades compared with just four downgrades. Profitability trends are also upbeat; the current free cash flow yield is above 3%.

Visa: Revenue & Earnings Forecasts, EPS Revision Trends

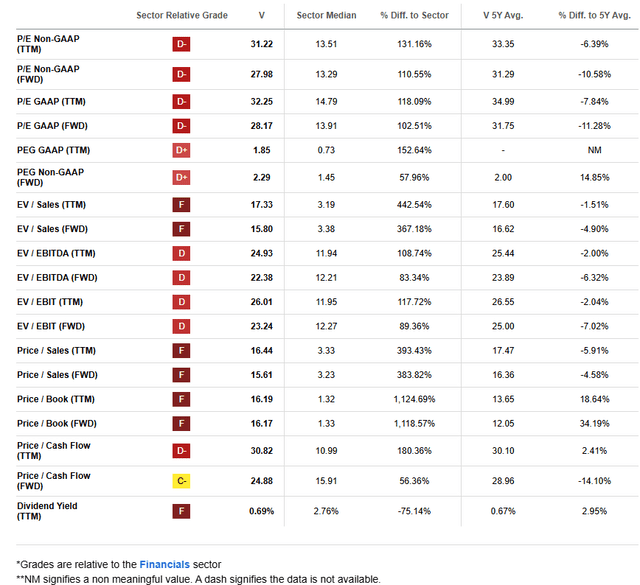

On valuation, Visa is not as attractively priced today as it was in January. If we assume forward 12-month non-GAAP EPS of $11.50 and apply a 29x multiple, then the stock should be near $334.

I reduced my P/E assumption due to the potential for increased regulatory risk and the reality that the incoming Trump administration is fervently pro-crypto, which could eventually impact traditional payment companies. Visa also trades slightly expensive on a price-to-sales basis.

Visa: Not A Compelling Valuation, But A Premium P/E Warranted

Key risks include adverse regulatory outcomes, particularly if the Trump team takes aim at credit card fees or moves to push crypto-backed transactions into the mainstream.

In the here and now, if we see consumer spending that is lower than expected, then Visa and its peers could underperform. Unfavorable currency changes is another risk, and the loss of existing customer contracts could pose EPS headwinds if they came about.

Competitor Analysis

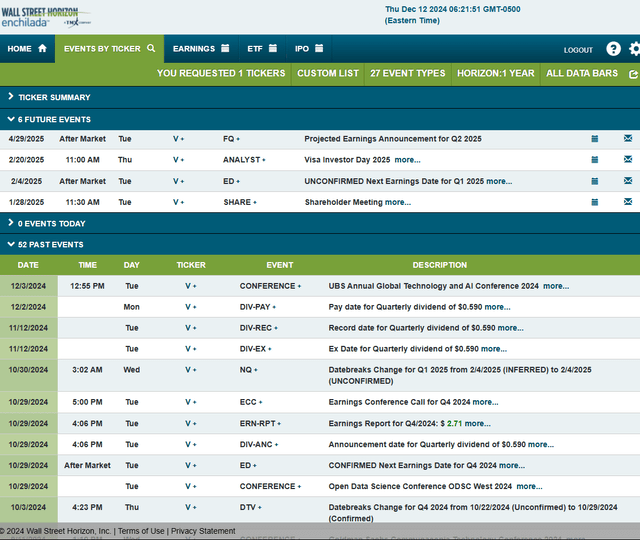

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q1, 2025 earnings date of Tuesday, February 4 AMC.

Before that, the California-based company hosts a shareholder meeting on Tuesday, January 28 with an investor day on Thursday, February 20.

Corporate Event Risk Calendar

The Technical Take

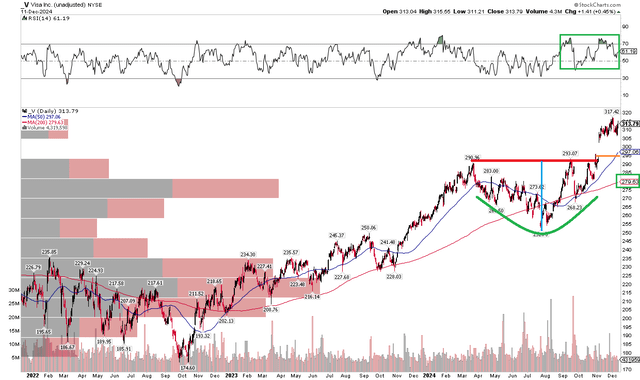

With shares modestly undervalued and a recent dividend hike signaling optimism heading into 2025, Visa’s technical chart is strong. Notice in the graph below that a bullish rounded bottom/corrective pattern took place from Q2 this year through last month.

Shares broke out above key resistance between $290 and $293 last month. That advance triggered a measured move upside price objective to $333 based on the $40 height of the previous range, added on top of the breakout point. So, there’s still room for upside.

Also take a look at the long-term 200-day moving average – it’s rising in its slope, suggesting that the bulls control the primary trend. What’s more, the RSI momentum gauge at the top of the graph has been ranging in a bullish zone between 40 and 80. A risk is a lingering gap down at $295, but that would be a great area to acquire shares, in my technical opinion.

Visa: Bullish Consolidation & Breakout Point to a $335 Target

The Bottom Line

I have a buy rating on Visa. I see the mega-cap as decent on valuation with technical upside. Both the fundamentals and the chart point to upside to the $330 to $335 range with key corporate events on tap in the first two months of 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.